Editor’s Note: Please see the glossary at the end for all terms highlighted in sea green found in the order that they appear.

Distributed ledger technology has the potential to solve some of the most prominent problems in the global economy, such as providing financial services to the 1.7 billion people that comprise the global unbanked population.1 However, the largest blockchains are not accessible for low-income economies or viable for daily use as they can only process a limited number of transactions per second. This bottleneck entails elevated transaction costs when network activity is high. But creating a highly scalable blockchain with minimal fees without sacrificing decentralization and security is challenging.2

To avoid this issue, developers have designed systems like interoperable blockchains and layer 2 solutions. These increase throughput while retaining security and decentralization. Even in their early stages of development and adoption, they are already transforming the crypto landscape significantly. One day, they may become the preferred option for decentralized finance (DeFi), non-fungible tokens (NFTs), and more, onboarding millions more users to the blockchain as they offer lower fees and more programmability.

In this report, we discuss why blockchains need to scale, the existing scaling solutions, the different types of layer 2 solutions, and how they may shape the crypto landscape.

Key Takeaways:

- A one-size-fits-all blockchain scalability solution doesn’t exist. However, rollups, which aggregate transactions and post them as one to layer 1, will have an edge to scale most decentralized applications (dapps) due to their compatibility and security advantages.

- Ethereum 2.0 and general purpose rollups have the potential to make DeFi, NFTs, and other Ethereum dapps much more accessible and cost-effective, and even provide an efficient framework for micropayments.

- Optimistic rollups currently dominate the layer 2 landscape but general purpose ZK-rollups are coming and can become the preferred layer 2 solution as they offer faster finality and may also offer privacy features.

Developers Must Solve the Scalability Bottleneck for Crypto to Reach Its Potential

To perform all possible use cases and provide the best possible user experience, blockchains need the ability to process a high number of transactions per second. Today, the largest Blockchains by market cap, Bitcoin and Ethereum, have limited transaction throughput, making them inadequate for many potential applications. The average transactions per second (TPS) the Bitcoin and Ethereum network have processed during May 2022 is around 3 and 14 respectively.3,4 For comparison, these TPS capabilities are far from the Visa payment network’s 20,000 TPS. However, demand for the Bitcoin and Ethereum networks continues to grow, particularly for Ethereum’s, as we highlighted in Ethereum: The Basics.

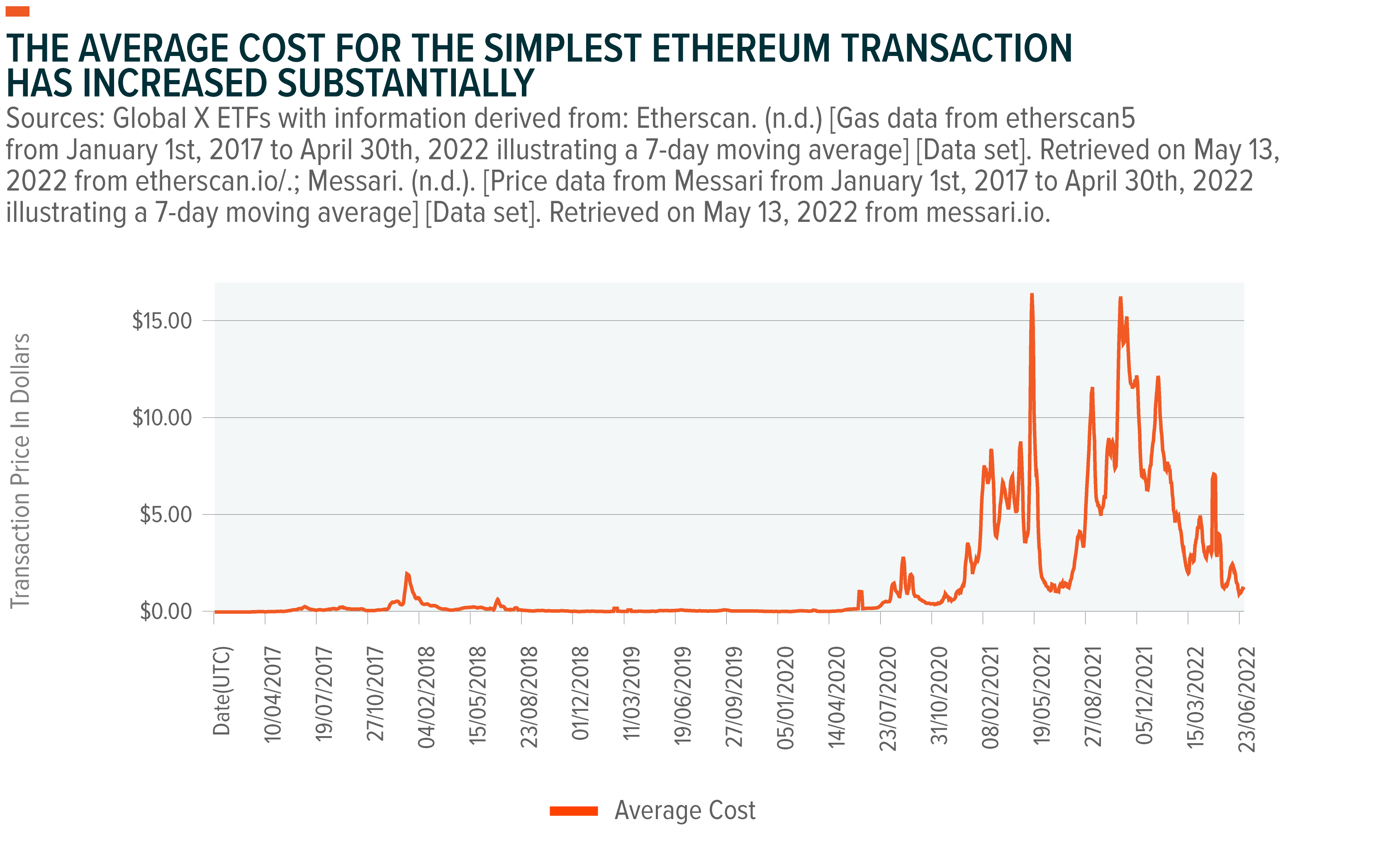

As a result of limited throughput and increasing demand, Ethereum’s transaction costs have increased. The chart below shows the cost of a simple ETH transaction from one address to another. Demand for transactions in the Ethereum network is typically linked to euphoria in the space which is correlated to price.

For more complex transactions that require interaction with smart contracts, costs can be 5–20 times higher.6 High transaction costs are a barrier to using blockchains, affecting low-income users the most, and may even de-incentivize the use of these blockchains if transaction costs get high enough. For distributed ledger networks to become the efficient and financially inclusive platform that powers the global economy, they must scale.

Multiple Scaling Solutions Emerging to Increase TPS and Lower Fees

Since Bitcoin’s inception, a primary focus for developers has been designing systems that can process a higher number of TPS with minimum fees. So far, the most popular approaches to scaling are improving layer 1 blockchains, interoperable blockchains, and layer 2 solutions.

Improving Layer 1 Blockchains

Mathematics and computer science research continue to improve consensus mechanisms and data architectures that increase throughput. For example, Solana uses an innovative proof of history consensus, which, paired with a reduced group of network validators using high-end hardware enables Solana to process up to a theoretical 50,000 TPS. However, the specialized hardware and low number of validators, means that Solana is more centralized than other chains. Centralization is a common tradeoff among the blockchains that can scale more than Bitcoin and Ethereum. Shard chains, an initiative on Ethereum’s agenda, are also a method of scaling layer 1s, but is highly complex and the complexity can introduce new risks and potential vulnerabilities, so thorough testing is required.

Interoperable Blockchains

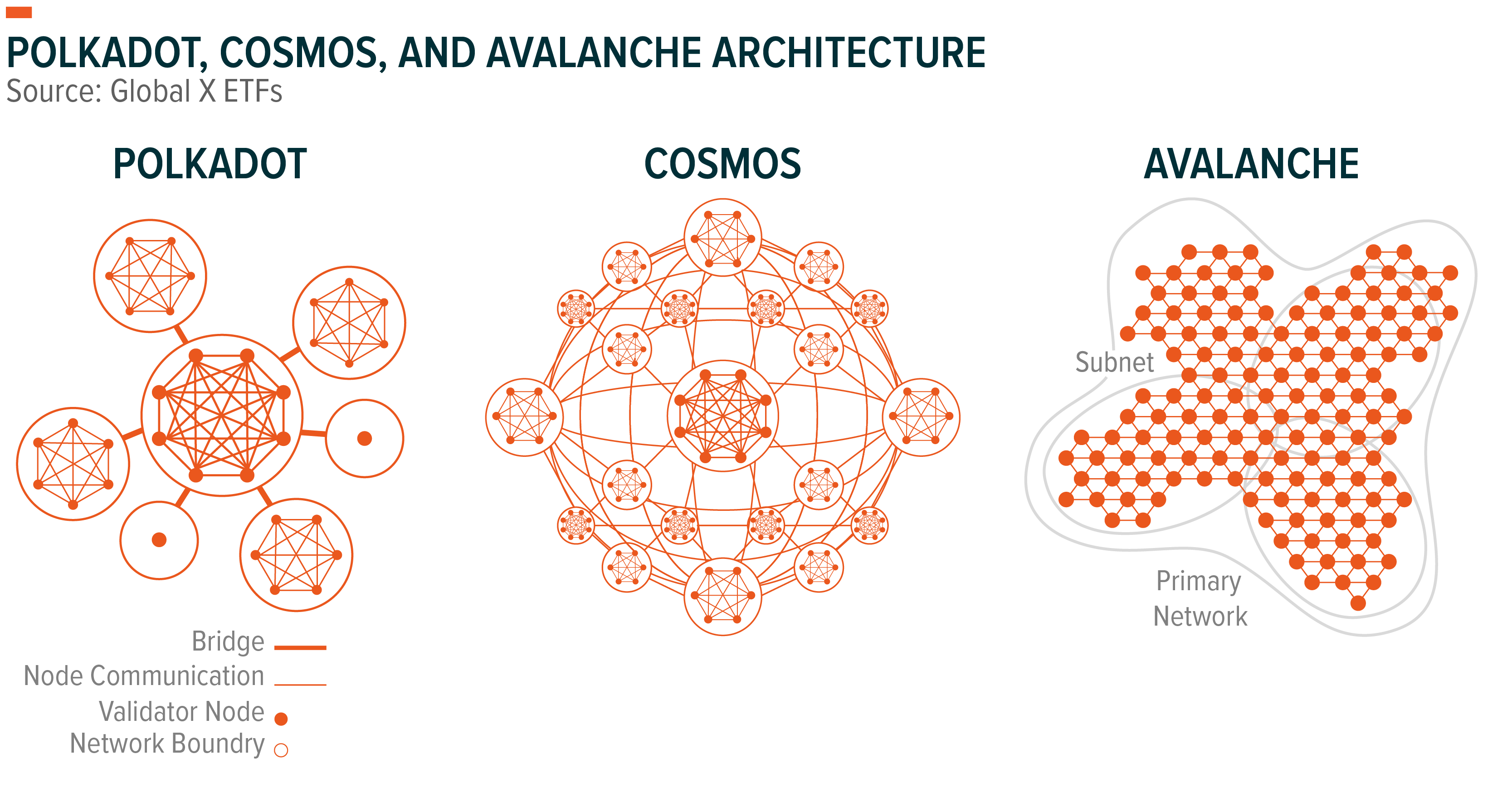

Interoperable blockchains can be thought as a network of blockchains that can communicate with each other. The main idea behind interoperable blockchains as a scaling solution is to distribute the computational load between various chains and process transactions in parallel. Beyond scaling, interoperable blockchains augment the design space, as blockchains can be built with different architectures tailored for specific applications or functions.

Polkadot, Cosmos, and Avalanche are ecosystems where interoperability enables the transfer of assets between blockchains securely and at a low cost. These three projects have unique architectures and come with trade-offs, in terms of scalability, security and decentralization.

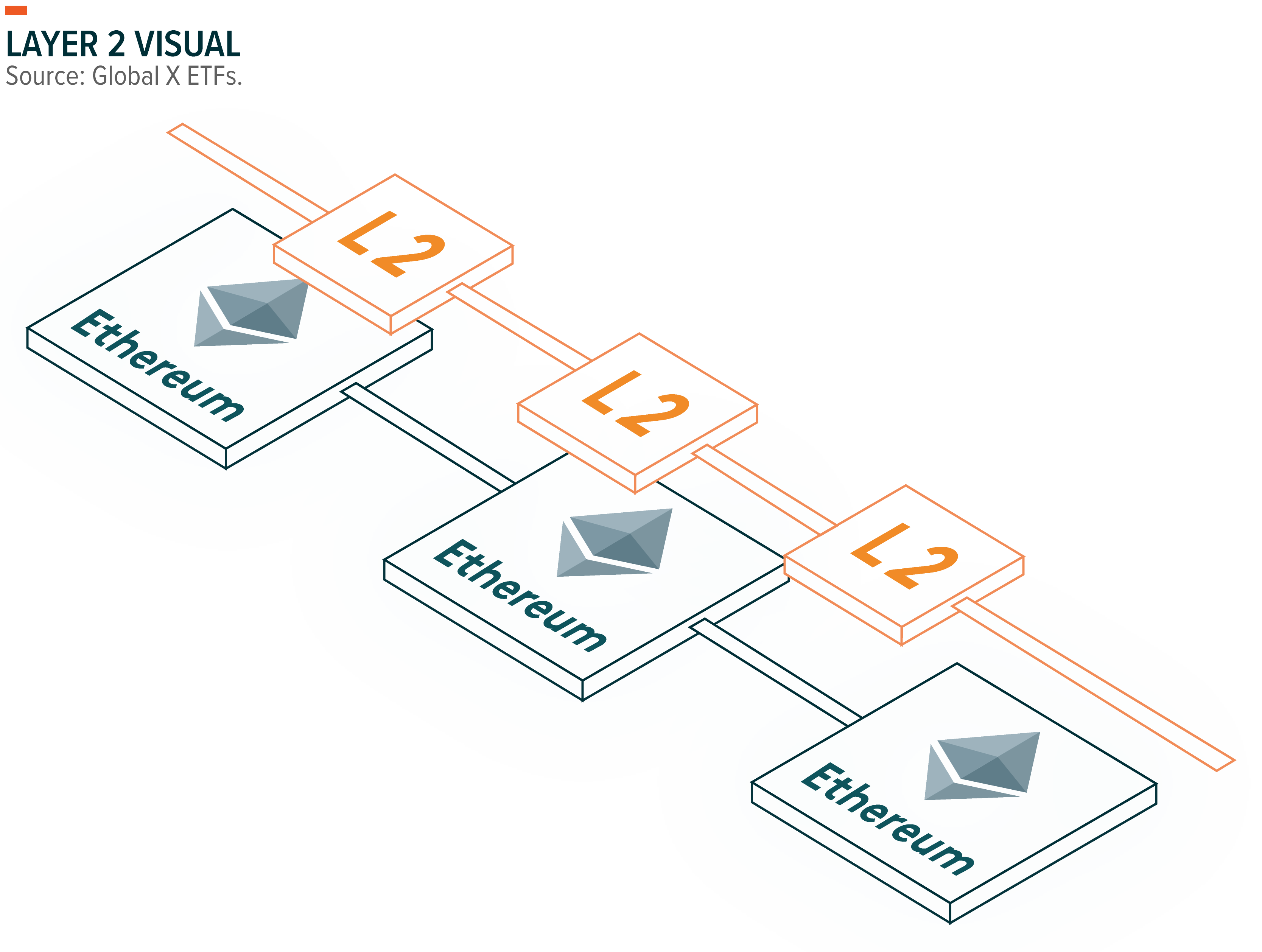

Layer 2 Solutions

A layer 2 solution is built on top of an existing layer 1, like Ethereum, and its aim is to increase the capabilities of layer 1. A layer 2 offloads computational work from layer 1 by processing transactions off-chain, increasing transaction speed and throughput. A metaphor typically used to describe layer 2 solutions is a sideroad. The sideroad can offload traffic from the main road (the layer 1 chain), to increase the number of cars travelling at the same time (increase number of transactions per second).

Layer 2 solutions have peculiar qualities that make them a compelling scaling solution. For example, layer 2 solutions do not require modifying a blockchain. Instead, they use existing features of layer 1 chains, such as smart contracts, which enables scaling without compromising decentralization or security. Another distinct property of certain layer 2s is that unlike layer 1 blockchains, their fees don’t necessarily increase with more transaction demand; in fact, they can even get cheaper. We will explain why later in the report.

Layer 2 solutions span general-purpose to application-specific solutions. Some have their own security measures, and some inherit their security from layer 1. However, in essence, they all share the same logic of processing transactions off-chain for scaling purposes. We will focus on Channels and Rollups, which we believe today to be the most potentially transformative solutions.

The Layer 2 Landscape Is Evolving, and Adoption Is Rising:

Channels

Channels are a peer-to-peer passage where parties can exchange multiple transactions off-chain while only submitting two transactions to layer 1, for the opening of the channel and its closure. Channels enable fast, almost feeless transactions, but they have limited use cases because they are application-specific and cannot run general-purpose smart contracts.

The best example of a payment channel today is the Bitcoin Lightning Network, which can process up to 100,000 TPS with almost zero fees. Conceived to enable microtransactions, the Lightning Network is gaining popularity as the Bitcoin circulating in it continues to grow.7 A pioneer in accepting Bitcoin Lightning payments is El Salvador, where it is now possible to pay for daily transactions, such as a burger at McDonalds with Bitcoin.

Rollups

Rollups are a source of excitement within the Ethereum community given several highly anticipated milestones set to be hit in 2022. Over the last year, rollups have become Ethereum’s go-to layer 2 family of solutions, with roughly 95% of the market share.8 Rollups are the only layer 2 solution that inherit the security of layer 1 and can scale general-purpose applications. Because of this feature, dapps can support rollups seamlessly, enabling users to interact with dapps at a fraction of a cost of layer 1.

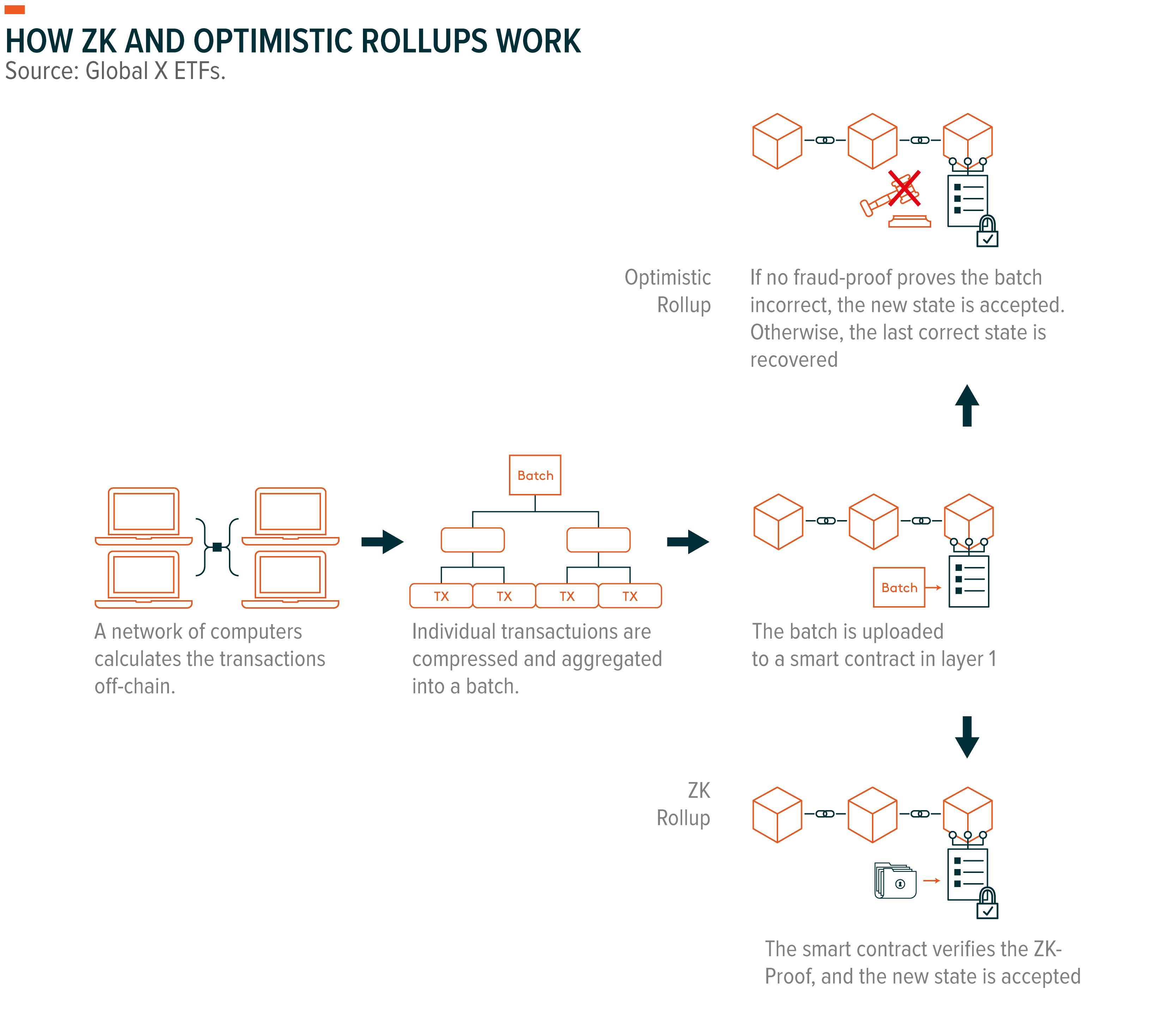

In rollups, numerous transactions are computed off-chain, and then compressed and aggregated into a batch, which contains information about the state. Thereafter, the batch is uploaded to the rollup smart contract on the layer 1 to update the state. The intricate step is proving that the new state is correct and that a malicious participant didn’t change it. The two major types of rollups, optimistic and zero-knowledge (ZK), tackle this proving problem differently.

- Optimistic rollups: When the batch is uploaded to layer 1, a dispute resolution period that can last for about a week starts. During this period, any user can challenge the batch and state by submitting a fraud proof. If the fraud proof shows the batch was fraudulent, the last correct state is restored. If no fraud proofs are published or the batch is valid, nothing has to be done; hence, the name “optimistic rollup”. Submitting a fraud proof is a rare event due to economic incentives in place that promote correct behaviour.

- ZK-rollups: A ZK-proof is generated from the batch, which is an innovative bit of mathematics and cryptography, as it allows proving information without revealing the information itself. To update the state, this cryptographic proof is posted to layer 1 along with the batch. The ZK-proof can quickly prove that the new state is the result of carrying out all the computations in the batch, even if the computations would take a long time to run.

A remarkable feature of rollups is that unlike layer 1 blockchains, their fees don’t necessarily increase with more transaction demand; in fact, they can even get cheaper. This is because the transaction costs of updating the state of the rollup is shared between all participants. With more users making transactions, the average transaction cost per user may decrease in certain scenarios, creating positive network effects.9

Optimistic Rollups Dominate the Layer 2 Landscape but ZK-rollups Are Here to Challenge

The layer 2 landscape today is practically exclusive to Ethereum, where Optimism and Arbitrum which are optimistic rollups are the current leaders. Their Ethereum Virtual Machine (EVM) compatibility means popular DeFi dapps like Uniswap, AAVE, and Curve Finance have been able to deploy in the Optimism and Arbitrum networks with minimum coding work. Optimism launched their highly anticipated token “OP” via airdrop on the 30th of May 2022. The token will be used for governance and community incentives. Arbitrum’s token airdrop is thought to arrive soon.

ZK-rollups currently lag optimistic rollups, being limited to application-specific uses like DYDX, Loopring, and DeversiFi due to the complexity of the underlying tech. However, general-purpose ZK-rollups, which many experts thought would take longer to develop, are now market ready. They could improve on optimistic rollups’ shortcoming.

Assets in an optimistic rollup must stay within the layer 2 protocol during dispute resolution period because the transaction could be challenged at any time. Effectively, the dispute resolution period must end for funds to move. Conversely, ZK-rollups’ time to finality can be measured in seconds. Vitalik Buterin and other prominent figures in the space have spoken about their long-term outlook for ZK-rollups, stating that they will win out in all use cases as ZK-proof technology improves.10

Matter Labs is working on ZK-Sync2.0, a ZK-rollup with its own VM. The testnet for ZK-Sync2.0 went live in May 2022, and the team announced the mainnet is coming in 2022.11 Polygon launched on the 20th of July Polygon zkEVM, a ZK-rollup currently in testnet, expected to go live in 2023.12 Both ZK-rollups will be able to run Ethereum smart contracts and dapps with minimum coding work.

ZK-Rollups and Ethereum 2.0 May Be a Turning Point for Crypto

The catalysts and technology coming to Ethereum form a compelling case to be positive about the growth of Ethereum’s ecosystem and increasing user adoption.

Currently, rollups can process 1,000–4,000 TPS, which is good, but still not valid for certain applications, such as global-scale micropayments. Visa’s 20,000 TPS is the standard. However, as we discussed in Crypto in a Portfolio, major upgrades are coming to Ethereum, including the transition to proof of stake and shard chains. The latter is predicted to increase the Ethereum chain’s data availability more than 20-fold.13 Rollups will get more than a 20x TPS boost, making them able to process up to roughly 100,000 TPS.

High throughput, low transaction fees, fast finality, and EVM compatibility could mean that ZK-rollups become the standard framework for dapp deployment, merchant payments, and more. The main centralized exchanges, such as Binance, FTX, and Coinbase, now support withdrawals to some optimistic rollups like Arbitrum and Optimism, allowing users to onboard those frameworks easily. ZK-rollup support may be coming soon too. Additionally, user friendly apps like Argent Wallet allow users to onboard ZK-Sync directly and offer interaction with DeFi apps from their mobile app.

Lower Transaction Fees Will Enable Further Blockchain Adoption

Blockchains are set to become more scalable as the tech behind layer 2 solutions and interoperable blockchains evolves. With shard chains and rollups evolving, DeFi, NFTs and more will be accessible to many more users as transaction costs become a fraction of what they are currently. With 100,000 TPS, ZK-rollups could be an efficient framework for micropayments when ETH 2.0 is out thanks to their fast finality and low fees. Additionally, interoperable blockchains are a scalable framework that expand the design space of blockchains, meaning more developers could be attracted to build innovative products on interoperable chains.

We believe the future for distributed ledger networks is bright and that one day, they could become the infrastructure for more efficient and inclusive financial systems, a plethora of dapps and could even host global micropayment networks.

Related ETFs

BKCH: The Global X Blockchain ETF seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies in digital asset mining, blockchain & digital asset transactions, blockchain applications, blockchain & digital asset hardware, and blockchain & digital asset integration.

Click the fund name above to view the fund’s current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Rohan Reddy

Rohan Reddy Global X Research Team

Global X Research Team