Within the unrelentingly complex realm of digital assets, stablecoins are a refreshingly simple concept. In short, their goal is to maintain a stable, unchanging price over time by tying their value to another asset class, such as the US Dollar. This stability stands in stark contrast to the historically volatile world of most other cryptoassets. Though they were first ideated in 2014, the stablecoin market saw only marginal growth for the next few years. In large part, this was due to crypto’s very limited user base at the time, and a lack of product-market fit. Ethereum, the epicenter of the decentralized finance (“DeFi”) movement, for example, did not even launch until July 2015.

With the emergence of smart contract blockchains and growing global adoption of blockchain technology and crypto payments over the past few years, however, the demand for cryptoassets with a stable value has exploded. Still an experimental industry at the time in 2017 with a sub $1B market capitalization, the stablecoin market today is worth well in excess of $100B and reached nearly $200B in the spring of 2022.1 As blockchain ecosystems continue to develop, it is likely that the amount of stablecoin use cases will only continue to grow, solidifying the industry’s role as one of the premier blockchain applications. In this blog post, we explore the various approaches to stablecoin design, analyze the ways these assets are being used today, and describe some of the key risks that users and investors should be aware of when interacting with these assets.

Key Takeaways

- Stablecoins are cryptoassets that maintain a constant value over time by pegging to the value of stable assets such as fiat currencies. An alternative to the inherent volatility of most cryptoassets, stablecoins are more suitable for transactional activity and preserving purchasing power over the short- to medium-term.

- The accelerating adoption of smart contract blockchains and of the decentralized applications they enable has provided tailwinds for the stablecoin market, which has expanded from a sub-$1B market capitalization in 2017 to nearly $120B today.2

- Stablecoins come in a variety of different formats, each with their own advantages, unique risks, and distinct mechanisms for maintaining stability. Together, stablecoins are critical to blockchain ecosystems as they facilitate global payments, DeFi liquidity, onchain commerce, and more.

What Are Stablecoins?

Prior to the advent of stablecoins, fundamental financial activities such as payments, lending, and borrowing were conducted using a variety of cryptoassets and tokens. The problem with this approach, however, was that cryptocurrencies were, and still are, subject to bouts of volatility and a lack of price predictability. This dynamic caused significant friction in blockchain-native finance, as even rudimentary activities implicitly required participants to incorporate factors such as token analyses and tax considerations into their decision to transact. In essence, value exchange was a zero-sum game in which one party was sure to emerge as a transaction’s clear winner while the other party took a loss. Crypto users are reminded of this every year on May 22nd, dubbed “Bitcoin Pizza Day,” which remembers one of crypto’s most infamous transactions: a bitcoin user paying 10,000 BTC for two delivery pizzas in 2010. Just one year later, that same payment would have been worth $67,400. At the time of writing, it would be worth $292,000,000.

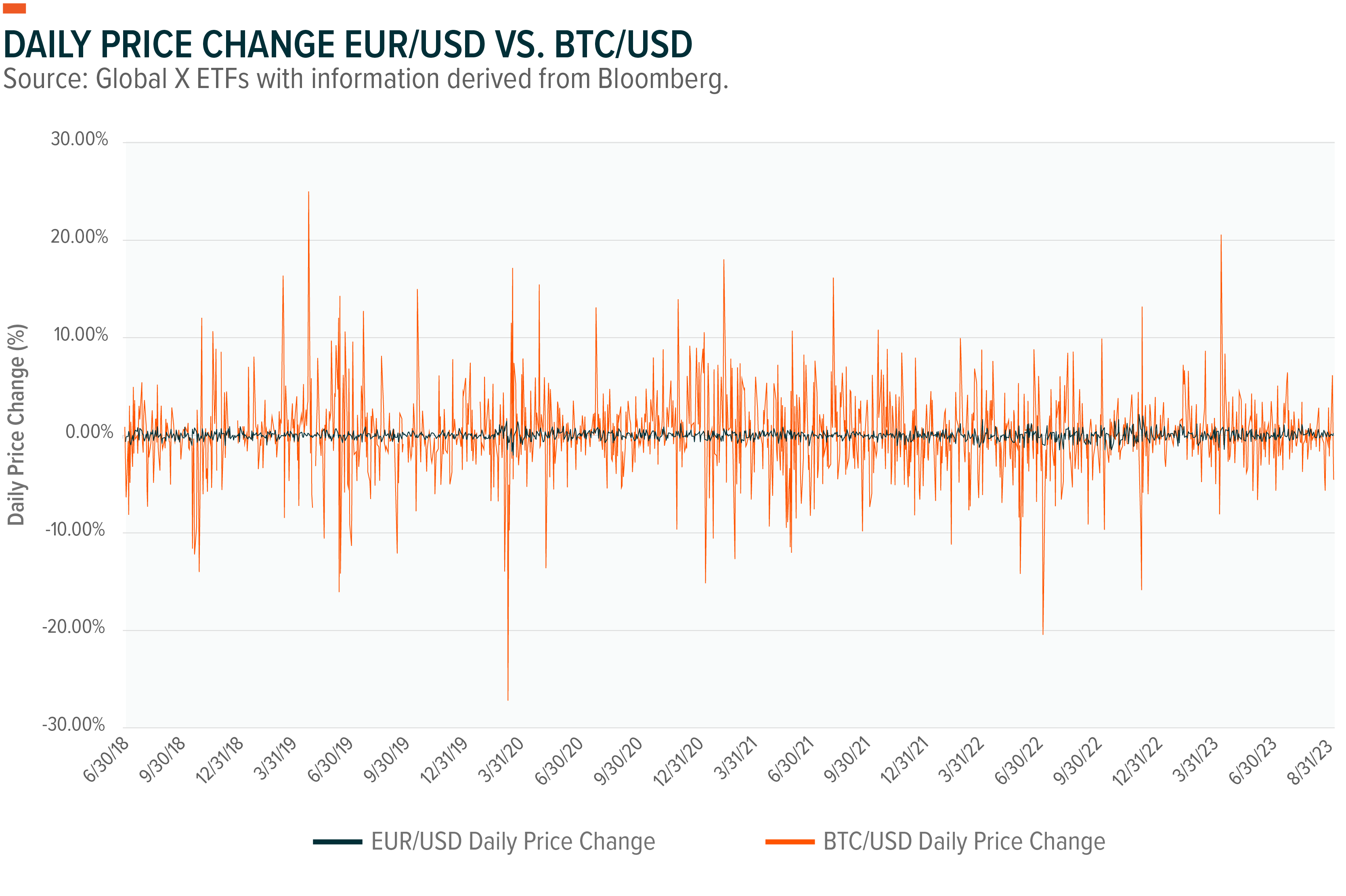

Stablecoins sought to address this glaring inefficiency in blockchain-native value exchange. As their name suggests, stablecoins are digital assets that are specifically designed to maintain a predictable, unchanging price. To achieve this, stablecoins peg their value to that of another ostensibly stable financial instrument. In most cases, stablecoins are pegged to real-world assets, most commonly to fiat currencies such as the US dollar, euro, or yen, or to commodities such as gold. Of course, exchange rates between the world’s largest fiat currencies do change gradually over time, but the magnitude of these variations tends to be much more muted than those of cryptoassets, especially over short time periods.

Maintaining this pegged exchange rate means that stablecoins can function as tokenized derivatives of their reference assets, making stablecoins the ideal blockchain assets for preserving purchasing power over the short to medium term, as well as for serving as an everyday medium of exchange. Furthermore, because stablecoins are designed according to the standards of the blockchains that they are deployed on—the ERC20 token standard on Ethereum, for example—stablecoins are also fully programmable and composable with blockchain applications and smart contracts.

What Are the Different Types of Stablecoins?

Though stablecoins are related to their reference asset, they are ultimately distinct, standalone vehicles. The value of one US Dollar as denominated and measured in USD, for example, is self-referential and will always be exactly 1:1. The value of a USD-pegged stablecoin, however, is determined by the free market and the countervailing forces of supply and demand. In this way, a USD-pegged stablecoin is more akin to a foreign currency than a digital dollar. Because there is nothing to guarantee that one USD-pegged stablecoin will always equal one USD, it is critical that stablecoins have robust mechanisms in place to manage the peg to their reference asset.

Fiat-Collateralized Stablecoins

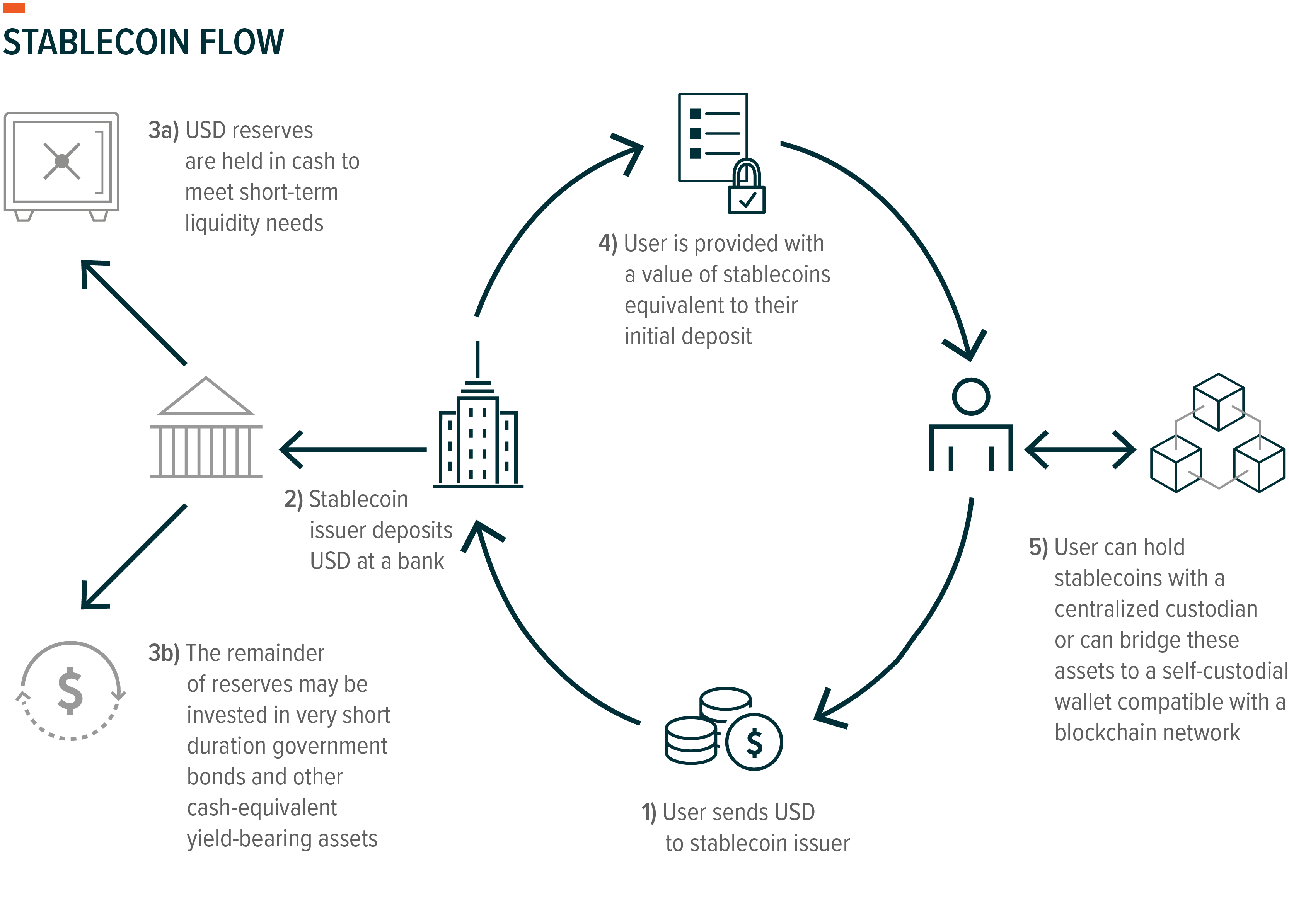

Fiat-collateralized stablecoins are designed to be fully backed by reserves of government-issued currencies and short-duration investment grade sovereign debt securities. Because the assets held in reserve are either the stablecoin’s reference asset or a highly liquid equivalent, fiat-collateralized stablecoins can be directly exchanged for their fiat pair, and vice versa. To mint new units of a stablecoin, users can deposit USD to a stablecoin issuer who will mint a corresponding amount of stablecoins. To redeem stablecoins for dollars, users can return their stablecoins to the issuer who will remove or “burn” the stablecoins from circulation and return the corresponding amount of dollars to the user. This process ensures that each unit of circulating stablecoin supply is backed by an equivalent claim to a unit of fiat currency held in a bank account, and that any user can mint/redeem a stablecoin with/for a corresponding unit of fiat currency. For those seeking access to these stablecoins without either the ability or the desire to mint new tokens directly from the issuer, these stablecoins can be accessed directly on any number of liquid centralized exchanges such as Coinbase, or decentralized exchanges such as Uniswap or Curve.

About $115B, or 93%, of the circulating stablecoin supply is collateralized by fiat currencies. Of this amount, over 99% is pegged to the USD. Among the leading stablecoin issuers in this subsector are Tether, which issues the USDT stablecoin, and Circle Financial, which issues the USDC stablecoin. Together, these companies account for about $108B, or 88%, of the global stablecoin market capitalization.3

While stablecoins minted by these issuers function in part as a claim to the assets held in the issuer’s reserve, today’s stablecoin issuers do not have bank charters. This means that reserve deposits do not carry the same benefits as traditional bank deposits, namely FDIC insurance. It also means that issuers are not subject to the same regulatory oversight, standards, and guidelines as traditional banking institutions. Accordingly, though fiat-collateralized stablecoins have emerged as a convenient means to bring stable assets onto blockchains, these assets still present considerable counterparty risk to users under the current framework.

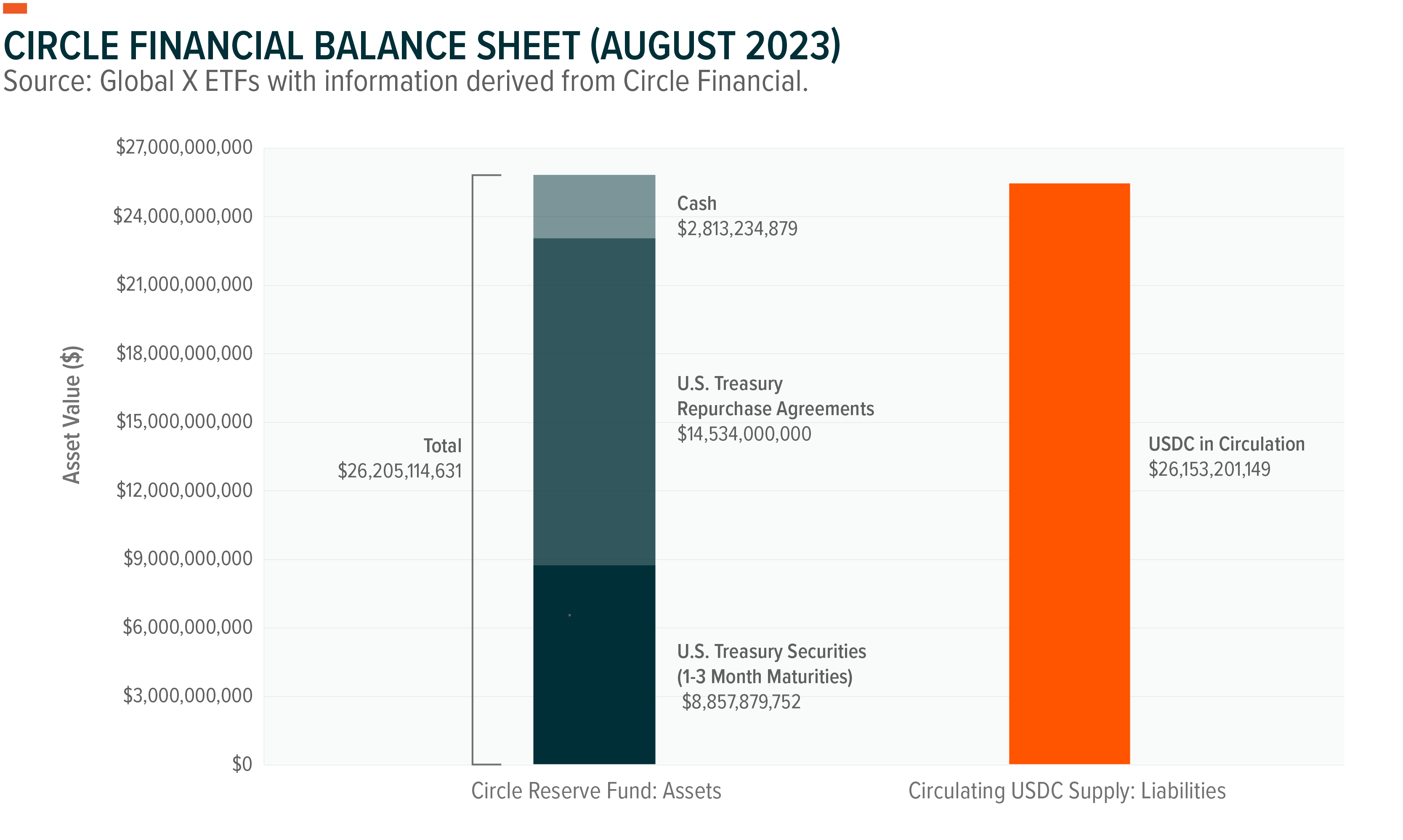

This reality has put the onus on stablecoin issuers to instill confidence in the stability of their products. Circle Financial, issuer of USDC, is one of the best examples of this. A U.S.-based company, Circle partners with preeminent U.S.-regulated financial institutions such as BNY Mellon to provide custodial services for the Circle Reserve Fund. Circle has also outsourced the management of the Circle Reserve Fund to BlackRock, engages Deloitte to conduct monthly audits of the reserves, and publishes monthly transparency reports to demonstrate the degree to which the circulating supply of USDC is fully collateralized and redeemable for USD. As a result, USDC is considered by many to be the most trusted and compliant stablecoin on the market.

Crypto-Collateralized Stablecoins

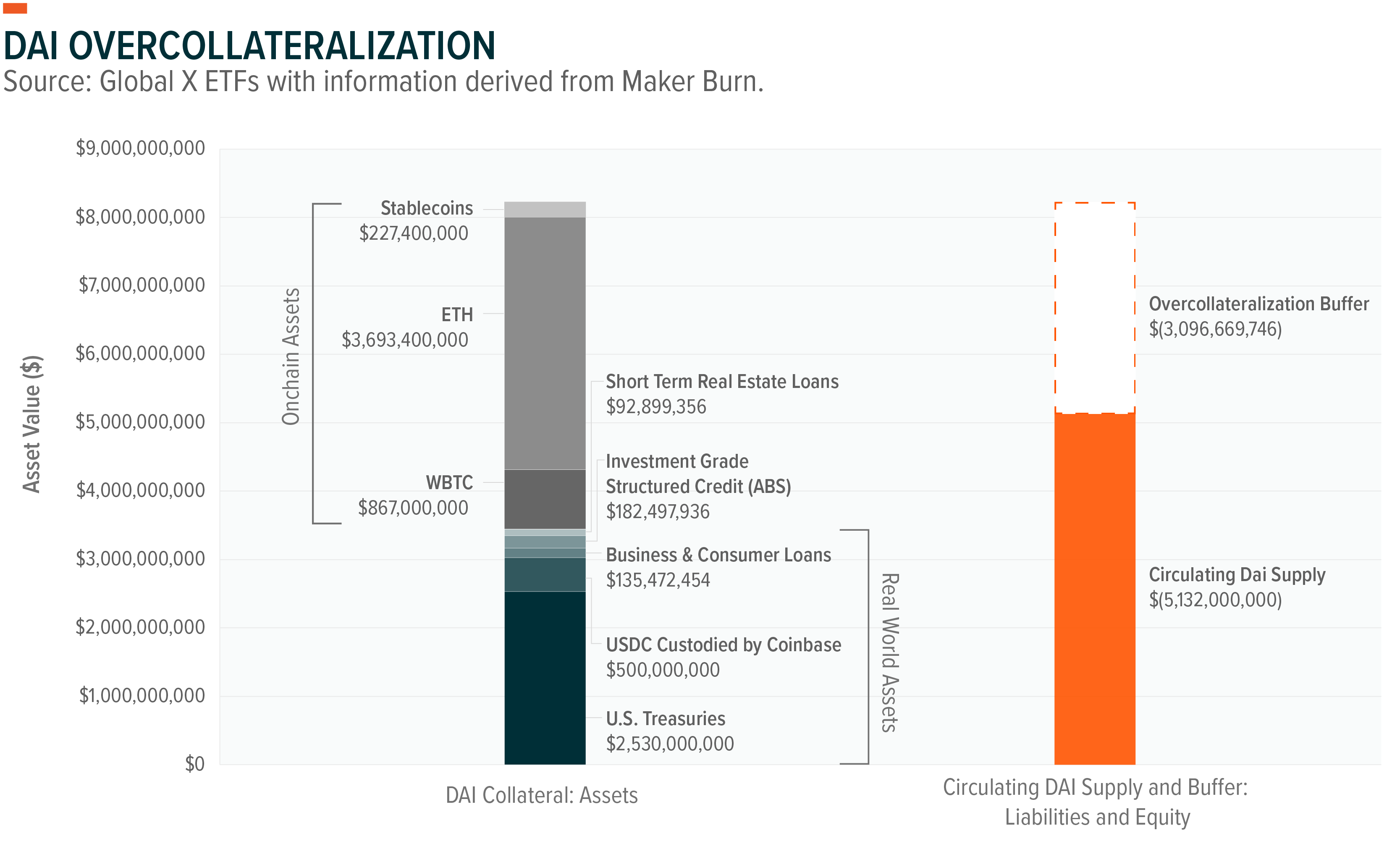

Like their fiat-collateralized alternatives, crypto-collateralized stablecoins are digital assets that seek to maintain a pegged exchange rate to a stable financial instrument, usually a fiat currency. Crypto-collateralized stablecoins, however, are backed not by the fiat currency that they seek to digitally represent, but rather are backed partially, or in some cases fully by cryptoassets. Perhaps the best example of this is Dai, a crypto-collateralized stablecoin issued by the Maker Protocol, which seeks to maintain a soft-peg to the US dollar. As of writing, Dai has a market capitalization of over $5B, accounting for about 80% of all crypto-collateralized stablecoins.4

The use of inherently volatile assets as collateral requires that crypto-collateralized stablecoins be overcollateralized, meaning the amount of assets held in reserve exceeds the value of stablecoins in circulation. This is needed as a buffer to ensure that the circulating supply of stablecoins remains fully backed in the case of market dislocations. The degree of overcollateralization varies depending on the quality of collateral deposited.

Beyond overcollateralization, crypto-collateralized stablecoins also rely on a combination of market forces and monetary policy adjustments to maintain a stable peg. Arbitrageurs, for example, are incentivized to buy when the value of the stablecoin is under its target price of $1 and sell when it is over its target price of $1, with the safety of being able to exchange the stablecoin for the collateral held in reserve. This action serves as a natural ballast for the stablecoin’s peg as market prices change throughout the day. During periods of more intense market stress, stablecoin projects also often rely on monetary policy adjustment to maintain order. As one example of this, the Maker Protocol employs a mechanism to make the cost of minting new Dai more expensive when the price falls below $1. This is done by adjusting the Stability Fee—a variable interest rate that is charged upon the minting of new Dai and which accrues on outstanding Dai balances. As this rate is adjusted upwards, the circulating supply of Dai on the market is reduced as users with outstanding Dai balances are incentivized to return their stablecoins to the protocol in exchange for their collateral. Likewise, this dynamic incentivizes those who are driving demand for Dai to access the stablecoin on the secondary market rather than minting new units of the stablecoin. This dynamic continues until the $1 peg is restored.5

Crypto-collateralized stablecoins offer several advantages over their fiat-collateralized counterparts. Using blockchain-native assets as collateral means that crypto-collateralized stablecoin projects can be run using smart contracts on public blockchain networks. One benefit of this is that it makes stablecoin issuance and management decentralized, permissionless, and globally accessible. Further, the open nature of blockchains allows for the continual auditing of stablecoin reserves by anyone on a real-time basis rather than having to wait for transparency reports and press releases—a boon to user confidence especially during periods of market uncertainty.

Another inherent benefit of this approach is that these projects often allow for a diversity of assets to be used as collateral. Not only does this provide users with greater flexibility when minting stablecoins, but it also provides diversification benefits to collateral pools. Finally, as many of these protocols rely on smart contracts and decentralized governance, counterparty risk is lower relative to fiat-collateralized stablecoins, which are run by centralized companies.

How Are Stablecoins Being Used?

Like fiat currencies, stablecoins have become invaluable to a wide range of use cases and applications across blockchain economies. Among the most simple, yet prominent, of these use cases is serving as a safe haven for crypto users. During periods of market volatility, stablecoins provide a means to reduce market exposure without having to off-ramp assets from the blockchain. In a related manner, stablecoins also provide blockchain users with a means of maintaining their purchasing power onchain without having to hold more volatile cryptoassets. On the Ethereum network, for example, nearly $70B of value is held via stablecoins, representing about 20% of all assets onchain.6

Stablecoins have also found product-market fit in the international sphere. For countries with unstable currencies such as Argentina, Venezuela, Turkey, and others, stablecoins provide citizens with the option to diversify their savings away from their nations’ rapidly devaluing currencies towards the stability of other currencies like the US dollar. Stablecoins have also emerged as highly efficient vehicles for international payments, offering extremely low transaction fees and fast settlement for global transactions.7 A 2022 World Bank Study underlined this fact, citing the average cost to send $200 globally as 6%, twice the targeted level as set in its Sustainable Development Goals. In fact, such transfers can cost upwards of 7.8% when being sent to countries in Sub-Saharan Africa.8 At the time of writing, a similar transfer would cost just 0.02% on an Ethereum Layer 2 network, with settlement occurring in a matter of minutes.9

Decentralized finance (“DeFi”) applications are another key beneficiary of stablecoins, serving as one of the primary sources of liquidity across the subsector. Decentralized lending and borrowing, for example, has become the second largest DeFi sector due, in large part, to the proliferation of stablecoin liquidity. For instance, about 52% of all assets borrowed and 25% of all assets loaned on Aave, the largest decentralized lending protocol, are stablecoins.10 For borrowers, stablecoins serve as a convenient source of collateral, as their stability reduces the likelihood of collateral liquidation, though this risk can never be eliminated entirely. For lenders, extending stablecoin loans provides an organic source of yield on stablecoin holdings. Of course, stablecoins have also emerged as critical assets across other DeFi segments as well, including decentralized exchange, derivatives protocols, and more.

What Are the Risks of Stablecoins?

Despite their ease of use, stablecoins present several risks that investors and users should be aware of. For fiat-collateralized stablecoins, counterparty risk is particularly prominent, as these stablecoins are issued by and dependent on centralized entities that do not provide the same deposit insurance as registered banks. Because this type of stablecoin represents a claim to the assets held in the issuer’s reserve fund, the issuer must be able to continually honor its obligation to exchange stablecoins for fiat reserves. Any disruptions in operations can lead to a loss of confidence in the stablecoin. Ultimately, the degree of counterparty risk is influenced by the issuer’s proficiency at managing market, credit, and liquidity risk adeptly, but cannot be removed entirely.

In fact, counterparty risk exists throughout the stablecoin value chain. This was evidenced amidst the short-lived US banking crisis set off by the collapse of Silicon Valley Bank (SVB) in March 2023. A preeminent banking partner for technology companies and the venture capital industry, SVB found itself in a precarious position as interest rates soared throughout 2022. These accelerating rates had caused SVBs significant holdings of long duration US government bonds to depreciate dramatically on a mark-to-market basis, leading to a timing mismatch between the bank’s assets and liabilities. This realization set off fears of a liquidity crisis, pushing depositors to withdraw funds from SVB en masse, forcing the bank to eventually freeze all accounts. Among SVBs depositors was Circle Financial, which at the time held $3.3B of cash reserves at SVB—about 8% of the total reserves backing USDC.11 Between the FDIC’s Friday afternoon announcement that it was taking SVB into receivership and the Sunday evening announcement that all SVB depositors would be made whole, the USDC stablecoin temporarily lost its $1 peg, falling to around $0.80. This drop was the result of large amounts of USDC redemption requests going unfilled by Circle Financial who, like SVBs other clients, was unable to access their accounts to honor the requests. Though USDC re-pegged to its $1 target within 24 hours, this black swan event demonstrated how counterparty risk can flow through the stablecoin value chain, presenting itself even when the issuer maintains stable operations.

Regulatory and legal risks are another key area of consideration for users of fiat-collateralized stablecoins. Given the nascency and global reach of the industry, stablecoin issuers are tasked with navigating highly complex and frequently changing regulatory landscapes. As these assets are subject to an array of money transmission, securities, custody, and other financial laws and regulations that can vary from jurisdiction to jurisdiction, changes to these laws, as well as any legal challenges, can have downstream effects on the efficacy of certain stablecoin projects.

While these risks certainly apply to crypto-collateralized stablecoins to varying degrees as well, these blockchain native stablecoins have their own unique challenges and constraints. One such example is the inherent volatility of the collateral used to back these stablecoins, which gives rise to high levels of market risk compared to fiat-collateralized stablecoins. Such market risk requires these stablecoins to be overcollateralized to account for volatility, reducing capital efficiency. To manage this risk at the protocol level, these projects also feature liquidation mechanisms whereby a user’s collateral is sold off if its value falls below a predetermined level in relation to the value of stablecoins minted. This process is akin to receiving a margin call on a levered equity position. For those involved in minting stablecoins directly from a protocol, risk of liquidation is a key consideration to be made. Further, the composability and interconnectedness of crypto-collateralized stablecoins with blockchain applications can lead to additional systemic risks whereby the health of large blockchain applications may affect the stability of the stablecoin. Finally, like all other software-based protocols and applications, the risk of bugs in smart contract code is another risk that users should be aware of.

Conclusion

In much the same way that fiat currencies provide the lubricant necessary for a nation’s economy to flourish, stablecoins play a similar role in blockchain economies where they are used as vehicles to preserve purchasing power, to facilitate nearly instantaneous global payments, and to provide the liquidity needed to power the DeFi industry. While their value proposition so far is clear, very little within the realm of crypto remains static for too long. As such, while the expectation across the industry is for the applications of stablecoins to continue to evolve and grow with the adoption of the underlying technology, careful consideration must also be given to the idiosyncratic risks of individual stablecoin projects as well as the systemic risks posed by the sector.

Global X Research Team

Global X Research Team