During April, daily global COVID-19 diagnoses reached all-time highs.1 Case growth plateaued at 5.7 million new cases per week. Emerging markets are currently experiencing a surge in COVID-cases, with India accounting for almost half of global new weekly cases.2 Vaccine distribution has helped reduce COVID-cases in the U.S., but global vaccine distribution has been uneven, creating a wall of worry surrounding the global economic recovery. The World Bank has warned that the economic recovery may lose steam on the back of rising COVID-cases.3 Below are two key concerns surrounding higher COVID-cases:

- In a worst-case scenario, failure to control the virus globally poses risks of virus mutations with unknown outcomes. This is a risk for both developed and emerging markets. Depending on the effectiveness of the current vaccines against variants (both current and future), this may present risks for countries that have successfully inoculated their populations.4

- A two-speed recovery remains a key risk to global economic growth. Emerging and developing economies accounted for two-thirds of global growth prior to the pandemic. Growth from these regions is potentially at risk if COVID-19 is not contained on a global scale. Advanced economies have generally fared better through the crisis due to their ability to spend (monetary and fiscal support) combined with their ability to secure vaccine supply agreements. According to the IMF, advanced economies and China are likely to emerge from the crisis with GDP per capita slightly higher than 2019, while emerging markets are likely to experience a decline in GDP per capita.5 A weak emerging market recovery may weigh on demand for goods from developed economies and could further exacerbate supply chains disruptions.6

While the situation in India remains concerning, it is encouraging that the global community is beginning to coalesce around providing assistance to emerging markets. The U.S. has committed to share 60 million AstraZeneca doses with the rest of the world, while offering India medical supplies, including rapid diagnostic test kits, ventilators, and protective gear.7

Following the Leadership Path

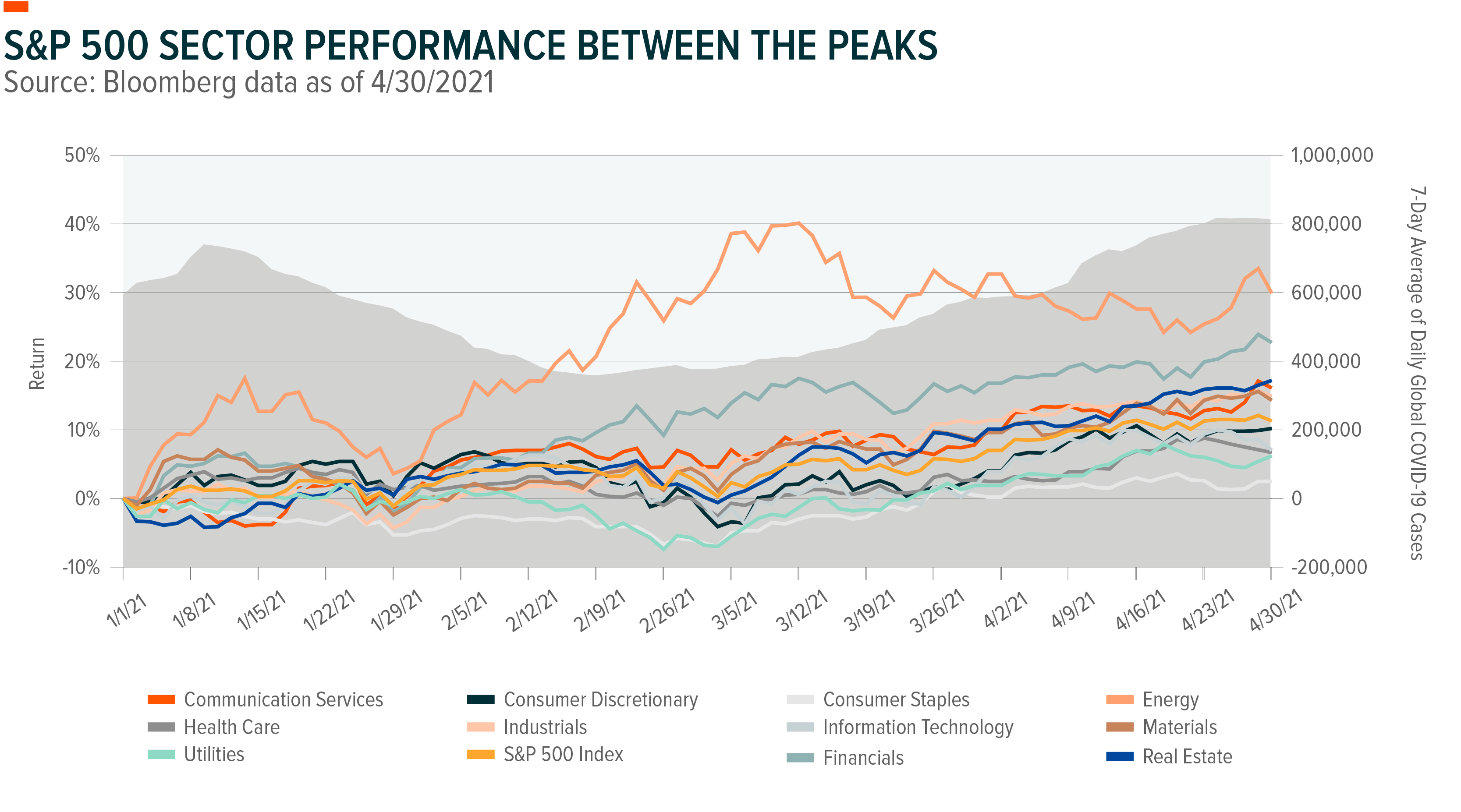

As COVID cases have risen globally, market leadership has shifted back to large-cap growth. Companies that are reliant upon the reopening of the global economy are most vulnerable to the current surge in infections. This scenario has had a large impact on the Energy sector, while favoring the more defensive portions of the market. In the chart below we plot the seven-day average of daily global COVID-19 cases relative to the YTD performance of the S&P 500 Index GICS sectors. This chart reflects the contrast between the recent waves of concern and earlier optimism as markets shifted between the COVID peaks. It is also worth noting the market exuberance for the Energy and Financials sectors when global COVID-cases started to plateau.

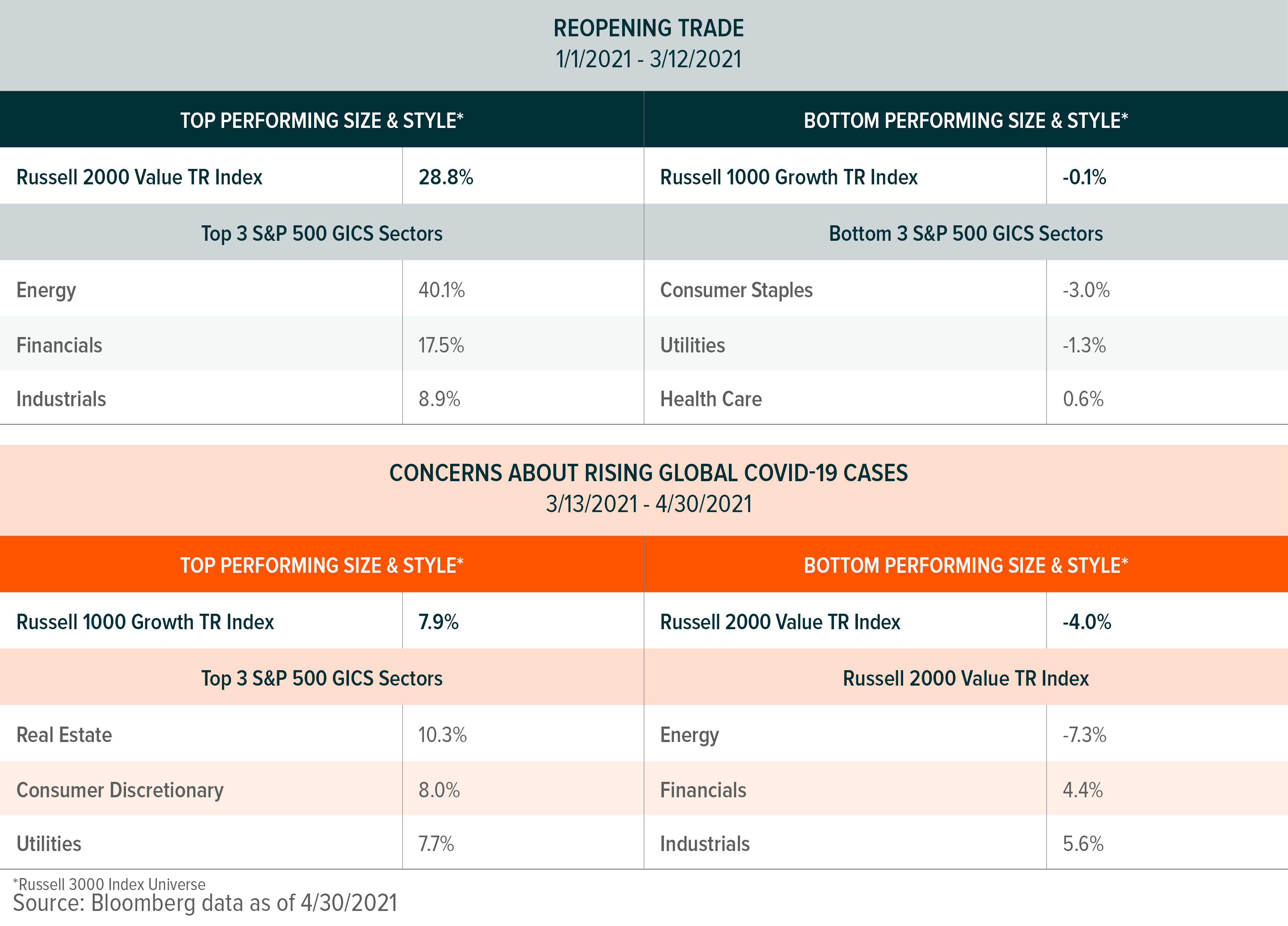

The reopening trade favored the Russel 2000 Value Index, while within large-caps, Energy, Financials and Industrials were the top performing S&P 500 GICS Sectors; however, as soon as COVID-cases spiked, these were the areas that lagged. Conversely, defensive high yielding sectors, such as Utilities, struggled during the reopening trade while leading the market during the more recent concerns. However, as the current COVID-wave started to flatten, sector leadership began to shift as the 10-year Treasury yield rose. The table below draws attention to the areas of the market that were leading and lagging during each period.

Where do we go from here?

The speed of global vaccinations and their effectiveness against new variants will likely impact the economic recovery. During the second quarter we are likely to get some clarity on the global vaccine rollout and its effectiveness against variants.8 Despite perceived concerns, market strength has been broad-based. April was a record setting month for the breadth of the market. Based on 4/29 data, 18 trading sessions experienced more than 95% of the constituents of the S&P 500 Index trading above their 200-day moving average. This is the highest number on record, double the previous high of nine days in September 2009. Before this record setting month, since 1990, there had only been an aggregate of 17 days where 95% of the constituents were trading above their 200-day moving average.9

We are potentially shifting from the stage of the recovery where the rising tide lifts all boats, into a more selective recovery with a greater focus on fundamentals. In line with this, the table below outlines the sectors we currently view as the most attractive during the economic reopening.

Michelle Cluver

Michelle Cluver