This post is the third post of a multi-part series of pieces designed to provide education around ETFs. For the full publication, click here.

ETFs have a relationship with several facets of capital markets. One key relationship is with Authorized Participants (APs). Understanding this relationship as well as what goes into the Total Cost of Ownership of an ETF is important. In this post, we explore both of these topics in a bit more detail.

What is the relationship of ETFs and Capital Markets?

A. The basics

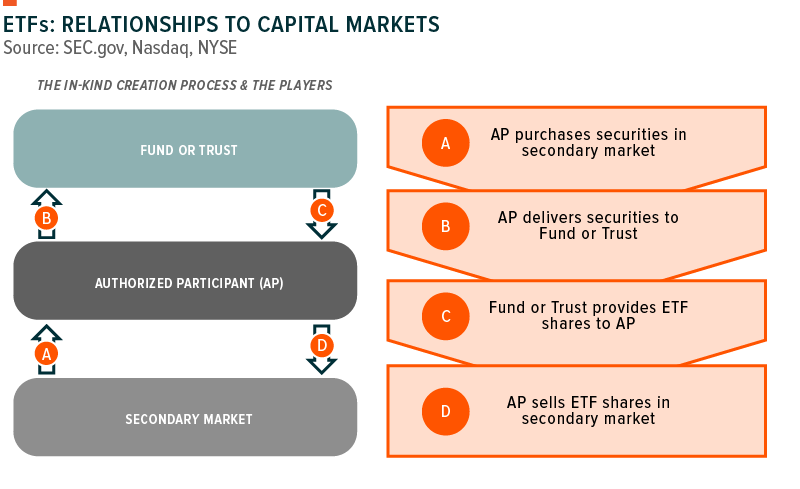

ETFs do not sell shares directly to investors. Shares of ETFs are issued in large blocks called creation units, typically numbering 50,000 shares per unit. Purchasers of creation units are often large financial institutions, called authorized participants (APs), and these purchases are often made “in-kind” vs. via a cash transaction. These “in-kind” transactions can have potential tax efficiency benefits in relation to capital gains tax treatment (see “The In-kind Creation Process & The Players” figure below).

The ETF share creation and redemption process facilitates trading on the secondary market at prices that are generally in line with funds’ Net Asset Values (NAVs), although ETF shares can trade at a premium or discount to NAV. This process requires that portfolio holdings be disclosed daily.

B. The Authorized Participant (AP)

- Are, most often, sizeable financial institutions, including:

- Market Makers

- Specialists

- Obtain and dispense the underlying assets of an ETF to make the in-kind share creation and redemption process possible

- Receive ETF shares for inventory to meet requests in the market or from a specific customer

- Can profit from the difference between the value of the fund’s underlying holdings vs. the price at which the fund trades on an exchange

What is an ETF’s “Total Cost of Ownership”?

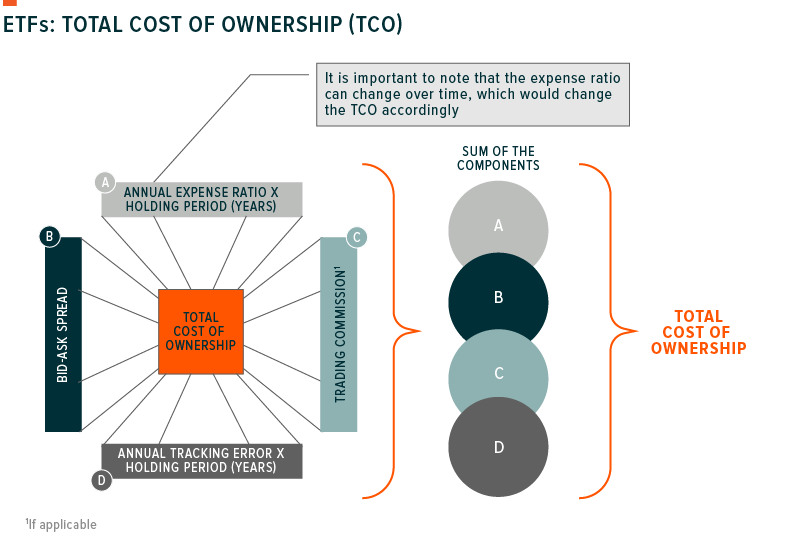

The total cost of owning an ETF may extend beyond its listed management fee. Other potential ETF costs can be thought of across four verticals (see “TCO Illustration” below): Expense Ratios, Bid-Ask Spread, Trading Commission1 and Tracking Error. Once considering all four of these verticals, it is possible that an ETF with a higher expense ratio could have a lower total cost than one with only a lower expense ratio.

Expense Ratios

- A fund adviser’s charge for managing the ETF, and other expenses such as transaction costs, commissions, etc.

- Often lower for ETFs vs. traditional mutual funds

- Tend to be higher for more difficult to manage funds (e.g., commodity, emerging markets)

Bid-Ask Spread

- The difference between the cost to purchase an ETF on an exchange vs. to sell it.

- Often smaller with domestic, large cap securities and larger for smaller cap or international securities

- ETFs with more assets under management tend to trade more frequently and have smaller bid-ask spreads

Trading Commission1

- A fee paid to a broker to execute a trade

- Based on a number of shares and/or their value

Tracking Error

- How closely the price of an ETF matches its benchmark

- An indication of a fund’s capacity to produce returns in keeping with the underlying index

- Complexity of markets (e.g., emerging markets) can lead to increased tracking error

Global X ETF Model Portfolio Team

Global X ETF Model Portfolio Team