Editor’s Note: Conversational Alpha® (CA) is a vehicle we use for deeper and more relatable discussions about portfolio construction. In that sense, it represents both a journey and a destination. This report is a periodic look at journeys and destinations that investors may want to consider.

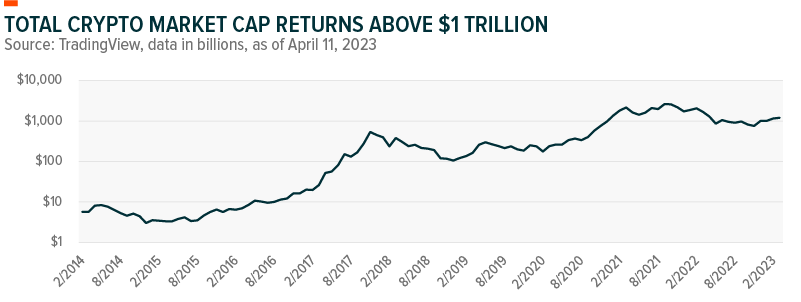

I’ll be honest, sometimes when I hear explanations about the minutiae of digital assets and the various technologies behind them, the complexity makes my head spin and I tune out. What does get and keep my attention is how and why assets behave the way that they do. And so far this year, Bitcoin (BTC) has my attention. After falling nearly 70% from its all-time high in November 2022, Bitcoin, the largest cryptocurrency by market cap, rallied about 70% year-to-date. That’s well ahead of the Nasdaq 100 Index’s 16.7% return and gold’s 8.8% return over the same period. Total crypto market capitalization briefly surpassed $1 trillion during the recent rally, still well below its all-time high of $2.6 trillion in September 2021.1

Aside from the potential for stellar returns, especially during risk-on periods, cryptocurrencies remain the subject of much debate and, in many ways, mystery. Whether just another risky investment or a revolutionary financial instrument, crypto’s story will continue to unfold.

Conversation Starters

- Blockchain technology is the real influencer in the digital assets space.

- Bitcoin’s correlation with traditional assets offers insight about crypto’s appeal.

- Expect governments to retain a healthy skepticism about cryptocurrencies.

- To Wrap It Up: Portfolio considerations.

- Moving On… Let’s Chart: Sovereign CDS spread flashes debt ceiling warning.

Crypto Job Numbers Offer a Glimpse into Its Rapid Rise

Ten years ago, even five years ago, if you told someone that you wanted to pursue a career in cryptocurrencies, you’d likely raise their eyebrows. They’d either have no idea what you were talking about, or they’d think you were taking a leap. I imagine some rather interesting conversations between parents and their kids about the prospect of jumping into this Wild West. Today, it’s a much different conversation, given the demandable nature of this field and its inertia. The sheer number of professionals working in this industry today is staggering. In 2022, roughly 82,000 professionals worked in cryptocurrencies, blockchain, and related technologies. That’s a nearly three-fold increase from 2019.2

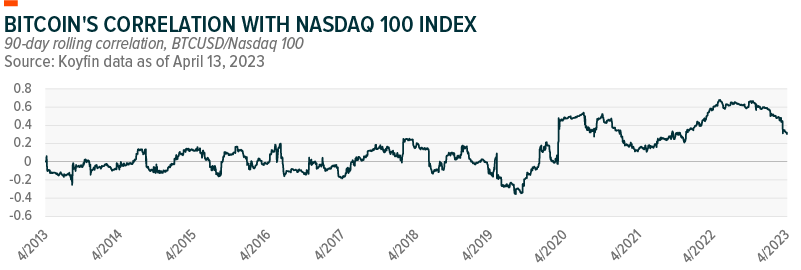

Most of these jobs are in Web3, the open-source virtual environment that could materialize into the next generation of the consumer internet. As powerful as Web3 may be, its architecture is what I think is notable at this stage. I think the same about Bitcoin. Gold is often bitcoin’s comp of choice, and their correlation tightening to 50% in March 2023 suggests that bitcoin may be the yellow metal’s digital cousin.3 But I believe the blockchain technology underlying bitcoin and cryptocurrencies and Web3 is likely to prove more influential.

Blockchain’s distributed ledger, which allows for secure, transparent, and tamper-proof transactions, has the potential to transform everyday life, including the way we shop, transact goods and services, even vote. Our relationship with the internet could change dramatically, given the potential to own our own digital content, which could be category killers for big data collectors. Blockchain technology already has business operations shifting. Amazon, for example, has a managed blockchain solution called Track and Trace for supply chain management. With it, clients can monitor their production processes end-to-end and verify authenticity.4

The Financial System’s Relationship with Crypto Will Continue to Evolve

Cryptocurrencies’ decentralization makes them a potential alternative to traditional currencies, which are often subject to inflation and manipulation. A more secure, democratic, and equitable way to send, track, and manage money has broad appeal, especially for participants in emerging and developing countries, where trust in the banking system can be in short supply. Of course, mistrust in banking systems is prevalent in the world’s biggest economies as well. The regional bank liquidity crisis is just the latest example amplifying the conversation about decentralized finance in certain circles.

To get a sense of shifting investor sentiment about cryptocurrencies, correlations offer interesting insight. For the most part, their correlation to risk assets has been high, but recently there was divergence, likely attributable to the regional bank woes and certain geopolitical events. At the onset of the war in Ukraine in February 2022, bitcoin’s correlation with the S&P 500 and Nasdaq 100 ticked lower, possibly fueled by the belief that bitcoin can offer relative safety. Correlations later increased as risk assets sold off in 2022, but bitcoin’s correlation with the Nasdaq 100 normalized recently.5

Cryptocurrencies exhibit features that could one day provide a more stable and secure form of currency than traditional fiat currencies, making them something of a government target. Do you think the U.S. government really wants competition for its fiat currency? I don’t. But that is not to say that governments and central banks around the world dismiss digital assets and blockchain technology. Quite the contrary, they recognize that the digitalization of money has the potential to shift the global financial system. They also recognize that it introduces new risks into the system that must be dealt with, as the Biden Administration’s Executive Order on Ensuring Responsible Development of Digital Assets from March 2022 illustrates.6

The collapse of crypto exchange FTX in November 2022 and the resultant contagion is but one example of these risks. As a result, the regulatory environment for cryptocurrencies is something to watch as it evolves, likely significantly from the current patchwork approach to something more defined. Notably, the risk reduction that comes with clearer regulatory regimes could benefit cryptocurrencies by encouraging greater participation.

To Wrap It Up: Portfolio Considerations

How cryptocurrencies fit in investment portfolios continues to develop. I discount cryptocurrencies’ parabolic growth in their earlier years and take the view that they may offer some diversification potential for certain investors during some periods. Thus far, evidence is limited that they can improve a portfolio’s risk-adjusted returns without regular rebalancing, which would create a meaningful amount of turnover.

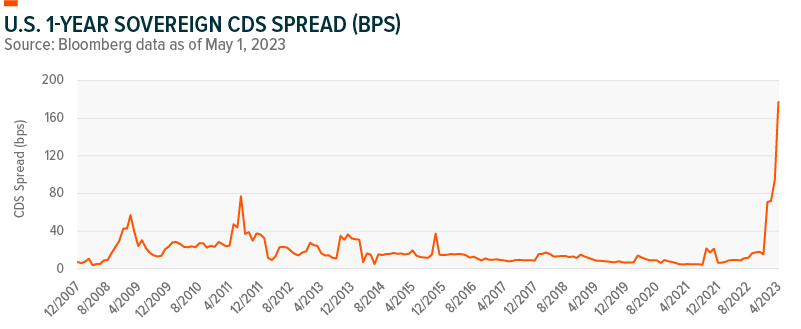

Let’s Chart: Sovereign CDS Spread Flashes Debt Ceiling Warning

We’re coming down the wire on the debt ceiling. The X-date, which is when the government is no longer able to pay its bills, could come as soon as June. In April, sovereign credit default swap (CDS) spread hit highs as demand for hedges against a U.S. default climbed. Currently, the spread is well above the July 2011 peak set during that debt ceiling crisis. As is now typical, I expect political rhetoric to ramp up ahead of an eventual deal, but the longer the uncertainty lingers, the more volatile markets are likely to get. Even the post-deal period sets out to be volatile, as I expect a huge amount of Treasury issuance to cause market dislocation.

Global X ETF Model Portfolio Team

Global X ETF Model Portfolio Team