The end of 2021 is in sight, casting a spotlight on 2022 forecasts. This report focuses on our expectations for the GICS sectors in the S&P 500 Index. Please also look out for our broader outlook for 2022. Overall, going into 2022, we have two broad views that apply to positioning across the S&P 500 GICS Sectors:

- Given peak liquidity, elevated valuations, and inflationary pressures, it is our view that investors should focus on segments of the market with pricing power.

- And ensure balance between growth and value.

Balancing Valuation and Pricing Power

With peak liquidity having been reached, we expect the market will now be paying closer attention to fundamentals. The market is contextualizing demand driven inflation, higher energy costs, expectations of when the supply chain will swing from tight to normal, and how the Federal Reserve (Fed) will respond to more sustained inflation pressures. In line with this, we believe equity markets are likely to be more selective in 2022 with a focus on valuations, fundamentals, and quality. Margins are expected to remain a key focal area into 2022 as investors dissect which segments have pricing power.

November started with news of U.S. inflation hitting a three-decade high, rising at a 6.2% annual rate in October and beating out the consensus estimate of 5.8%. This is the highest level of inflation we’ve seen since 1990 and it seems like the ‘transitory’ story is transforming into something a bit more peskily persistent. Q3 earnings came in stronger than expected with companies generally being able to pass along higher prices. But there’s only so much input cost a company can pass onto the consumer before higher costs begin hurting their financials. Margin pressure is forecast to impact Q4 earning with S&P 500 net profit margins expected to contract from 12.9% to 11.8%. This is slightly below the September estimate of 11.9%, with Consumer Discretionary and Industrials experiencing a reasonable contraction in their forecast net profit margin while the Energy sector is forecast to enjoy continued margin expansion into Q4 2021.1

Pricing pressure comes at a time when there will likely be less supportive monetary policy. The Fed started tapering their balance sheet purchases in November. They are currently reducing their $120 billion worth of monthly bond purchases by $15 billion each month. This places the projected end date for tapering around June, potentially opening the door to higher policy rates into the second half of next year. There is a reasonable chance that tapering is sped up and ends prior to June.

Against this backdrop of elevated inflation and the prospect of higher interest rates, we conducted a deeper analysis into the pricing power of different S&P 500 GICS sectors and industries relative to their respective valuations levels. This analysis was intended to understand the areas with pricing power and if there were segments with pricing power that remained at more attractive valuations.

Setting up the Analysis

Margin Analysis:

Analyzed the trends in operating profit margins and sales for all 11 GICS sectors and 63 GICS industry groups to determine where we were most and least concerned about margin pressures into the year ahead. This analysis looked at the historic operating profit margins and sales trends since 2018 to understand which industries have consistently seen improving margins as scale improves (Software) verse those that had a challenging 2020, but margins have recovered, and we believe the underlying companies are well positioned to benefit from higher yields and/ or commodity prices (Banks, Energy sector).

We developed a margin ranking and a valuation ranking to establish a combined ranking that considered the ability to pass on higher prices while being mindful of valuations. The tables below outline our key findings as well as the methodology behind the analysis. Our base case analysis provides a low weight on margin movements during 2020, focusing more on the ability to improve margins during 2021 and margin expectations for the year ahead. The base case emphasized how operating margins of each underlying industry are likely to react in a higher inflation environment with good demand. With the emergence of the Omicron variant, we also created a margin assessment that gave greater priority to margin stability during the challenges of 2020.

Valuations Analysis:

The valuation ranking looked at the current sector Price / Earnings (P/E) and Price to Book (P/Book Value), as of 10/31/2021, relative to its historic levels since 2018, as well as comparing the current P/E and P/Book Value relative to the S&P 500 Index. Within the valuation component, a 70% weight was placed on each sector relative to its historic prices to avoid substantially penalizing sectors that historically traded at a premium to the market.

Base Case

While the Omicron variant increased COVID-19 as a risk factor, our base case remains that Fed actions will be the focus of 2022. In this scenario, margins and valuations are both highly important. We shifted slightly towards the margins side with 60% of the combined ranking coming from margins and 40% from valuations. In a rising yield environment, we favor cyclical sectors with above average purchasing power. Financials, Energy, Industrials and Materials were the most positively correlated with rising real (inflation-adjusted) Treasury yields. These are cyclical sectors that are likely to benefit the most from improving economic growth and higher yields. Overall, Energy, Financials and Materials scored well in our analysis. These are cyclical sectors that are likely to benefit from higher yields and commodity prices while valuations are more moderate.

See methodology here.

Balancing Growth and Value

During 2021, COVID-19 diminished as a risk factor. That is, until the Omicron variant raised the question of how the global economy and markets will respond to a highly contagious variant that potentially includes mutations that could help it evade the current vaccines. While cyclicals and positioning for higher inflation remain our base case position, we believe this should be balanced with exposures that are less reliant on strong underlying economic growth.

With travel bans spreading, the question on investor’s minds is the probability of renewed lockdowns. Prior to the identification of the Omicron variant, select European countries had already starting reimposing restrictions, with Austria being the first western European country to reimpose nationwide lockdowns in response to the current wave of cases.2 With its Zero-COVID policy, China remains a lockdown risk. And, as home to six of the ten busiest container ports, this remains a critical weakness in supply chain normalization.

At this stage, our base case scenario is that U.S. lockdowns remain highly unlikely, but heightened caution can still have an adverse impact on consumption. Albeit unlikely, should lockdowns occur we would likely see the Energy and Materials sectors react negatively while the Information Technology and Communication Services sectors would likely react positively. With the reimposition of some travel bans, WTI crude oil prices declined more than 10% on the 26th of November, dropping below $70 / barrel for the first time since early September.3 The Energy sector is highly sensitive to global economic growth expectations and community mobility. While the initial list of countries on the current travel ban represent a small fraction of global travel, heightened COVID-19 concern may reduce willingness to travel and it may result in heightened caution and reduced community mobility.

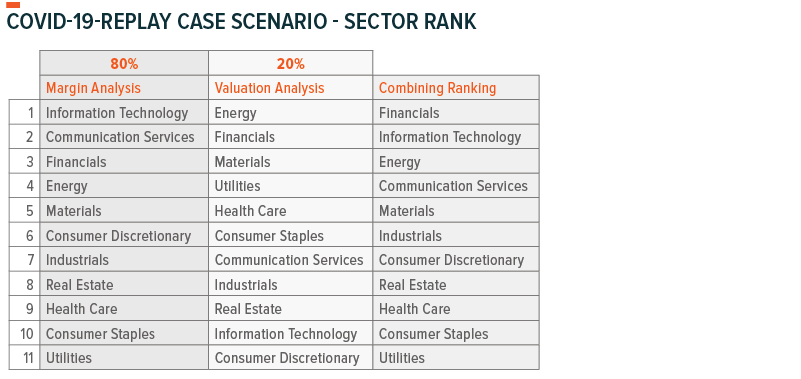

Higher energy prices have been a substantial contributor to elevated inflation. As such, reduced energy prices may give the Fed some breathing room as they navigate through a higher inflationary environment and the shift from tapering their balance sheet to raising interest rates. This could reduce the focus on higher yields and valuations. In line with this, we repeated the margin analysis while placing a greater emphasis on margin stability during periods of reduced sales growth. Should economic growth come into question, valuations, inflation, and the Fed are likely to become lesser concerns. As such, the weighting between the margins and valuation ranking is shifted to further favor margins in the COVID-19-replay scenario (80%:20% vs 60%:40% in the base case).

Information Technology scored well on our base case margin analysis and as reflected in our COVID-19-replay case scenario, both Information Technology and Communication Services were segments that generally provided some stability during the challenging period. Part of the reason the Information Technology and Communication Services sectors screened well in the margin analysis is that the underlying industries have been less impacted by supply chain bottlenecks and tend to have strong balance sheets. While the U.S. supply crunch may have already peaked, we only expect supply chain issues to normalize in the second half of 2022. These industries that were less impacted by supply bottlenecks are also well represented in the work-from-home segments of the market that should benefit from increased COVID caution.

While it does not ensure a profit or guarantee against a loss, diversification is always an important strategy to any investment thesis. Given the delicate economic environment we are currently in, it is important to ensure a balance between market segments that are sensitive to economic growth and those that can grow despite the economy.

See methodology here.

Segments that Scored Poorly

Utilities, Consumer Staples, and Real Estate are areas that historically are adversely impacted by higher real Treasury yields. While the business models in the Energy and Real Estate sectors generally allow companies to pass on higher prices, Utilities and Consumer Staples have generally reflected a weak ability to pass along pricing pressure. However, these are defensive sectors that will remain an essential part of consumption should consumers reduce discretionary spending. As such, though Utilities and Consumer Staples are currently our least favored sectors, they still provide potential diversification benefits should the economic environment deteriorate substantially.

The table below outlines our full sector views. These views are updated monthly.

Michelle Cluver

Michelle Cluver