Editor’s Note: Conversational Alpha® (CA) is a vehicle we use for deeper and more relatable discussions about portfolio construction. In that sense, it represents both a journey and destination. This report is a periodic look at journeys and destinations that investors may want to consider.

For a long time, I thought augmented reality and virtual reality (AR/VR) were impressive technologies and compelling investment themes but not necessarily a fit for me as a consumer. Still, I bought an Oculus VR headset last year, and I used it to watch Netflix, play a Star Wars video game, and “visit” some beautiful places I have yet to check off my bucket list. My 11 year-old son went VR bowling with it a few times, but like me, the novelty wore off. Oculus has undeniably cool features like motion tracking, built-in audio, and a huge library of games and experiences. But the lack of connection to my physical surroundings while wearing the headset wasn’t my favorite.

One person I know who’s never wavered on his high conviction in immersive technologies like AR/VR and the Metaverse is Pedro Palandrani, Global X Director of Research. He and I have had a running conversation about their merits for years. Pedro continually extolled their virtues, but I couldn’t completely wrap my mind around the argument. Fast forward to the technology extravaganza that was CES® 2023, which Pedro and I attended in January. It’s where my thinking on these technologies shifted.

Conversation Starters

- The Metaverse is compelling now due in large part to the industrial story. Video games can be fun, too.

- The Industrial Metaverse, helped by digital twin tech, is already at work redefining industries.

- Consumers are likely to follow industry’s lead in a modern day immersive technology transfer.

- Moving On… Let’s Chart: Debt ceiling fight likely to ratchet up volatility. Think July 2011.

- To Wrap It Up: Portfolio considerations.

VR Clarity in an Underwater Biosphere

More consumer interaction with AR/VR and the Metaverse is necessary for their widespread acceptance and adoption. However, I think it’s important to highlight where these technologies are increasingly deployed for their utility—in industry. I believe it’s their industrial applications that can best help investors understand where this disruption is headed.

These thoughts occurred to me as I took in CES, noting gaming companies’ latest immersive technologies, which are synonymous with CES. They were on display again this year with a host of new functionalities, including haptic bodysuits that engage human senses. But it wasn’t a gaming company that pulled led me to into the Metaverse, it was a German industrial manufacturer.

I visited Siemens’ booth in the industrial wing of the VR showcase, and before I knew it, I had a headset on. Siemens’ VR took me to a simulated biosphere called Nemo’s Garden, the company’s Italian partner that’s leveraging oceanic conditions to create an underwater environment that can produce crops.1

For the project, Siemens used digital twin technology to build an exact 3D replica of the farm and its underwater surroundings. The replica gives researchers the opportunity to continuously monitor, test, and adapt the farm in ways that would be nearly impossible in the physical world. What struck me as I toured the project was the practicality of the Metaverse use case. It wasn’t entertainment, it was agriculture. The auto, healthcare, manufacturing, and retail industries, among others, see the practicality in it all, too.2

Digital Twin Efficiencies Worthy of a Doubletake

The use of AI and real-time sensor input to build and test complete 3D replicas of systems fascinates me. I think the operational efficiencies, cost savings, and crisis management capabilities gained from digital twin technology can be industry-shifting. Current economic headwinds, the pullback in globalization and rise of reshoring, and the corporate sustainability push can all help accelerate its adoption.

Today, monitoring and analysis are digital twin tech’s primary uses. For example, farmers use digital twins to monitor plant biology and to help determine optimal planting locations for plant types. Construction firms use digital twins to analyze prospective projects for their potential impact on the physical landscape and existing infrastructure, and to analyze completed projects for strengths and weaknesses.3

Eventually, industrial users could go beyond monitoring and may be able to replicate and manipulate operations on factory floors virtually, for example. Workers may be able to oversee operations from their desks while robots complete tasks within the factory’s physical and digital worlds simultaneously.4

Reverse Technology Transfer a Likely Trend

Historically, the military offers good examples of how technology transfer works. In short, R&D spending results in an end product for military use that eventually makes its way to civilian markets. We can thank the military for such products as the Jeep, the microwave, and orange juice concentrate.

Sometimes, technology transfer works in reverse, and VR seems like an apt example. While VR emerged largely as a consumer product, its current trajectory suggests that wide adoption across industries can help push it towards ubiquity. One way industry’s VR use can facilitate this transfer is through workplace training, which can bring companies new efficiencies and introduce new users to the tech. Lincoln Electric, one of the world’s largest welding equipment makers, discovered that with VR it could train welders in 23% less time and reduce costs by nearly $250 per student.5 Industry leaders such as Volkswagen, Boeing, and Loft Dynamics also use VR to cut training time and costs.6

As its ability to roleplay expands, I would be surprised if VR training does not become more commonplace for doctors, salespeople, retail workers, and maybe even for those of us on Wall Street.

I’m on board.

Let’s Chart: Debt Ceiling Fight Likely to Ratchet Up Volatility

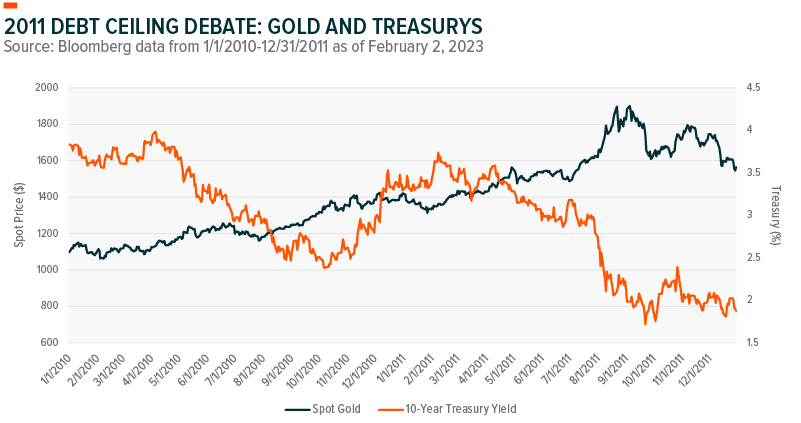

Current wrangling over the debt ceiling recalls the July 2011 debacle when lawmakers didn’t raise the ceiling until two days before the government was estimated to run out of cash. The possibility of a shutdown rattled markets and triggered rises in the 10-year Treasury yield and gold prices in the first half of 2011. Thereafter, the 10-year Treasury declined sharply as the S&P downgraded U.S. long-term federal debt for the first time.

We anticipate downside risk from the current debt ceiling negotiations should they drag. Such political brinkmanship combined with slowing economic growth, declining corporate earnings, a hawkish Fed, and possible default or downgrade scenarios would likely prolong volatility in the near term.

To Wrap It Up: Portfolio Considerations

I believe innovation will persist, despite the current economic challenges. CapEx is at historically high levels as companies seek improved efficiencies through the use of advanced technologies, including AR/VR and the Metaverse.7 In my view, these technologies can revolutionize industries over time. With this industrial growth opportunity significant and adoption likely to accelerate, a lack of allocation to the space may be a missed opportunity for growth.

Global X ETF Model Portfolio Team

Global X ETF Model Portfolio Team