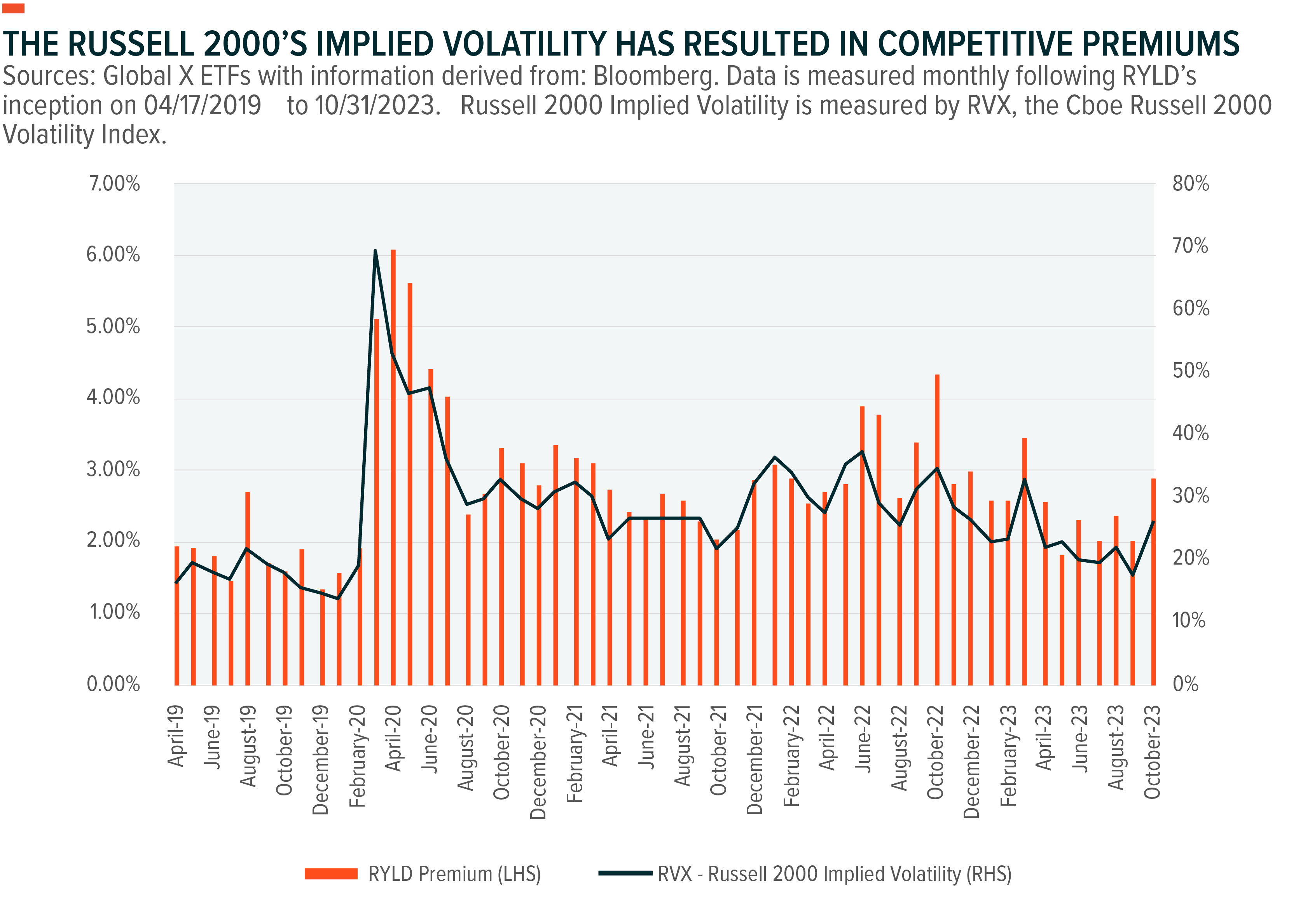

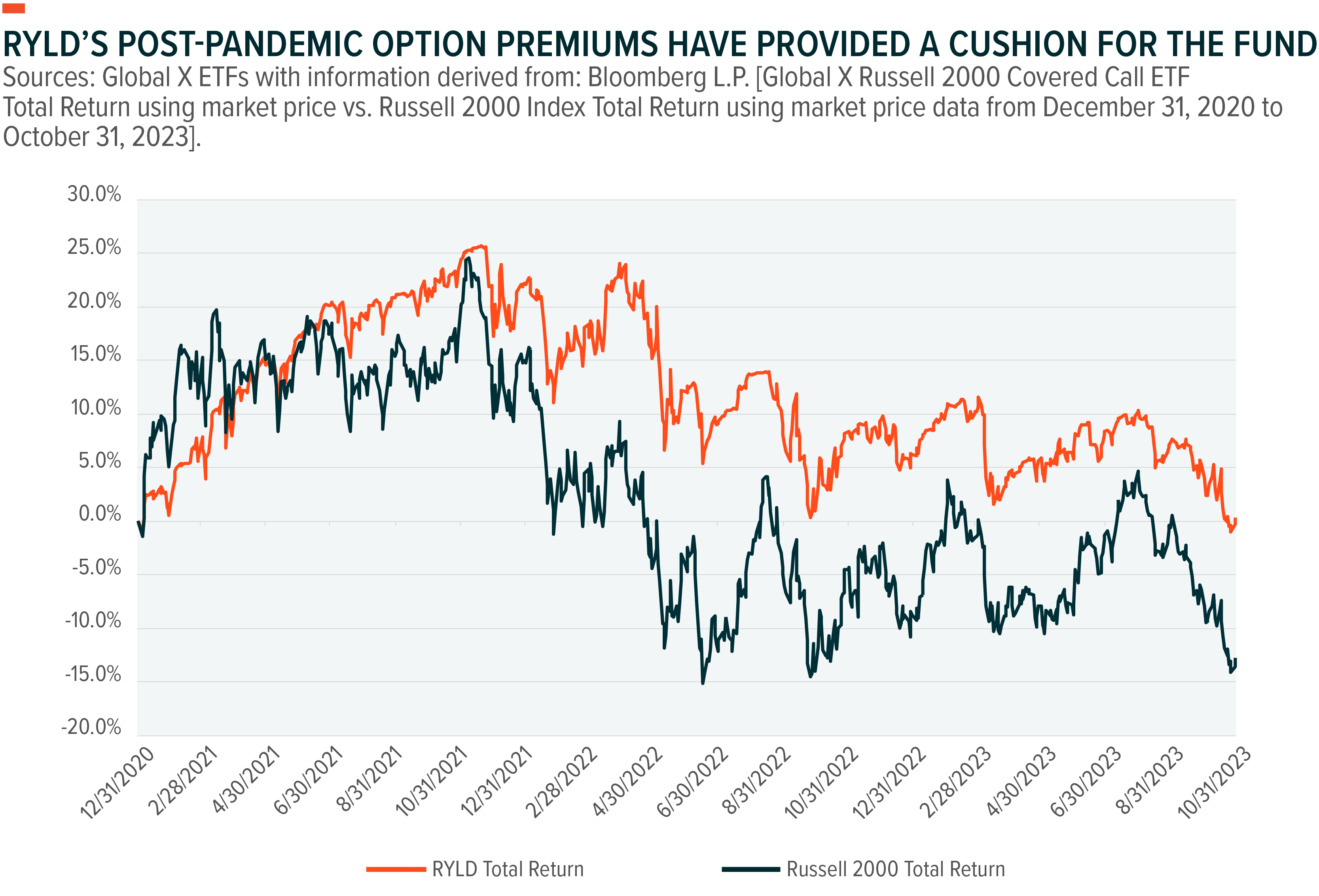

Compared to the Nasdaq 100 and S&P 500 Indices, the Russell 2000 Index has had more than its fair share of ups and downs post-pandemic. The CBOE Russell 2000 Volatility Index, RVX, which measures implied volatility for the Russell 2000, reflects this trend, and these widely oscillating moves were particularly evident in 2022, when the RVX sat at higher-than-average historical levels for the vast majority of the calendar year.1 We believe covered call option strategies on the Russell 2000 are especially well suited for market conditions like these, as option premiums have a tendency to rise when volatility is elevated, a relationship that we will explore further in this piece. This backdrop has helped the Global X Russell 2000 Covered Call ETF (RYLD) realize solid premiums since its inception in April of 2019. Consequently, the fund has been able to provide a yield that is higher than many other asset classes. For these reasons, we believe RYLD can be an attractive, multipurpose addition to a portfolio.

Key Takeaways

- The Russell 2000’s growth-oriented composition generally provides shareholders with a high-risk, high-reward investment opportunity. RYLD takes this traditionally volatile asset as a base for a total-return and yield-oriented vehicle with a focus on monthly income.

- The income produced by RYLD tends to increase amid elevated levels of volatility and may help soften steep market declines compared to holding the components of the Russell 2000 by themselves.

- Against most any market backdrop, RYLD applies an efficient, repeatable process that has the potential to provide a competitive yield.

RYLD Can Be a Tool to Increase a Portfolio’s Yield

The Russell 2000 Index consists of the smallest 2,000 stocks by market capitalization within the broader Russell 3000 Index. These equities offer their investors some of the greatest potential for growth in the U.S. equity market. As you might expect, that potential for reward also comes with the risk of significant losses. For instance, an investor is more likely to receive greater capital appreciation from a small-cap technology company focused on something like generative artificial intelligence than exposure to a large-cap soft drink producer. That said, an investor in the small-cap company is also more likely to lose significant value on their initial investment than the investor in the large-cap company.

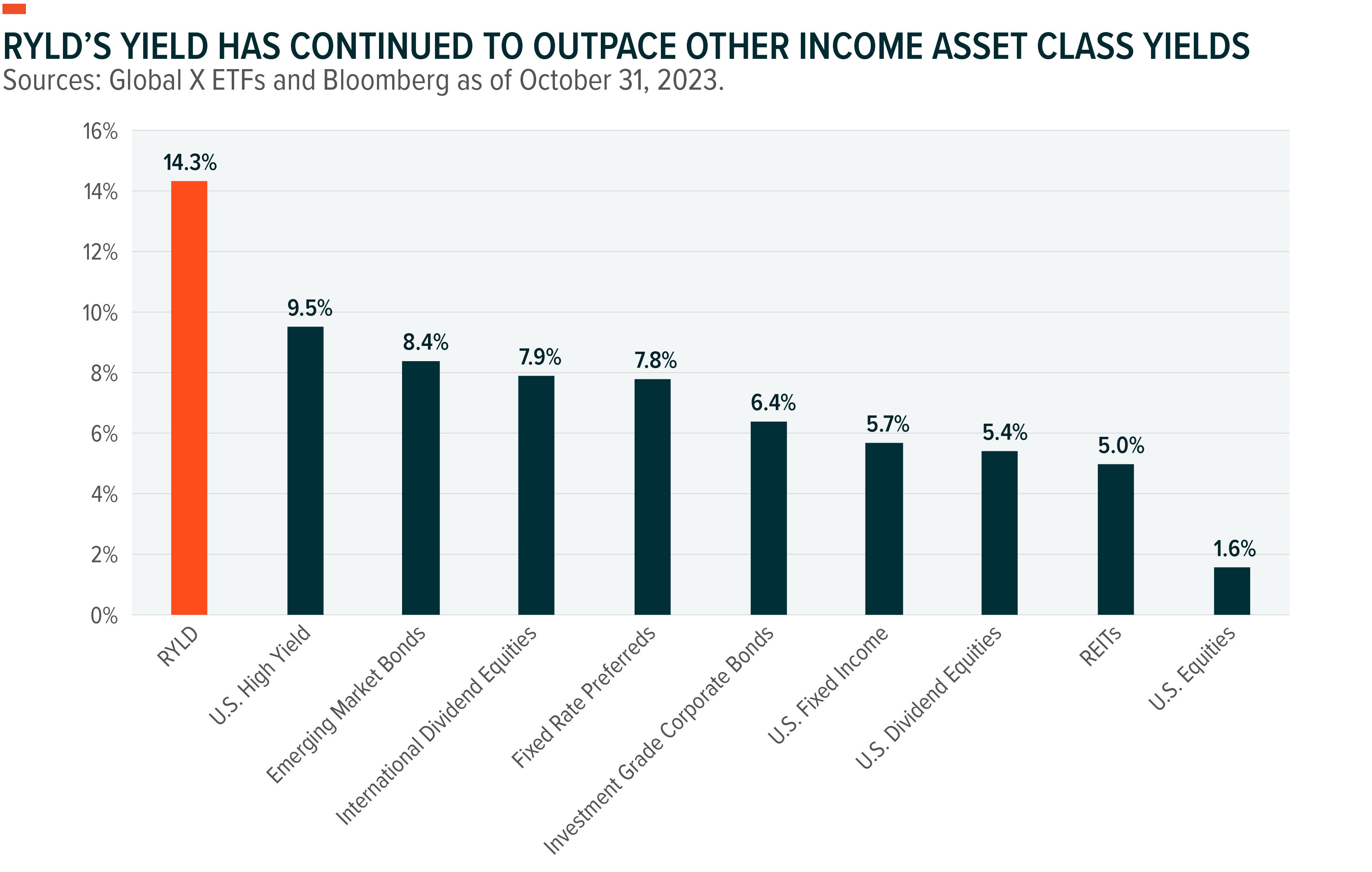

This risk and reward dynamic is especially true amid elevated market volatility. However, covered call strategies like the Global X Russell 2000 Covered Call ETF (RYLD) tend to outperform their respective equity indexes in such environments, because they do not rely upon price appreciation alone. Instead, funds like these attempt to capitalize on volatile price movements by seeking to attract premium income. Perhaps most importantly, the premium income RYLD derives is independent of the balance sheets and the credit quality characteristics of the underlying companies themselves. Naturally, this helps investors to hedge against potential company defaults or missed dividend payments. Accordingly, as of October 31, 2023, RYLD’s 12-month trailing yield was approximately 14.32%.2

In addition to the dividends received from its equity holdings, the fund derives income by selling at-the-money covered call option contracts on the Russell 2000 Index. These contracts, once written, are guaranteed by the Options Clearing Corporation (OCC), which operates under direct supervision from the U.S. Securities and Exchange Commission (SEC) as well as the Commodities Futures Trading Commission (CFTC). Coupled with the vast liquidity associated with Russell 2000 Index options, these guarantees can help reduce risk factors associated with RYLD’s investment strategy.

Past performance is not a guarantee of future results. For 30-day yield and performance current to the most recent month- and quarter-end, please click here.

Asset class representations are as follows: International Dividend Equities, Dow Jones EPAC Select Dividend TR Index; U.S. Dividend Equities, S&P 500 High Dividend Index; U.S. High Yield, Bloomberg U.S. Corporate High Yield Total Return Index; Fixed Rate Preferreds, ICE BofA Fixed Rate Preferred Securities Index; Emerging Market Bonds, Bloomberg EM USD Aggregate Total Return Index; Investment Grade Corporate Bonds, Bloomberg U.S. Corporate Total Return Index; REITs, FTSE NAREIT All Equity REITs Total Return Index; U.S. Fixed Income, Bloomberg U.S. Aggregate Index; U.S. Equities, S&P 500 Index. RYLD, Dividend Equities and U.S. Equities yields are indicated by their 12-month yields. Fixed Income yields are indicated by yield-to-worst.

Many income investors looking to increase their portfolio’s income may extend their duration, take on geopolitical risks, or accept lower credit quality on the bonds that they seek to purchase. Duration risk involves lengthening the average maturity of a bond portfolio, potentially leaving an investor exposed to greater drops in market value if interest rates rise. Credit risk, on the other hand, comprises the investor effectively lending capital to a low credit quality institution or government who may not necessarily be able to pay back its principal or make coupon payments. Taking on these risks may not be prudent for your average person seeking income. Based on its ability to produce a competitive yield, RYLD may represent an attractive alternative for investors seeking to attain current income while simultaneously reducing their exposure to long duration and credit risk.

RYLD’s income component can fluctuate, month to month. However, since inception, the fund has been able to provide a yield that remains competitive. What’s more, from a total return perspective, RYLD has outperformed the Russell 2000 Index by approximately 13 percentage points post-pandemic.3 We believe this outperformance may be related to a new investment paradigm having taken shape in which interest rates could potentially remain higher for longer, thereby likely making it more difficult for small cap companies to finance their business needs and grow to scale. So far, RYLD’s option premiums have helped give it a leg up in comparison to its reference index.

Performance data quoted represents past performance. Past performance is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted.

RYLD Offers Efficiency in an Array of Market Backdrops

A common question we receive at Global X is, “Why does RYLD purchase the Vanguard Russell 2000 ETF (VTWO) to create its long position instead of the underlying index components?” The short answer is efficiency. The Russell 2000 Index consists of stocks that are on the lower end of the market capitalization spectrum. Therefore, many of its underlying constituents are much more thinly traded than stocks in a large-cap index such as the S&P 500.

The lack of trading in these stocks can make many of the index’s components less liquid and therefore more difficult to gain favorable pricing when rebalancing. Purchasing VTWO can help alleviate these concerns for RYLD, as it tracks the Russell 2000 Index with very little historical tracking error, and it does so at a low cost to its investors.

This manner of efficiency, coupled with the passive nature of the fund helps to promote both an understandable and repeatable process regarding the functioning of the product. Indeed, despite implied volatility playing such a significant role in option premium generation for RYLD, the fund has delivered value and efficiency against a wealth of investment backdrops. This includes periods when volatility is low and the market is rising, during which time the fund’s NAV would be expected to increase because RYLD reinvests a portion of the premiums received back into the fund. The function helps build up the fund’s NAV, as opposed to distributing all of its premiums and experiencing more frequent NAV decay.

RYLD’s approach is systematic, selling monthly at-the-money call options and distributing to its shareholders the lesser of 1% of NAV or half of the call premium generated. This repeatable approach not only allows for more predictable income month to month, but it also simplifies a seemingly complex options process. No matter the economic environment, RYLD continues this procedure, with the remainder of the premium reinvested back into the fund. Meanwhile, investors remain allocated in preparation for a possible spike in volatility, allowing them to potentially capitalize on drops in the market from an income standpoint.

Conclusion: RYLD Uses the Russell 2000’s Volatility to Its Advantage

Covered call strategies tend to work best in environments where market uncertainty is at its highest, but they can also be effective sources of income when markets are on an upward trajectory. The Global X Russell 2000 Covered Call ETF is one such strategy. Speculative indexes like the Russell 2000 are certainly not one size fits all. However, in the context of covered call writing, general appeal for indexes like the Russell 2000 can be broadened to include investors with an income focus.

Related ETFs

RYLD- Global X Russell 2000 Covered Call ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Global X Research Team

Global X Research Team