Copper is a workhorse metal in the global economy given its high ductility, conductivity, and corrosion-resistant properties. Today, clean energy initiatives are catalysts that could lead to higher secular demand. Another major demand factor is the possibility of a quicker-than-expected economic recovery in China, driven by the recovery in its influential property sector. Demand is only one side of the story, though, as production disruptions in key South and Central American regions add to concerns that the copper market may be heading into a deficit. In this piece, we discuss these factors and more, including how investors may want to consider exposure to copper.

Key Takeaways

- The recovery of China’s property market is a critical component of the trajectory for global copper demand. In our view, the Chinese government’s latest rescue package can lead to a robust rebound in China’s building and construction.

- Supply and inventory risks are a consideration with copper being a core material building block for renewable power grid and electric vehicle (EV) infrastructure.

- We believe copper presents compelling investment opportunities, including through leveraged plays like copper miners.

China’s Property Market Recovery to Support Copper Demand

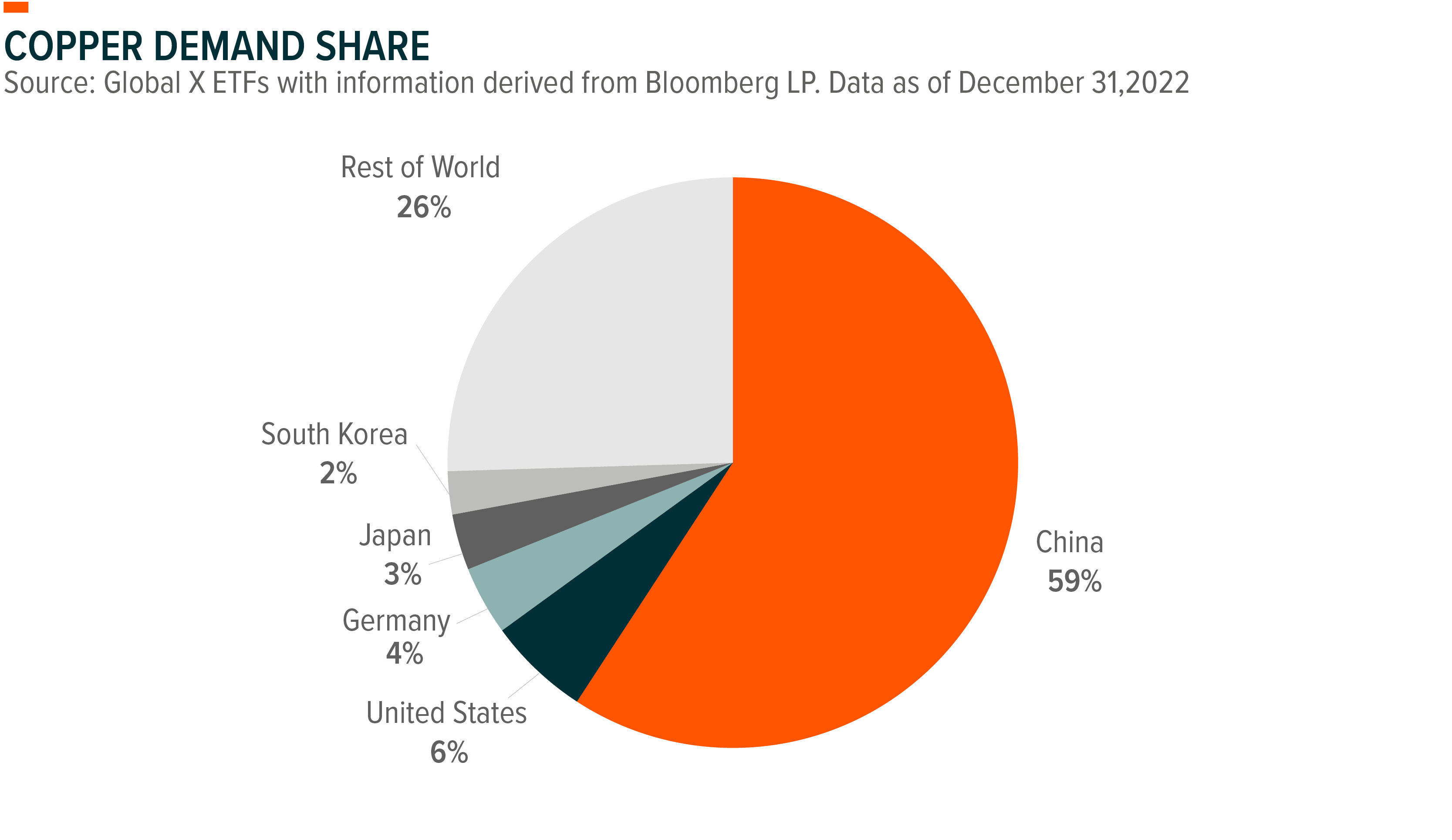

China is the biggest consumer in the world, using more than half of the world’s supply.1 At the center of China’s consumption is its building and construction sector, which accounts for about 30% of total copper end use.2 How China’s property sector bounces back from COVID-induced slowdowns is a key factor in the trajectory for copper demand. The massive property sector rescue package that the government unveiled in November 2022 should help.3 This rescue package is more pragmatic and comprehensive than earlier measures, signaling the central government’s determination to support developer financing and manage the spillover risks.

As part of the package, the China Banking and Insurance Regulatory Commission (CBIRC) outlined 16 steps to aid the property sector. Among them, the CBIRC lifted a ban on equity refinancing for property developers, allowing listed builders to sell local shares for debt payments and acquisitions. To finish housing projects, construct affordable housing, refill working capital, and pay off debt, listed developers in China will be permitted to begin private placements.4 Also, the property sector received new loan lines totaling $162 billion from China’s leading banks, proving a significant, synchronized infusion of liquidity into the Chinese real estate market.5

The 2023 Government Work Report (GWR), an annual report that details the government’s economic development plans for the year, largely restated the vows made at the government’s 2022 Central Economic Work Conference (CEWC) in December 2022. The government remains committed to improving property developers’ balance sheets and ensuring home supply. The GWR did remove the statement that “housing is for living, not for speculation.” 6 Instead, the government now encourages the steady growth of the property market, signaling a change from curbing speculation to boosting demand. In keeping with CEWC, the government stressed supporting basic and upgrading housing demand by rolling out financial support.7

Helped by government stimulus, China’s home prices steadied in January to end a 16-month decline 8 and gained momentum in February 9. Should home prices continue to stabilize and boost buyers’ confidence, it could be viewed as an early sign that property sales may start to improve.

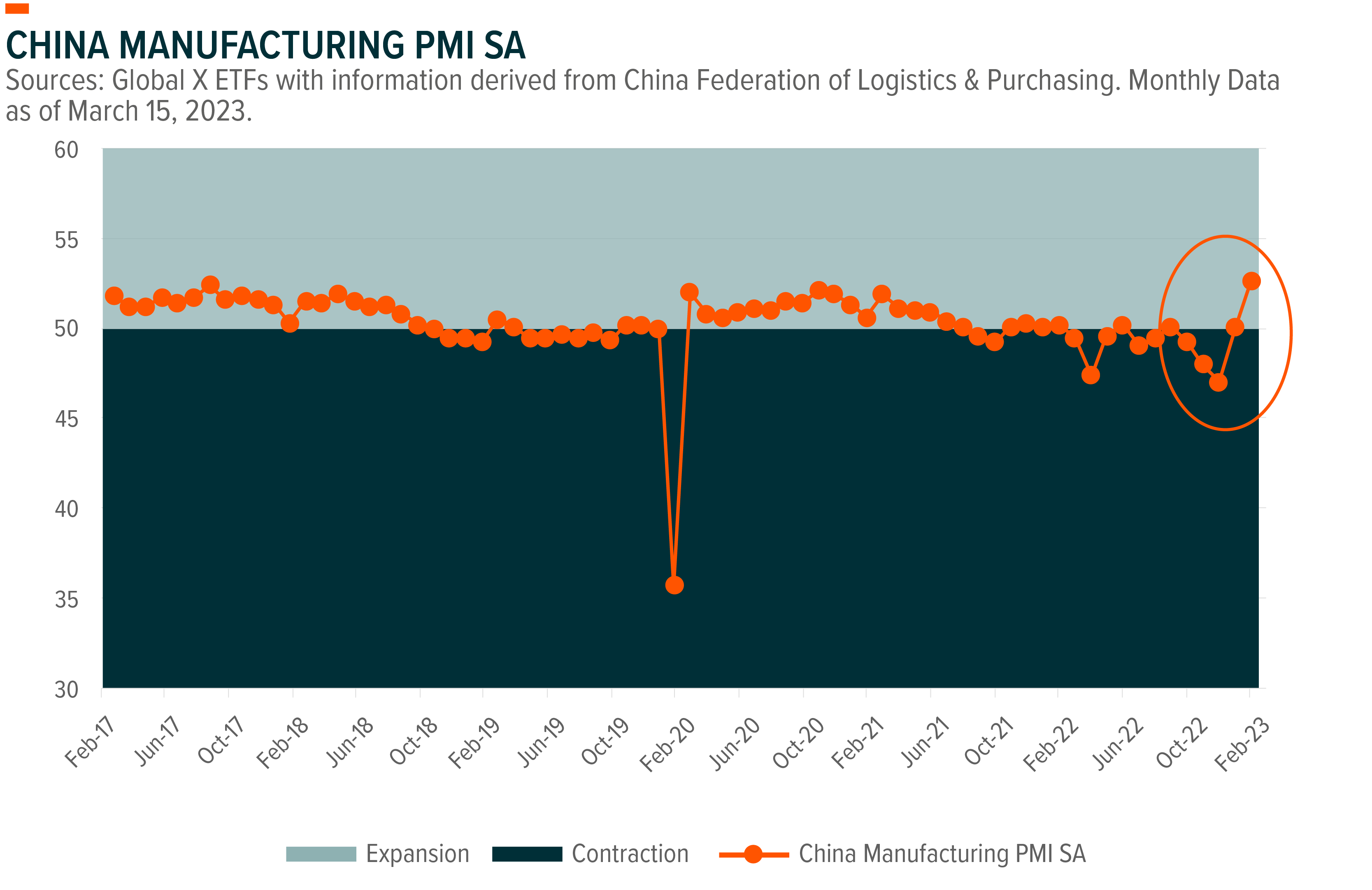

More broadly, China reported that its manufacturing sector is recovering rapidly. According to February Purchasing Managers’ Index (PMI) data, China’s manufacturing sector expanded at its quickest rate since April 201210, potentially paving the way for higher output and increased economic activity. Moreover, China’s March NBS PMI survey showed service and construction activities driving the post-Covid recovery.11

Production Interruptions Raise Concerns About Copper Supply

Copper supply might increase in 2023 due to project ramp-ups 12, but supply disruption risks are a consideration, particularly in key Central and South American production regions. Chile and Peru alone provide almost 40% of the global copper supply.13 Recent disruptions in the region include the Las Bambas copper mine in Peru, where production was partially cut after road blockades in February 2023 prevented the delivery of raw materials14. In late February 2023, First Quantum stopped processing ore at its Panama mine due to mine tax and royalty disputes.15

Disruptions like these increase the risk of a copper shortfall in the coming years, which can put pressure on prices. Other potential stumbling blocks to the rapid expansion of capacity include land acquisition and grid connection risks. Water scarcity in arid locations is another risk, as copper extraction typically requires significant water use. Already, in December 2022, commodity trading and mining company Glencore forecasted a 50 mt supply shortage by 2030.16.

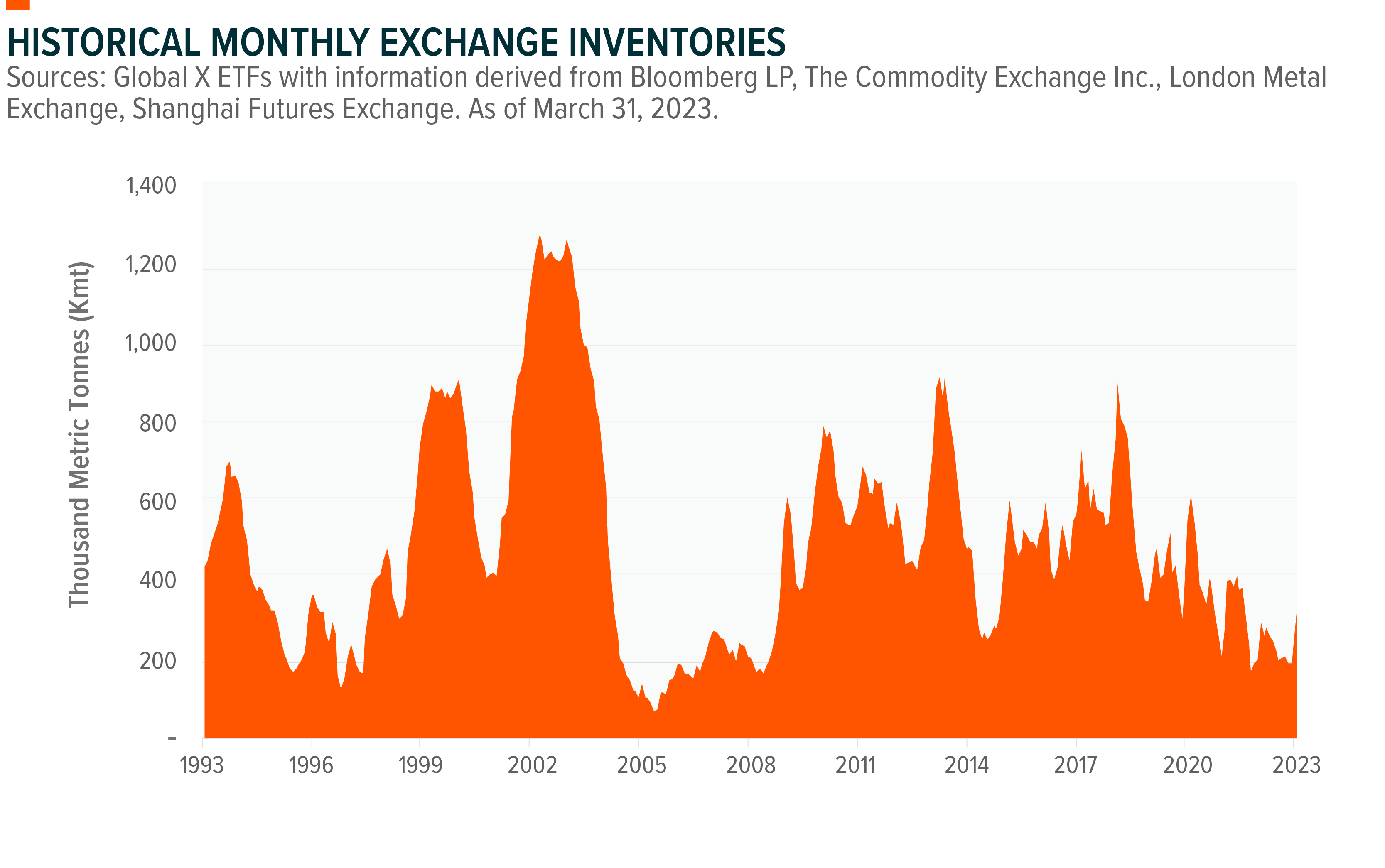

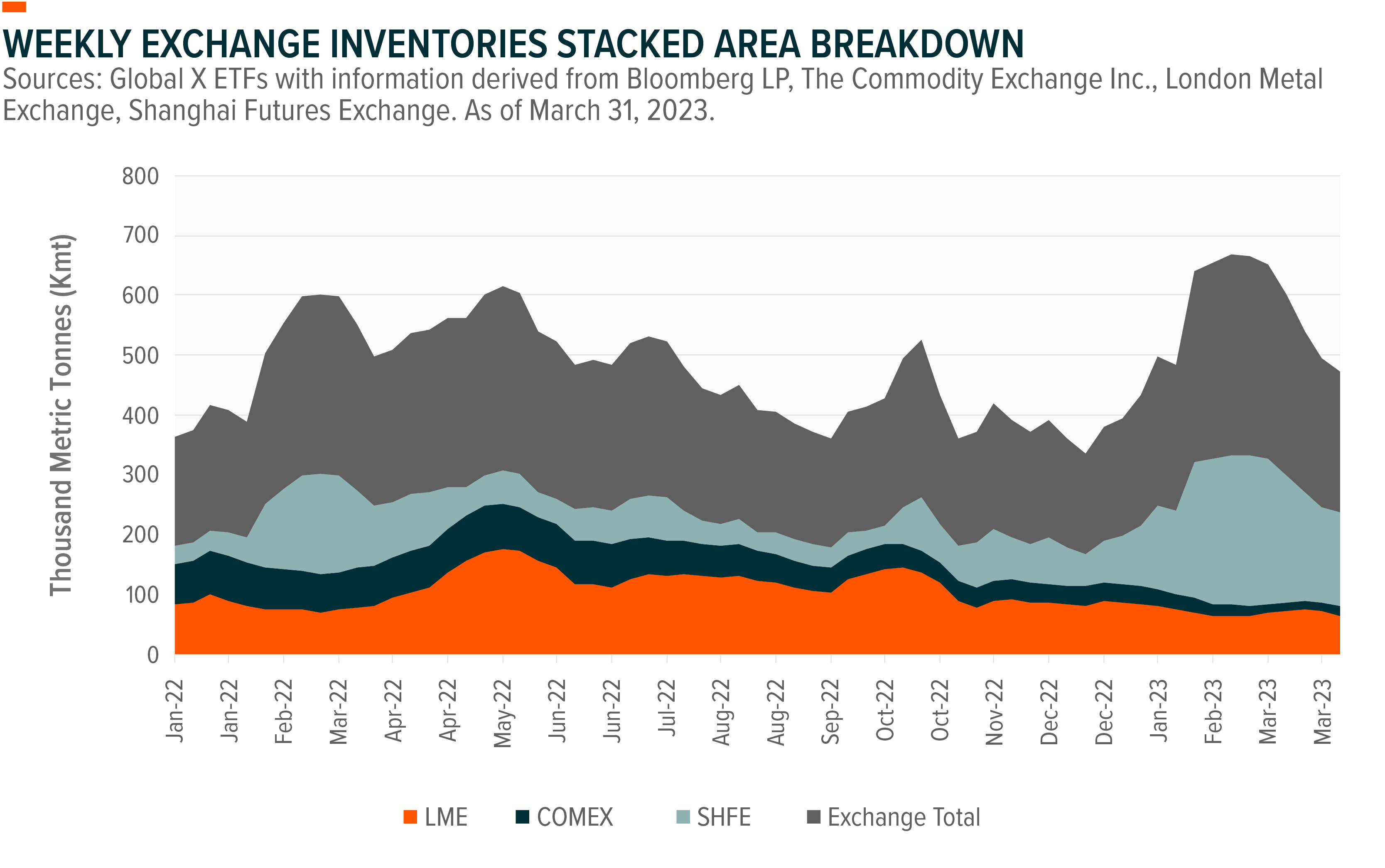

Low copper inventories in the United States and Europe exacerbate the production disruptions in South and Central America, adding to the perception that the copper market may be approaching a deficit. If Chinese demand keeps rising as it did in February, Goldman Sachs expects the world to run out of visible copper inventory by the third quarter, this year.17 Low inventories increase the possibility of a price surge in the event of significant drawdowns and a subsequent rush by traders to replenish their stock.

Despite a recent increase, inventories remain very low in the London Metal Exchange (LME) and Commodity New York Mercantile Exchange (COMEX)18. However, inventories grew in the Shanghai Futures Exchange (SHFE) following Lunar New Year, which is a seasonal occurrence linked to the holiday. If inventories were to fall earlier or more quickly than expected, it could confirm expectations of a strong rebound in Chinese demand. SHFE falling inventory levels from the last week of February confirmed a rebound back.19

Demand for Clean Energy Can Trigger a Copper Super Cycle

Copper’s useful characteristics imply that its demand is closely linked to economic cycles, industrialization, and now the energy transition. In the near term, we expect copper prices to find support from global catalysts such as the Federal Reserve’s (Fed) eventual pause of its hiking cycle, a weaker U.S. dollar and China’s reopening. In the medium term, energy transition-related demand and lagging supply investment might mainly drive copper prices.

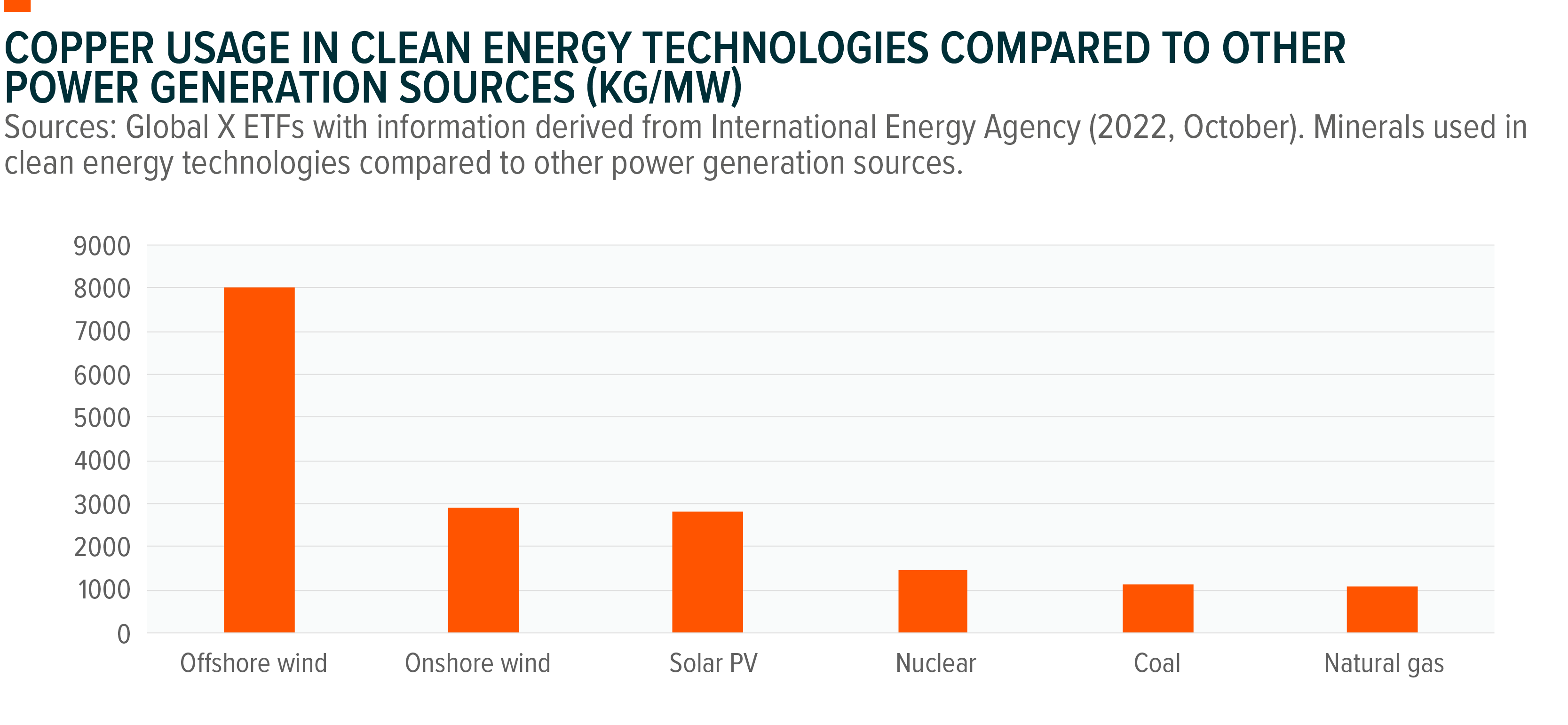

Many governments are investing to develop renewable energy including solar power and to increase electric vehicles (EV) adoption, notably the United States and Europe.20 As a result, these two economies are becoming key drivers of the surge in copper demand. For example, the Biden administration recently granted $2.8 billion for EV battery manufacturing.21 The Inflation Reduction Act of 2022 provides credits to buy EVs, and if all goes according to plan, 50% of all new cars sold in the United States could be some type of EV 2030.22 Europe increased its demand for copper as part of its accelerated shift to renewables to wean off Russian gas.23

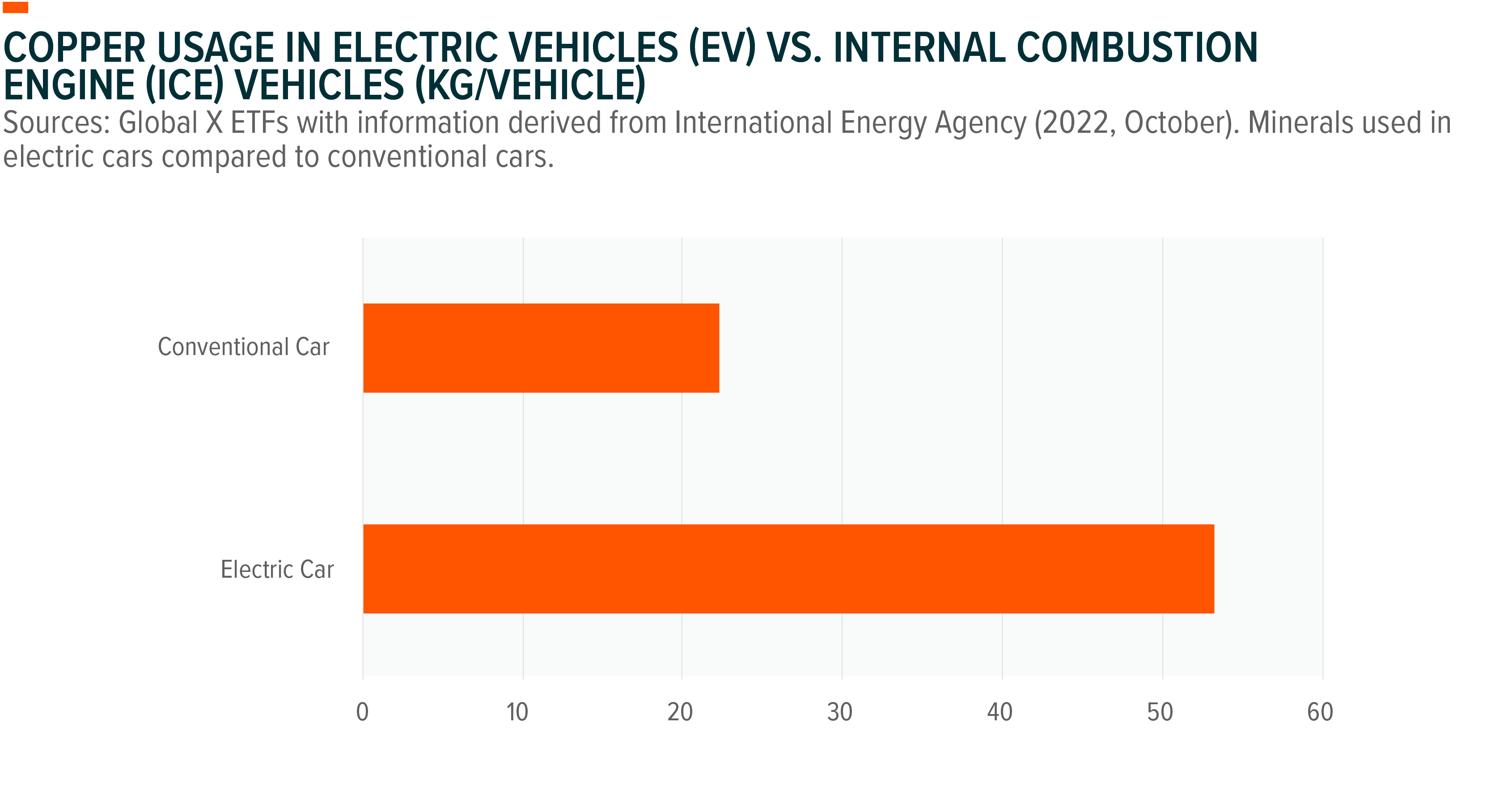

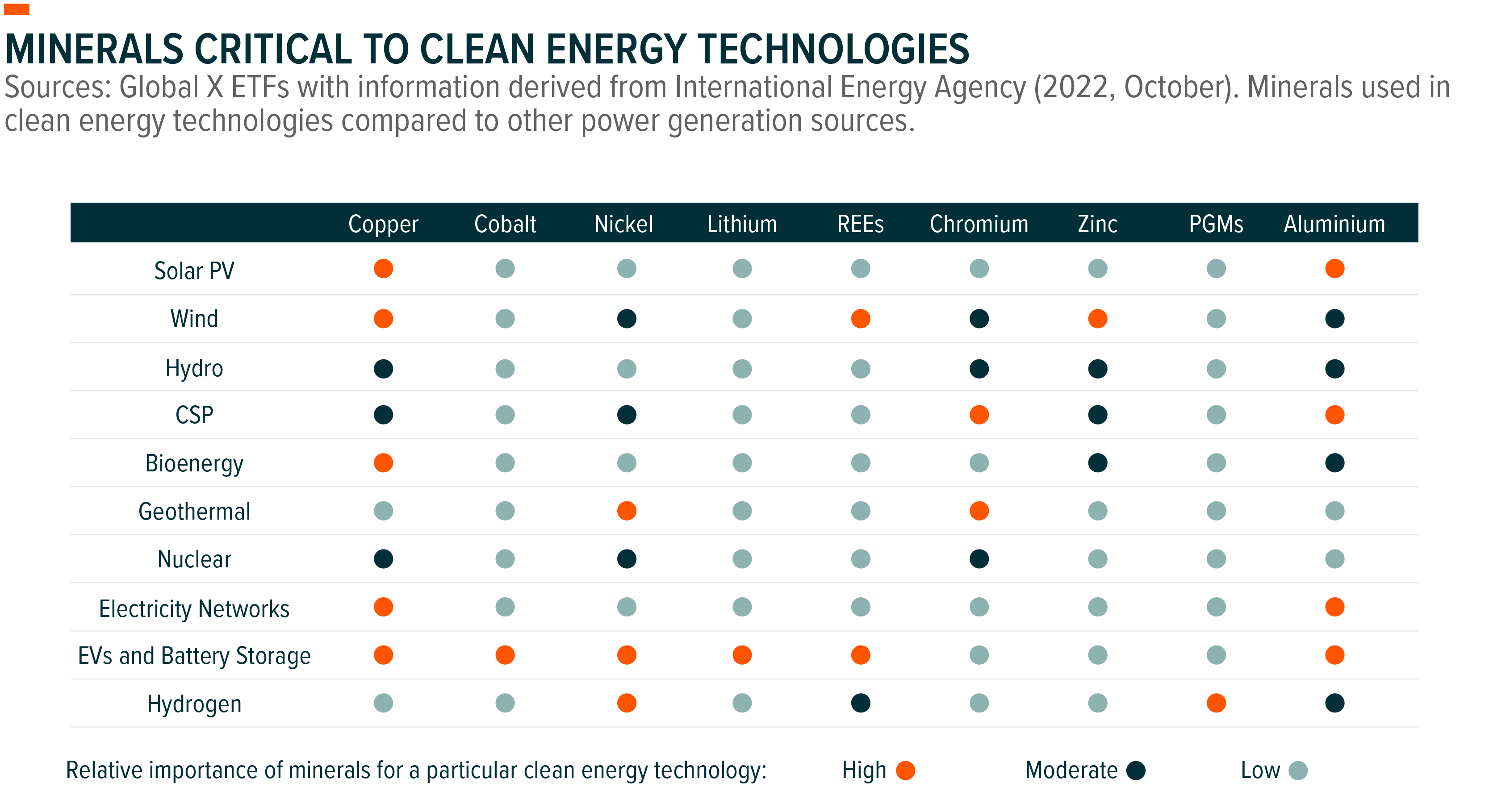

According to the International Energy Agency (IEA), annual copper demand globally is expected to double by 2030.24 Copper is one of the minerals that will be indispensable to the energy transition. Its conductive qualities make copper a key component of low-emissions power production technologies like solar photovoltaic (PV) panels, wind turbines, and batteries, in addition to its widespread use in the energy transmission and distribution grids.25

Multiple Ways to Invest in Copper, Including Leveraged Plays via Miners

Investors can gain exposure to copper through physical copper, futures, and mining stocks. Physical copper bullion can be bought directly from precious metal dealers, who sell it at spot market prices. The advantage of physical ownership is that its value closely tracks the price movements of the broader copper market. Also, owners have direct access to their investment. One downside is that dealers can charge premiums to buy and sell copper, which can dramatically reduce returns. In addition, storage costs must be taken into account.

Paper trading of copper is conducted through the futures market. Paper trading provides investors with exposure to copper without needing to physically hold the metal, potentially improving liquidity and reducing the cost of ownership. Unlike the bullion market, futures markets can also allow investors to use leverage. One downside of futures is contango, which occurs when future prices of a commodity are higher than its spot price. Contango can erode gains over time, even if the spot price of copper rises. For example, the Copper forward curve has been recently rather smile-shaped, including phases of contango, such as from June to November 2023.26

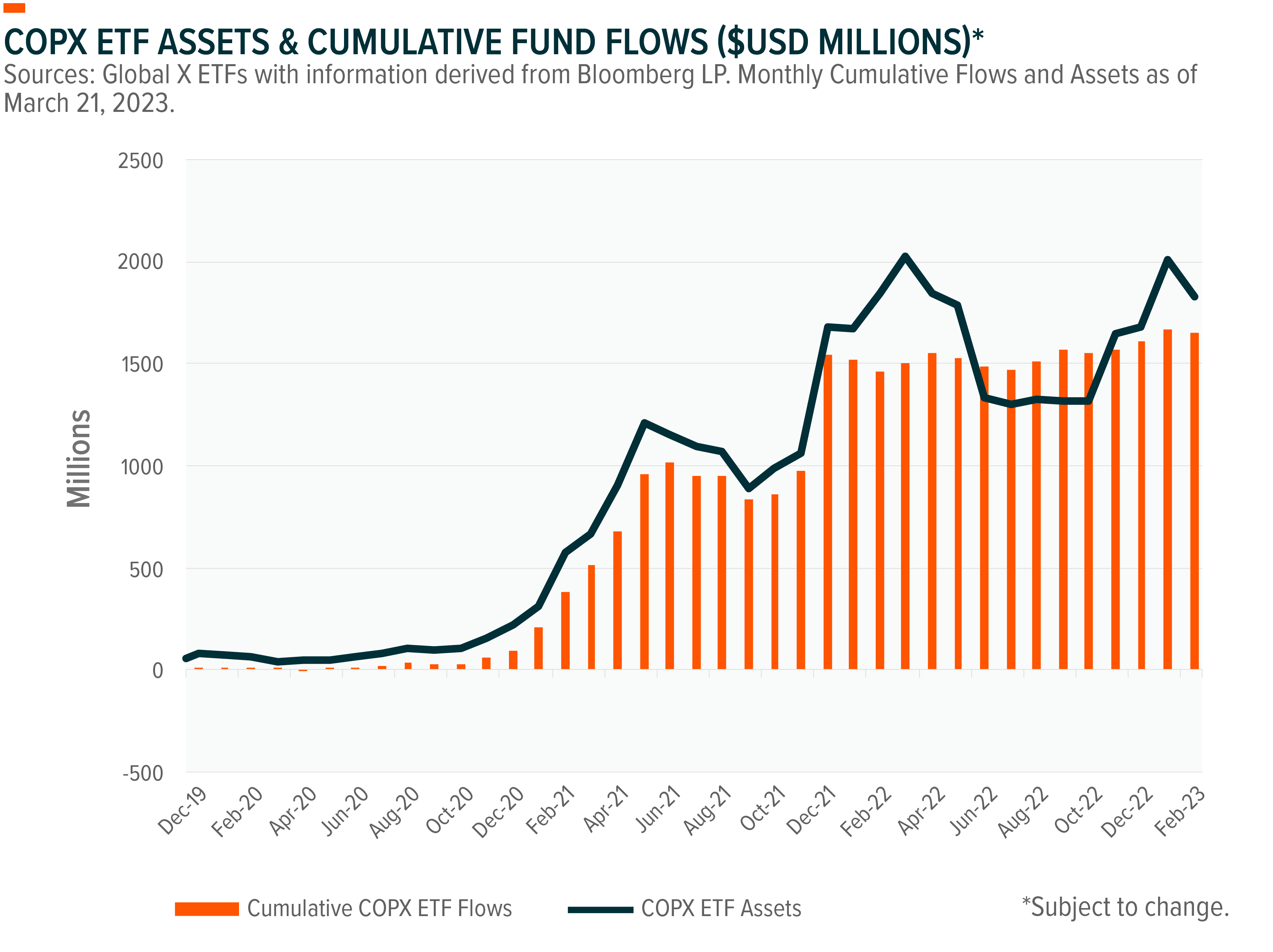

Copper mining stocks offer indirect exposure to copper prices. These stocks tend to be leveraged plays on copper prices due to the fixed costs of extracting the metal. Historically, copper miners outperform bullion in bullish markets because of how these companies use their operating leverage to increase profits, which can boost share prices. Unlike investing directly in copper, miners can expand production as profit margins grow. A potential drawback for investors is exposure to idiosyncratic risks associated with owning a particular company’s stock. To counteract this risk, investors may look to an ETF, which owns a broad basket of companies involved in copper mining.

This high inflation environment makes for difficult operating conditions, causing some analysts to be pessimistic about the mining industry’s capacity to exceed the commodity price. Due to largely fixed expenses in the mining business, companies’ profits depend on both cost curves and the copper price. Currently, copper is trading over cash cost support compared to other base metals.

Conclusion: Demand Catalysts Materializing into Opportunities

Copper may not have the shine of a precious metal, but the world puts it to work in myriad ways due to its unique characteristics. Tight supply, a bullish long-term story linked to the energy transition, and the potential for an economic boom as China reopens create a compelling investment case for copper, in our view. Despite high volatility and risks linked to an expected global slowdown, we believe copper is still supported in the near term while a Supercycle is envisioned over the decade.

Related ETFs

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Rohan Reddy

Rohan Reddy