We view Vietnam as an exciting growth story that is likely to benefit from both near-term cyclical tailwinds and long-term trends, including favorable demographics, foreign investment into the country, and a move up the manufacturing value chain. The country’s pro-business government, proximity to China, and amicable relationship with that nation position it well as a source of alternative manufacturing capacity as corporations diversify their supply chains beyond China in the wake of Covid-19 and geopolitical tensions between China and the U.S. We believe these factors will contribute to rising disposable income and drive domestic consumption.

Key Takeaways

- Vietnam’s export-led economy positions the country to be a potential outsize beneficiary of the current global cyclical recovery.

- Vietnam’s export sector continues to gain global competitiveness and is a nearshoring beneficiary.

- We believe the long-term opportunity, underscored by the pro-business government and favorable demographics, remains very much intact.

A “Friendshoring” Champion…

Rising tensions between the U.S. and China and Covid-19 related supply disruptions sparked global corporates to seek more resilient and diversified supply chains. Vietnam has emerged as a key destination for these types of nearshoring investments due to:

- Improving Relations With the U.S.: President Biden’s visit to Vietnam last September represented a significant shift in relations between the two countries, with the Vietnamese government subsequently upgrading its relationship with the U.S. by two notches to a “Comprehensive Strategic Partnership.”1 This reclassification to its highest level, now on par with that of China and South Korea, could help further attract foreign direct investment (FDI) to the country from the U.S., which is already Vietnam’s largest export market.2

- Clear China +1 Winner: Vietnam’s proximity to China makes it a clear partner for a China +1 type supply chain model where supply chains are diversified beyond China, especially since China is currently one of Vietnam’s largest trade partners.3

- Pro-Business Government: Recent reforms, including labor and state-owed enterprise reforms, continue to make Vietnam an attractive market for FDI.

- Growing Cost Competitiveness: Vietnam is becoming an increasingly competitive industrial and manufacturing market. Vietnamese labor is now ~3x less expensive than Chinese labor, while demographic tailwinds are expected to ensure an ample supply of increasingly skilled labor moving forward.4

- Favorable Demographics: Over two thirds of Vietnam’s 100mn+ population is considered working aged.5

- Attracting Higher Complexity Investments: Recent deals outline how Vietnam is moving up the value chain, with Nvidia announcing new investments in the technology sector.6

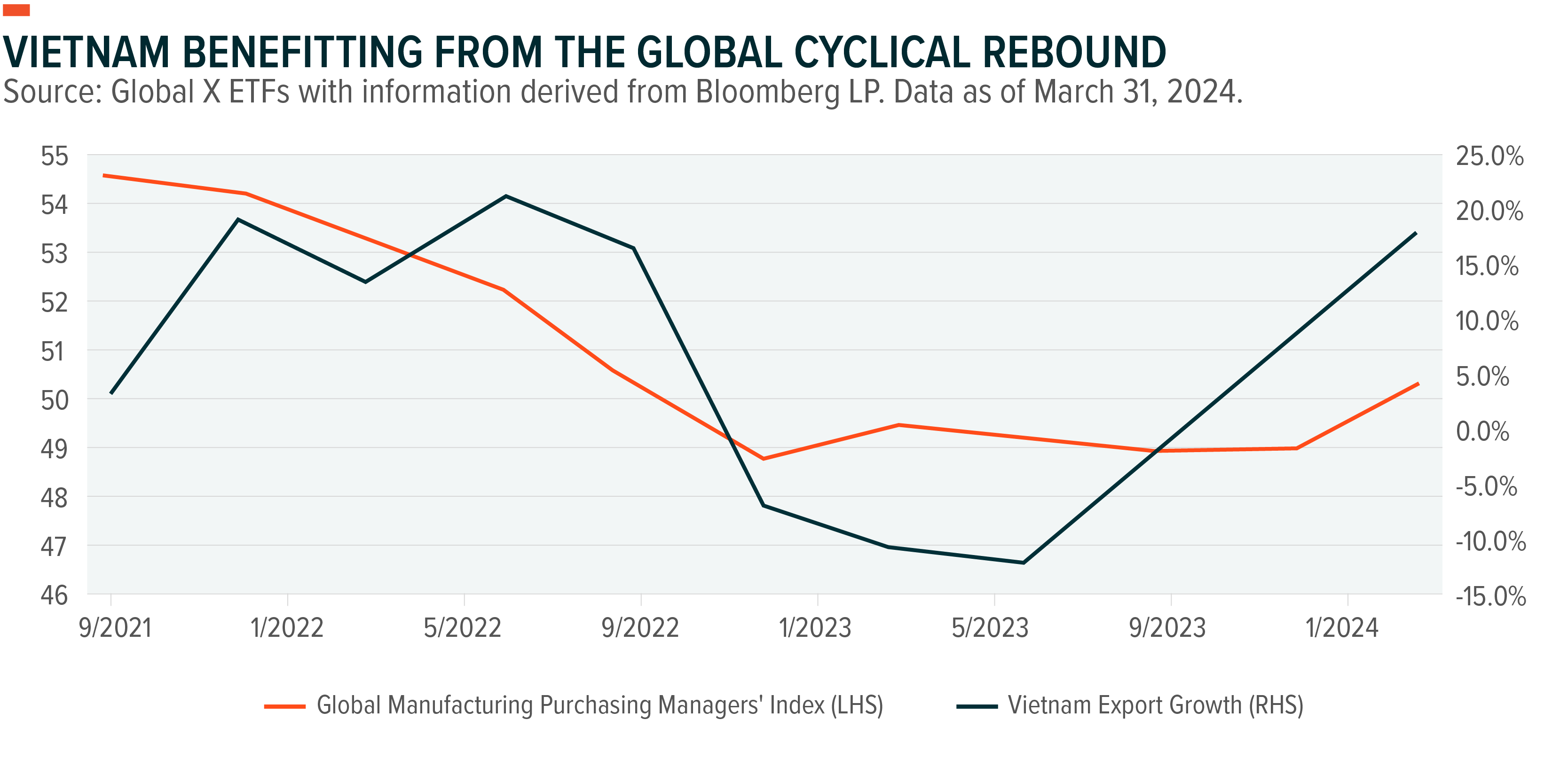

…Making Vietnam a Key Beneficiary of Global Cyclical Strength

Vietnam has been one of the world’s fastest growing economies in recent decades, driven by its increasingly competitive export sector, high levels of investment, and quickly rising levels of domestic consumption. Over the past few years, growth has slowed, closely tracking the post-covid decline in global goods demand. We saw the Central Bank move quickly to cut rates in order to stimulate growth, while the government increased public investment, resulting in the country’s real growth rate remaining at an elevated level and well above the global average, with gross domestic product (GDP) rising +5.1% y-o-y in 2023.7 Looking ahead, we see Vietnam’s export-led economy positioning it well to be an outsized beneficiary of the global cyclical rebound.

An Attractive Long-Term Opportunity

In addition to the short-term tailwinds discussed above, the long-term outlook for Vietnam remains bright. We see the current pro-business government continuing to execute on its reform agenda, improving the ease of doing business in the country and in turn further attracting FDI. We see room for Vietnam to not only grow its export sector but move up the value chain, evidenced by the recent deal between FPT and Nvidia to build a $200mn AI factory in the country.8 All this investment and export-led growth will likely result in rising disposable income and drive domestic consumption. Vietnam stands out from other emerging markets due to its young population, ample availability of increasingly skilled labor, cost competitiveness, and the current pro-business government. We see the above factors continuing to drive outsized economic growth in the country and paving the way for Vietnam’s eventual reclassification from Frontier to Emerging Market status.