Over the last four months, commodities have experienced their most significant rally since the end of 2011.

- Many major commodities are up this year, with silver leading the way

- The Gold – Silver ratio is shrinking given the outperformance of silver relative to gold

- The top performing emerging markets tend to have positive correlations to commodities and are net commodity exporters

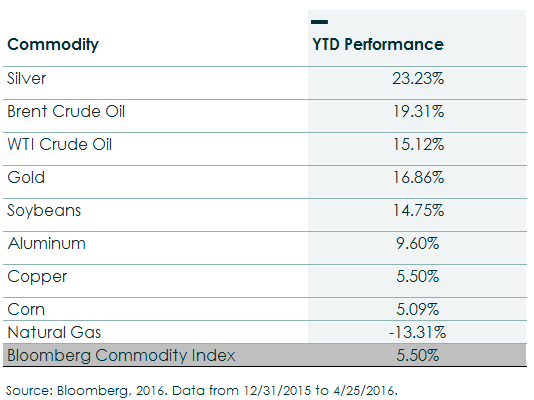

Commodity Performance:

Below is a snapshot of the year to date performance of the largest holdings in the Bloomberg Commodity Index. So far, precious metals and oil have been the year’s best performers.

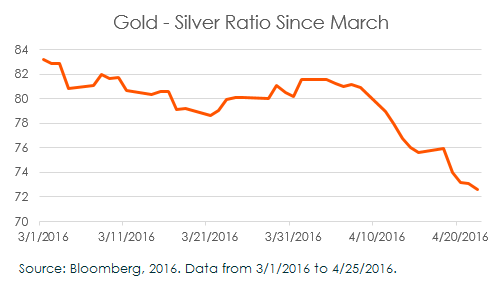

Silver’s Rise:

While gold has performed well in 2015, silver’s rise has been even more pronounced. This has resulted in a shrinking of the gold-silver ratio, which indicates how many ounces of silver it takes to purchase one ounce of gold. In March, the gold-silver ratio reached its highest level since 2008, but has since shrunk by -12%. Silver’s rally is either the result of normalization of its value compared to gold, or a signal of a strengthening global economy, given silver’s higher usage in industrial capacities than gold.

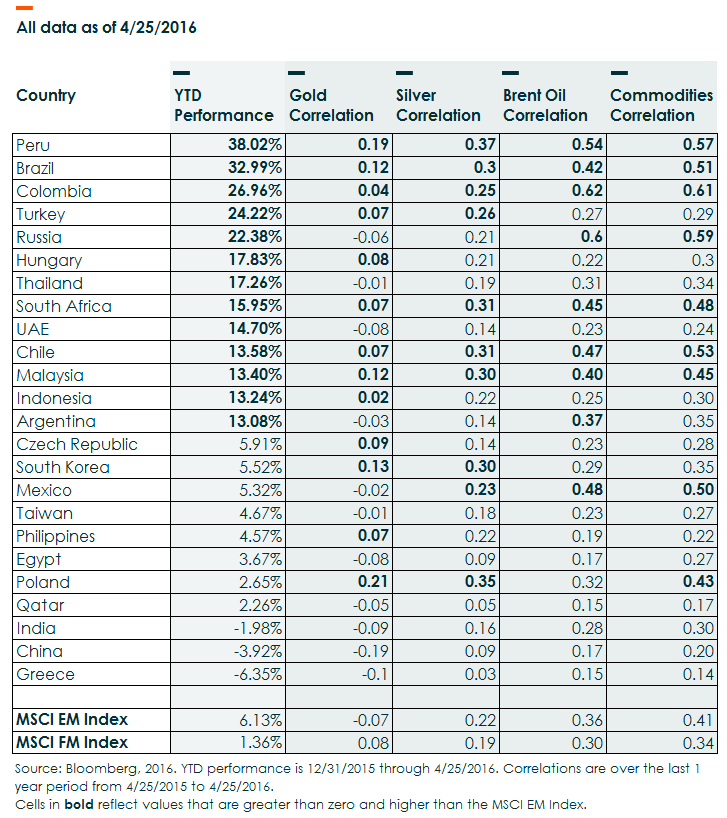

Emerging Markets and Commodities:

Many emerging markets derive significant revenues from exporting commodities. Below is a look into the performance of each emerging market in 2016 and their correlations to gold, silver, oil and the Bloomberg Commodity Index since the beginning of this year. It should come as little surprise that India and China have been among the worst performers as they are the largest net importers of commodities according to the International Monetary Fund and have below average correlations to commodity prices. Commodity-export heavy countries however, like Brazil, South Africa, and Russia, have above average correlations to commodities and have been among the best performers.

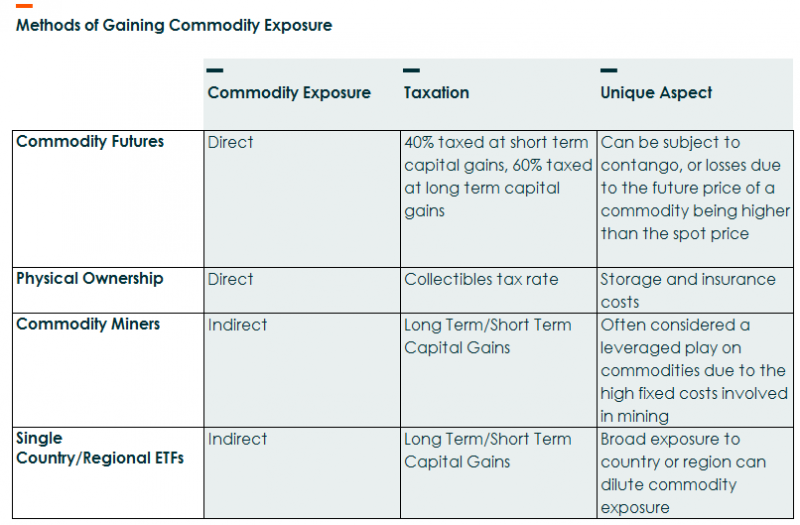

While many investors have reduced their exposure to commodities and emerging markets due to poor performance over the last few years, the recent bounce demonstrates the potential for a rapid rebound and long term returns for patient investors. It’s important for investors to remember that exposure to commodities can come in a variety of forms. Options include buying commodity futures, owning the physical commodity or an ETF that owns the physical commodity (if its relatively easy to store), investing in commodity miners such as companies engaged in silver mining, or gaining exposure to a single country or region with high dependence on a specific commodity. While all methods are viable strategies, the correlations to the price movements of the commodities and the taxation on gains can vary significantly. For long term investors, we believe gaining commodity exposure through targeted access to equities, either by owning commodity miners or single country ETFs, is among the more tax efficient methods for gaining commodity exposures and avoids the pitfalls of ‘contango’ – the losses one can experience if the future price of a commodity is higher than the spot price.

Global X Research Team

Global X Research Team