This blog was originally posted in October 2018 and was updated in June 2019.

While still in a relatively nascent phase, ESG (Environmental, Social, & Governance) investing continues to receive strong interest from investors. In a recent survey, we found that 80% of investors indicated that that it was at least somewhat important to them to align their investments with their personal values.1 Our ESG offering, the Global X Conscious Companies ETF (KRMA), passed its two year anniversary last fall, prompting us to analyze KRMA’s growing track record to see how its index has a unique approach to selecting companies (via the multi-stakeholder operating system) and how this has affected performance while aligning with investors’ values.

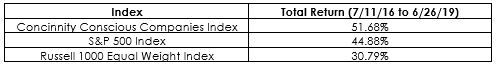

A common hesitation among investors when considering ESG strategies is uncertainty around performance. While many investors would prefer to align their investments with their principles, few are willing to accept lower returns in exchange. To that end, we looked into how KRMA’s index has performed relative to the S&P 500 and other indexes. The result: KRMA’s index has outperformed these indexes since inception, indicating that this ESG strategy has not had to come with tradeoffs.

Source: Bloomberg. 7/11/16 (KRMA’s inception date) through 6/26/19 Returns are cumulative. The standardized and most recent month-end performance for KRMA can be found by clicking here. The performance data quoted represents past performance. Past performance does not guarantee future results. Index returns are for illustrative purposes only and do not represent actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

It’s important to note that KRMA tracks an index which tracks stocks based on the multi-stakeholder operating system, or “MsOS”. The MsOS ranks companies for based on their demonstrated ability to achieve positive outcomes for five key stakeholders: 1) customers; 2) employees; 3) suppliers; 4) local communities; and 4) stock & debt holders. This makes KRMA’s index an inclusionary methodology – Companies have to earn their way into the index – rather than an exclusionary one, where companies are removed from a prominent index for failing to meet certain requirements. This inclusionary approach is a key differentiator among other ESG approaches, which tend to follow exclusionary approaches (e.g. no firearms, tobacco, alcohol).

An important question to analyze is how the MsOS changes KRMA’s exposures compared to a broader market-cap index. Given KRMA’s equal weighting approach and large and mid cap exposures, we look at KRMA’s sector weights versus the Russell 1000 Equal Weight Index, in addition to the S&P 500.

As demonstrated in the chart below, the most overweight sector in KRMA relative to the equal weight Russell 1000 has been the Consumer Discretionary sector. On the flip side, the two most underweight sectors are the Utilities and Energy sectors, with around -6% underweights since inception.2

Source: Bloomberg. Data represents daily average overweight/underweight of KRMA relative to Russell 1000 Equal Weight Index and S&P 500 Index since KRMA inception of 7/12/16 to 6/26/19. All numbers are approximate. Allocations subject to change.

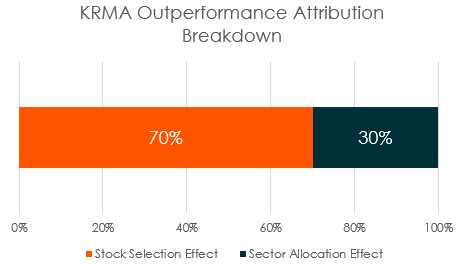

The bias towards the Consumer Discretionary sector is likely a result of companies in that sector going to greater lengths to appeal to discerning consumers who care about the values of the brands they support. Meanwhile, Utility and Energy companies are often highly regulated at the federal and/or state level, resulting in less incentive to appease stakeholders. These firms may prefer instead to improve business efficiency at all costs. Despite these sector biases, the primary contributor to outperformance in KRMA has been stock selection, as demonstrated below. This shows that companies with good values have rewarded investors with stronger performance after neutralizing any sector biases.

Source: Bloomberg. Data from 7/12/18 to 6/26/19. Performance relative to the Russell 1000 Equal Weight Index. Past performance is not a guarantee of future results.

If recent reports are any indication, stakeholders today continue to hold companies with strong values in high regard. Conversely, companies perceived to be lacking in these areas could be putting themselves at risk. Employees, for example, place a strong emphasis on working for a company whose values align with their own. 86% of millennials said they would consider taking a pay cut to work for a company whose missions and values lined up with their own.3 Customers too believe it’s important for companies to promote positive values. In one study, 66% of consumers stated they would be willing to spend more on a product if it came from a sustainable brand.4 For investors (another key stakeholder), ESG investing is becoming increasingly popular, particularly amongst Gen X and Millennial investors. But this trend is also taking hold across the broader investment community. Nearly $60 trillion in assets controlled by institutional investors are looking to implement ESG principles, representing double digit growth rates, relative to past periods.5

These data points present a compelling argument that ESG investing is not just a fad, but a useful investment approach for isolating companies with inherent potential advantages over less values-driven firms. We believe the multi-stakeholder operating system is an effective way to implement an ESG investment approach because of the accountability it puts on an organization to extend its values to multiple stakeholders, not just one particular group. Over time, we believe this will not only continue to align investors’ values with their investments, but could also present compelling long term outperformance potential.

Related ETFs

KRMA: The Global X Conscious Companies ETF is designed to provide investors an opportunity to invest in well-managed companies that achieve financial performance in a sustainable and responsible manner and exhibit positive Environmental, Social and Corporate Governance (ESG) characteristics.

Rohan Reddy

Rohan Reddy