The recession that wasn’t. The 20% equity correction that wasn’t. The earnings cliff that wasn’t. The stalling corporate investment that wasn’t. That value over growth trade that wasn’t. The banking crisis that wasn’t. The cutback in consumer spending that wasn’t. The debt ceiling debacle that wasn’t. Numerous negative narratives floating around at the start the year did not materialize in the first half, which went largely as we wrote in these pages.1

In equities, growth led the way in what was a rather sanguine economic environment.2 That isn’t to say stocks are in the clear. Risks lurk, including Russia’s nuclear weapons in Belarus, a continued downward spiral in U.S.-China relations, a Fed that gets too aggressive by focusing on the 2% inflation target, and commercial real estate and private equity downturns. While acknowledging these risks, we believe investors have reasons for optimism in the second half and beyond, due in no small part to the AI ecosystem and the makings of an innovation boom.3

Key Takeaways

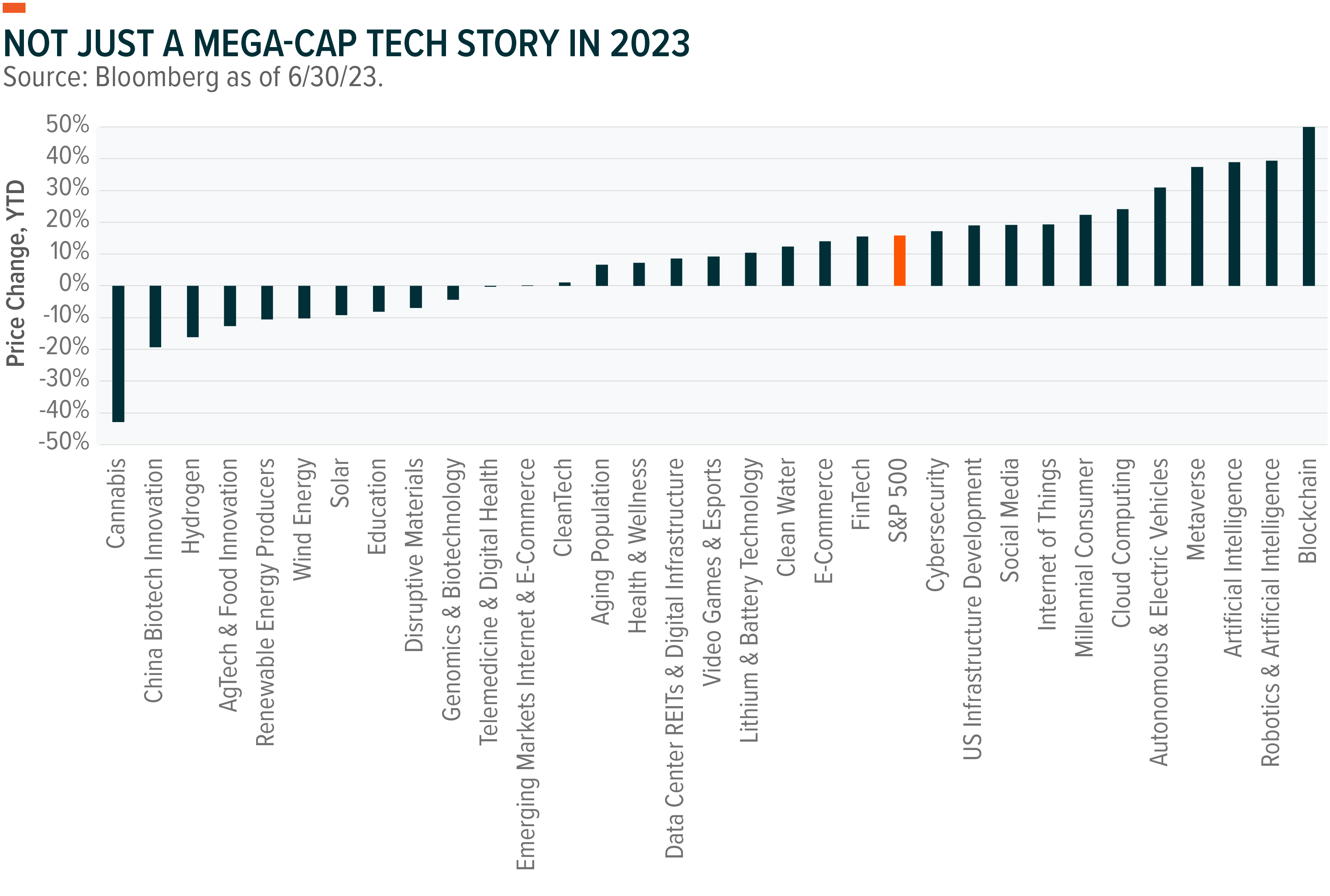

- Equities, and growth stocks in particular, were strong performers in the first half with many innovation-related themes leading the market higher.

- Excitement over AI mirrors prior innovation booms that persisted for extended periods and pushed stock valuations higher.

- Our analyses indicate that many themes that outperformed in the first half, such as Robotics & Artificial Intelligence, Cloud Computing, and Internet of Things, may still be attractive. Beyond AI, U.S. Infrastructure and Agtech offer compelling opportunities, in our view.

Us and Them

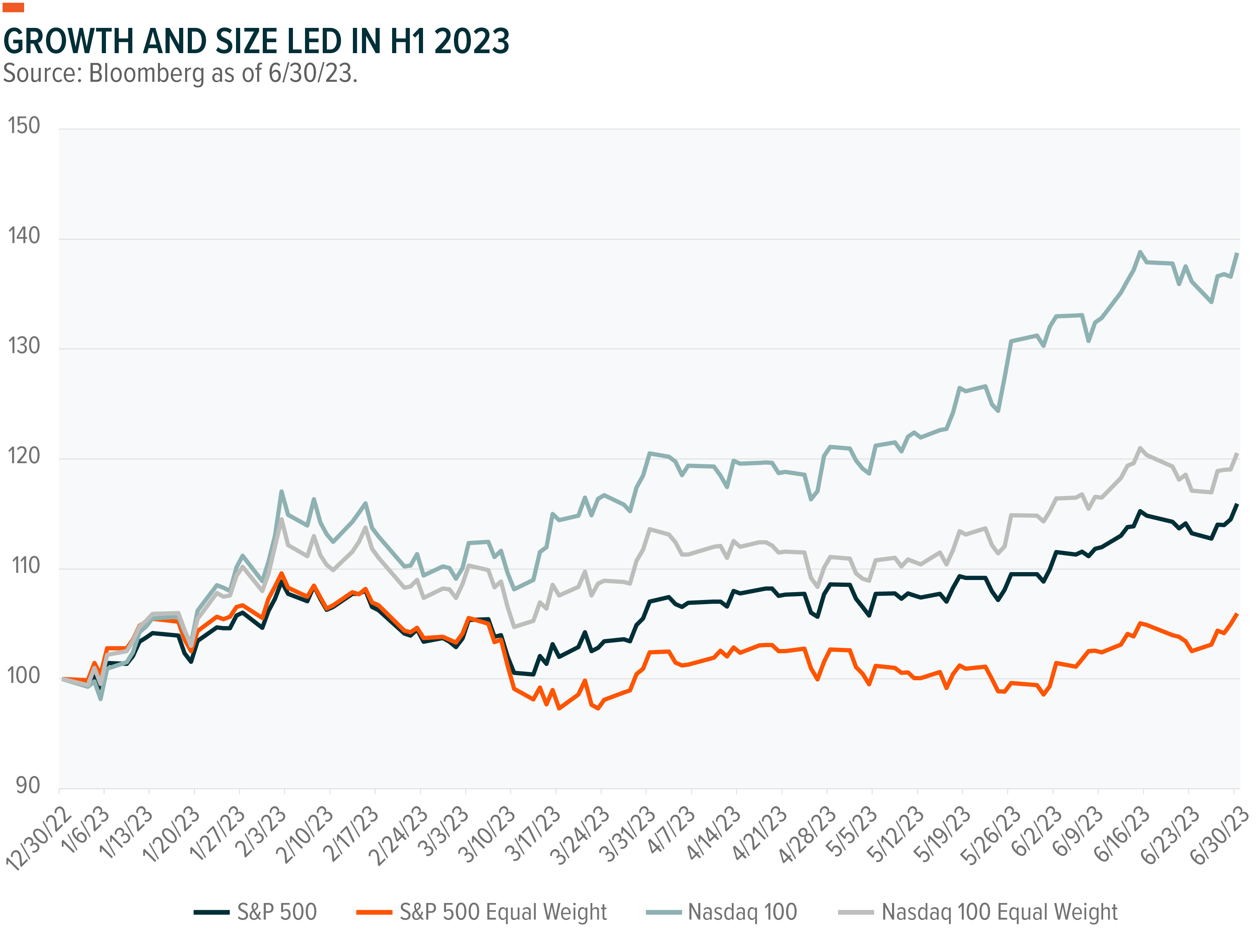

At the start of 2023, our view was that economic growth would slow, but labor, leverage, and liquidity were still sufficiently healthy to avoid a recession and an equity selloff, and that proved to be true.4 Equities rallied off the relatively cheap multiples of 2022, though performance was uneven. The S&P 500 cap-weighted index increased 16% and the equal weighted S&P 500 was up only 6%.5 The narrow nature of the advance that seems concentrated in high quality mega-cap technology names has drawn scrutiny, but that is not the whole story. The equally weighted Nasdaq 100 outperformed the cap-weighted S&P 500. While large companies were an important part of the rally, the more accurate story is that growth moved higher.

A number of technology-oriented themes delivered strong performances. Many of the top performers, beyond Blockchain’s rapid rebound, are tied to artificial intelligence and automation (see chart). Robotics & AI beat the S&P 500 year-to-date with no exposure to the traditional big tech MMAANG stocks.6 The same is true for the Internet of Things device makers that help machines translate the physical world into digital signals. Cybersecurity companies also beat the S&P 500, showing that their business model can be profitable with sufficient discipline. Consumer-oriented themes like Millennial Consumers and Social Media faired well as spending remained resilient even in the face of elevated inflation. Not all the winners were tech-focused, with U.S. Infrastructure continuing the strong run from 2022.

Welcome to the Machine

ChatGPT was trained on 300 billion words, or enough content to fill 3 million books.7 While that may seem like a lot, consider that the Library Congress has over 26 million books and 176 million different texts.8 What we’ve seen thus far is only the start of AI, and the implications are staggering. By 2030, AI could contribute $15.7 trillion to the global economy, which is more than China’s GDP in 2022.9 The innovation story runs deeper than AI, though. Corporate investment continues to grow faster than earnings, as it has since the onset of COVID. While initially triggered by the need to function through the pandemic, sustained corporate investment may be triggering an innovation boom.

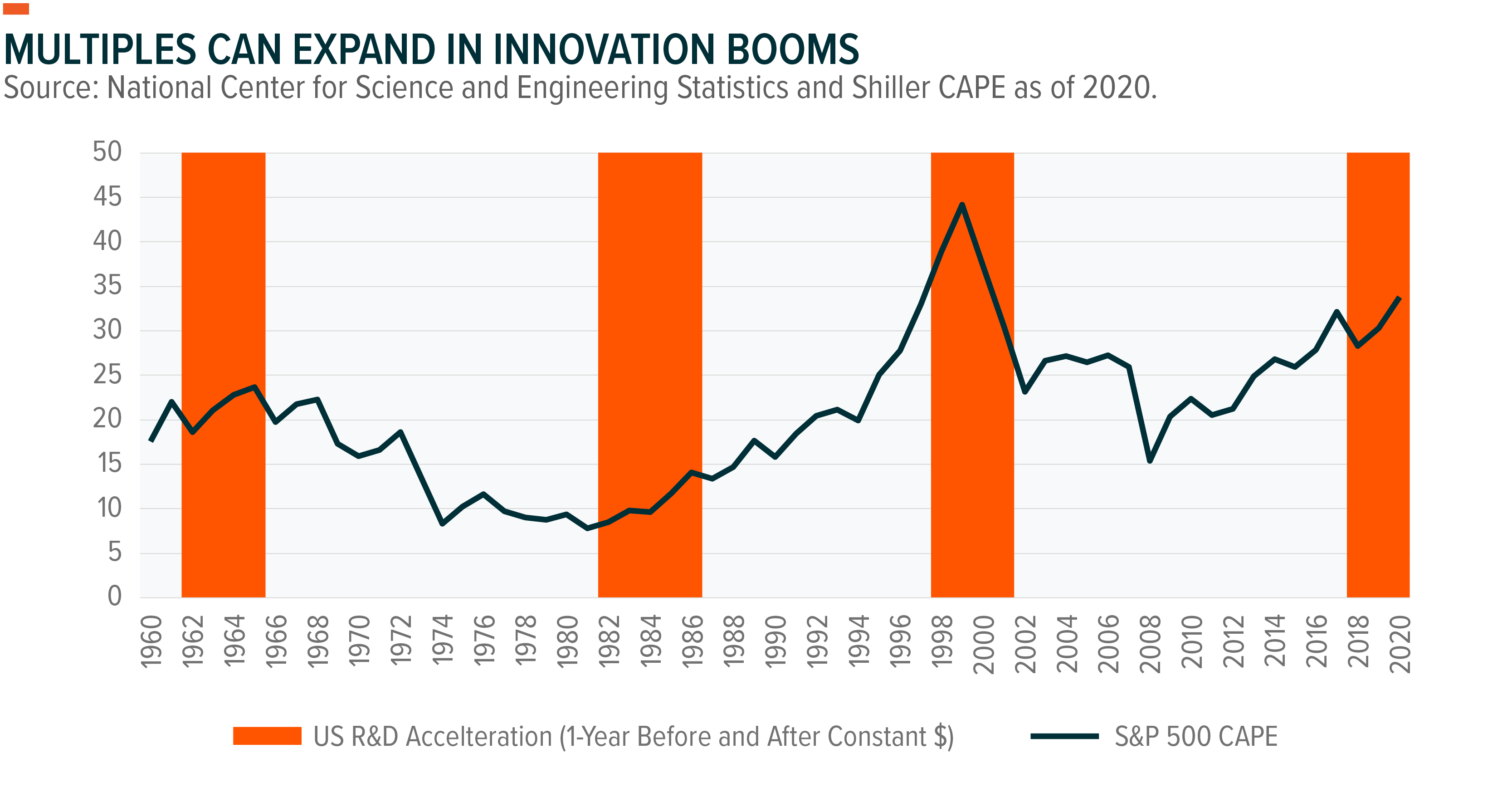

Research and development (R&D) spending, used here, is one measure of an innovation boom. Since 1960, R&D spending grew more than one standard deviation above the mean three times, and the same is happening now (see chart). Including the years before and after the acceleration in R&D spending, where early adopters and late entrants begin and end the cycle, innovation boom periods lasted 4–5 years.10 During these periods, equity market valuations typically moved meaningfully higher, measured by the cyclically-adjusted price to earnings ratio.

Each of these cases included the integration of new productivity enhancing technology. The 1960s brought mainframe computing. The personal computer helped fuel the boom in the early 1980s, and the growth of the internet contributed to investment in the late 1990s. Today, it could be AI integration inclusive of the hardware and data buildouts that fuels a multi-year cycle. The software algorithms draw much of the attention, but there is a broader ecosystem of processor companies, data storage, sensors, data transmission, and expertise likely needed to support the scaling and application of the new technology.

Concerns that equity valuations already reflect the innovation boom appear valid on a market cap weighted basis, but we think looking under the surface is important, where equal weighted indexes have not moved as much. For example, the S&P 500 equal weight currently has a forward PE at 16.9 times versus the average of 17.7 times since 2009.11 The Nasdaq equal weighted only moved from 26.1 times to 26.9 times, modestly above the 10-year average of 23.4 times.

Innovation booms generally permeate throughout the economy, thus the increase in aggregate R&D spending. If the adoption of new automation technologies proves pervasive, then many companies may still benefit given that these are the very early days of AI integration.

Wish You Were Here

Given the fairly modest flows to equities so far this year, it is possible that many investors don’t have much exposure to rapidly evolving and productivity enhancing technology.12 However, investors who believe that they missed the move in many of the hot themes might be relieved to hear that there could be more gas in the tank. Growth stocks were shunned in 2022, and we believe that their selloff last year creates varied opportunities.

According to our analyses, AI companies and themes that comprise the broader AI ecosystem may be set up to produce strong fundamental results in the second half and beyond as part of a new long-term thematic cycle. For example, Cloud Computing companies may offer reasonable valuations and ultimately integrate new AI product offerings with existing software suites over time. On the hardware side, Internet of Things companies may help integrate AI software into everyday life for consumers and companies, while Robotics & AI companies focus on industrial use of artificial intelligence. Both themes offer exposure to processor companies as well. Data Center REITS is another potential hardware opportunity as new capacity comes online to meet demand. Related to the growth of digitalization is the need to secure systems with Cybersecurity.

Two other themes that investors may want to consider are U.S. Infrastructure and Agtech. U.S. Infrastructure performed well in 2022, and over the past 18 months has returned +10%, compared to -7% for the S&P 500.13 Despite U.S. Infrastructure’s strong performance, there is very little long-term growth built into the current valuation (see charts below), even with expected spending from 2021’s $1.2 trillion Investment Infrastructure and Jobs Act (IIJA).14 Spending from 2022’s CHIPS Act and the Inflation Reduction Act (IRA) may also flow to infrastructure companies.15 As Agtech lost 13% in the first half, this could a contrarian theme to watch. Firms likely were adversely impacted by food inflation impacting cost structure, but that headwind should wane in the coming months.16

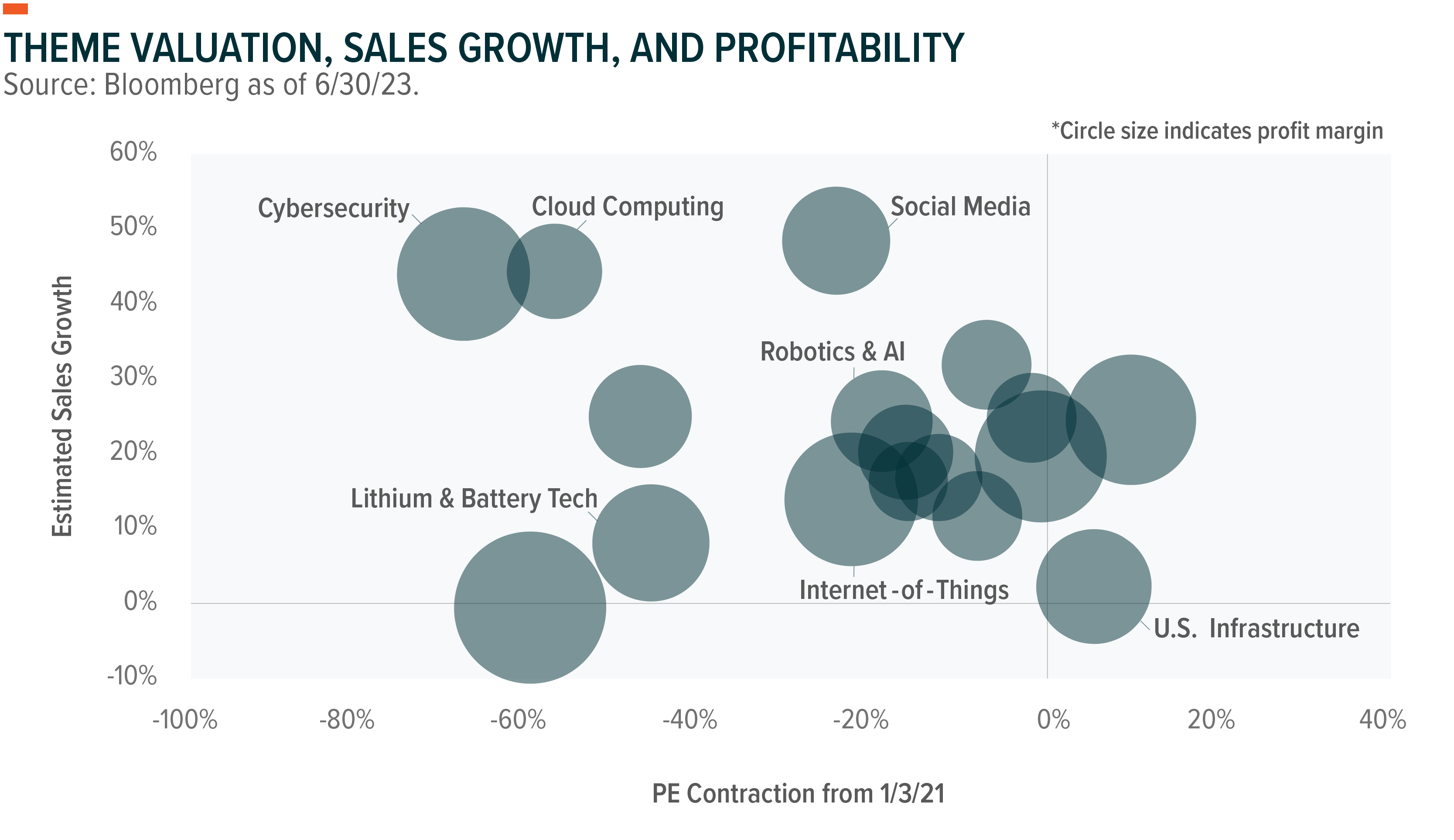

When we look at recent performance, the tradeoff between growth and valuation could still be favorable. Many themes remain below peak valuations in 2021, despite mounting recoveries from their 2022 lows (see chart). Themes tied to AI and corporate investment such as Robotics & AI and Cybersecurity have yet to return to their pandemic highs. Meanwhile, expected sales growth over the next year for numerous themes, including Cloud Computing and Cybersecurity, is expected to outpace the S&P 500 at 9% and Nasdaq at 15%.17

One concern throughout 2022 was that growth companies may not be profitable, but multiple themes maintained high single to double-digit profit margins in the first half despite higher interest rates, high producer inflation, and slowing growth. The Cybersecurity, Internet of Things, and Robotics & AI themes all posted profit margins of 13%.18

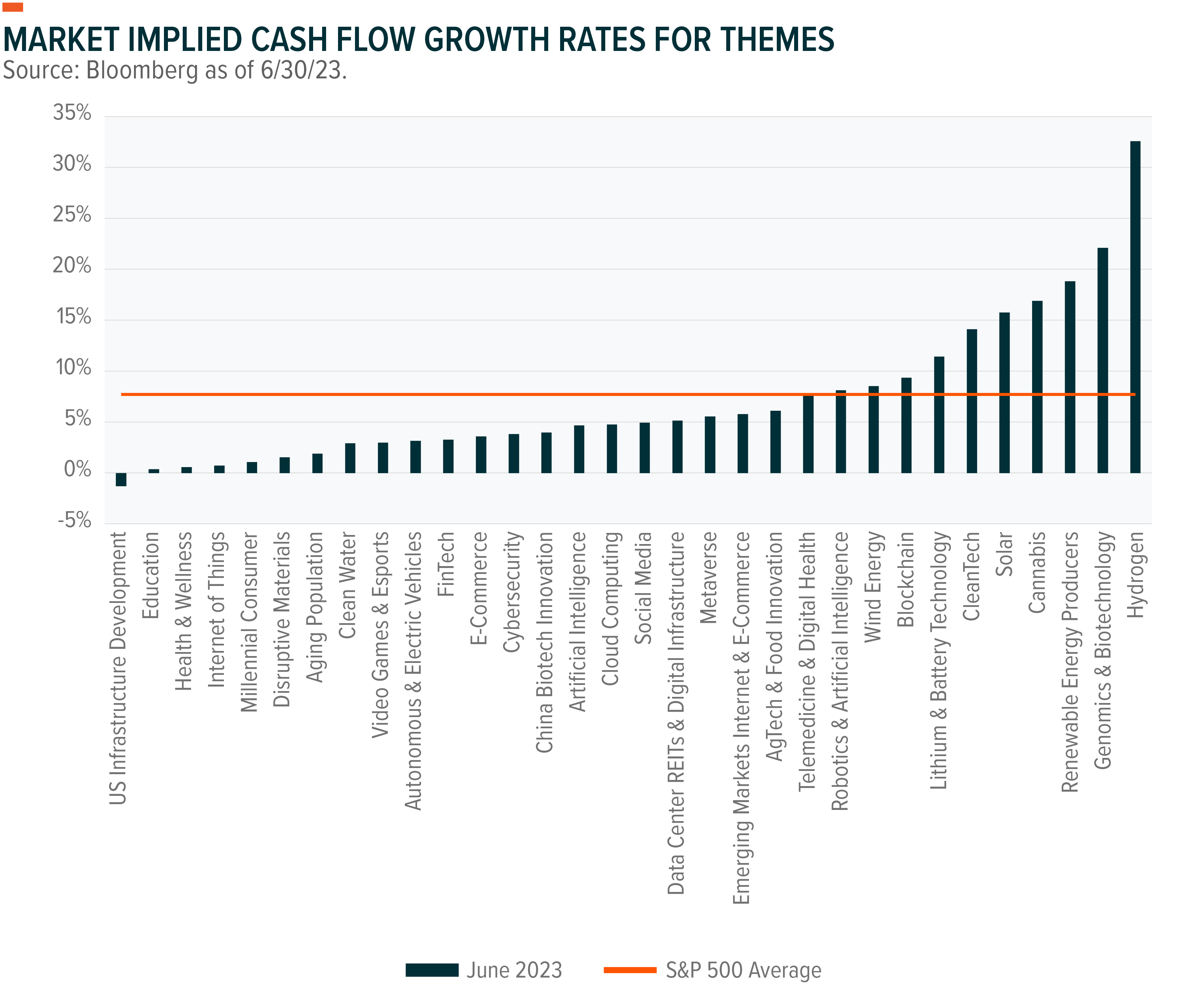

Measures like sales growth over a single year offer insights, but we encourage thematic investors to focus on the long-term growth expectations embedded in stocks prices, as discussed at length in previous Inflection Points.19 Despite strong recent performances, many themes currently trade with reasonable valuations based on market-implied (or terminal value) growth expectations. This exercise simply uses market cap as the net present value, and then incorporates consensus cash flow estimates and the weighted average cost of capital to calculate the market-implied long-term growth expectations.

In terms of free cash flow, historically the S&P 500 grows at 7–8% annually, and on a relative basis a number of growth-related themes remain attractive.20 AI ecosystem themes inclusive of software such as Artificial Intelligence and Cloud Computing and hardware-related Internet of Things and Data Center REITS still trade with implied long-term growth rates of 1–5%, well below the S&P 500 average. Robotics & AI, which has significant exposure to processing and automation, is still only priced for estimated free cash flow growth of 8%. Cybersecurity is priced at 4%. U.S. Infrastructure is priced for free cash flow contraction after the next two years, which seems surprising given the multi-year government spending bills and drive to onshore production.

It was a strong first half, but this may not be the time for investors to be comfortably numb. The same applies to first half contrarians.

Scott Helfstein

Scott Helfstein