Investors have more access to China A shares than ever. As part of its November 26 rebalance, MSCI increased its A shares’ index inclusion factor (IIF) from 15% to a 20%. The move is the last of a three-phase process that widens the scope of investment opportunities in China, and may require investors to review their existing China exposure. For Global X, the development carries import because it substantially increases the pool of eligible fund constituents. Now eligible are certain stocks listed on the ChiNext exchange (China’s version of Nasdaq) and, for the first time ever, mid-cap A shares.

China A shares increase their MSCI footprint

MSCI began including A shares in its global investable market indexes (GIMI) in 2018. MSCI opted for a phased approach, rather than fully including A shares at their float-adjustment market capitalization in the MSCI China, Emerging Markets, and All Country World Indexes. The approach limited eligible companies and kept their initial IIF to just 5% of their full weight.

In February, MSCI announced that it would accelerate the process in 2019 over the course of three phases. The increase to 20% in November follows incremental increases to 10% in May and 15% in August.

The completion of Phase 3 means the MSCI China Index now includes an additional 204 China A-shares, 189 of which are mid-caps. As a result, A shares have a 12.1% weighting in the MSCI China Index and a 4.1% weighting in the MSCI Emerging Markets Indexes.

China A shares represent a compelling opportunity set

The A share market features more than 3,500 companies with a combined market capitalization of over $6 trillion, making it one of the largest equity markets in the world. Historically, government restrictions limited foreign access to the A share market, leading China-focused indexes and funds to seek investment exposure to China via Hong Kong’s much smaller H share market. For comparison, the H share market numbers less than 250 companies and has a market cap of approximately $750 billion.

Importantly, local dynamics drive A share market growth more than global factors, suggesting that these names are less vulnerable to external risks or geopolitics. By sector, investors can now expect greater access to themes emerging in China’s Consumer Staples, Tech, Industrials and Health Care sectors.

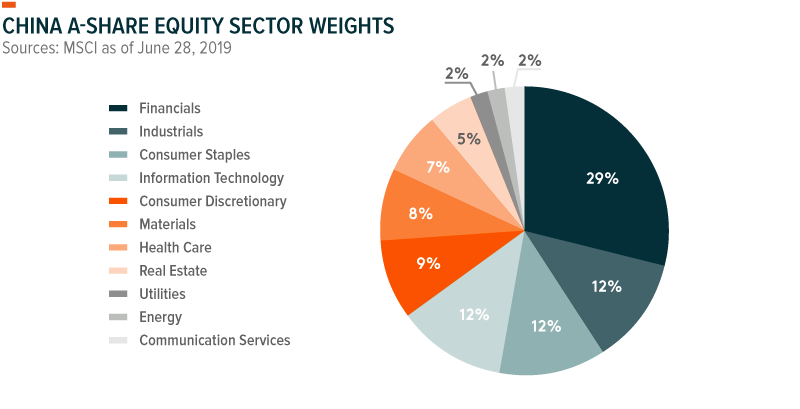

In terms of sector weight, Financials (30%), Industrials (12%), Consumer Staples (12%) and Information Technology (12%) comprise the bulk of the A share market.

Important investment risks associated with the A share market could include the prevalence of state-owned enterprises (SOEs) or the scope of government influence over those SOEs, potential limits on foreign shareholder rights and privileges, and administrative challenges or trading issues.

Conclusion

An increasingly investable China is a significant opportunity for investors. And that includes A shares as they become more influential in global equity markets. In our view, A shares are necessary for comprehensive, well-rounded exposure to China, whether through a broad country fund or a more sector-specific fund. For investors with existing exposure to China, MSCI finalizing the implementation of A shares on its indexes is a key development. A shares’ larger footprint in MSCI’s benchmark indices may warrant adjustments to sector exposures to control for thematic opportunities, as well as risks and valuations.

Related ETFs

- The Global X MSCI China Communication Services ETF (CHIC)

- The Global X MSCI China Consumer Discretionary ETF (CHIQ)

- The Global X MSCI China Consumer Staples ETF (CHIS)

- The Global X MSCI China Health Care ETF (CHIH)

- The Global X MSCI China Energy ETF (CHIE)

- The Global X MSCI China Financials ETF (CHIX)

- The Global X MSCI China Industrials ETF (CHII)

- The Global X MSCI China Information Technology ETF (CHIK)

- The Global X MSCI China Materials ETF (CHIM)

- The Global X MSCI China Real Estate ETF (CHIR)

- The Global X MSCI China Utilities ETF (CHIU)

Global X Research Team

Global X Research Team