Resilience. Currently, this term is most frequently applied to the U.S. economy, but it should also apply to portfolios and especially income focused portfolios. With a soft landing and lower policy interest rates potentially on the horizon, there are plenty of opportunities for advisors. Although economic growth may slow, this could be a rate cutting environment that’s more supportive for equities than fixed income.

Focusing on the equity income space, this is a diverse area that provide both income and the possibility for capital growth. These investments can include quality companies with growing dividends, higher-risk high-yield companies, preferred stocks that blend equity and fixed income features, and derivative strategies like covered calls. Equity income can also complement fixed income strategies, potentially enhancing diversification and total return. This whitepaper details yield-focused equity solutions and their potential portfolio applications for investors.

Key Takeaways

- Equity income solutions can provide dual benefits of income generation and potential capital appreciation.

- There’s a wide range of equity income solutions that investors can use to create balanced portfolios that are suitable for multiple market environments.

- Equity income can be combined with fixed income to create a diversified, yield-focused strategy that can also benefit from capital appreciation without adding undue risk.

Yield in a Promising yet Fragile Macro Environment

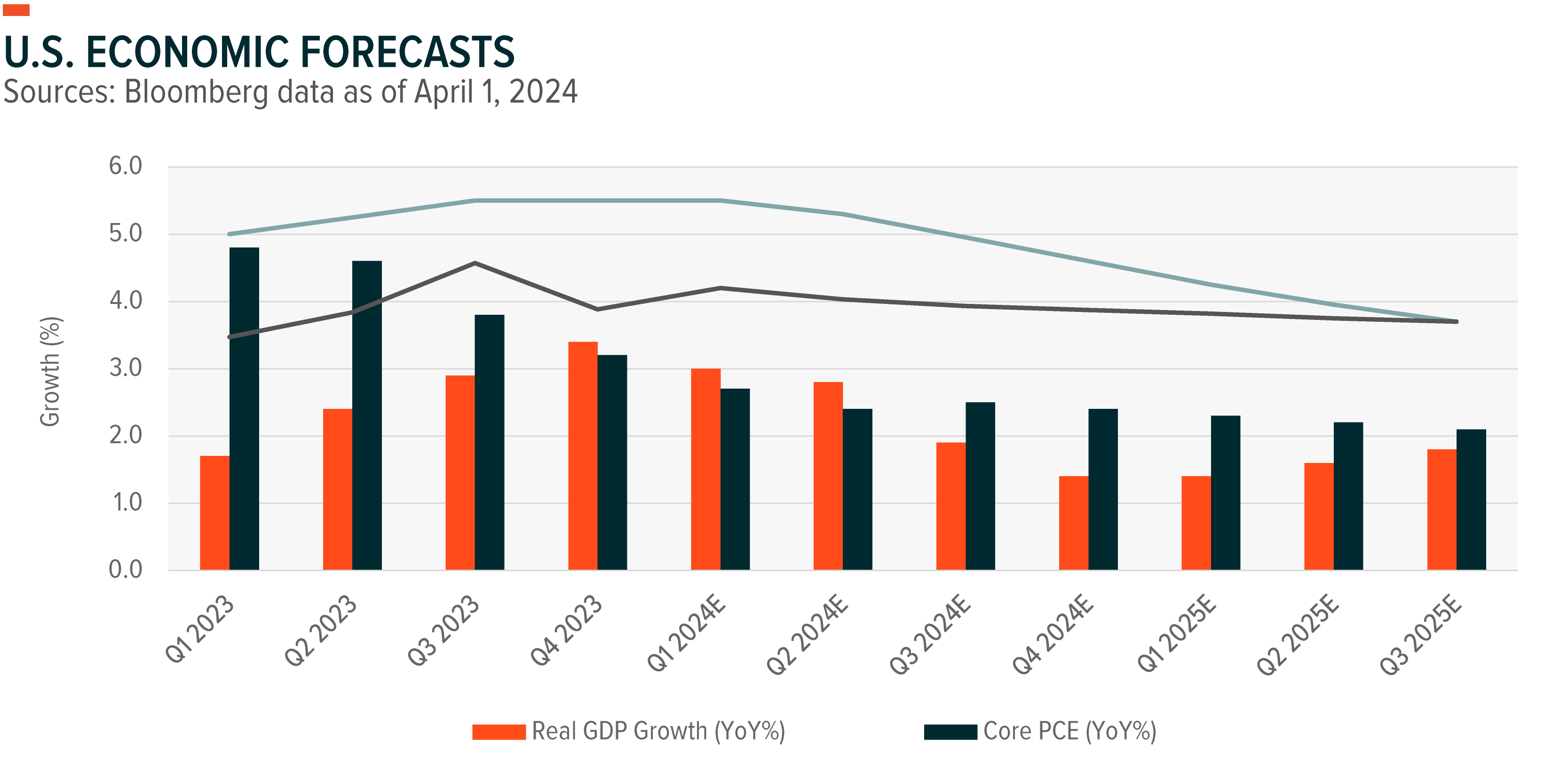

A soft landing has become the consensus view for the U.S. economy, with real GDP growth expectations revised up on continued resilience. This resilience has been supported by both fixed investment and consumer spending. From a peak of 3.4% in Q4 2023, real GDP growth is expected to slow through Q4 2024, albeit remaining positive, before rebounding. However, this hinges on continued strength in the labor market.

Historically, the Federal Reserve (Fed) has increased interest rates slowly while reducing them rapidly. Under this scenario, fixed income is a good option as policy interest rates plummet. However, we believe the current rate cutting cycle will be vastly different – one where underlying economic resilience may help support a slow, drawn-out rate cutting cycle. Given the potential for inflation to remain elevated, and for delays in yield reduction, equities may have more to gain from the interest rate cutting cycle that we’re about to enter. For yield-oriented investors, there may be opportunities to incorporate equity income solutions into their portfolios.

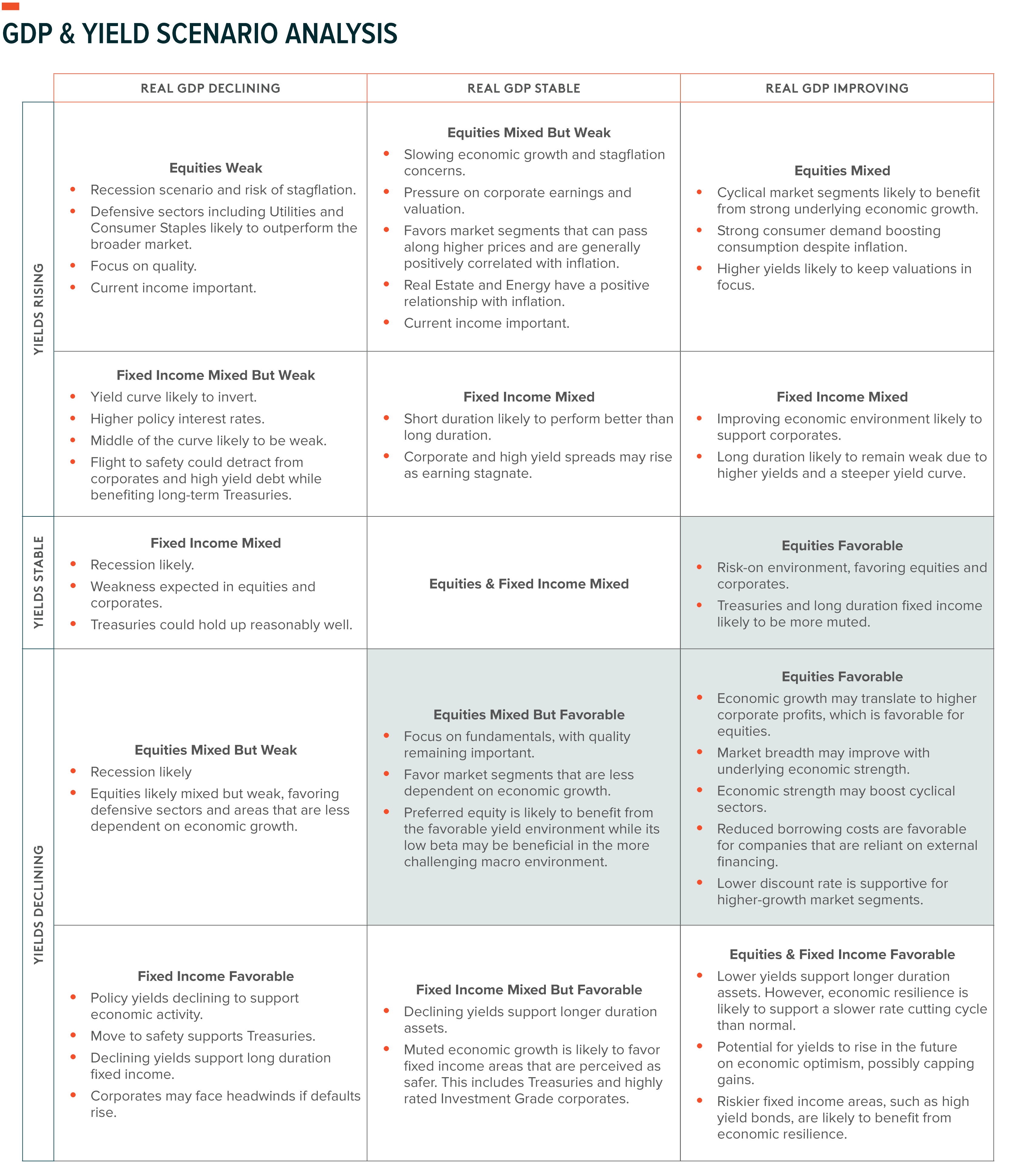

The scenario table below outlines the typical relationship between asset classes and economic variables. Markets are forward looking, with the first interest rate cut priced in for June 2024.1 But continued economic resilience and higher-than-expected inflation may push out the start of the Fed’s rate cutting cycle. While markets will adjust to shifting expectations surrounding the Fed’s likely trajectory, at this stage the most likely scenario is slow real economic growth and a slow decline in policy yields that maintains real yields at a restrictive level. Here is a summary of positioning implications based on the current economic environment.

- Slowing economic growth warrants defensive exposure with a greater focus on quality.

- Current profitability and consistent dividend distributions to shareholders are critical.

- Longer duration assets become attractive as yields decline from peak levels.

Equity Income Building Blocks

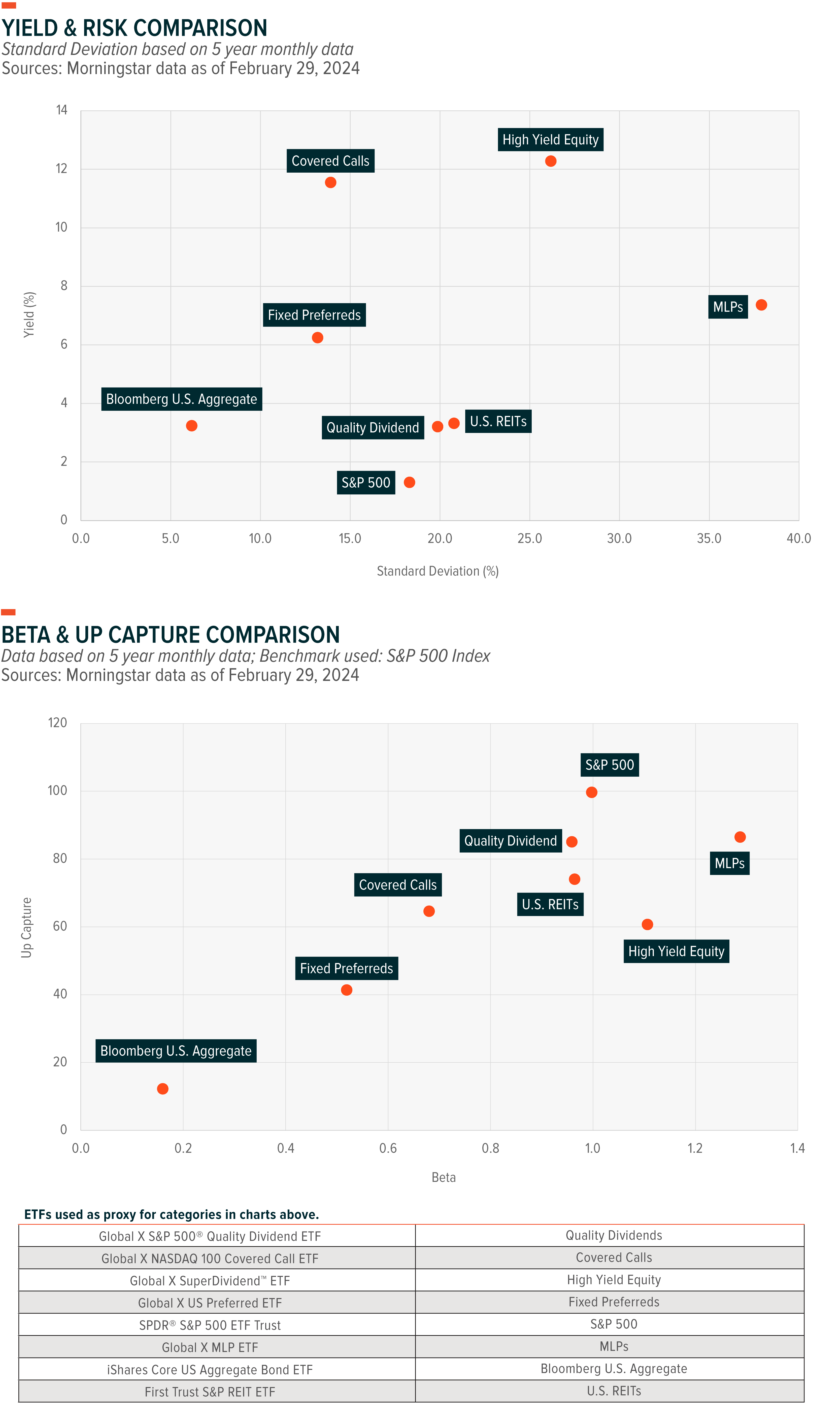

Equity income offers many solutions that can generate yield while providing upside potential in the current environment. Equity income can be obtained from common equity, preferred equity, or by using derivatives. The below risk and reward charts illustrate the tradeoff between yield, standard deviation, beta, and upside capture. For long-term investors in search of yield, these are essential areas to balance within a portfolio.

Covered Calls Offer Differentiated Yield

Covered calls perform best when markets are rangebound, receiving premium income and potentially small improvements in the underlying equities while not having the underlying called. In a rising market, covered calls typically underperform the overall market because the underlying security is called away, affecting the capital gain return, not the income return. In a declining market, covered calls provide a small buffer of protection because of their premium income.

This return profile is reflected in the reasonably subdued beta and up capture ratio reflected on the chart above. While covered calls provide a good level of income that compensates for market volatility, within a portfolio this exposure should be complimented by areas that provided better up capture in a rising market.

Preferred Equity Offers Risk Mitigation with High Yield

Preferreds are above common equity and below bondholders in the capital structure. We favor preferred equities due to their position in the capital structure and low beta. Within a portfolio that includes common equities, their lower sensitivity to equity markets aids in reducing portfolio volatility. The dividend on fixed rate preferreds remains stable relative to a reference rate, which can be beneficial in a falling rate environment. Additionally, the yield from preferred stocks can be treated as qualified dividend income instead of ordinary income, resulting in favorable tax treatment. It is important to remember that variable and fixed-rate preferreds have duration risk due to their perpetual nature.

The preferred equity market may face periods of heightened volatility during episodes of banking stress. As securities that are included in regulatory capital, banks are one of the largest issuers of preferreds. During normal market conditions, this is a boost for preferred credit quality. However, it also means that preferreds are impacted by the overall health of the financial system.

Common Equity Yield Strategies

Common equity can be used to augment a portfolio’s yield, target specific exposures, improve diversification, or add quality. The level of yield and volatility varies greatly across these different use cases.

Quality Dividends

We view the quality dividends segment as a core strategic holding because of its focus on profitable growth and quality value. Historically, companies with strong free cash flow and healthy balance sheets fare best among value factors during market downturns. BofA Securities research shows the risk of deep value strategies becomes increasingly pronounced during late-cycle and recession periods, while the quality factor can provide a timely hedge. Quality stocks typically provide a lower payout ratio relative to high yielding equities, but they focus on consistent dividends and dividend growth despite the economic environment. Therefore, quality stocks’ lower yield is less sensitive to economic changes.2 While the U.S. economy is expected to achieve a soft landing, slowing economic growth still prioritizes quality exposure.

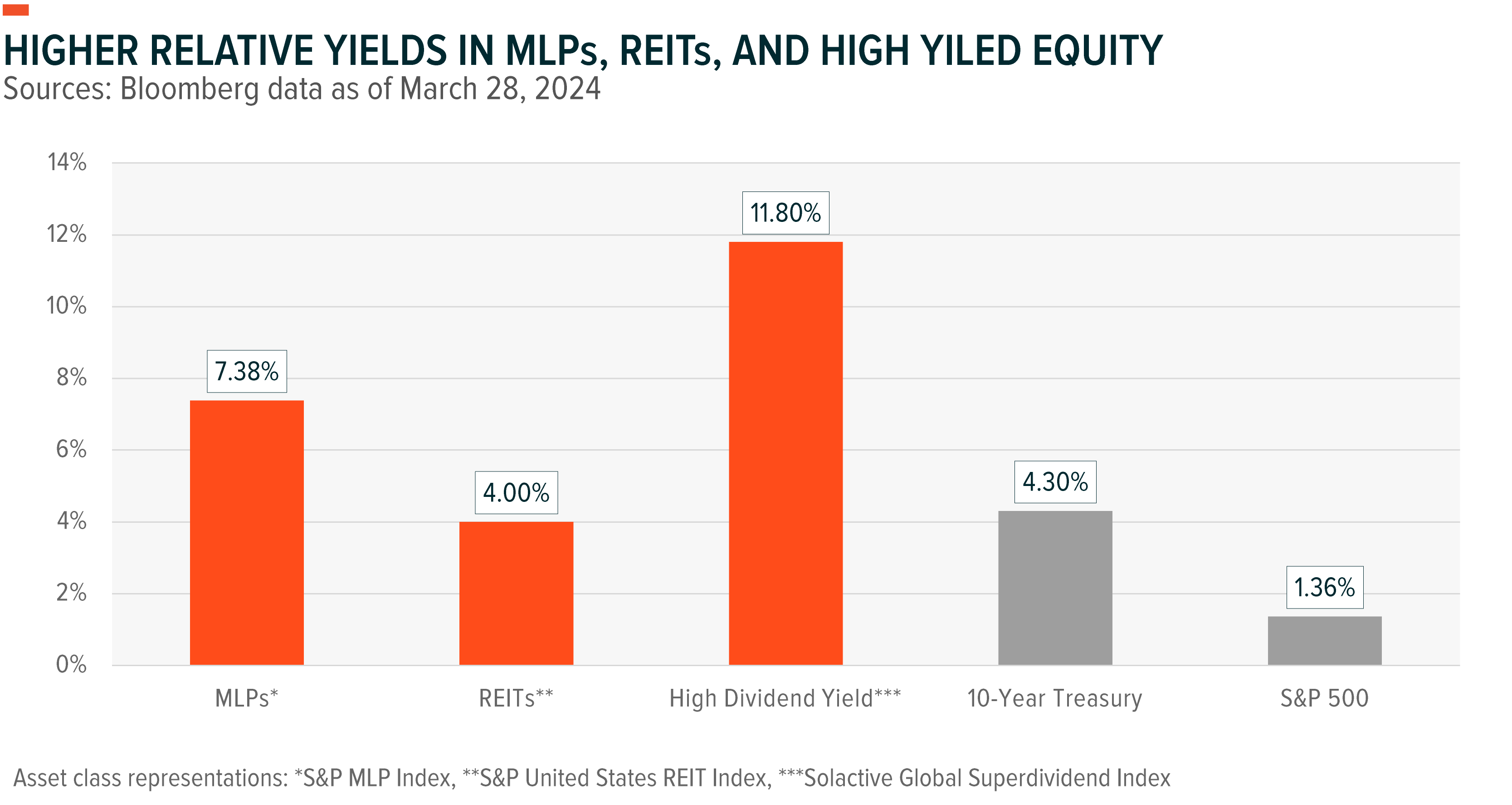

High Dividend Yield, MLPs and REITs

Master Limited Partnerships (MLPs), which cover exploration, storage, and distribution of crude oil and natural gas, are compensated on volume growth, so profits tend to rise alongside higher demand. Strong volume growth is typically associated with higher energy prices. U.S. domestic oil production remained robust at about 12.5 million barrels per day (bpd) in January 2024.3 Improved drilling techniques expanded output with increased cost efficiency, which is supportive for the companies in the MLP space.4 MLPs tend to have higher yields because of their structure from a taxation perspective. MLPs must distribute 90% of their income in the form of dividends to maintain their preferred tax treatment, which includes no federal or state taxes.

Real Estate Investment Trusts (REITs) are companies that own or finance real estate across different property types. Like MLPs, REITs must distribute about 90% of their income in the form of dividends to keep their preferred tax status. Therefore, REITs tend to pay a higher-than-average yield. REITs cover a wide scope of property types, which could help investors maintain their real estate exposure through different phases of the business cycle. For example, residential REITs benefit in areas and times of population growth and strong housing fundamentals. Healthcare REITs benefit from an aging population. Mortgage REITs hold mortgages and mortgage-backed securities (MBS) on their balance sheets, profiting from the spread between income earned and the interest paid on assets. Lastly, office REITs tend to benefit when employment rises, although headwinds remain in this space with the post-Covid hybrid work environment. Although the labor market remains tight, the U.S. office vacancy rate stands at around 18%, as of January 2024.5

MLPs and REITs provide targeted exposure in a specific sector, but a very high yield can also be achieved using products that diversify across sectors and potentially also geographies. Typically, these diversified exceptionally high yielding equities may provide small cap and deep value focused exposure. These are areas that can be highly cyclical, typically performing well during the expansion phase of the business cycle, but due to quality considerations they typically struggle during challenging economic periods.

The chart below shows MLP and REIT yields versus 10-year Treasury and S&P 500 yields.

Equity Income Opportunities in a Portfolio Context

When combining equity income products within a portfolio, it’s important to consider exposure diversification while also diversifying the portfolio’s sources of income. During this process it’s essential to implement a structure that can provide a sustainable yield through different market environments. When strategically blended, these equity income elements can create a robust portfolio capable of navigating the ebb and flow of market dynamics.

As discussed in the building blocks section, covered calls and preferreds are great ways to diversify a portfolio’s sources of yield while also reducing market sensitivity due to their low beta. However, while providing an excellent source of income, these areas are best paired with portfolio segments that offer good upside capture.

Depending on the portfolio’s yield target, quality dividends can provide a solid foundation with a decent upside capture ratio. This can be complemented by including select higher yielding common equity exposures based on the economic and market environment. Cyclical exposures typically outperform during the expansion phase of the business cycle. While the U.S. economy is likely to avoid a recession, economic growth is on a slowing trajectory. This can be a challenging economic backdrop for certain very high yielding strategies.

Equity Income Portfolios as a Satellite Exposure

Equity income portfolios can be thought of as well diversified stand-alone portfolios, or as a high yielding component of a broader portfolio strategy. This context will determine the importance of equity exposure diversification while also impacting how to think about pairing equity income with fixed income.

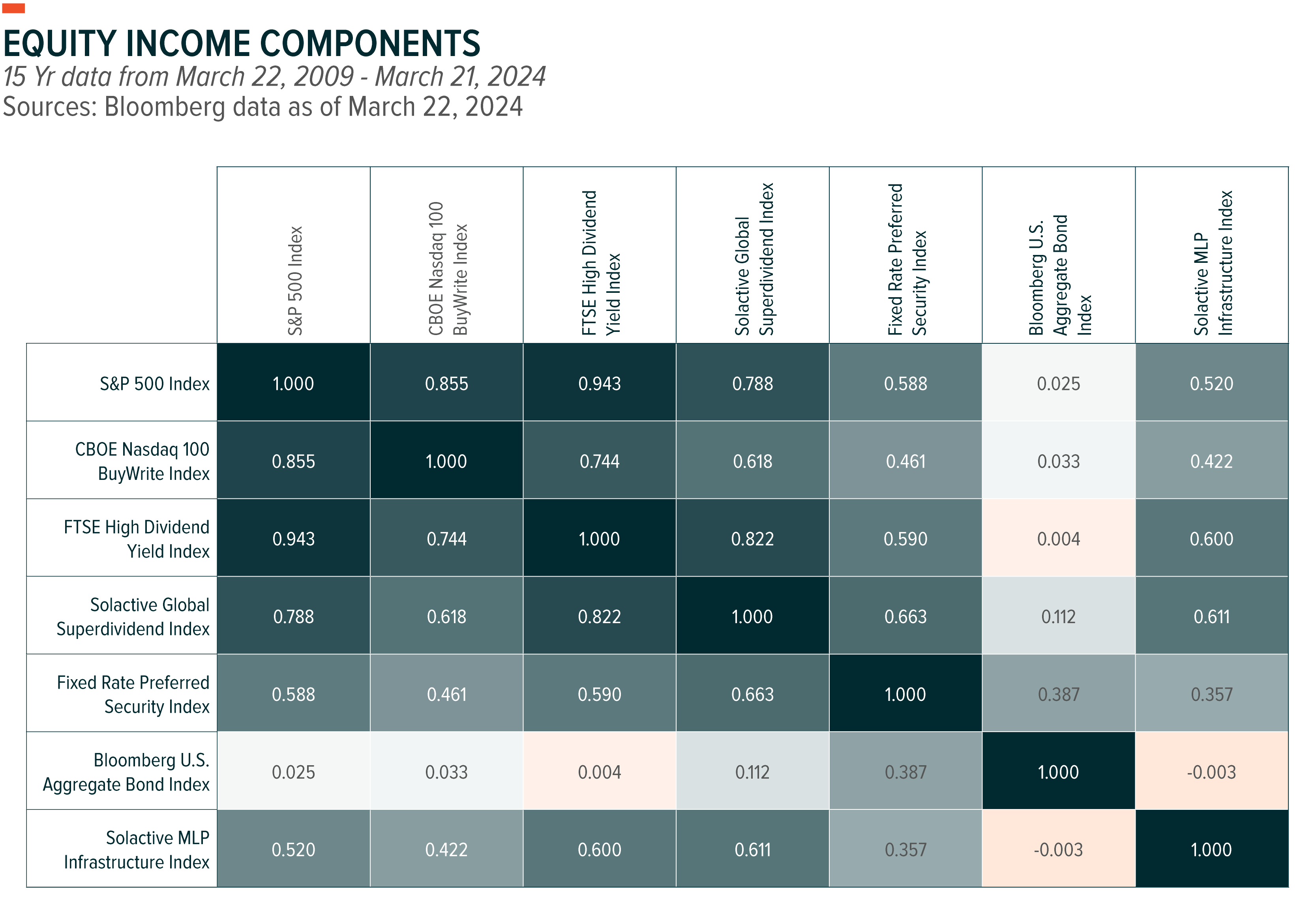

As illustrated on the correlation table, combining equity income solutions with each other can provide diversification benefits and support returns through various market cycles. When combining equity income products, investors should be conscious of how certain parts of the equity income market perform under various macro dynamics. This way they can scale each segment up and down as necessary. Additionally, this table reflects the correlation between different equity income areas relative to broad beta U.S. equities.

After a decade of low rates and a short period of rapid interest rate hikes, fixed income yields, and potential returns have become attractive again. Combining equity income with fixed income can help provide diversification benefits and increase return potential. This is especially true within the current drawn-out rate cutting cycle, where economic resilience is likely to support equity returns.

As reflected on the correlation table, several areas, including covered calls, FTSE High Dividend Yield and MLP indices have almost no correlation with the Bloomberg U.S. Aggregate Index. Zero correlation between two assets indicates that there is no linear relationship between their returns. For investors looking for yield but needing to balance capital preservation and capital growth requirements, there’s potentially a wide range of exciting opportunities.

Holistic Approach for Higher Yields & Total Return

Finding yield through equity income is important, but selectivity is vital given current economic climate. Exposure to quality stocks can provide resilient yield. Covered calls can offer attractive income but performs best in a rangebound market environments. And preferred stocks can provide a reasonable income and low beta.

Each of these areas generally focus on either yield or return potential. Combining equity income solutions can improve a portfolio’s exposure diversification while also diversifying its sources of yield. This can create a portfolio that provides a solid yield while also focusing on total returns. Equity income portfolios must be flexible enough to capture upside while maintaining a decent yield throughout the business cycle.

David Beniaminov

David Beniaminov Michelle Cluver

Michelle Cluver