2021 was a strong year for U.S. equity markets. The S&P 500 Index returned +11.0% in Q4, bringing its 2021 return to +28.7%. This index ended the year near all-time highs after setting 70 new all-time highs during the year, majority of which were clustered in the middle of year. 2021 ended with a strong rally as Omicron fears subsided. Three of the final six trading days set new all-time highs for the S&P 500 Index.

We believe the boom of the last 21 months cannot be repeated. As such, we expect the market will be more selective in 2022, with a greater emphasis on fundamentals, quality, and valuations. We believe 2022 is likely to be the year of the Federal Reserve (Fed). Updated guidance and sentiments from the Fed about inflation expectations, and the speed and trajectories for tapering and interest rate increases, will likely dominate sentiment in the equities and fixed income markets both in the U.S. and globally. While greater emphasis has been paid to the U.S. markets during the COVID-19 recovery period and the last decade, increased focus on valuations may encourage investors to look at global markets.

While U.S. markets powered ahead in 2021, international developed and emerging markets (EM) remained more subdued. Developed markets (MSCI World ex U.S. Net TR USD Index) increased +3.1% and emerging markets (MSCI Emerging Markets Net TR USD Index) declined -1.3%, bringing their 2021 returns to +12.6% and -2.5%, respectively. Expectations for the Fed to raise interest rates detracted from fixed income markets with the Bloomberg U.S. Aggregate Bond Index being basically flat in the fourth quarter while declining -1.5% in 2021.

Higher Interest Rate Expectations

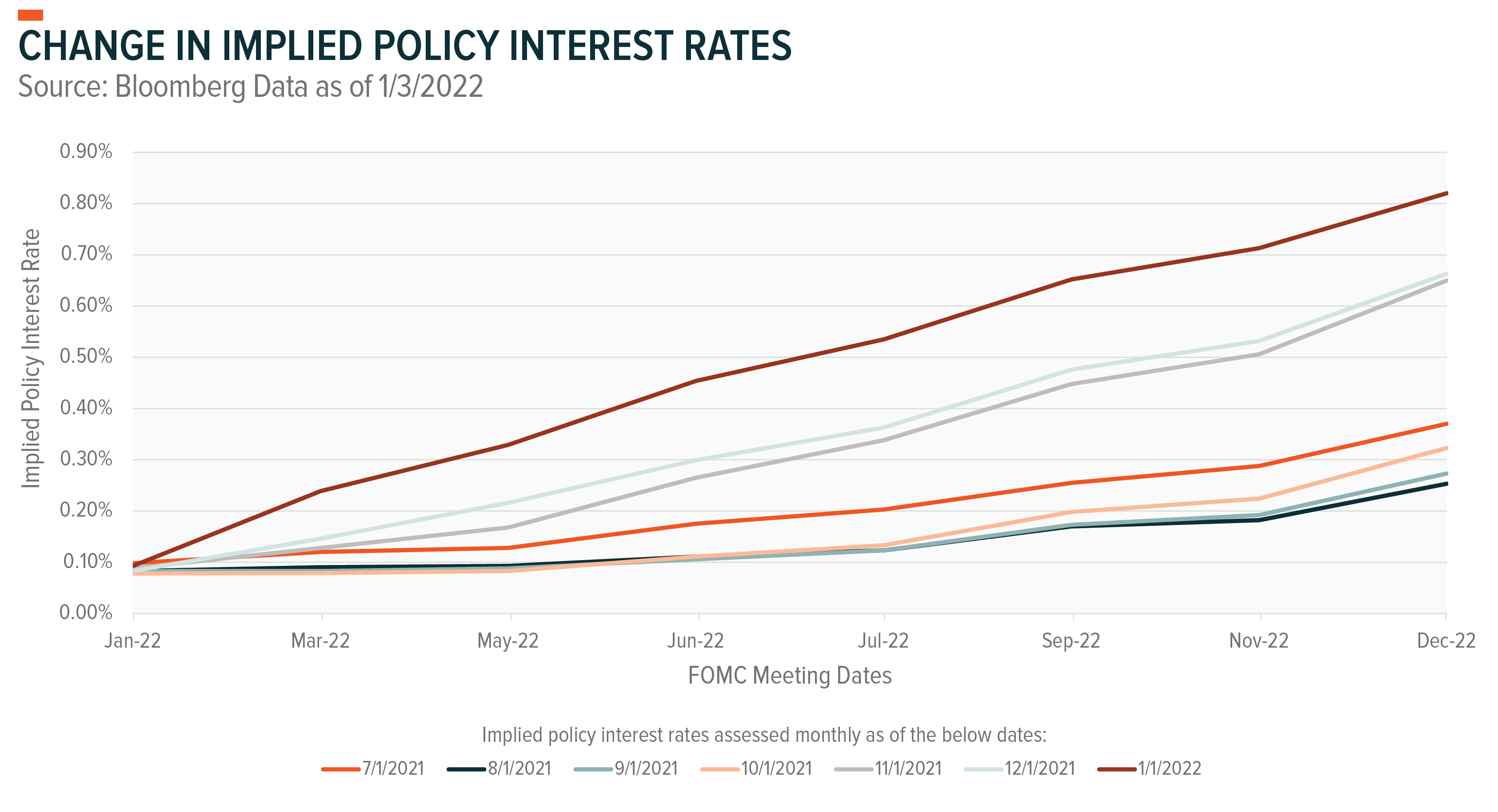

As discussed in our recent outlook piece, The Fed’s Great Balancing Act, we believe the Fed will dominate market sentiment in 2022. Striking the right policy balance will be a challenge as the Fed shifts from tapering to increasing policy interest rates. In December the Fed doubled the speed of their tapering, shifting from reducing their monthly asset purchases by $15 billion per month to reducing these purchases by $30 billion per month. The market responded by bringing forward the expectation of the first interest rate hike from June to March 2022. The Implied Policy Interest Rate chart reflects how quickly interest rate expectations have increased as the Fed started tapering. Faster or slower rate hikes are likely to have a substantial impact on both equity and fixed income markets during 2022.

Omicron is a Headwind for Supply Chain Normalization

While Omicron’s symptoms are milder than Delta’s, its impact on inflation and supply chains are not to be underestimated. The current wave of cases is substantially higher than the waves caused by previous variants. In the U.S. more than a million people were diagnosed with COVID-19 on Monday the 3rd of January 2022, more than double the previous 1-day peak for any country since the start of the pandemic.1 While this hasn’t translated into high casualties, the impact is being felt across the economy as those who are infected isolate.

There are two competing factors when considering the potential impact of Omicron from an inflation perspective. On the demand side of the equation, in the near term, a higher number of people isolating and individuals becoming more cautious are likely to dampen demand pressures. While the market has shrugged off the initial growth concerns raised by Omicron, the disruption caused by canceled flights and school closures will likely impact consumer spending, especially spending on travel and services.

Shifting focus to the supply side, Omicron is yet another hiccup in the normalization of supply chains. Prior to the spread of Omicron, we anticipated that inflation would remain elevated until mid-2022 while supply chains normalized. Given Omicron’s potential impact on global supply chains, we expect the normalization process may be delayed a bit, potentially happening more fully into the second half of 2022.

China remains the greatest risk to global growth and supply chains. Over the last two years, China has been highly successful at using technology to help impose its zero-COVID strategy. However, this means a smaller proportion of their population is likely to have antibody protection caused by prior infections. Combined with apparently less effective vaccines, this creates an environment where Omicron could have a negative impact on economic growth and supply chains as this highly contagious variant interacts with China’s zero-COVID strategy.2 But this risk factor could be reduced should China shift away from their zero-tolerance COVID strategy and / or complete the development and rollout of their mRNA vaccine.

Capital Expenditure (Capex) and Investment in Supply Chains

Where there is disruption there is also opportunity. Supply chain disruptions have been a recurring challenge since 2018 when tariffs were imposed as part of the U.S.–China trade dispute. Don’t forget tariffs are inflationary. The trade dispute continues to reverberate with the U.S. encouraging companies to onshore production and China isolating more. Notably, increased focus on Chinese data privacy may reduce shipping data, potentially reducing supply chain visibility for Western companies. As China is home to six of the world’s 10 busiest container ports, the lack of shipping data could have major implications for supply chains.3

Bank of America Securities Research is expecting a strong capex cycle over the next few years with U.S. manufacturing capex expected to increase at a 7% compound annual growth rate (CAGR) through 2025, well above the 2.8% capex growth seen between 2007 and 2019.4 Q3 earnings indicated potential signs of a new capex cycle.5 Bottlenecks and the need for improved efficiency are likely to support capex spending, particularly with respect to automation. The demand for automation-related capex is also likely to be positively impacted by the push towards onshoring combined with rising U.S. wages.

Large Caps Maintain the Lead

Continuing the trend from Q3, U.S. large caps significantly outpaced small caps in Q4 with the Russell 1000 Index rising +9.8% while the Russell 2000 Index only increased +2.1%. Despite small caps having a strong first half, a deterioration in small cap market breadth adversely impacted their overall performance for the year, with the Russell 1000 Index rising +26.5% while the Russell 2000 Index increased +14.8%.

Market breath had some interesting patterns during 2021. Optimism surrounding the reopening rotation combined with high levels of fiscal and monetary stimulus created an environment that helped float all boats during the first half of 2021. However, rising inflation pressures and economic growth concerns resulted in a narrower market during the second half of the year that tended to favor large caps. The Russell 1000 Index ended the year with 63% of its constituents trading above their 200-day moving average while only 47% of the Russell 2000 Index was above this level.6

The reduction in small cap market breadth was split by style – with small cap value remaining the strongest segment in 2021 while small cap growth was the weakest. During 2021, the performance of the top three market segments were reasonably similar with the Russell 2000 Value Index, Russell 1000 Growth Index and Russell 1000 Value Index returning +28.3%, +27.6% and +25.2%. While the Russell 2000 Growth Index lagged, only providing a return of +2.8% during 2021.

Shifting focus back to Q4, performance was dominated by large caps, but there was no clear pattern between value and growth. The Russell 1000 Growth Index led the pack with a return of +11.6% followed by the Russell 1000 Value Index and Russell 2000 Value Index with a return of +7.8% and +4.4%, respectively. In line with its trend throughout 2021, the Russell 2000 Growth Index lagged, remaining basically flat for the quarter.

Strong Market Breadth Across Most S&P 500 Sectors

Strength in large cap growth during the fourth quarter helped boost U.S. equity markets at the end of the year. Ten of the 11 S&P 500 GICS Sectors had positive returns in Q4. Real Estate (+17.5%), Information Technology (+16.7%) and Materials (+15.2%) were the top performing sectors while Communication Services (-0.0%), Financials (+4.5%), Energy (+7.9%) and Industrials (+8.6%) were the weakest sectors.

- Real Estate typically preforms well late cycle. In the current inflationary environment, this sector benefits from its inflation protected yield.7

- Market breadth has remained reasonably strong in the large cap Information Technology sector. Around 78% of the Information Technology constituents of the S&P 500 Index are trading above their 200-day moving average, improving from around 60% in early October.8 Omicron shifted the focus from valuations to economic growth. This benefited growthier market segments as the market navigated the new variant.

- The Chemicals industry had a strong quarter, driving the solid performance in the Materials sector.

Apart from Communication Services, even the sectors with the weakest performance continued to reflect reasonably strong returns. This reflected in reasonably high levels of market breadth across most sectors within the S&P 500 Index. The notable exception is the Communication Services sector where only 29.6% of its constituents are trading above their 200-day moving average. This is down from around 60% at the end of Q3 and more than 80% at the end of Q2.9 While the Media and Entertainment industry exposures drove the sector’s weakness, most areas were reasonably subdued.

Q4 Performance was impacted by concerns and optimism surrounding the Omicron variant of COVID-19. WTI crude prices and 10-year Treasury yields dipped in November before ending the quarter at a similar level to the start of Q4. Cyclical sectors such as Financials and Energy are highly sensitive to crude prices and the 10-year Treasury yield. This weighed on their performance relative to the broader market.

Are There Alternative to Equities?

Policy rates are almost certain to rise during 2022. Longer-duration yields have already risen, with more likely to follow. Higher market yields weighed on fixed income markets during Q4 and most of 2021 with the Bloomberg U.S. Aggregate Bond Index remaining basically flat in the fourth quarter while declining -1.5% during 2021. During the quarter, longer duration Treasuries outpaced short to intermediate duration as the yield curve flattened on the long end. However, duration was not reward on a full year basis and is likely to remain a risk as the Fed shifts from tapering to raising policy interest rates.

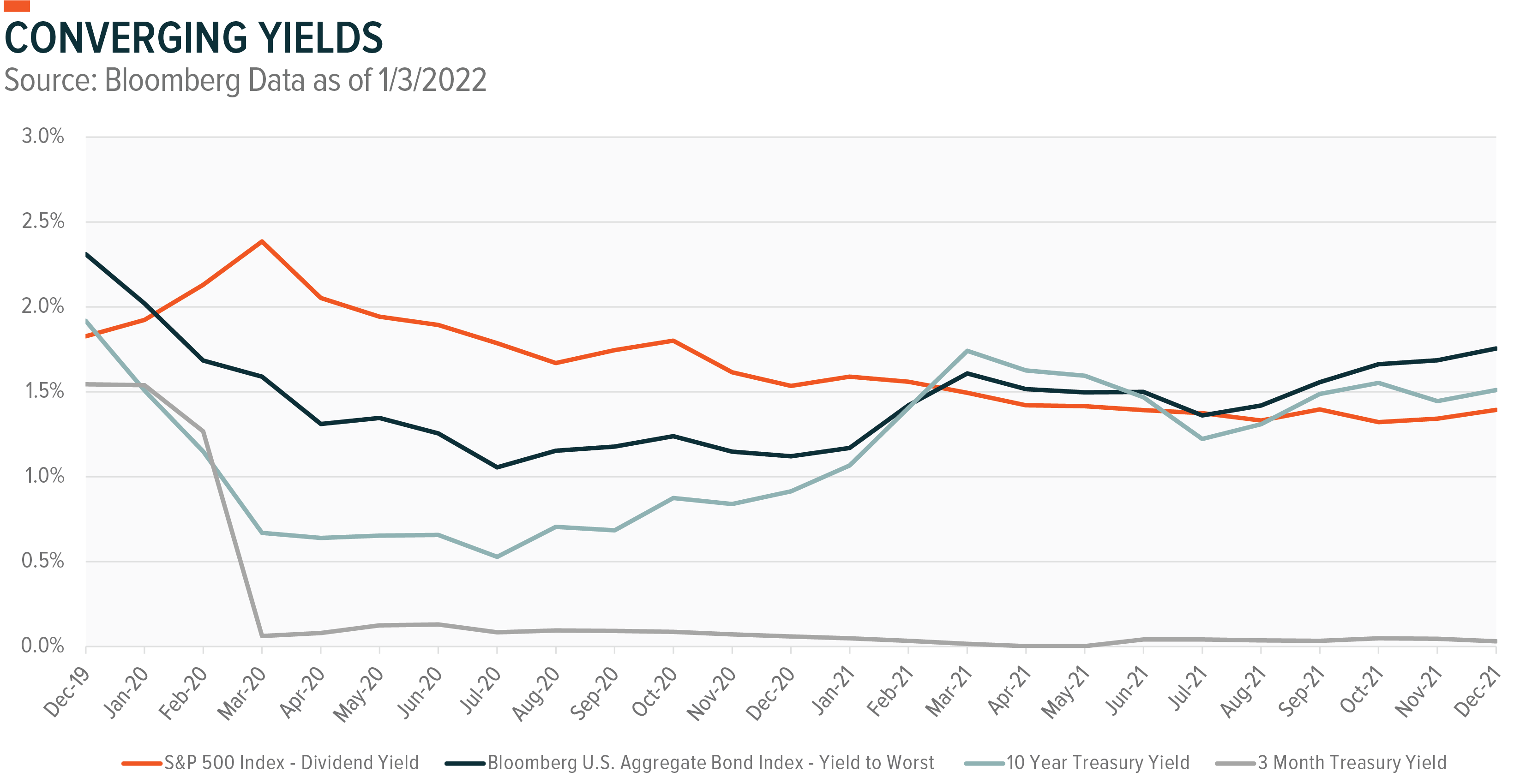

Expectations for higher yields raised questions about asset allocation and the future of the 60-40 portfolio in an environment where fixed income markets are less supportive to returns. This has been compounded by inflation pressures raising the recurring saying: there’s no alternative to equities. However, as we progress through 2022, this saying is likely to come under pressure as market yields and cash yields rise closer to the dividend yield on the S&P 500 Index. Referring to the Converging Yields chart, the dividend yield on the S&P 500 Index has converged with the 10-year Treasury Yield and the yield-to-worst on the Bloomberg U.S. Aggregate Bond Index. As yields rise and fixed income valuations moderate, future expectations for returns in the fixed income asset class will improve.10 While fixed income is likely to remain a challenge in the first half, we believe it could start playing a larger role into the second half. Risks for the 10-year yield are skewed to the upside. As protection, investors can shorten duration, use floating rate instruments and invest in equity income-oriented solutions.

Cash yields remain near 0%. However, the implied policy interest rate is reflecting at least two interest rate increases during 2022 and there is the potential the Fed could move faster than initially expected by the market. Policy interest rates are expected to reach 0.82% by the end of 2022.11 This would significantly reduce the gap between cash yields and the S&P 500 dividend yield. This creates an environment where dividend growth will need to keep pace with rising yields in order for equities to maintain their status of there being no alternatives.

A More Selective Market with a Greater Focus on Valuations and Quality

U.S. equity market valuations are elevated. Given expectations for reduced monetary policy support and slower real GDP growth, substantial multiple expansion is less likely in 2022. This shifts the focus to company fundamentals. Strong underlying earnings and revenue trends are needed to support valuations.

Higher market yields increase the focus on valuations. Fast growing companies provide higher duration risk as future earnings are being discounted at a higher yield. Moving into a late cycle environment, free cash flow is likely to be a focus as uses of cash rise with higher capex spending as well as higher financing and operating costs due to elevated inventory costs and higher wages.12

In a rising yield environment, we favor cyclical sectors with above-average purchasing power. This will help support earnings and margins as inflation pressures feed through the economy. Additionally, as market yields rise, there is likely to be greater focus on inflation protected yields. Energy and Real Estate are two sectors where companies are typically able to pass through inflation costs to consumers.

Overall, we expect the market to be more selective in 2022. In our view, margins, fundamentals, and quality will be key to portfolio positioning in the year ahead. Where possible, we are targeting quality value and profitable growth while being cautious with our approach to deep value and aggressive growth.

The Long and Winding Road to Normal

The pandemic illustrated that the market can look beyond challenging periods, provided they are not perceived as permanent. This message remains important, considering the current supply chain disruptions and elevated energy prices. In our view, most of the disruptions are temporary and will be resolved. However, given the Omicron variant, supply chain normalization may take longer.

Supply chain disruptions are likely to have a substantial impact on companies and their relative competitiveness. Certain companies have been able to utilize their financial flexibility to ensure supplies, while others are reaping the rewards of greater supply chain analytics. This creates a more selective environment while creating demand for improved efficiency. Overall, supply chain capex and increased adoption of automation are likely to be important market areas into the years ahead.

Michelle Cluver

Michelle Cluver