Artificial intelligence (AI) is beginning to drive substantial top-line growth for technology companies beyond the semiconductor sector, creating potential investment opportunities across an expanding AI ecosystem. So far, key beneficiaries have included cloud computing, digital advertising, technology consulting, and data center infrastructure providers.

The scale of this expansion is evident in recent market developments: For example, in less than two years since launch, Microsoft expects its AI business to scale to $10 billion in annual revenues.1 Google’s Cloud unit witnessed growth acceleration due to AI adoption.2 In ads, Meta credits recent AI investments for enhanced targeting.3

This momentum suggests that the secondary effects of the AI revolution are already materializing and are poised to benefit a broad range of industry participants. As evidence of monetization mounts, we anticipate more enterprises to ramp up capital expenditures and commitments towards AI infrastructure, adding fuel to the ongoing AI arms race. As the monetization and investment flywheel strengthens, the theme could continue to be viewed favorably by investors in 2025.

The growing commercialization of enterprise AI creates opportunities across the tech ecosystem, from data centers and consultants to cloud providers and cybersecurity firms.

Pure-play AI firms have been sprinting out of the gate. OpenAI, backed by Microsoft, launched Chat GPT in November 2022 and reached $3.6 billion in annualized revenue in August 2024—a 125% increase from the previous year.4 If this growth trend holds, OpenAI is projected to finish 2024 with $5 billion in net revenues—a staggering 225% increase year-over-year (YoY).5 Anthropic, another key player in the AI services space, is also seeing significant growth following the release of its AI chatbot, Claude, in March 2023. It is on track to generate $1 billion in revenue by the end of 2024, up from just $100 million last year, highlighting the rapid commercialization of foundational generative AI models.6

The AI theme extends well beyond developers of LLMs. The rapid adoption of AI has had a ripple effect, benefitting a variety of players in the broader AI ecosystem. Consulting firms like Accenture and IBM are seeing substantial growth, with AI-related services contributing significantly to their top-line growth. Accenture, for instance, disclosed nearly $3 billion in generative AI consulting bookings in pipeline as of September 2024, reflecting strong client demand to gain competitive advantages through AI implementation.7

Cloud computing and software companies are also capitalizing on the AI wave. ServiceNow reported strong generative AI bookings since launching "Now Assist," with its Chief Financial Officer attributing the largest net-new annual contract value contribution for any new product family to AI adoption.8 Oracle is seeing robust growth in its Infrastructure-as-a-Service (IaaS) division, largely attributed to increased AI workloads.9 Data center leader Equinix secured significant new contracts driven by AI infrastructure demand. The company’s xScale portfolio of hyperscale data center facilities leased 20MW of new capacity in Q3 and nearly 90% of its operational and under-construction xScale capacity has already leased.10

The advertising sector is reaping rewards from AI adoption as well. Meta Platforms recently reported 19% year-over-year (YoY) quarterly revenue growth, driven by a 7% rise in ad impressions and 11% growth in average price per ad, boosted by AI integration.11 Amazon integrated generative AI based product image generation tools, leading to noticeable increase in ad impressions for certain campaigns.12 We anticipate cloud computing, software applications, and infrastructure companies that have unique market positioning, robust distribution, and access to privileged data to be the primary beneficiaries as AI services demand expands. These leaders will likely experience accelerated growth in 2025 as the AI market matures.

The rapid evolution of AI infrastructure is underscored by growing investments in data centers, with GPU clusters—networks of servers optimized specifically for AI workloads—scaling at an unprecedented pace. This growth is fueled by two key factors: the increasing efficiency and scalability of GPU clusters, and the emergence of cutting-edge hardware like Nvidia's Blackwell GPU, which continues to push the boundaries of performance.

XAI’s “Colossus,” part of Elon Musk’s X platform, is being hailed as the world’s most powerful AI training cluster.13 Built in just 122 days, Colossus represents a major milestone in AI infrastructure with a budget of $3-4 billion, and is expected to eventually double in capacity.14 Plans are underway to add 100,000 GPUs — split evenly between Nvidia H100 units and next-generation H200 chips—to further boost its processing power.

Meta Platforms is also investing in hardware at an unprecedented scale. The firm recently revealed two versions of its 24,000 GPU data center-scale cluster, which will support its next-generation AI models.15 While GPU clusters are smaller than traditional data centers today, the growing demand for AI computing will require massive infrastructure expansion.

Major technology companies - including Meta, Amazon, Alphabet, and Microsoft - are driving unprecedented investment in AI infrastructure. Hyperscalers are projected to invest over $200 billion in capital expenditures (CapEx) in 2024, with this figure anticipated to approach $250 billion by 2025. Although not all this spending is directly tied to AI, a significant and increasing portion is being allocated to AI infrastructure, reflecting its growing strategic importance.16 Microsoft and OpenAI have discussed launching a single 5 GW data center dedicated to AI workloads, potentially costing over $100 billion.17

Colocation providers, defined as companies providing data-center rental capacity to large companies, form a critical part of the broader data center market and are also expanding their AI-focused infrastructure offerings. Equinix, a leader in hyperscale co-location, has secured nearly $15 billion to fund the buildout of AI data centers in the US.18 This expansion supports the delivery of infrastructure to train and deploy large-scale private AI models to Equinix’s clients, which tend to be Fortune 500 companies across sectors beyond technology.

The growth of AI data centers in 2025 is expected to drive demand for ancillary products, including low-power CPUs, memory, storage systems, networking components, and cooling and power management equipment. For example, cooling products supplier Vertiv witnessed revenue growth of 19% YoY in the three months of July to September 2024, raising guidance for the next 12 months. Additionally, GPU clusters are increasingly energy intensive. Currently, data centers consume nearly 1-1.5% of global electricity and are projected to account for over 5% by 2030.19 This trend is prompting investments in technologies such as nuclear power and energy production located near data center facilities, along with thermal and power management solutions.

As AI adoption advances, enterprises are shifting from relying solely on general-purpose AI models to developing proprietary LLMs. By leveraging unique, proprietary datasets, organizations are creating highly customized AI solutions tailored to their specific business needs. These solutions aim to automate workflows more effectively by fine-tuning models on domain-specific data, resulting in tools that are significantly more actionable and task-oriented.

This trend is gaining momentum, with recent examples illustrating its broad applicability:

This trend is likely to accelerate as the cost of AI infrastructure is expected to continue to decline. While today’s systems are optimized for training workloads, the next generation is expected to focus on inferencing, offering greater efficiency at a fraction of the current cost.25

For enterprises, this evolution unlocks significant opportunities, including potential for streamlined operations, lower expenses, and new revenue streams. As organizations invest in AI in an effort to maintain their competitive edge, we expect robust demand for supporting technologies like data warehousing, management systems, pipelines, and advanced analytics platforms.

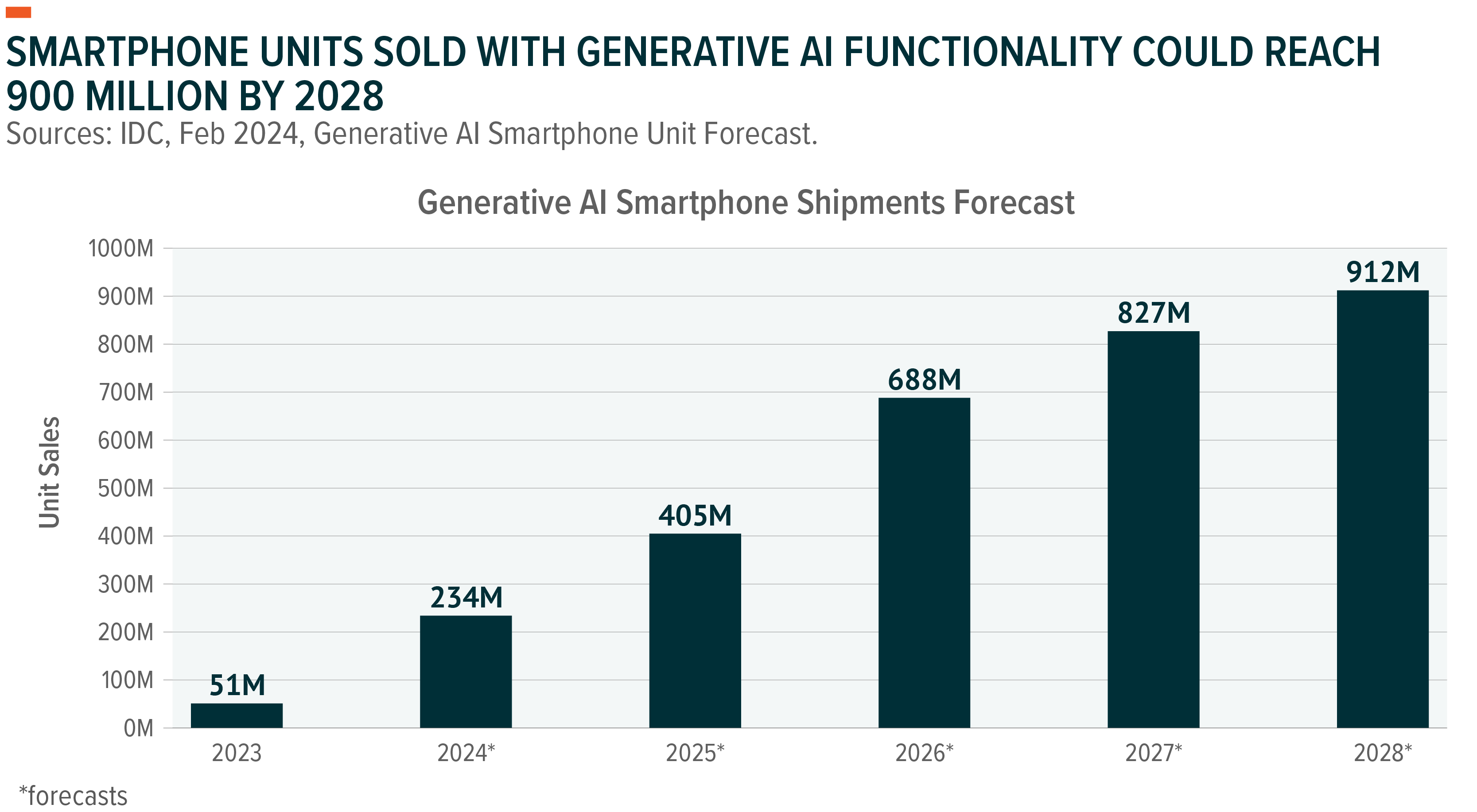

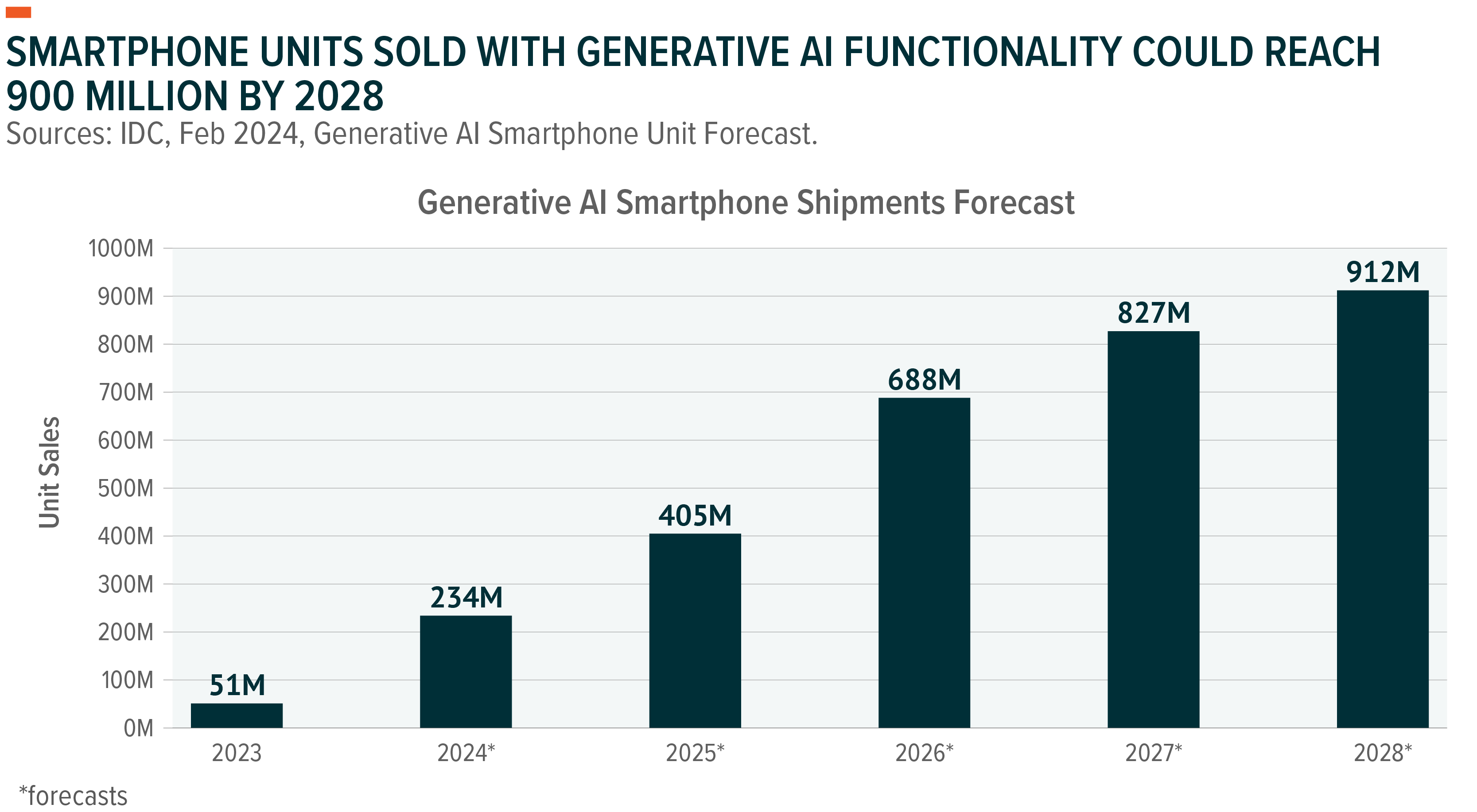

Smartphones are at the forefront of the AI device revolution, with major manufacturers like Apple and Samsung integrating advanced AI features into their latest products. Apple's introduction of Apple Intelligence enhances the user experience through personalized tools such as an upgraded Siri, which now leverages both proprietary large language models and OpenAI's GPT-4. Samsung's Galaxy AI focuses on practical applications like real-time language translation and advanced photo editing capabilities.

With the global smartphone market valued at roughly $500 billion annually, these innovations are expected to spark a significant upgrade cycle as users replace older devices to access these new AI-driven features.26 This is likely to benefit a wide range of component suppliers and vendors in 2025 as well. The momentum also extends to personal computers. By the end of 2025, AI-enabled PCs are projected to sell over 114 million units, up more than 165% YoY.27

The impact of integrating AI on devices extends far beyond smartphones, impacting industries from wearables and medical devices to industrial equipment and home automation. The industrial Internet of Things (IoT) market, for example, is forecast to grow at a compound annual growth rate (CAGR) of 23%, reaching $1.7 trillion by 2030.28 Incorporating AI chipsets directly into industrial equipment offers substantial benefits, such as local processing and data capture, and enhanced security by minimizing the need to send data to the cloud for processing. Companies like Qualcomm are already experiencing significant revenue growth in their Industrial & IoT segments, highlighting the increasing demand for AI across diverse applications.29

We believe these upgrades are critical for further optimizing manufacturing processes, improving automation, and reducing inefficiencies. As AI capabilities expand across devices, they can fundamentally transform how connected systems operate, making them more efficient, responsive, and secure.

AI is driving significant mergers and acquisitions (M&A) activity across the U.S. tech sector. Recent notable M&A, announced and completed, include:

Major cloud providers are also making strategic AI investments. Amazon committed up to $4 billion to Anthropic to enhance AWS's AI capabilities, while Microsoft's $14 billion investment in OpenAI continues to shape its cloud infrastructure strategy.31

This momentum is expected to continue into 2025, as companies across the tech landscape, from hardware to software, look to capitalize on the rapidly evolving AI space. The new U.S. administration is also expected to remain friendly to M&A.32

As AI use cases expand across industries, companies that own critical distribution channels, data, and proprietary relationships in niche markets are becoming increasingly attractive acquisition targets. With tech valuations leveling off and the need for AI solutions intensifying, cloud computing, in particular, could see a surge in deal-making activity in the year ahead.

The AI deal momentum is extending to public markets. Cerebras Systems, known for its AI inferencing chips, has filed for what could be a $20 billion IPO.33 CoreWeave, a GPU-as-a-service provider, is similarly targeting 2025 for a potential public offering.34 These moves signal strong investor appetite for AI infrastructure plays.

Significant changes are underway in the technology industry due to AI. The rapid growth of companies like OpenAI and Anthropic highlights how quickly AI solutions are gaining traction, with notable revenue increases reflecting strong market demand. More enterprises are expected to invest in AI infrastructure to meet their specific needs, particularly as custom model development picks up pace and new revenue opportunities materialize. Monetization is now evident across the ecosystem - from cloud computing and data centers to AI-enhanced applications - driving a surge in strategic acquisitions as companies seek to strengthen their competitive positions. With clear revenue momentum and expanding use cases, we believe AI remains a compelling investment theme for 2025.

Related ETFs

AIQ – Global X Artificial Intelligence and Technology ETF

SNSR – Global X Internet of Things ETF

DTCR – Global X Data Center & Digital Infrastructure ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.

The scale of this expansion is evident in recent market developments: For example, in less than two years since launch, Microsoft expects its AI business to scale to $10 billion in annual revenues.1 Google’s Cloud unit witnessed growth acceleration due to AI adoption.2 In ads, Meta credits recent AI investments for enhanced targeting.3

This momentum suggests that the secondary effects of the AI revolution are already materializing and are poised to benefit a broad range of industry participants. As evidence of monetization mounts, we anticipate more enterprises to ramp up capital expenditures and commitments towards AI infrastructure, adding fuel to the ongoing AI arms race. As the monetization and investment flywheel strengthens, the theme could continue to be viewed favorably by investors in 2025.

Key Takeaways

- Increased monetization of enterprises’ AI investments, including the development of proprietary large language models (LLMs), is creating opportunities for a wide array of companies in the AI ecosystem, such as data centers, consultants, ad platforms, cloud computing companies, and cybersecurity firms.

- As AI moves to the edge, smartphones and other connected devices could be positioned for a strong upgrade cycle, potentially benefitting a wide range of component suppliers and vendors.

- Deal activity and mergers and acquisitions M&A are likely to pick up in 2025, as companies across the tech sector look to capitalize on the rapidly evolving AI landscape.

Trend 1: Monetization Paves Way for Industry Expansion

The growing commercialization of enterprise AI creates opportunities across the tech ecosystem, from data centers and consultants to cloud providers and cybersecurity firms.

Pure-play AI firms have been sprinting out of the gate. OpenAI, backed by Microsoft, launched Chat GPT in November 2022 and reached $3.6 billion in annualized revenue in August 2024—a 125% increase from the previous year.4 If this growth trend holds, OpenAI is projected to finish 2024 with $5 billion in net revenues—a staggering 225% increase year-over-year (YoY).5 Anthropic, another key player in the AI services space, is also seeing significant growth following the release of its AI chatbot, Claude, in March 2023. It is on track to generate $1 billion in revenue by the end of 2024, up from just $100 million last year, highlighting the rapid commercialization of foundational generative AI models.6

The AI theme extends well beyond developers of LLMs. The rapid adoption of AI has had a ripple effect, benefitting a variety of players in the broader AI ecosystem. Consulting firms like Accenture and IBM are seeing substantial growth, with AI-related services contributing significantly to their top-line growth. Accenture, for instance, disclosed nearly $3 billion in generative AI consulting bookings in pipeline as of September 2024, reflecting strong client demand to gain competitive advantages through AI implementation.7

Cloud computing and software companies are also capitalizing on the AI wave. ServiceNow reported strong generative AI bookings since launching "Now Assist," with its Chief Financial Officer attributing the largest net-new annual contract value contribution for any new product family to AI adoption.8 Oracle is seeing robust growth in its Infrastructure-as-a-Service (IaaS) division, largely attributed to increased AI workloads.9 Data center leader Equinix secured significant new contracts driven by AI infrastructure demand. The company’s xScale portfolio of hyperscale data center facilities leased 20MW of new capacity in Q3 and nearly 90% of its operational and under-construction xScale capacity has already leased.10

The advertising sector is reaping rewards from AI adoption as well. Meta Platforms recently reported 19% year-over-year (YoY) quarterly revenue growth, driven by a 7% rise in ad impressions and 11% growth in average price per ad, boosted by AI integration.11 Amazon integrated generative AI based product image generation tools, leading to noticeable increase in ad impressions for certain campaigns.12 We anticipate cloud computing, software applications, and infrastructure companies that have unique market positioning, robust distribution, and access to privileged data to be the primary beneficiaries as AI services demand expands. These leaders will likely experience accelerated growth in 2025 as the AI market matures.

Trend 2: Infrastructure Development Will Be Essential to Meet Demand

The rapid evolution of AI infrastructure is underscored by growing investments in data centers, with GPU clusters—networks of servers optimized specifically for AI workloads—scaling at an unprecedented pace. This growth is fueled by two key factors: the increasing efficiency and scalability of GPU clusters, and the emergence of cutting-edge hardware like Nvidia's Blackwell GPU, which continues to push the boundaries of performance.

XAI’s “Colossus,” part of Elon Musk’s X platform, is being hailed as the world’s most powerful AI training cluster.13 Built in just 122 days, Colossus represents a major milestone in AI infrastructure with a budget of $3-4 billion, and is expected to eventually double in capacity.14 Plans are underway to add 100,000 GPUs — split evenly between Nvidia H100 units and next-generation H200 chips—to further boost its processing power.

Meta Platforms is also investing in hardware at an unprecedented scale. The firm recently revealed two versions of its 24,000 GPU data center-scale cluster, which will support its next-generation AI models.15 While GPU clusters are smaller than traditional data centers today, the growing demand for AI computing will require massive infrastructure expansion.

Major technology companies - including Meta, Amazon, Alphabet, and Microsoft - are driving unprecedented investment in AI infrastructure. Hyperscalers are projected to invest over $200 billion in capital expenditures (CapEx) in 2024, with this figure anticipated to approach $250 billion by 2025. Although not all this spending is directly tied to AI, a significant and increasing portion is being allocated to AI infrastructure, reflecting its growing strategic importance.16 Microsoft and OpenAI have discussed launching a single 5 GW data center dedicated to AI workloads, potentially costing over $100 billion.17

Colocation providers, defined as companies providing data-center rental capacity to large companies, form a critical part of the broader data center market and are also expanding their AI-focused infrastructure offerings. Equinix, a leader in hyperscale co-location, has secured nearly $15 billion to fund the buildout of AI data centers in the US.18 This expansion supports the delivery of infrastructure to train and deploy large-scale private AI models to Equinix’s clients, which tend to be Fortune 500 companies across sectors beyond technology.

The growth of AI data centers in 2025 is expected to drive demand for ancillary products, including low-power CPUs, memory, storage systems, networking components, and cooling and power management equipment. For example, cooling products supplier Vertiv witnessed revenue growth of 19% YoY in the three months of July to September 2024, raising guidance for the next 12 months. Additionally, GPU clusters are increasingly energy intensive. Currently, data centers consume nearly 1-1.5% of global electricity and are projected to account for over 5% by 2030.19 This trend is prompting investments in technologies such as nuclear power and energy production located near data center facilities, along with thermal and power management solutions.

Trend 3: Proprietary Models Are Expected to Unlock AI Applications

As AI adoption advances, enterprises are shifting from relying solely on general-purpose AI models to developing proprietary LLMs. By leveraging unique, proprietary datasets, organizations are creating highly customized AI solutions tailored to their specific business needs. These solutions aim to automate workflows more effectively by fine-tuning models on domain-specific data, resulting in tools that are significantly more actionable and task-oriented.

This trend is gaining momentum, with recent examples illustrating its broad applicability:

- In financial services JPMorgan Chase and Bloomberg are both developing LLMs trained on their own vast internal datasets to improve operational efficiency and decision-making, and deliver unique insights, analysis, and reporting.20,21

- In cybersecurity, companies like Palo Alo Networks are training their own LLMs that can assist security professionals better detect and respond to threats.22 For fiscal Q4 2024, Palo Alto disclosed AI related recurring revenues of over $200 million, up nearly four times on a YoY basis, underscoring the demand for AI-embedded solutions.23

- In defense, Palantir recently secured a wide range of contracts for its AI-enabled services, including accelerating deployment on defense and military-specific AI models across defense applications.24

This trend is likely to accelerate as the cost of AI infrastructure is expected to continue to decline. While today’s systems are optimized for training workloads, the next generation is expected to focus on inferencing, offering greater efficiency at a fraction of the current cost.25

For enterprises, this evolution unlocks significant opportunities, including potential for streamlined operations, lower expenses, and new revenue streams. As organizations invest in AI in an effort to maintain their competitive edge, we expect robust demand for supporting technologies like data warehousing, management systems, pipelines, and advanced analytics platforms.

Trend 4: AI Is Expected to Make its Way to Most Everyday Devices

Smartphones are at the forefront of the AI device revolution, with major manufacturers like Apple and Samsung integrating advanced AI features into their latest products. Apple's introduction of Apple Intelligence enhances the user experience through personalized tools such as an upgraded Siri, which now leverages both proprietary large language models and OpenAI's GPT-4. Samsung's Galaxy AI focuses on practical applications like real-time language translation and advanced photo editing capabilities.

With the global smartphone market valued at roughly $500 billion annually, these innovations are expected to spark a significant upgrade cycle as users replace older devices to access these new AI-driven features.26 This is likely to benefit a wide range of component suppliers and vendors in 2025 as well. The momentum also extends to personal computers. By the end of 2025, AI-enabled PCs are projected to sell over 114 million units, up more than 165% YoY.27

The impact of integrating AI on devices extends far beyond smartphones, impacting industries from wearables and medical devices to industrial equipment and home automation. The industrial Internet of Things (IoT) market, for example, is forecast to grow at a compound annual growth rate (CAGR) of 23%, reaching $1.7 trillion by 2030.28 Incorporating AI chipsets directly into industrial equipment offers substantial benefits, such as local processing and data capture, and enhanced security by minimizing the need to send data to the cloud for processing. Companies like Qualcomm are already experiencing significant revenue growth in their Industrial & IoT segments, highlighting the increasing demand for AI across diverse applications.29

We believe these upgrades are critical for further optimizing manufacturing processes, improving automation, and reducing inefficiencies. As AI capabilities expand across devices, they can fundamentally transform how connected systems operate, making them more efficient, responsive, and secure.

Trend 5: Deal Activity and M&A Likely to Pick Up

AI is driving significant mergers and acquisitions (M&A) activity across the U.S. tech sector. Recent notable M&A, announced and completed, include:

- Hewlett Packard Enterprise’s (HPE) $14.3 billion acquisition of Juniper Networks aimed at expanding its AI infrastructure capabilities, particularly in data center networking solutions.30 The deal underscores hardware’s increasingly foundational role for AI's future growth.

- Nvidia has accelerated its acquisition strategy, completing five deals in 2024 – its most active year in five years. Key purchases include Run, a GPU orchestration software provider, for $700 million, and Octo AI, an enterprise-AI inferencing platform, for $250 million. These acquisitions reflect Nvidia's push into enterprise-grade AI solutions.

Major cloud providers are also making strategic AI investments. Amazon committed up to $4 billion to Anthropic to enhance AWS's AI capabilities, while Microsoft's $14 billion investment in OpenAI continues to shape its cloud infrastructure strategy.31

This momentum is expected to continue into 2025, as companies across the tech landscape, from hardware to software, look to capitalize on the rapidly evolving AI space. The new U.S. administration is also expected to remain friendly to M&A.32

As AI use cases expand across industries, companies that own critical distribution channels, data, and proprietary relationships in niche markets are becoming increasingly attractive acquisition targets. With tech valuations leveling off and the need for AI solutions intensifying, cloud computing, in particular, could see a surge in deal-making activity in the year ahead.

The AI deal momentum is extending to public markets. Cerebras Systems, known for its AI inferencing chips, has filed for what could be a $20 billion IPO.33 CoreWeave, a GPU-as-a-service provider, is similarly targeting 2025 for a potential public offering.34 These moves signal strong investor appetite for AI infrastructure plays.

Conclusion: Transformative and Ready for Use

Significant changes are underway in the technology industry due to AI. The rapid growth of companies like OpenAI and Anthropic highlights how quickly AI solutions are gaining traction, with notable revenue increases reflecting strong market demand. More enterprises are expected to invest in AI infrastructure to meet their specific needs, particularly as custom model development picks up pace and new revenue opportunities materialize. Monetization is now evident across the ecosystem - from cloud computing and data centers to AI-enhanced applications - driving a surge in strategic acquisitions as companies seek to strengthen their competitive positions. With clear revenue momentum and expanding use cases, we believe AI remains a compelling investment theme for 2025.

Related ETFs

AIQ – Global X Artificial Intelligence and Technology ETF

SNSR – Global X Internet of Things ETF

DTCR – Global X Data Center & Digital Infrastructure ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Category:Thematic Growth

Topics: