Developing a new medicines usually takes 10-15 years and, on average, costs $1.3 billion.1,2 Only 9.6% of drugs entering phase I clinical testing reach the market.3 To this end, pharmaceutical companies heavily invest in developing the next pharmaceutical blockbuster, spending an average 21% of revenues in research and development (R&D).4 With those odds, it is important to understand factors that contribute to successful clinical trials and subsequent drug launches.

There are various ways to evaluate investigational treatments and to understand the potential return on investment (ROI). In this piece, we look at the highest grossing pharmaceutical companies and products of 2023, along with essential factors to consider when forecasting potential standouts in the future.

This piece is Part 2 in a 2-part series on the fundamentals of investing in pharmaceutical companies. The first part discussed the drug lifecycle through the drug discovery process, clinical trials, regulatory approval, and generic competition.

Key Takeaways

- In 2023, the pharmaceutical industry saw unprecedented innovation with a record-breaking number of regulatory approvals. Among all treatments, Merck’s Keytruda and AbbVie’s Humira emerged as the top sellers.5

- Many factors should be evaluated when estimating potential revenue opportunities and return on investment for investigational treatments, including the disease the drug treats, the biological target the treatment seeks to promote or inhibit, the technology the treatment relies on to engage with the target, and how the treatment is administered.

- Through clinical testing, a drug’s efficacy and safety determine if it should be approved and in what sequence treatment should be administered given other commercially available medicines.

2023 Recap: What Can We Learn from 2023’s Market Winners?

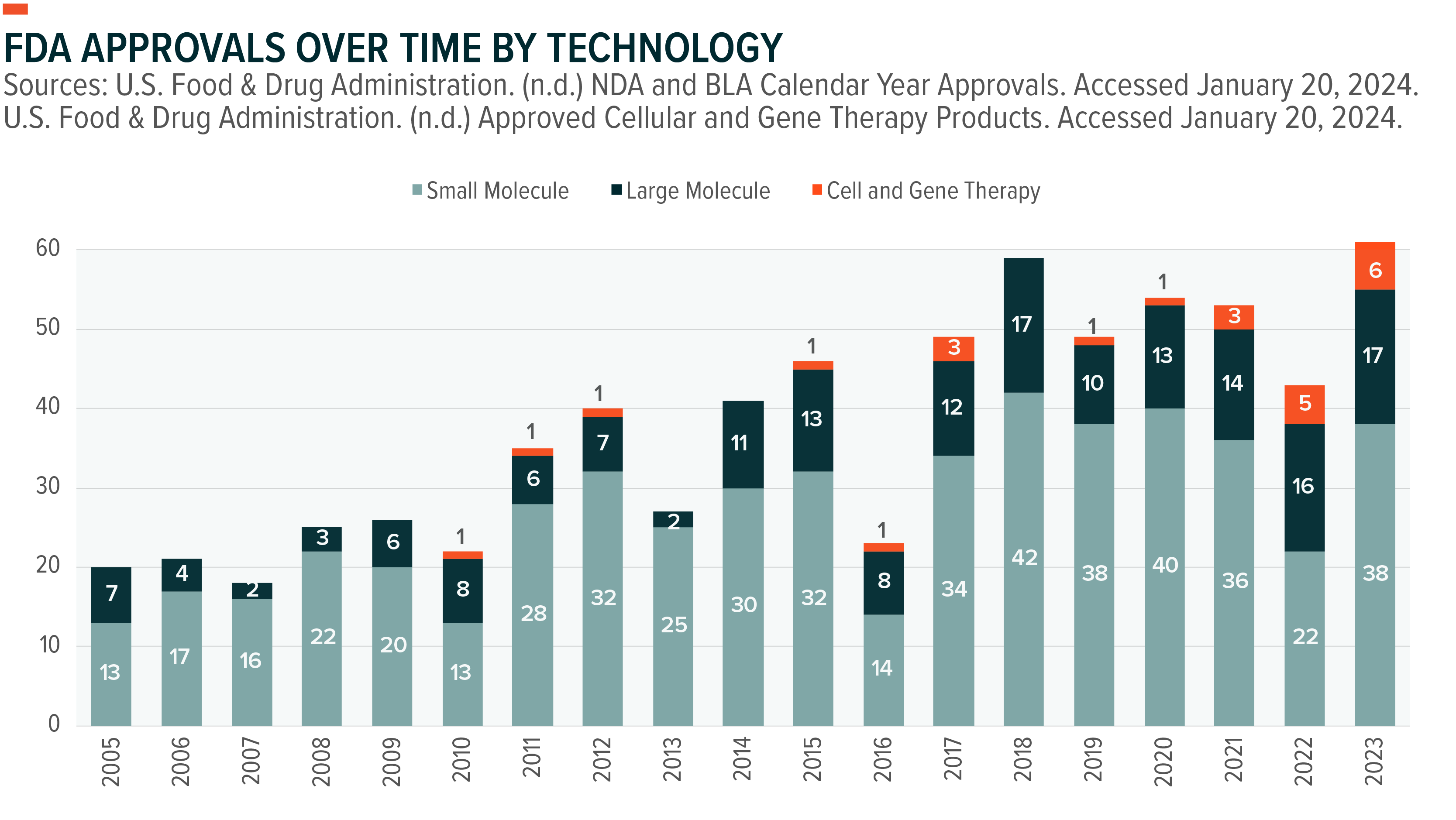

Looking back, 2023 proved to be an exciting year of pharmaceutical development. The United States Food and Drug Administration (FDA) approved the highest number of new drugs in history (61), marking a record year in pharmaceutical development.6 Last year saw the first approval for a gene editing treatment and saw weight loss drugs like Wegovy (colloquially referred to as Ozempic) become household names.

Among the flurry of activity, we examine the top ten highest selling drugs during the year. This list notably included AbbVie’s Humira, which was first approved in 2002, and provided an entirely new way of treating autoimmune disorders like Rheumatoid Arthritis.7 The list also includes newer market entrants, like Pfizer and BioNTech’s COVID-19 vaccines, Comirnaty.

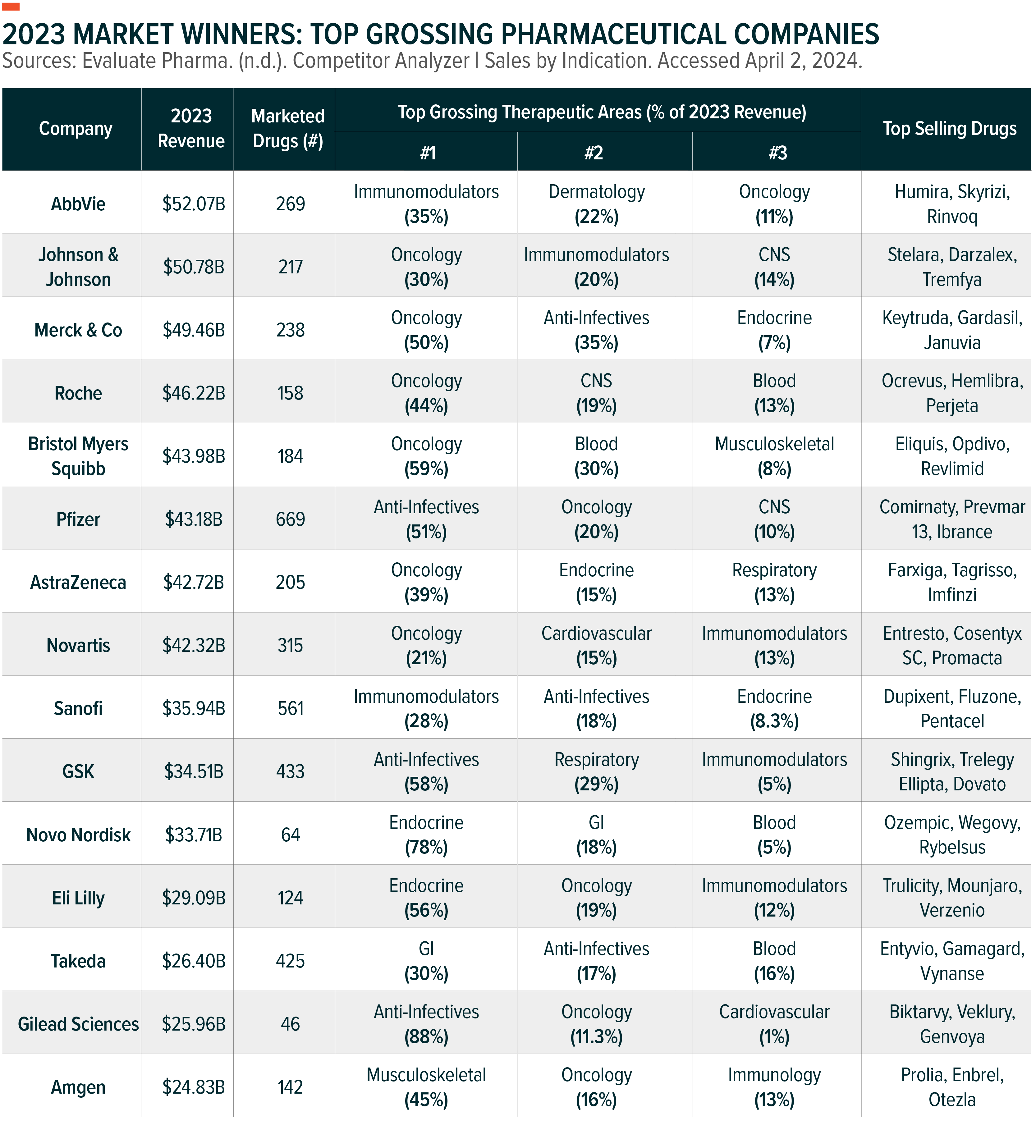

Among the host of players in the industry, we also examine the highest grossing pharmaceutical companies in 2023.

CNS = Central Nervous System

Evaluating Drug Candidates: Helping Predict Future Successes

Many factors can play a role when estimating the potential revenue opportunity for an investigational drug. These can range from the number of patients the treatment could treat to how the treatment is administered. Here, we outline key considerations for evaluating investigational drugs.

Indication

A drug’s indication is simply the specific medical condition or disease the treatment seeks to treat. Indications can be very broad, like for Aspirin which can be used for pain relief, prevention of blood clots, fever reduction, and many other use cases. Other times, indications can be very narrow, such as a specific mutation of cancer in a specific organ.

The indication dictates the total addressable market for the investigational treatment, though other information like how prevalence is expected to change and how competitive that market is are also important considerations.

Understanding the expected risk and return potential across different therapeutic areas can help provide important context as to the opportunities ahead. Common considerations include developmental risk, measured by expected approval rates, and potential return on investment, measured by expected peak sales. Therapeutic areas on the top right of the graph, for example, are characterized by lower expected risk and higher expected return than the industry median. Inversely, categories in the bottom left are characterized as higher risk, lower return categories.

Understanding the market size for each treatment category is also important. The size of each bubble corresponds to its global revenue estimates in 2028.

This analysis shows that oncology, for example, has the largest market opportunity ahead but also the lowest expected approval rates (higher risk).8 Conversely, the cardiovascular category appears to carry a lower development risk while addressing a smaller market opportunity.

For the most part, pharmaceutical firms develop treatments for common illnesses that affect a large group of patients. To encourage innovation in the treatment for rare diseases, governments often grant several advantages to pharmaceutical firms. One such designation is “orphan diseases.”

- Orphan Disease: A disease with a small enough population, where there is a lack of a market large enough to gain support and resources for discovering treatments for it, except by governments granting economically advantageous conditions to creating and selling such treatments. In the U.S., for example, disorders with less than 200,000 patients qualify for seven years of market exclusivity from approval.9 Sponsoring firms also receive tax credits, are eligible for R&D grants for clinical trials and receive discounts for FDA applications.10

Mechanism of Action:

A mechanism of action (MoA) refers to the specific process through which the drug produces its intended influence on the body.

For example, GLP-1s are the MoA behind popular drugs Ozempic and Wegovy. This mechanism works by mimicking the effects of GLP-1, a hormone that helps regulate blood sugar levels. GLP-1 receptor agonists can increase insulin production and decrease glucagon production, which can help to lower blood sugar levels.

In other instances, MoAs block or inhibit proteins that play a pivotal role in an illness. In some instances, PD1 proteins can suppress the activity of T-cells, allowing cancer to evade immune surveillance. Inhibiting PD1 proteins can enhance the ability of the immune system to recognize and target cancer cells.

Technology

A drug’s technology refers to the method used to target the illness via the mechanism of action. In other words, it is the technology utilized to interact with its target (MoA) to achieve the desired effect.

Technologies are categorized into three main groups:

- Small Molecule: Small molecule drugs are chemical compounds that typically consist of a number of atoms arranged in a specific chemical structure. Examples of small molecule drugs include aspirin, acetaminophen, ibuprofen, and statins. Small molecule drugs are expected to achieve 2028 sales of $572 billion, growing at an estimated 5.0% compound annual growth rate (CAGR).11

- Large Molecule: Large molecule drugs – also known as biologics – are molecules derived from living organisms. These include, for example, vaccines, insulin, and monoclonal antibodies. Biologic drugs are mostly administered via injections or IV infusions. Examples of biologic drugs are insulin, the COVID-19 mRNA vaccine, and weight loss drugs like Ozempic. Large molecule drugs are expected to achieve 2028 sales of $650 billion, growing at an estimated 8.7% CAGR.12

- Cell & Gene Therapy (CGT): Cell and gene therapies are a newer, advanced therapeutic modality that relies on the manipulation of cells or genetic material to treat or prevent illnesses. Examples of CGTs include CAR-T cell therapies for cancer and gene editing drug Casgevy. CGT drugs are expected to achieve 2028 sales of $42 billion, growing at an estimated 45.5% CAGR.13,14,15,16 For more information on CGTs, see The Genomic Medicine Revolution.

- Gene Editing: Editing parts of the genome by removing, adding, or altering sections of DNA.

- Cell Therapy: Transplanting healthy human cells to replace or repair damaged tissue and/or cells

- Gene Therapy: Replacing a defective or missing gene in a patient’s cells with a healthy version of that gene.

- Gene-Modified Cell Therapy: Transplanting genetically modified cells to fight disease.

Efficacy

The main consideration for any drug gaining approval is if the drug works as intended. In other words, it measures the effectiveness of the treatment. Depending on the illnesses, efficacy can be measured in many ways.

Common endpoints in cancer, for example, include:

- Overall Survival (OS): Time from dosage to death from any cause

- Progression-Free Survival (PFS): Time from dosage to documentation of disease progression or death

- Objective Response Rate (ORR): Percentage of subjects confirmed complete response (CR) or partial response (PR) to treatment

- Duration of Response (DoR): Time from documentation of tumor response to disease progression

Safety

When it comes to pharmaceuticals, merely being effective is not good enough. Side effects and patient safety are also primary concerns, and thus understanding the side effects and how tolerable they are is key.

If there are no approved treatments for the illness, greater side effects may be tolerated. Alternatively, if the indication is highly competitive, minimal side effects might be tolerated. Standards for side effects tolerance differ between different illnesses, though the general understanding is that the rewards of the treatment must outweigh the potential risks.

Common terminology regarding side effects include:

- Adverse Events (AEs): Unfavorable changes in the health of clinical trial participants. Though the sponsor keeps track of all AEs for regulatory submission, grade 3 AEs or above must be reported to the appropriate regulatory bodies immediately. If serious or frequent enough, the regulatory body can halt the clinical trial to investigate further.

- Black Box Warnings: In the US, the FDA can approve a drug with a black box warning or ‘boxed warning.’ These are meant to alert the public and healthcare providers to serious side effects the drug may cause. The warnings also explain how adverse reactions might be worse for certain groups of people, such as pregnant women or elderly patients. The warning must be included in the medication package in bold letters and surrounded by a black border, hence the warning’s name.

Line of Therapy

In some instances, like cancer treatments, novel drugs may be approved to a particular “line-of-therapy.” These refer to a specific sequence of treatment a patient receives.

A treatment may, for example, be approved as a first-line therapy, meaning it is recommended as the initial treatment for a particular condition once the patient is diagnosed. Other treatments may be approved as second- or third-line therapies, to be used after initial therapies have failed.

Many factors can inform what line-of-therapy a treatment receives approval for, such as effectiveness, safety profile, invasiveness, cost, and how it compares to alternative treatments for the same condition.

The line-of-therapy of a treatment can be an important factor in estimating the total return on investment of a drug. CAR-T cell therapies have, for a long time, been approved in heavily pretreated patients given how new the technology is. Recent clinical trial data has pointed to CAR-T therapies being effective in earlier lines and thus, expanding the pool of patients that could benefit.17

Dosing

Dosing refers to not just the size of the dose, but also how it is administered. Though dosing form, for the most part, is a lesser point of differentiation between treatments, it can still play a key factor in a drug’s success. In instances where all currently approved treatments are administered via an intravenous (IV) infusion, for example, a treatment that comes in pill form or an injection that can be administered at home can drive higher demand.

Frequency of dosing is also increasingly becoming a point of differentiation (e.g. taking a pill three times a week versus taking a pill once a week). The pharmaceutical industry wants to offer convenience for the patient to help ensure medication adherence without compromising efficacy. Frequency of dosing is usually influenced by the drug’s half-life.

- Half-Life: A parameter that represents the time it takes for the concentration of the drug in the bloodstream to decrease by half. The longer the half-life, the more infrequent dosing can be.

Conclusion

Drug candidates face a complex process to ensure the most effective and safe treatments gain regulatory approval. However, investors should be aware that approval does not necessarily translate to commercial success, as many factors can determine if a drug will be a blockbuster or ultimately flop. Understanding key differentiating factors for medications can help forecast expected revenue for pharmaceutical sponsors and return on investment, potentially enabling investors to make more informed decisions.

Related ETFs

GNOM – Global X Genomics & Biotechnology ETF

AGNG - Global X Aging Population ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.