Despite the Fed’s efforts to raise interest rates, many fixed income investments continue to deliver historically low yields to investors. As a result, investors are increasingly considering alternative sources of income, including strategies that potentially provide higher yield than traditional fixed income investments and those that offer the opportunity for capital appreciation along with income.

One area gaining significant attention from investors is dividend-focused ETFs, which Bloomberg recently estimated has $151 billion in assets under management.1 There are dozens of approaches to dividend investing, but we find that the majority of strategies fall into the following three categories: high dividend, dividend growth, and quality dividend. The table below demonstrates some of the key differences between these strategies, including their primary outcomes.

The chart below demonstrates how indexes representing each dividend strategy compare on key measures: dividend yield3, earnings growth, and profitability (defined as return on equity). As one would expect, the fundamentals for each of these indexes tend to align with their desired outcomes. The high dividend index, for example has the highest yield, while the dividend growth index has the highest earnings growth, and the quality dividend index has the strongest return on equity. Equally as important, however, are the tradeoffs: quality dividends and dividend growth often come at the expense of yield and vice versa.

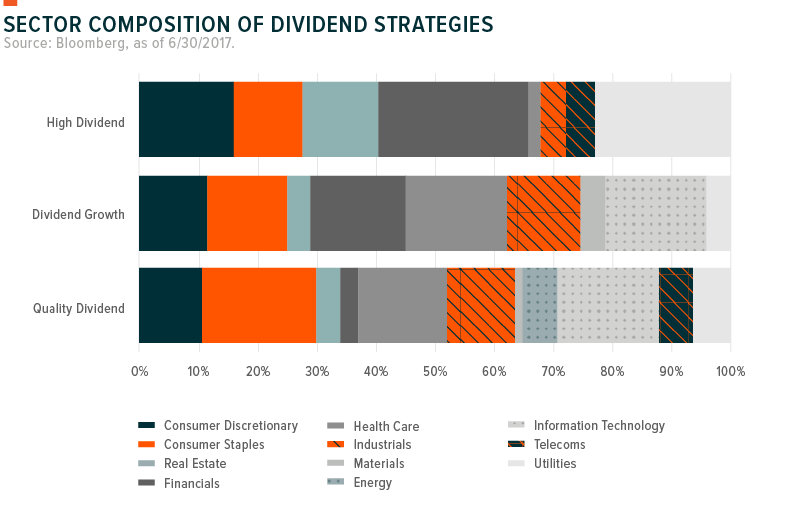

These dividend strategies (represented by the indexes mentioned in the italics above) also tend to exhibit certain sector biases, as illustrated in the chart below. Differences in sector weights can present distinct return drivers and risks for each strategy. The high dividend strategy favors sectors with low valuations (like Energy and Financials) and sectors that distribute a high percentage of their cash flows (like Utilities). The dividend growth strategy, on the other hand, favors historically low-dividend paying sectors like Health Care and Information Technology, which should have a greater capacity to increase dividends because of their lower starting point. The quality dividend strategy leans most heavily on Consumer Staples, which tend to be more resistant to economic downturns.

It is important to note that high dividend, dividend growth, and quality dividend strategies are distinct approaches and demonstrate significant differences in desired outcomes, fundamentals, and sector exposures. Given these differences, we believe investors should carefully consider which strategy best aligns with their investment objectives. In addition, investors may consider combining multiple dividend strategies in a single portfolio in an effort to manage fundamentals or sector exposures. It’s worth noting that some dividend ETFs already do this; it is not uncommon to see hybrid strategies that combine high dividend yielders that meet certain quality screens, for example. While a hybrid approach like this can potentially result in more balanced sector exposures and fundamentals, it often comes at the expense of maximizing the dividend yield, quality or growth characteristics of the portfolio.