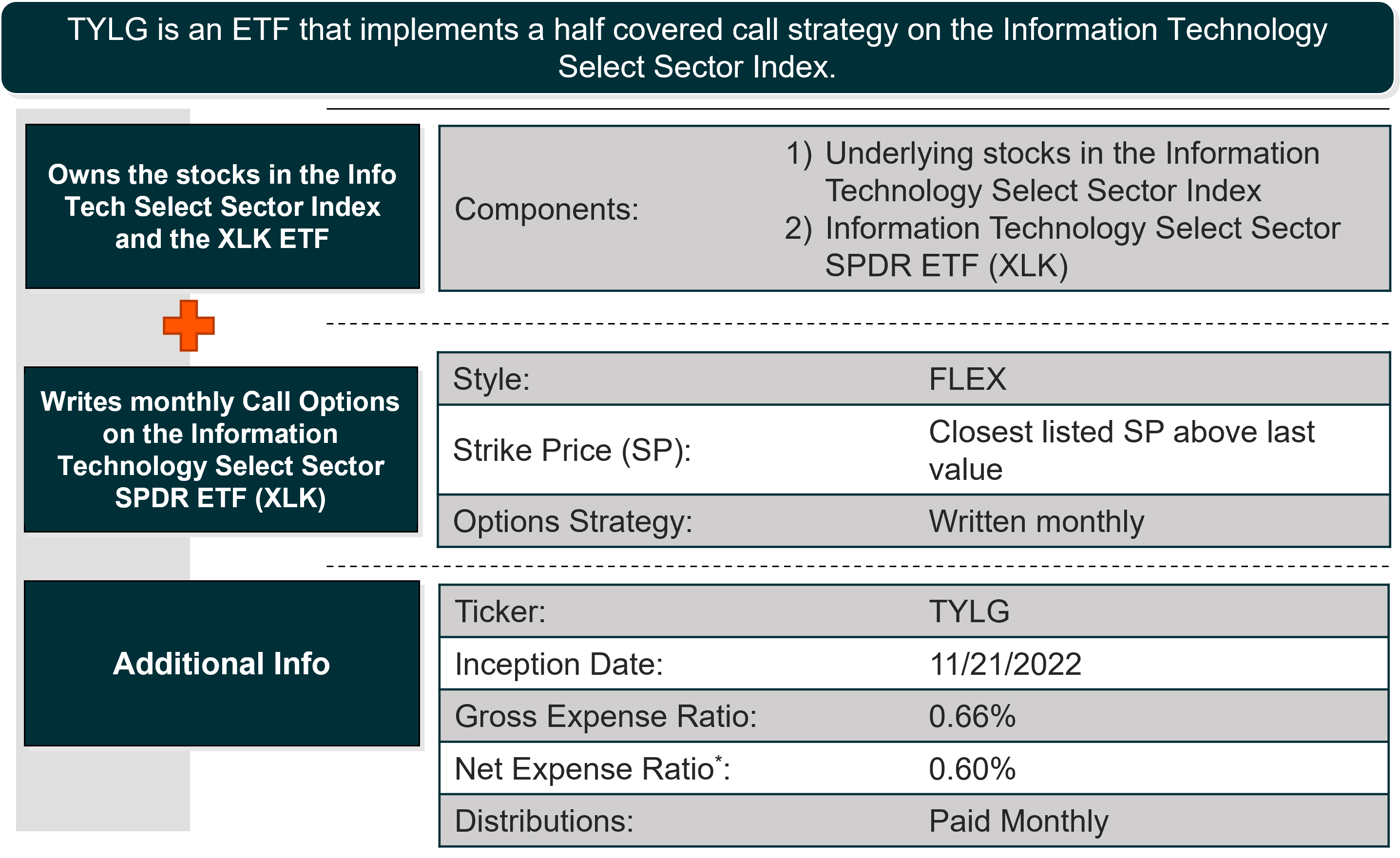

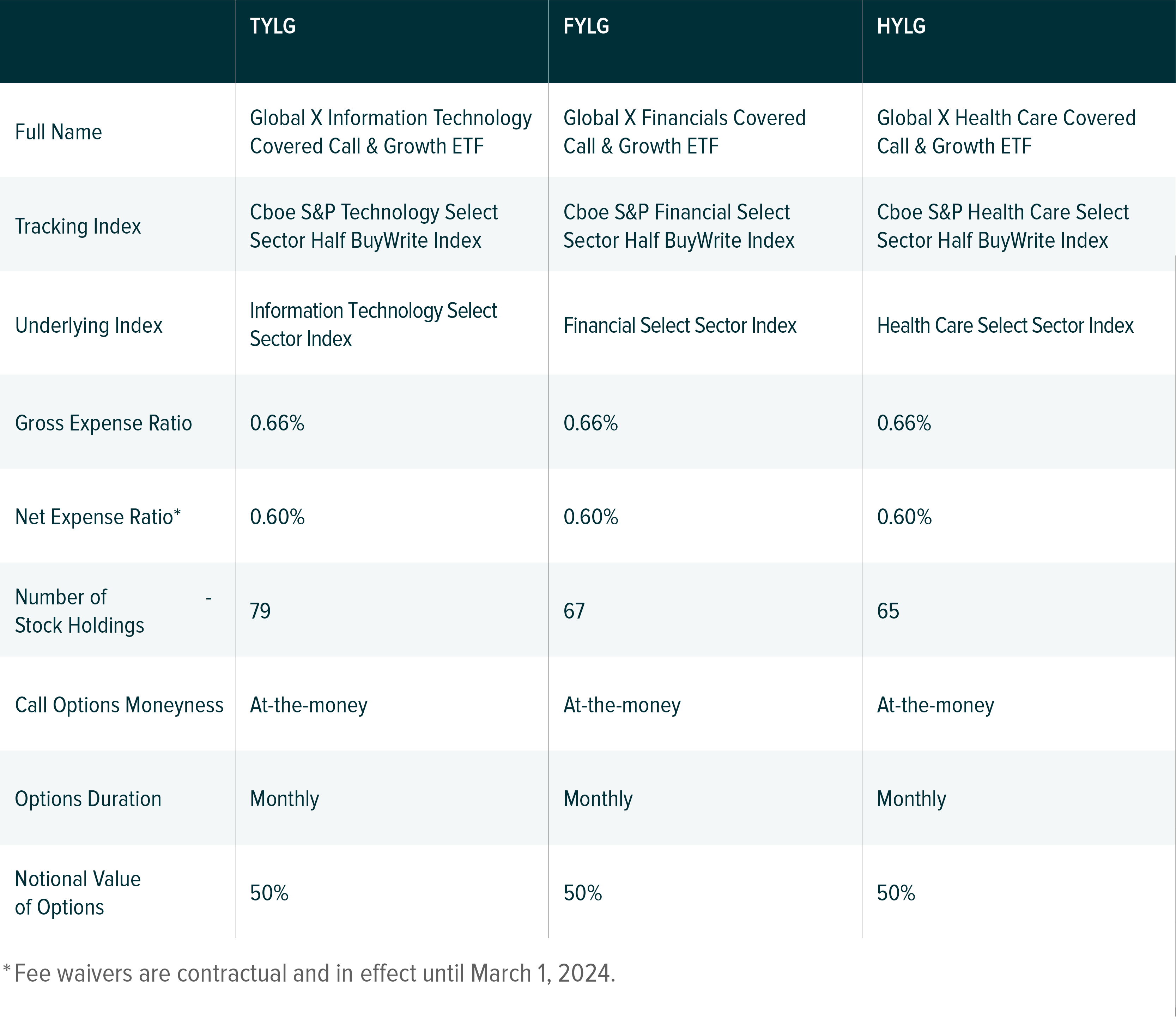

On November 22nd, we listed the Global X Information Technology Covered Call & Growth ETF (TYLG), the Global X Financials Covered Call & Growth ETF (FYLG), and the Global X Health Care Covered Call & Growth ETF (HYLG). TYLG, FYLG, and HYLG are the latest additions to Global X’s covered call suite, which is designed to offer investors both income and upside potential (though some may cap that potential). These three funds are our first offerings for sector based covered call solutions for investors, which we believe offers a targeted approach to income and growth potential. These funds write covered calls on 50% of the value of the underlying sector fund. TYLG, FYLG, and HYLG now brings Global X’s options-based ETF suite to 18 funds in total.

For the last decade, income investors have struggled to find diversified sources of income for their portfolios. In this current environment, traditional sources of income like dividend paying equities and fixed income solutions have not kept pace with yield objectives for many income investors. Investors are increasingly looking to diversify their portfolios across different asset classes and investment strategies. Our launch of sector covered call funds looks to provide long-term growth potential from specific sector exposures while also providing high income potential.

While there are few investment strategies that do well in volatile markets, we believe that income focused strategies could be well positioned. Another area potentially worth examining for investors is the sector exposure that will be provided by the sectors they currently have allocations to. With the launches of TYLG, FYLG, & HYLG, we believe these funds give investors additional options within specific sectors to consider. Because of the sector differences across healthcare, financials and technology, the macro drivers of the three indexes are likely to be different, both over the long term and even over shorter time frames. This can lead to divergences in performance, volatility, and correlation relative to other income strategies.

Key Takeaways

- There are potential benefits to investors for diversifying their portfolios. For sectors like Financials, Healthcare, and Technology, potential long-term tailwinds include rising healthcare spending, a growing global economy, and increasing technological advancements. These are also amongst the largest sectors in the S&P 500.

- Healthcare, Technology and Financials may see some continued volatility in the rising rate environment we are seeing today.

- Sector covered call strategies allows investors to stay invested in key sectors in the market, but in a more defensive manner. Income oriented investors may find these strategies attractive as elevated volatility historically leads to higher options premiums collected. TYLG, FYLG, & HYLG sell covered calls on 50% of the notional value of their respective portfolio and offer investors potential income in the form of monthly distributions.

Sector Covered Call ETFs Designed for Income and Growth Potential

The Global X Sector Covered Call & Growth ETFs, TYLG, FYLG, & HYLG, seek to generate monthly income through covered call writing on their respective sectors. These three sectors are Information Technology, Financials, and Healthcare. Similar to our other Global X broad index Covered Call and Growth ETFs like QYLG, the Sector Covered Call ETFs write “at-the-money” covered calls each month on 50% of the notional value of the portfolio. However, the Sector ETFs write options on the sector SPDR ETF corresponding to their underlying index, whereas our broad index covered call ETFs use exchange traded index options.

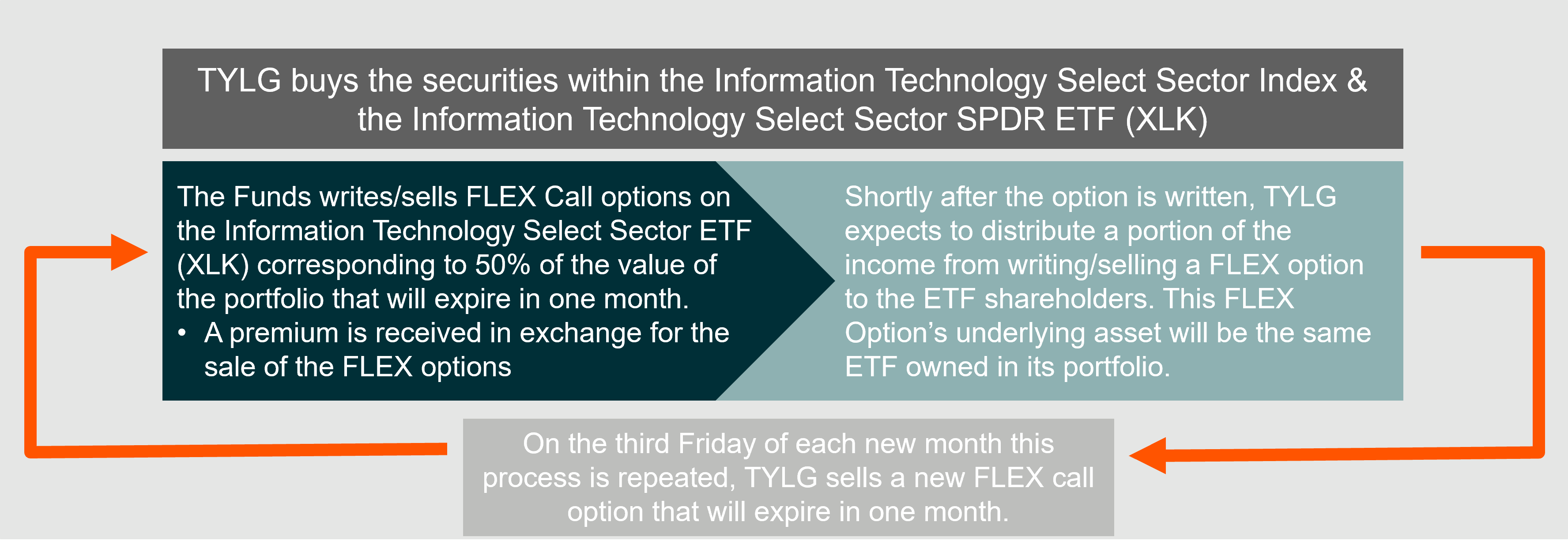

Below is an example of the fund structure and roll process with TYLG. Both FYLG and HYLG follow similar process as TYLG.

*Reflects fees incurred by the Fund after waivers and reimbursements – fee waivers for TYLG are contractual and in effect until at least March 1, 2024.

*Reflects fees incurred by the Fund after waivers and reimbursements – fee waivers for TYLG are contractual and in effect until at least March 1, 2024.

By writing calls on 50% of the portfolio, the strategy allows investors to capture half the upside potential of their respective sector. For instance, TYLG buys the stocks in the Information Technology Select Sector Index and shares of the Information Technology Select Sector SPDR ETF and sells “at-the-money” covered calls corresponding to 50% of the value of the portfolio. This allows the funds the opportunity to monetize options premiums on the ETF tracking the Information Technology Select Sector Index, while also retaining half the upside potential of that index.

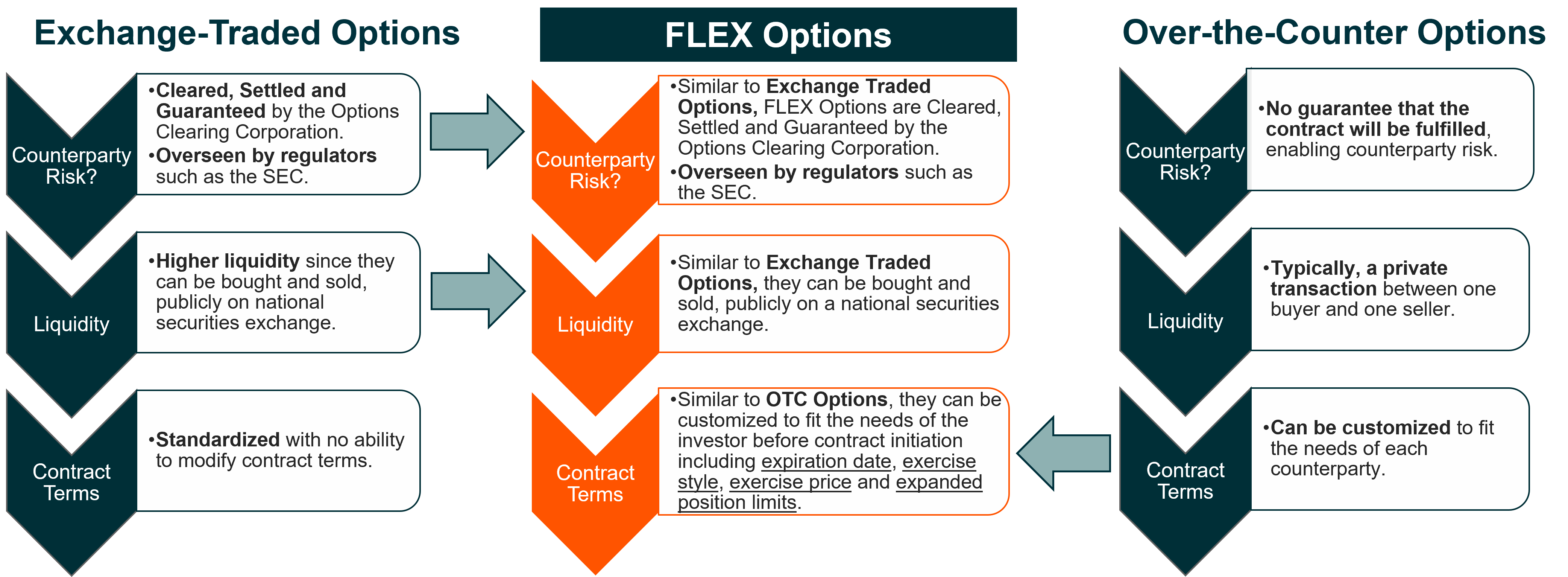

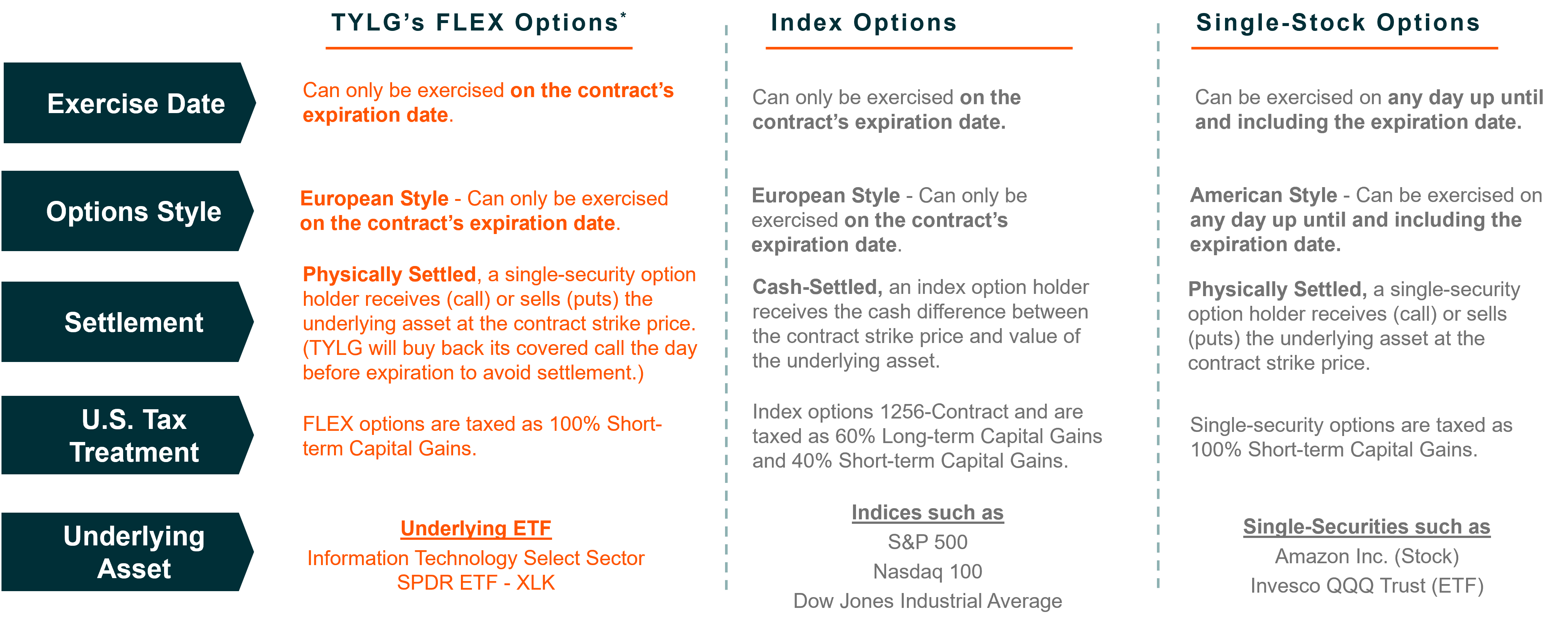

COMPARING FLEX OPTIONS WITH EXCHANGE-TRADED AND OVER-THE-COUNTER OPTIONS

Originating in 1993 by the CBOE Options Exchange, FLEX options were created with the intention of offering the capabilities of an over-the-counter option and exchange-traded option in one product.

Just like Exchange Traded Options, they can be bought and sold, publicly on national securities exchange. Similar to OTC Options, they can be customized to fit the needs of the investor including expiration date, exercise style, exercise price and expanded position limits.

Flex Options are European style options which mean that they can be exercised only on the contract’s expiration date. Similar to our broad index Covered Call ETFs, the Sector Covered Call ETFs write “at-the-money” covered calls each month. However, the Sector Covered Call ETFs write FLEX Options on the corresponding Sector SPDR ETF whereas our broad index Covered Call ETFs use exchange traded index options.

EXCHANGE-TRADED INDEX OPTIONS VS. TYLG’s FLEX OPTIONS

*To the specifications of TYLG’s FLEX Options. FLEX Options allow investors to customize key contract terms, including exercise date, exercise style, and exercise price.

*To the specifications of TYLG’s FLEX Options. FLEX Options allow investors to customize key contract terms, including exercise date, exercise style, and exercise price.

Global X’s Sector Covered Call & Growth ETFs offer investors the ability to tailor their portfolio sector risks towards sectors that are often underweight within a typical equity income portfolio or to express a sector view in a more efficient manner. Within an equity portfolio, an investor looking for high income can replace sector index strategies with a sector covered call & growth strategy in an effort to capitalize on volatility within that sector. Additionally, investors looking for portfolio diversification and offset sector imbalances may find sector covered call and growth strategies to be more fitting for their portfolios.

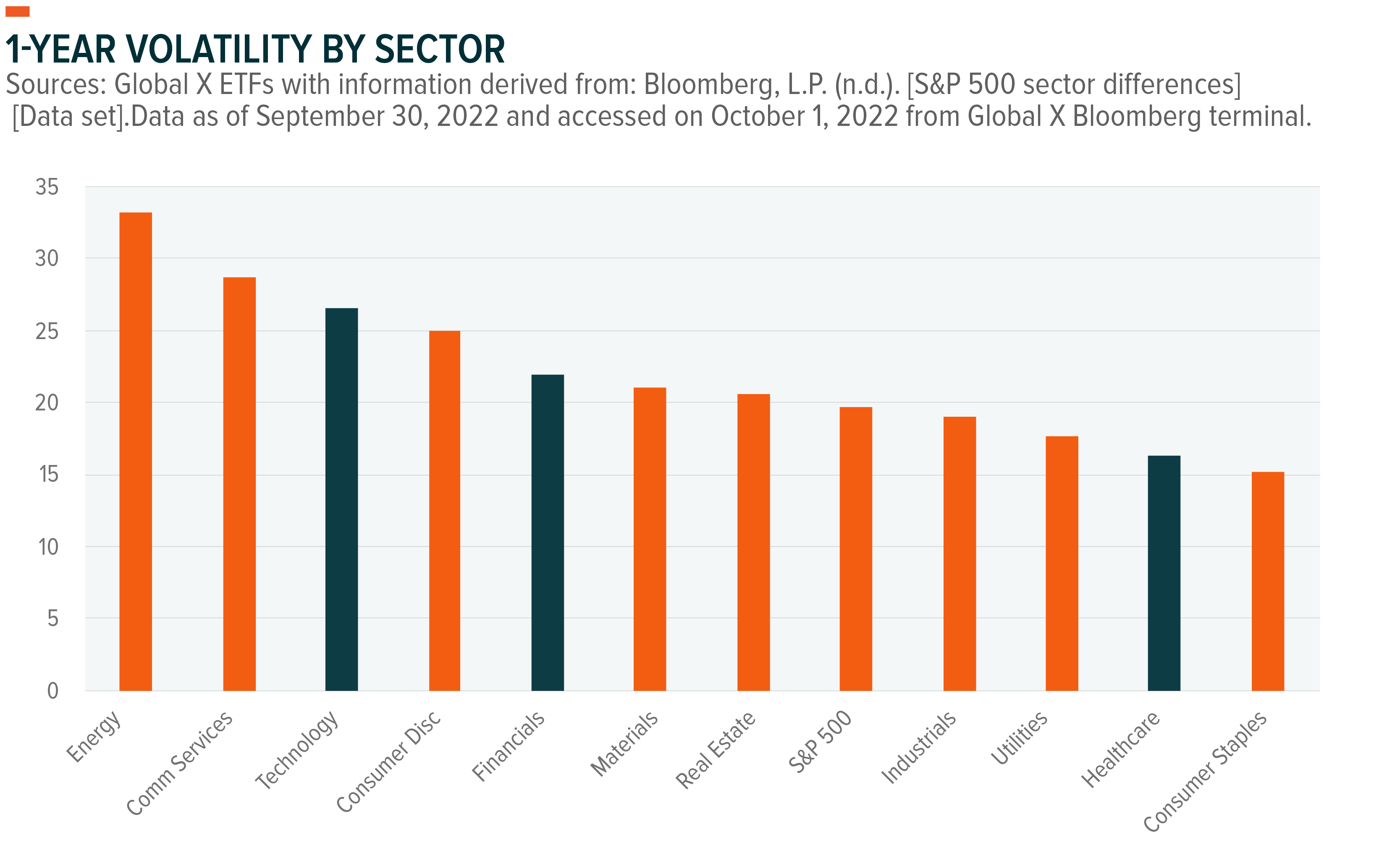

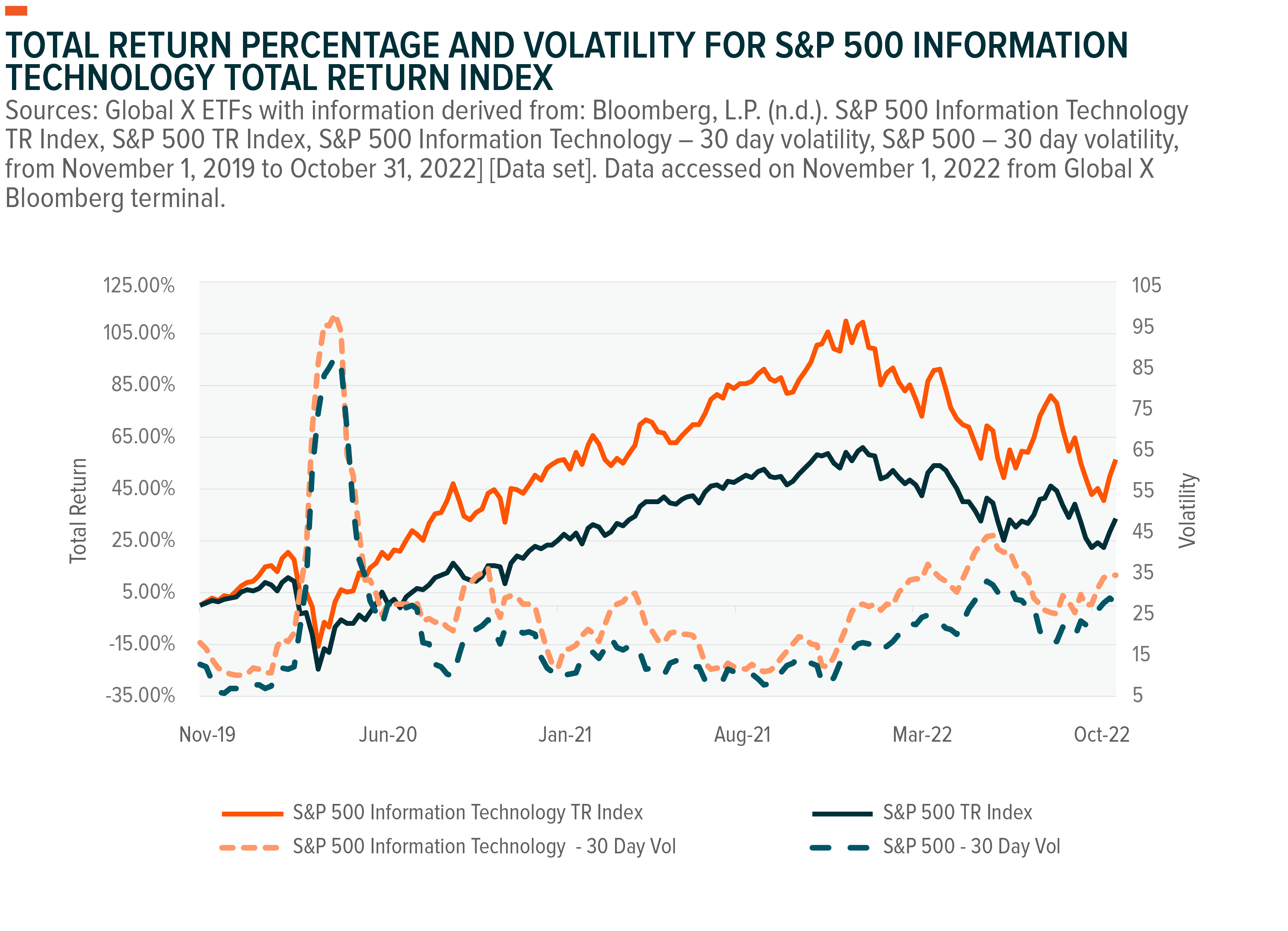

For Information Technology and Healthcare companies, higher rates can correlate to higher operating costs which can negatively affect their business models. Financials are also affected by interest rate volatility which can lead to increased volatility for the sector. Our sector covered call and growth funds can capitalize on this volatility as higher volatility is generally correlated to higher option premiums.

Below we can see the one-year volatility across the sectors as of September 30th, 2022.

The Healthcare Sector Growth-Oriented Profile

The healthcare sector has not disappointed in the last decade as an aging population and increased care has provided tailwinds for the industry. From 10/19/2011-10/19/2022, the healthcare sector (Health Care Select Index) has displayed annualized returns of 15.57% while the S&P 500 returned 11.63% in that time frame.1 The healthcare sector has seen strong performance – 78.83%, as measure by the Health Care Select Index – relative to the broad index – 64.18%, as measured by the S&P 500 Index.2

We believe the potential macro circumstances including pass-through consumer inflation and evolving business model along with vertical integration should continue to support sector growth in healthcare. Acceleration of value-based care models and increasing application of technology across the industry may continue to provide benefits into the future. Looking into the next few years, healthcare profit pools are expected to continue to accelerate at 6% per year as overall patient volume increases, spurred by the aging population.3

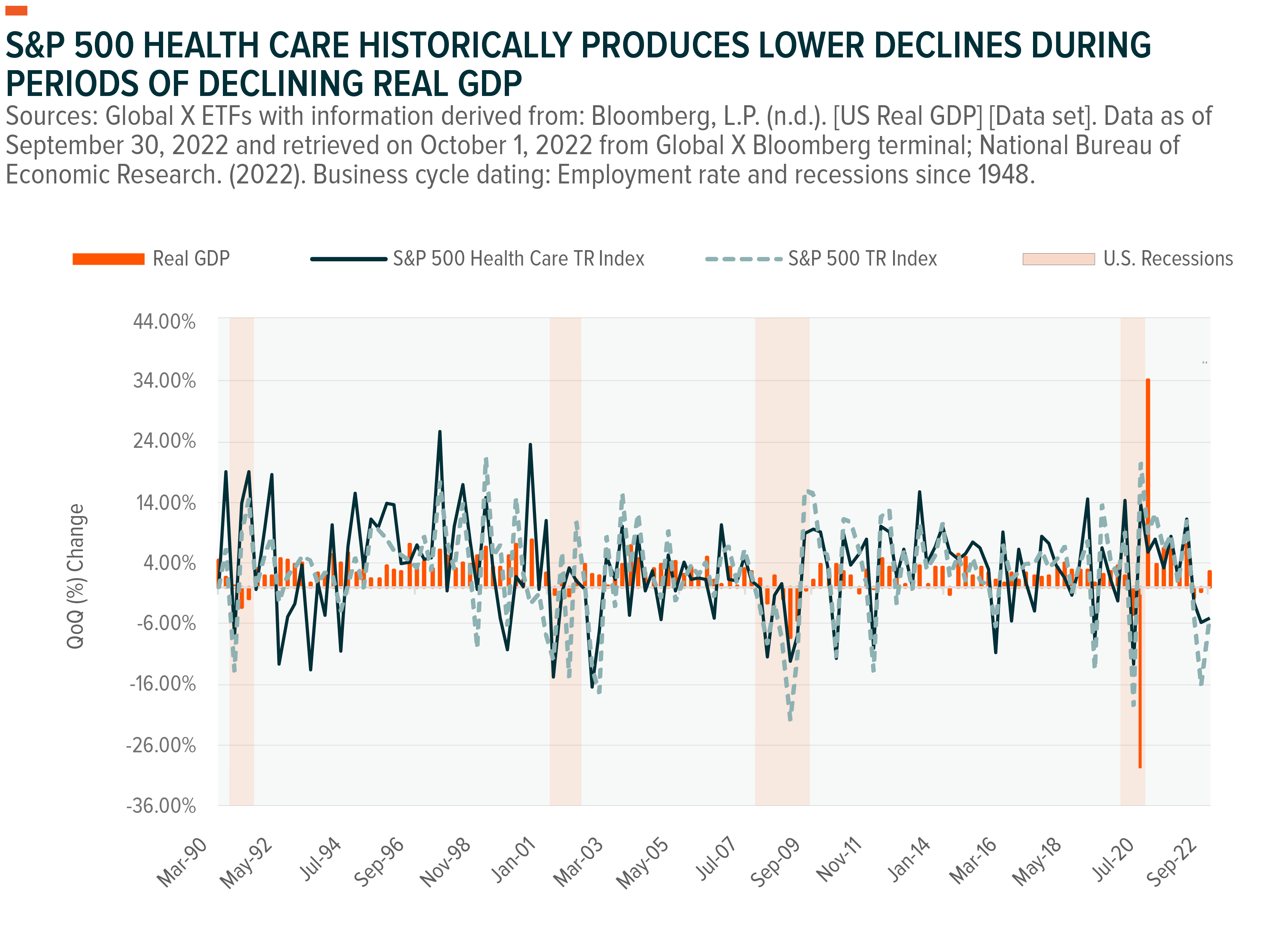

Unlike the majority of GICS sectors and broad market indices, healthcare volatility relative to the S&P 500 tends to rise during periods when the economy is strong and decline during economic turmoil (shown below). Healthcare has long been considered one of the most reliable defensive sectors-an effective portfolio buffer when equity markets turn volatile. This is because hospitals, drug makers, medical device firms and other companies across the healthcare sector generally benefit from steady consumer demand regardless of the economy’s strength (i.e., inelastic demand).

In this graph above, we can see that in periods of strengthening real (inflation-adjusted) GDP, healthcare volatility tends to be elevated. In periods of economic expansion, healthcare companies tend to place higher emphasis on research and development (R&D) and compete in major blockbuster areas such as oncology and have greater focus on mergers and acquisitions. In periods of slowing real GDP growth, there tends to be less R&D productivity for pharmaceuticals and biotechnology and less focus on regular health interventions. Per capita health expenditures of countries tends to vary by economic development; higher income countries spend on average $3,000 on each citizen whereas low income countries only spend up to $30 per capita. An increase in healthcare expenditure leads to more regular health interventions which improve labor and productivity and thus in turn GDP.4

Macro Tailwinds Have Been Helping the Financial Sector

The financial sector has continued to grow in the past few decades. This has provided market environments with a strong macro backdrop for the financial services and asset management industry. Global assets under management saw steady growth over the last 20 years which has been largely driven by strong equity markets around the globe. The financial sector has seen considerable transformation in the sources of investment capital with retail investors becoming the most important investor segment. In 2021, global net flows from retail were significantly higher than that from institutions with 6.6% from retail investors compared to 2.8% from institutions.5

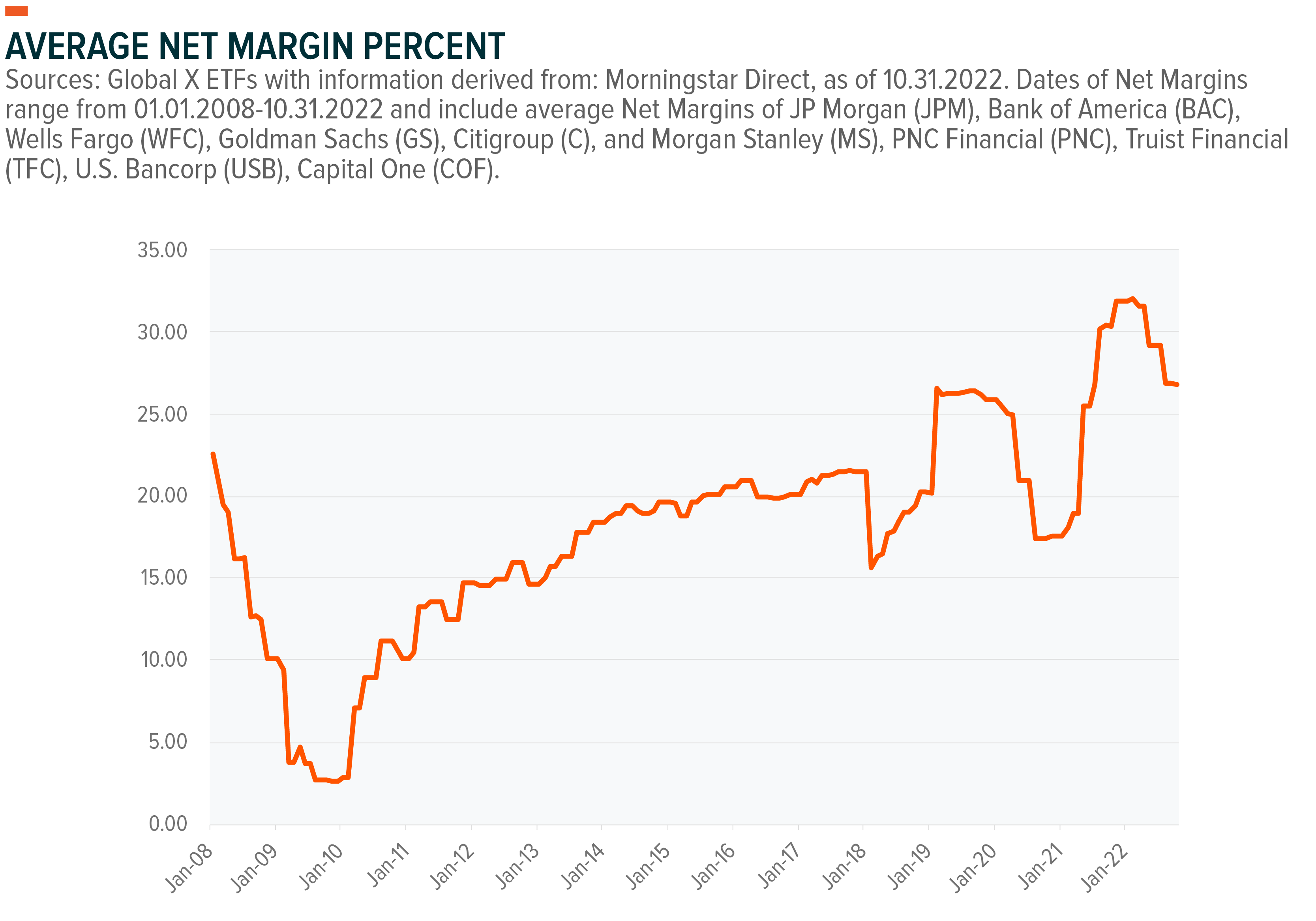

Additionally, the changing interest rate landscape could provide another macro tailwind for the sector. As higher interest rates are occurring with the Federal Reserve in the midst of its interest rate hiking cycle, profit margins could expand for financials issuers. As investors fret about the possibility of higher interest rates, many financial companies stand to benefit, as higher interest rates generally increase earnings.

Comprising 23% of the Financials Select Sector Index (as of 10/31/2022 from Morningstar), the Big 4 Banks – JP Morgan Chase, Bank of America, Wells Fargo Bank, Citibank – are key drivers in the overall economy, lending to companies across many different sectors. As we can see below, since the Great Recession major banking institutions had their net margins increase, depicting positive financial positioning.

The Growth Oriented Profile of the Technology Sector

The technology sector is likely to see tailwinds from increased adoption of key disruptive technologies such as cloud computing, cleantech and cybersecurity. Increased focus on productivity by companies is also likely to provide a boost to software names. Technology has continued to be a significant portion of the globalized market as companies increasingly rely on technology as a crucial element of their business.6

Cloud technology and increased analytics have helped companies to grow effectively. Cloud native infrastructure software has helped companies launch and scale quickly without needing to be on top of public cloud resources. Additionally, it has allowed companies to pay as they go based on their use rather than make large upfront outlays; thus, allowing them to focus on other key areas of business growth. Drawing insights from large data sets has permitted companies to offer customers more real-time feedback and adjustments across platforms.

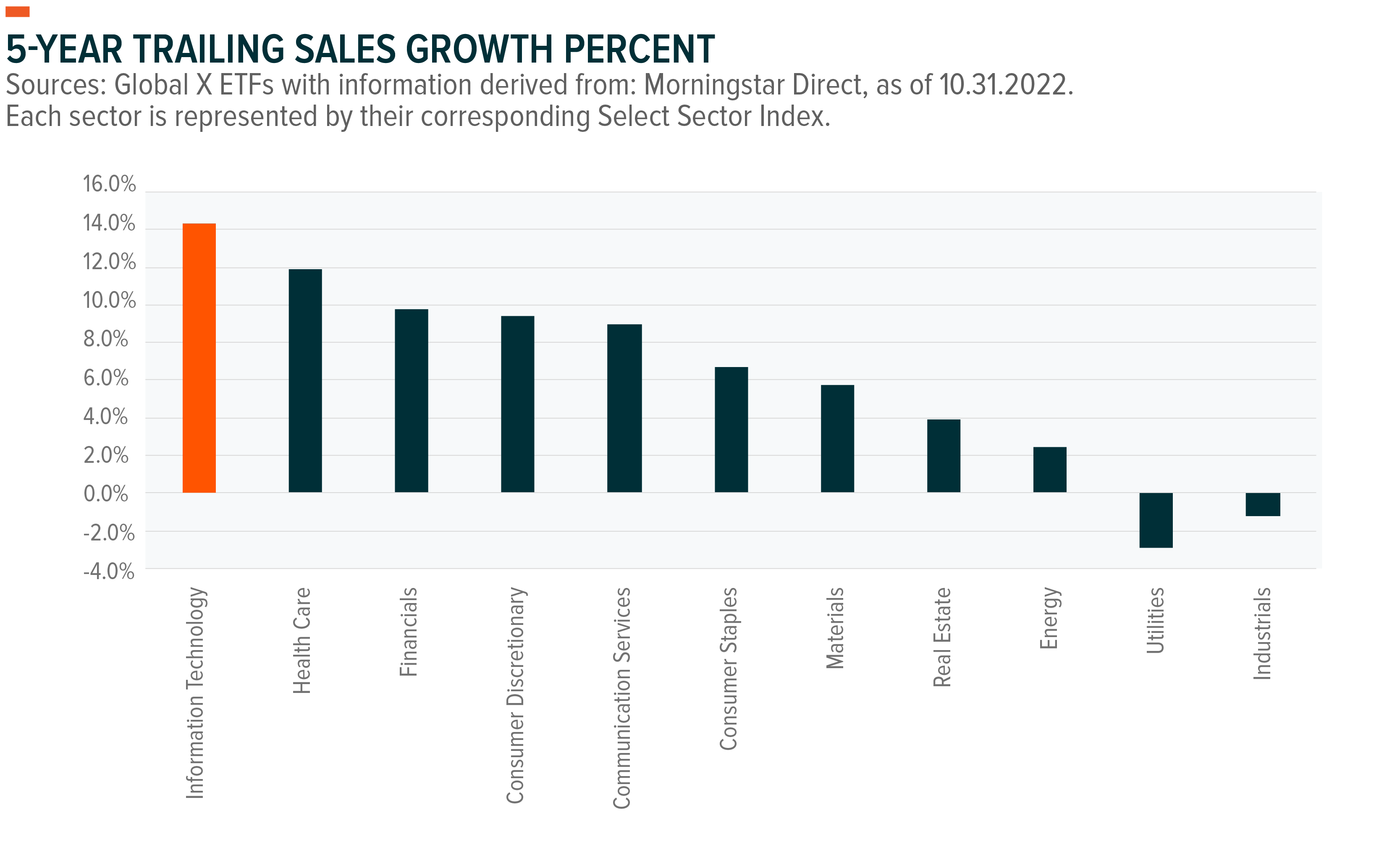

When looking at 5-Year Sales Growth we can see how the Information Technology Sector has led the way in growth relative to the other GICS sectors.

Covered Call Strategies Can Thrive in Volatility

If there continues to be a period of rising interest rates, one potential way to enhance portfolio yield is with income from a covered call strategy. This involves purchasing the stocks in the underlying index (in the case of the Global X Sector Covered Call & Growth ETFs, healthcare, technology, financials indexes) and subsequently writing call options on the sector. Covered calls strategies limit upside participation but can generate income through collecting the premiums received from option-writing. In volatile markets, option premiums tend to rise, and therefore, covered call strategies tend to perform best in choppy or sideways markets rather than in major bull or bear markets.

Investors with an indifferent or bearish view on a specific sector tend to either hold or sell their positions, respectively, to avoid potential losses. However, a sector covered call & growth strategy allows investors to express this view more efficiently in the form of selling covered call options (and therefore receiving premiums).

Accordingly, investors who are hoping to express a bullish sector view can also do it with a sector covered call and growth strategy. For instance, investors with a bullish view on a specific sector tend to overweight their positions to seek higher potential returns. As the sector covered call and growth strategy is limited to only half the upside from the option’s strike price, investors who hope to express their view more conservatively are able to maintain their equity exposure while also mitigating a degree of downside risk with the covered call premiums that they receive through the funds’ distributions.

Implementing a Sector Covered Call and Growth Strategy

Should yields continue to rise, this could present headwinds to the Healthcare, Technology and Financials sectors and equity income and fixed income sources. However, tailwinds from an aging population, rising interest rates and increased technology infrastructure could provide potential long-term tailwinds for these sectors.

Sector covered call strategies such as on information technology & financials & healthcare could be beneficial in volatile market environments. Higher volatility is correlated with higher option premiums from selling covered calls which can enhance yields even in a trendless market. Sector covered call strategies also allow investors to stay in the market in a more defensive manner while potentially benefitting from the Federal Reserve’s hawkish trajectory as the funds seek to provide monthly income.

Related ETFs

TYLG: The Global X Information Technology Covered Call & Growth ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Information Technology Select Sector Index and the Technology Select Sector SPDR Fund, and “writes” or “sells” corresponding call options on the Information Technology Select Sector SPDR Fund representing approximately 50% of the value of TYLG’s portfolio.

FYLG: The Global X Financials Covered Call & Growth ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Financial Select Sector Index and the Financial Select Sector SPDR Fund, and “writes” or “sells” corresponding call options on the Financial Select Sector SPDR Fund representing approximately 50% of the value of FYLG’s portfolio.

HYLG: The Global X Health Care Covered Call & Growth ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Health Care Select Sector Index and the Health Care Select Sector SPDR Fund, and “writes” or “sells” corresponding call options on the Health Care Select Sector SPDR Fund representing approximately 50% of the value of HYLG’s portfolio.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.

Rohan Reddy

Rohan Reddy