The February MLP Monthly Report can be found here offering insights on MLP industry news, the asset class’s performance, yields, valuations, and fundamental drivers.

The latest quarterly MLP Insights piece providing analysis into the midstream space can be found here as well.

Summary

News

1) Chinese oil consumption is expected to touch a new high this year as it eases its Zero Covid policy, boosting global demand and prices. Daily demand is expected to increase by 800,000 barrels per day in 2023, bringing consumption to an all-time high of around 16 million barrels per day, according to the median estimate of eleven China-focused consultants surveyed by Bloomberg News. China’s more robust forecasted demand in the second quarter is expected to offset the usual seasonal weakness in crude.

2) The EU agreed to impose a $100-per-barrel cap on premium products, such as diesel, and a $45-per-barrel limit on low-end products, such as fuel oil, exported by Russia. Shipping firms transporting Russian oil products can access western insurance and financing if they pay less than the prescribed level. The implicit discount for diesel under the price cap is rather minor, which is in part due to worries about oil market tightness.

3) OPEC+ bolstered the oil producer group’s current output policy, keeping production cuts to 2 million barrels per day (bpd), as agreed in November last year, to prop up the market in the face of escalating Chinese demand and uncertainties in Russian supply prospects. Expectations of a recovery in Chinese demand collide with fears of a global recession. Investors are hoping the US Federal Reserve will signal an end to its rate-hike cycle, which the oil market will closely monitor.

Sources: Bloomberg News. (2023, January 13). Chinese oil demand seen hitting record on covid zero pivot. Bloomberg.; Foy, H., Hancock, A., Sheppard, D., & Brower, D. (2023, February 4). EU agrees price caps on Russian oil products. Financial Times.; Astakhova, O., Edwards, R., & Dahan, M, E. (2023, February 1). OPEC+ sticks to oil output policy after brief meeting. Reuters.

Performance: Midstream MLPs, as measured by the Solactive MLP Infrastructure Index, increased by 6.43% last month. The index increased by 24.06% since last January. (Source: Bloomberg)

Yield: The current yield on MLPs stands at 7.24%. MLP yields remained higher than Emerging Market Bonds (7.03%), Fixed Rate Preferreds (6.47%), and the broad market benchmark for Investment Grade Bonds (4.96%) and lower than High Yield Bonds (8.20%).1 MLP yield spreads versus 10-year Treasuries currently stand at 3.72%, lower than the long-term average of 5.63%.2 (Sources: Bloomberg; Board of Governors of the Federal Reserve System. (2023, January 31). Preformatted package: Treasury constant maturities [Data set]. Data Download Program.)

Valuations: The Enterprise Value to EBITDA ratio (EV-to-EBITDA), which seeks to provide more color on the valuations of MLPs, decreased by 18.91% from last month. Since January 2022, the EV-to-EBITDA ratio is down by approximately 20.11%. (Source: Bloomberg)

Crude Production: The Baker Hughes Rig Count decreased to 771 rigs, decreasing by 8 rigs from last month’s count of 779 rigs. US production of crude oil stood at 12,200 mb/d in the last week of January increased from December levels of 12,100 mb/d. (Sources: Baker Hughes. (2023, February 9). North America rig count.; U.S. Energy Information Administration. (2023, February 9). Petroleum and other liquids.)

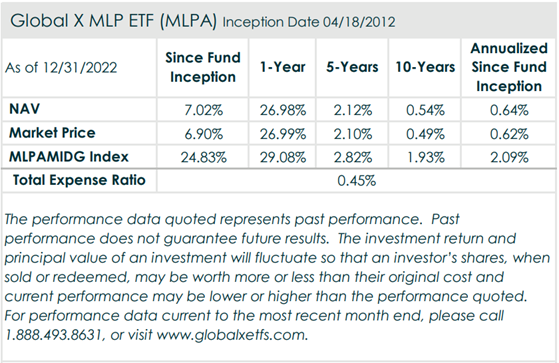

For performance data current to the most recent month- and quarter-end, please click here.

DEFINITIONS

Solactive MLP Infrastructure Index: The Solactive MLP Infrastructure Index is intended to give investors a means of tracking the performance of the energy infrastructure MLP asset class in the United States. The index is composed of Midstream MLPs engaged in the transportation, storage, and processing of natural resources.

S&P MLP Index: S&P MLP Index provides investors with exposure to the leading partnerships that trade on the NYSE and NASDAQ. The index includes both master limited partnerships (MLPs) and publicly traded limited liability companies (LLCs), which have a similar legal structure to MLPs and share the same tax benefits

Bloomberg US Corporate High Yield Total Return Index: The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Bloomberg EM country definition, are excluded.

ICE BofA Fixed Rate Preferred Securities Index: The ICE BofA Fixed Rate Preferred Securities Index tracks the performance of fixed rate US dollar denominated preferred securities issued in the US domestic market.

Bloomberg EM USD Aggregate Total Return Index: The Bloomberg Emerging Markets Hard Currency Aggregate Index is a flagship hard currency Emerging Markets debt benchmark that includes USD-denominated debt from sovereign, quasi-sovereign, and corporate EM issuers.

Bloomberg US Corporate Total Return Index: The Bloomberg US Corporate Total Return Value Unhedged Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Crude Oil: Measured based on the Generic 1st ‘CL’ Future, which is the nearest crude oil future to expiration.

EBITDA: Earnings before interest, tax, depreciation and amortization (EBITDA) is a measure of a company’s operating performance. Essentially, it’s a way to evaluate a company’s performance without having to factor in financing decisions, accounting decisions or tax environments.

Average Spread: Average spread is the average of the excess of the MLPs yield over the 10 year treasuries yield.

Enterprise Value (EV): EV is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization.

Rohan Reddy

Rohan Reddy