Low and likely falling interest rates coupled with tight credit spreads are limiting the bond market’s upside and leaving investors searching for alternative sources of yield. While investors often have specific allocations to corporate bonds and high yield debt, not all portfolios include dedicated allocations to preferred stock. In this piece, we shed light on key developments in the debt markets and discuss reasons why preferreds ought to be considered for income-focused portfolios. Discussion topics include:

- Corporate Debt Growth

- Tight Credit Spreads

- Preferreds as an Alternative

- The Health of the Banking Sector

Corporate Debt Growth

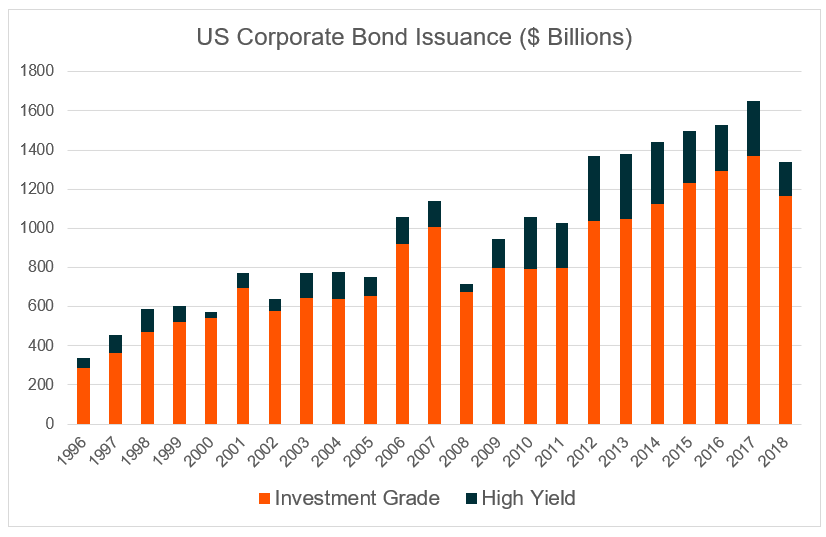

Investment grade and high yield debt issuance has grown tremendously as the economy has strengthened and the Fed has kept interest rates generally quite low compared to historical standards. At the same time, demographics trends like baby boomers reaching retirement age has kept demand for fixed income instruments high. Likewise, even more aggressively accommodative central bank policies abroad have made US Corporate Bonds relatively attractive for foreigners. As such, companies have aggressively taken advantage of these dynamics to issue low cost debt to investors.

Source: SIFMA. Data annually from 1996 through 2018.

As the corporate market has swelled, debt has become riskier. There has been significant growth in lower rated parts of the bond market, like the BBB rated segment which sits just above junk status and has tripled in growth since 2009 to now make up over half of investment grade debt. In the leveraged loan market, so called “covenant lite” loans account for 80% of the market today compared to just 6% in 2008, resulting in fewer protections for investors.1

Tight Credit Spreads

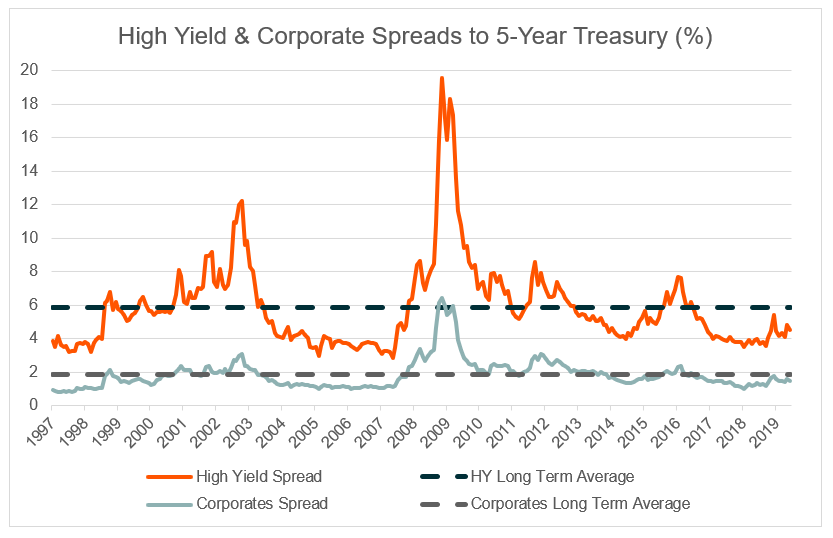

While typically increased risk is associated with higher expected returns, the bond market has demonstrated the opposite move. Investment grade and high yield bonds are showing lower spreads up US Treasuries than their historical average, indicting a smaller risk premium for taking on their credit risk.

Source: Bloomberg. Data monthly from January 1997 to June 2019. High Yield represented by the Bloomberg Barclays High Yield Index. Corporate Bonds represented by the ICE BofAML US Corporate Index. Measured using Yield to Maturity.

Preferreds As an Alternative

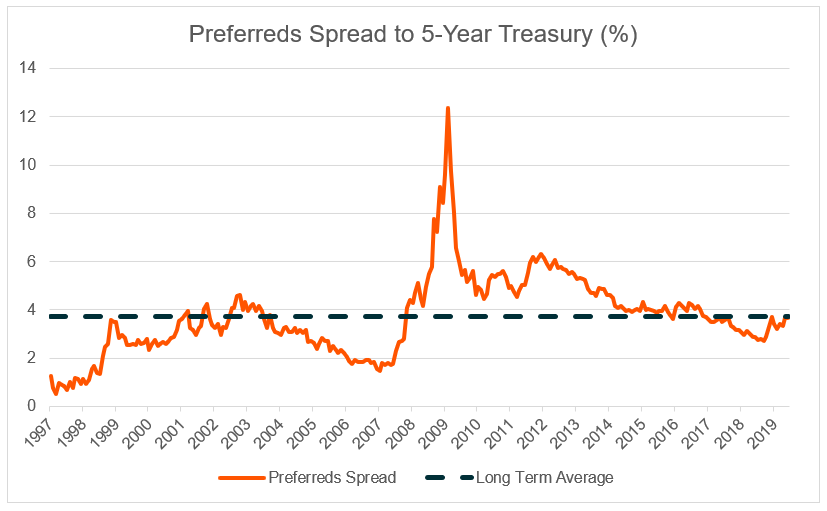

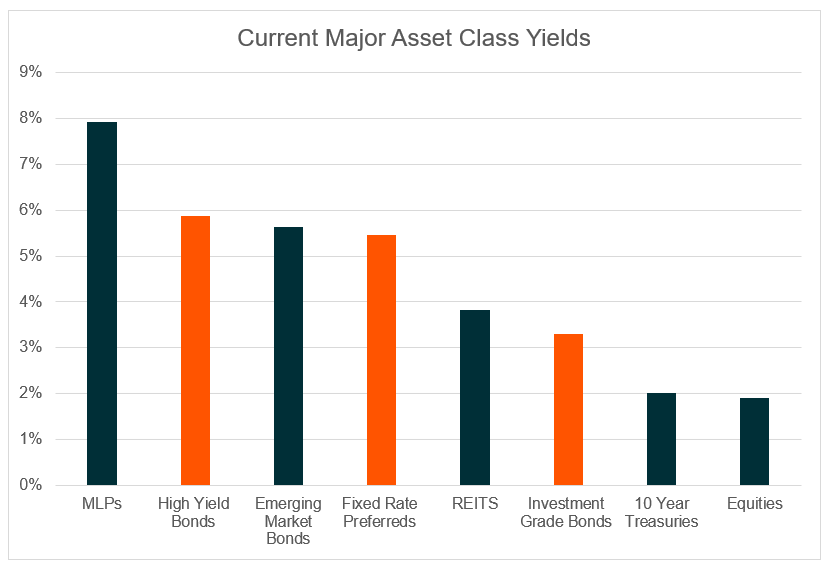

Preferreds, on the other hand, currently look more appealing as spreads are more in line with their historical averages. While high yield debt has spreads that are 133 basis points lower than their long term average, and investment grade debt is 36 basis points lower, preferreds are virtually in-line with historical figures. This shows that they are more fairly priced based on historical data than traditional corporate debt that looks expensive.

Preferred stock is often analyzed alongside corporate & high yield bonds because of its yield-focused characteristics and fixed income-like behavior. Preferreds sit junior on the capital structure to traditional bonds, and trade on an exchange offering additional liquidity. For portfolio construction purposes, we believe they should be considered alongside corporate debt, high yield, and other income-generating asset classes like emerging market bonds and senior loans as a source of potential income. Particularly when compared to corporate debt, we believe now may be the time to rotate money away from the more traditional portions of the fixed income market and into preferreds.

Source: Bloomberg. Data monthly from January 1997 to June 2019. Preferreds represented by the ICE BofAML Fixed Rate Preferred Securities Index.

The Health of the Banking Sector

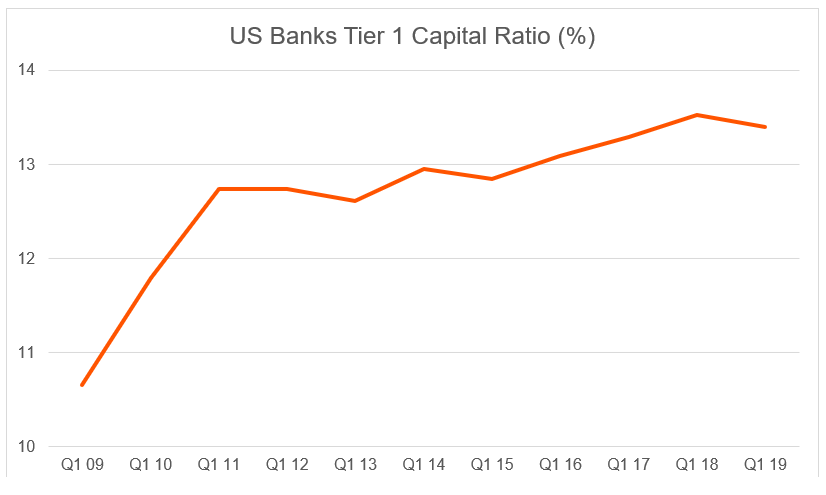

A defining characteristic of preferreds is the prevalence of issuance by banks, because of the incentives to reduce leverage post-financial crisis and for regulatory reasons that include preferred stock being part of certain Tier 1 capital ratios. Therefore, the health of the banking sector plays an important role in determining the riskiness of the preferred market.

While the 2008 financial crisis put great pressure on the preferred market, the banking sector has cleaned up significantly over the past decade. This has been driven by both operational and regulatory changes that have helped de-risk the profile of banks. For example, the Fed’s shift to paying interest on reserves has helped dramatically increase Tier 1 capital from 10.7% in Q1 2009 to 13.4% ten years later.

Source: International Monetary Fund, Bank Reg Data, Bloomberg. Data annually from Q1 2009 to Q1 2019.

As a result of these de-risking efforts, in late June of this year, the Fed announced that 18 of the largest banks passed their stress tests, and gave approval for all of them except one to raise dividends and increase share buybacks.2 It does raise the question of growth potential of the banking sector going forward in the eyes of a common equity holder, with such a focus being placed on risk management, but from a creditor or preferred equity holder’s standpoint, these are viewed as positive developments.

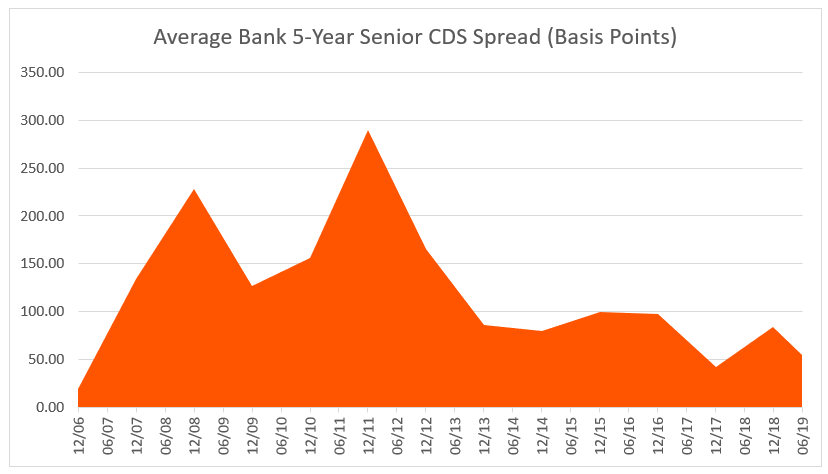

Source: Bloomberg. Data from 12/31/2006 to 6/30/2019, and uses end of year data from 2006 to 2018, and 6/30/2019 data. Numbers are an average of 5-year CDS spreads from banks tested on Federal Reserve’s June 2019 stress test list.

Conclusion

Generating yield in the current environment is proving to be challenging and may be getting harder as the Fed indicates a more dovish approach.

With the banking sector paring back risk, interest rates expected to remain low with dovish Fed policy, and credit spreads showing more value than other traditional fixed income instruments, we believe there is an overall positive backdrop for preferreds in the current market environment.

Although not structured as traditional bonds, they have historically displayed bond-like behavior, and often come with tax advantaged treatment that normal bonds don’t offer, including a portion of the dividends taxed as Qualified Dividend Income (QDI), rather than ordinary bond interest.

Source: Bloomberg, AltaVista Research, & Federal Reserve. Data as of 6/30/19.

Related ETF

PFFD: The Global X U.S. Preferred ETF invests in a broad basket of U.S. preferred securities, providing benchmark-like exposure to the asset class. It seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the ICE BofAML Diversified Core U.S. Preferred Securities Index.

Rohan Reddy

Rohan Reddy