The long-awaited $2T U.S. infrastructure plan has arrived. On March 31, 2021, the Biden Administration announced the American Jobs Plan and the complementary Made in America Tax Plan. They outlined which areas could receive investment, the amount of investment required, and different ways it could get funded. At a high level, it includes investment in:1

Physical Infrastructure

- Transportation Infrastructure ($621B)

- Buildings, Schools, and Hospitals ($250B+)

- Infrastructure Resilience ($50B)

Energy, Water, and Digital Infrastructure

- CleanTech, clean energy, and related infrastructure ($300B+)

- Water utilities ($111B)

- Digital infrastructure ($100B)

Much of the plan is in line with the expectations set in advance of the 2020 presidential election, though there are some differences (see How a Biden Presidency & COVID-19 Could Impact Infrastructure Development). In addition to the above, it includes investment in care for older and disabled individuals ($400B), manufacturing and small businesses ($300B), innovation and research ($180B), and workforce development ($100B).

In the next section, we will take a look at each infrastructure-related investment area. Following that, we will explore how the plan could get funded and what legislation could actually pass through congress.

INVESTING IN PHYSICAL INFRASTRUCTURE

Transportation: The American Jobs Plan addresses transportation infrastructure through investment in: roads and bridges; public transit; electric vehicles (EV); passenger and freight rail services; and ports, waterways, and airports. In particular, the plan would:

- Build and repair 20,000 miles of highway, roads, and streets, as well as fix 10,000 bridges in disrepair ($115B)

- Establish and grow the U.S. EV market by incentivizing EV purchases, building a network of charging stations, reshoring supply chains for EVs and batteries, replacing or electrifying transit vehicles, school buses and the federal fleet ($174B)

- Address repair backlogs for buses, rail cars, stations, and thousands of miles of tracks and other related infrastructure, as well as expand public transits reach to meet demand ($85B)

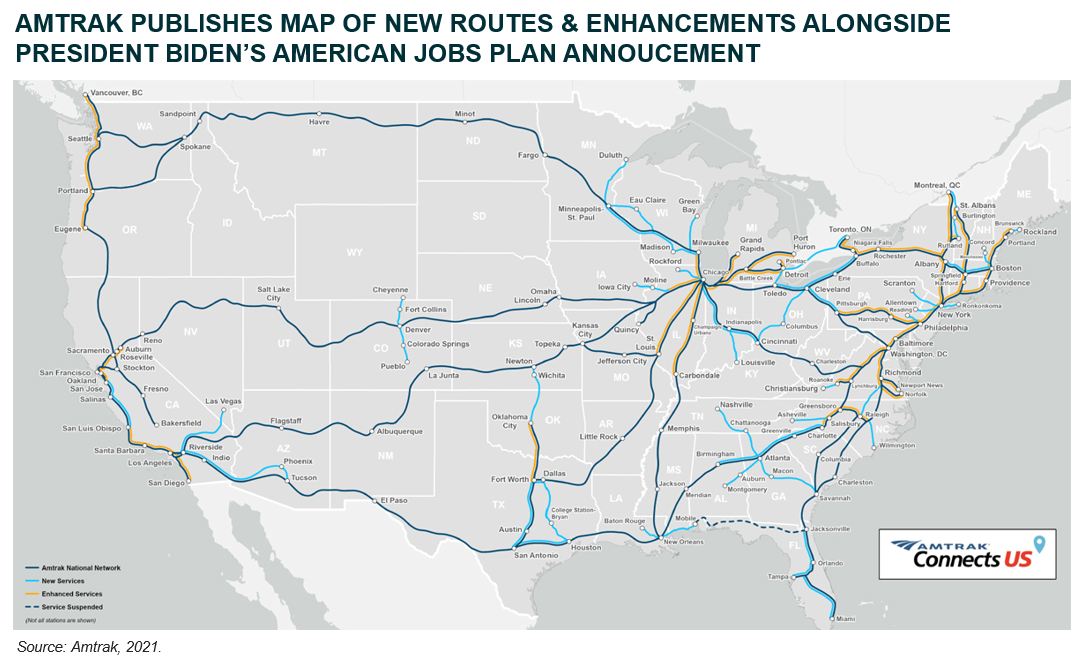

- Bolster passenger and freight rail services by addressing Amtrak project backlogs, connecting new destinations, and enhancing services in high traffic areas ($80B)

- Upgrade commerce-facilitating infrastructure by improving ports and waterways, and modernizing airports ($42B)

- Expand general transportation infrastructure in areas without affordable transportation options and where past investment created economic boundaries ($20B)

Buildings, Schools, and Hospitals: Other efforts to revitalize physical infrastructure encompass investment in commercial buildings, homes, schools, and hospitals. In particular, the plan would:

- Build, retrofit, and/or rehabilitate over 2M energy efficient and electrified housing units, low and middle-income homes, and commercial buildings ($213B)

- Improve education infrastructure by modernizing public schools, community colleges, and childcare centers with climate friendly and innovative facilities ($130B+)

- Upgrade Veterans Affairs hospitals and federal buildings by building state of the art, climate-friendly facilities (~$30B)

Infrastructure Resilience: President Biden’s plan highlights the importance of ensuring that existing and new infrastructure is resilient to climate risk, natural deterioration, and obsolescence. Investment areas in this vein include protection from wildfires, coastal resilience, and research and development in durable advanced materials. While the entire plan inherently seeks to build resilient and climate-aware infrastructure, it also carves out $50B for these efforts.

Our Take

Inadequate transportation infrastructure results in significant economic losses that can be avoided with investment. Every year, traffic congestion costs our economy over $160B, motorists spend over $1,000 on lost fuel, and traffic accidents result in over 35,000 deaths (4x that of Europe per capita).2 By investing in physical infrastructure like roads, bridges, ports, and airports, the U.S. can limit economic loss by mitigating inefficiencies. Further, enhancements to public transit like offering new options, upgrading existing ones, and increasing their range can improve overall productivity by facilitating commerce and improving economic participation.

Similar benefits could come from investing in commercial buildings, homes, and hospitals. Widespread affordable housing could expand employment opportunities, while keeping consumption dollars (disposable income) in the hands of workers. The modernized nature of the structures the plan seeks to build could provide further economic benefit by improving the health of those who occupy them.

While building this infrastructure will create jobs, investment in schools can go a step further. Improving educational outcomes can ensure that more individuals are equipped with the skills needed for next-generation employment. And by offering childcare and public schooling, the U.S., can improve labor force participation rates for caregivers, bringing back those who may have been forced to leave or excluded in the past.

Key Beneficiaries

New and retrofitted physical infrastructure will be comprised of materials like asphalt, construction aggregates, concrete, steel, and copper. Construction products and equipment will be essential in building physical infrastructure, while construction and engineering service companies will likely be those putting said materials and equipment to use. Industrial transportation companies are also a key player, bringing all the above to the areas where infrastructure is needed most. And finally, across all these segments, the plan favors companies based in America, that generate revenues in America, and already pay taxes in America.

ENERGY, WATER, AND DIGITAL INFRASTRUCTURE

CleanTech and Clean Energy: Investment in clean energy and CleanTech is inextricable from the development of next-generation infrastructure. This is especially true given President Biden’s intention to catch up with the rest of the world by achieving 100% carbon free electricity by 2035 and putting the country on a path to reach net-zero emissions by 2050.3 Many of these investments are included physical infrastructure investments. Expanding electrification and energy efficiency in buildings, homes, schools, and hospitals and growing the market for EVs means investment in the CleanTech value-chain. Other areas, however, can be considered separately, including the intention to:

- Modernize the power sector by embracing smart grid technologies, building out at least 20 gigawatts of high-voltage capacity power lines, and creating incentives for clean energy generation and storage. This includes exclusively purchasing clean energy for federal buildings and creating energy sector jobs focused on plugging orphan oil and gas wells ($100B)

- Make the U.S. a leader in climate science and innovation by investing in R&D for clean energy, utility scale storage, hydrogen, carbon capture use and storage, among other technologies ($35B)

- Catalyze CleanTech manufacturing by procuring EVs, charging ports, and electric heat pumps with federal funds ($46B)

Water utilities: The plan includes a significant overhaul of the U.S. water utility infrastructure to improve the safety of drinking water. Investment in water utilities seeks to:

- Replace 100% of all lead pipes and service lines that deliver drinking water ($45B)

- Revamp and upgrade treatment plants and systems for drinking water, wastewater and stormwater ($56B)

Digital infrastructure: The plan also seeks to expand internet infrastructure, covering 100% of the country with high-speed and future-proof broadband ($100B)

Our Take

U.S. investment in CleanTech and clean energy could provide immense economic benefit. CleanTech includes the infrastructure and technology that enables clean power implementation and adoption. Without modern grids, utility-scale storage, and the technology that goes into clean energy sources, the ability to scale next generation power would be extremely limited. Power infrastructure in the U.S. already desperately needs to be revitalized – the economy loses up to annually $70B from power outages.4

Investment in CleanTech would support the shift to clean energy, while providing dampening economic losses from current inadequacies. Such a transition could also create job opportunities in installation, maintenance, and manufacturing, as well as long-term opportunities in clean energy research and development. The plan has tens of billions of dollars dedicated to creating job opportunities for those working in the energy sector and for underserved individuals.

Looking more broadly, a shift to clean energy and clean technologies would reduce levels of the atmospheric carbon-dioxide that causes 75% of global warming.5 Impacts of this warming include increased billion-dollar natural disaster frequency, submerged coastlines, and lethal heat waves – all things which could result in direct or indirect negative economic impacts. If warming continues on its current path, some scenarios estimate annual GDP per capita losses reaching as much as 14% in the next 80 years.6

Investing in digital infrastructure will bring high-speed internet to the 30 million Americans who live in areas with no broadband infrastructure.7 The internet is essential to modern life and next-gen work and education. Such an investment would level the playing field for those living in underserved areas. In the long-term, this should increase the U.S.’s overall intellectual capital and give more people a chance to work in next-gen jobs. The plan also seeks to reduce internet costs by removing legislative barriers to competition. This should put more consumption dollars in American’s pockets.

The U.S. is falling behind China and others when it comes to investing in these areas. Aggressively funding digital infrastructure and clean technologies could help the U.S. become a leader in next-gen industry and innovation. Wright’s Law describes the idea that the cost of each unit manufactured decreases as a function of cumulative units produced.8 So for technologies like EVs, where the U.S. lags the rest of the world in adoption, investment in related domestic manufacturing could dramatically increase sales by making them more affordable.

Key Beneficiaries

Companies involved in the clean energy and CleanTech value-chains would be well positioned to benefit from the Plan. These include renewable energy producers and component manufacturers, as well as those with business activities related to electric grids, energy storage, electrification, and energy efficiency. Other efforts to reduce emissions should benefit companies involved in carbon capture, use, and storage, and renewable hydrogen.

Additionally, companies that manufacture or produce telecommunications equipment and semiconductors related to connectivity and electrical transmission could benefit from digital infrastructure spending. Construction and engineering companies could also benefit from this aspect of the plan.

ADDITIONAL INVESTMENTS

Innovation and Research: The Jobs Plan underscores the importance of the U.S. reestablishing itself as a hub of innovation. It seeks to use public funds to make the U.S. a leader in artificial intelligence, biotech, advanced computing, clean energy and more ($180B)

Manufacturing: President Biden is seeking to bring the U.S. back to the forefront of manufacturing and secure supply chains through investment in monitoring domestic industrial capacity and semiconductor manufacturing ($100B). Other related efforts include those mentioned for clean energy, health care and pharmaceuticals, and assorted R&D ($300B total)

Workforce Development: The plan includes initiatives to provide dislocated workers and underserved communities with next-gen training that would equip them with the skills needed to work in clean energy, manufacturing, and caregiving ($100B)

Long-Term Care: President Biden calls for Congress to invest in expanding access to long-term care for older and disabled individuals ($400B)

Our Take

These investments would help the U.S. maintain its economic competitiveness through the rest of the century. Bolstered manufacturing and reshored supply chains would increase domestic output and productivity, while R&D funding would help the country keep pace with global technological advancement. These areas would also provide jobs in the short-term, while creating new opportunities in high-skill industries.

GETTING IT BUILT

The American Jobs Plan seeks to invest over $2T in the next decade, with 1% of GDP per year invested in infrastructure over the next 8 years.9 The Made in America Tax Plan is the complementary funding component of this effort. The Tax Plan seeks to:

- Set the corporate tax rate at 28%

- Increase the minimum tax on U.S. companies to 21% to avoid multinational U.S. companies receiving an exemption on foreign asset returns

- Limit the ability of corporations to use foreign tax havens

- Eliminate the ability to deduct offshore expenses

- Establish a 15% minimum tax on corporations’ book income

The American Jobs Plan also seeks to activate the private sector and garner private investment for funding and participation in construction and development. It also includes innovative approaches to reducing costs and removing constraints, including changes to zoning laws, thoughtful removal of red tape, and by favoring companies based in America and generate revenues in the country.

While the cost is steep, the economic benefits explained in the previous sections could outweigh the tax increases stipulated by the Made in America Tax Plan. Overall, S&P estimates that such a plan could create 2.3M jobs by 2024 and inject $5.7 trillion into the economy, raising per-capita income by $2,400 (note this is analysis was done prior to the announcement, but is rooted in the same idea).10

U.S. GDP has leveled out at around 2% for the past 20 years, well below the 4% long-term average.11 Looking to history as an example, the U.S. Interstate Highway System cost $500B to build. In the years since, the system has returned more than $6 in economic productivity for every $1 it cost.12 While the American Jobs Plan is expensive, it could prove worthwhile in the short- and long-term.

GETTING IT PASSED

Speaker Pelosi set the ambitious goal of passing the bill through the house by July 4th.13 Unlike the American Rescue Plan a.k.a COVID-19 Stimulus Package, which was an outgrowth of last year’s policy discussions, the infrastructure bill needs to be drafted into law. Passing the bill in July means the Senate isn’t likely to take it up until later in the summer, factoring in recess. This means possible Senate passage likely falls after Labor Day.

We think it is reasonable to expect that more gets added to the core infrastructure component of the plan, rather than it being trimmed down. The more legislative priorities it addresses, the harder it will be for moderate or progressive Democrats to vote no. The bill could be passed through reconciliation or majority, and while moderate Democrats have indicated that they would rather avoid reconciliation, Senate Majority Leader Schumer has indicated there is room for a second reconciliation bill in 2021.14

Related ETFs:

PAVE: The Global X U.S. Infrastructure Development ETF seeks to invest in companies that stand to benefit from a potential increase in infrastructure activity in the United States, including those involved in the production of raw materials, heavy equipment, engineering, and construction.

CTEC: The Global X CleanTech ETF seeks to invest in companies that stand to benefit from the increased adoption of technologies that inhibit or reduce negative environmental impacts. This includes companies involved in renewable energy production, energy storage, smart grid implementation, residential/commercial energy efficiency, and/or the production and provision of pollution-reducing products and solutions.

RNRG: The Global X Renewable Energy Producers ETF seeks to invest in companies that produce energy from renewable sources including wind, solar, hydroelectric, geothermal, and biofuels.

DRIV: The Global X Autonomous & Electric Vehicles ETF seeks to invest in companies involved in the development of autonomous vehicle technology, electric vehicles (“EVs”), and EV components and materials. This includes companies involved in the development of autonomous vehicle software and hardware, as well as companies that produce EVs, EV components such as lithium batteries, and critical EV materials such as lithium and cobalt.

DTCR: The Global X Data Center & Digital Infrastructure ETF seeks to invest in companies that operate data center REITs and other digital infrastructure supporting the growth of communication networks.

SNSR: The Global X Internet of Things ETF seeks to invest in companies that stand to potentially benefit from the broader adoption of the Internet of Things (IoT), as enabled by technologies such as WiFi, 5G telecommunications infrastructure, and fiber optics. This includes the development and manufacturing of semiconductors and sensors, integrated products and solutions, and applications serving smart grids, smart homes, connected cars, and the industrial internet.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.

Global X Research Team

Global X Research Team