The rapid adoption of telemedicine and digital health during COVID-19 pandemic is remarkable, yet unsurprising. In the years preceding the health crisis we now find ourselves in, a paradigm-shift in health care toward digitization was percolating. Structural trends like health care inequality, human longevity, systemic inefficiency, and improving connectivity served as kindling for the seemingly inevitable, albeit gradual adoption of technology in the sector.

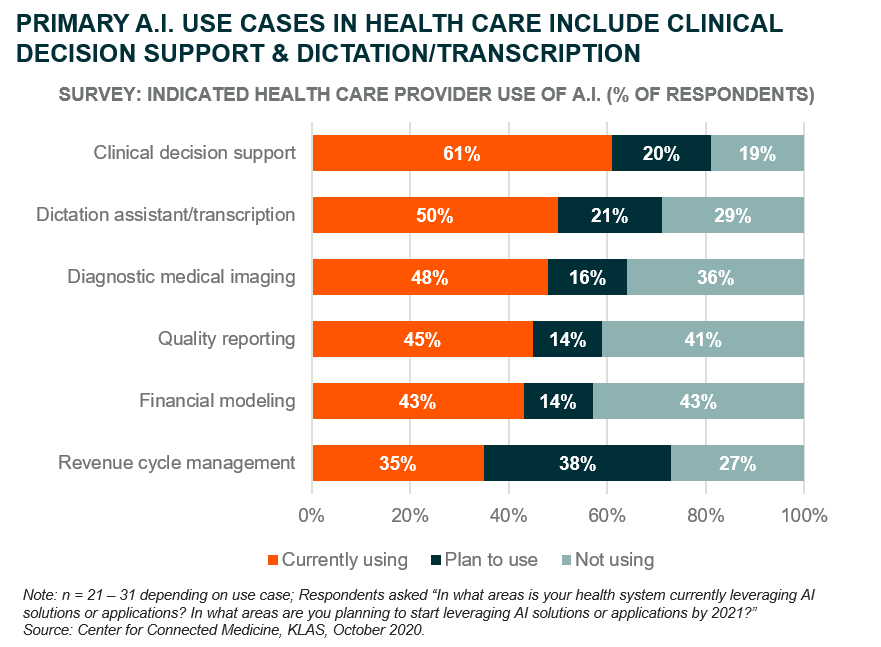

2020’s global lockdowns and widespread infection fears ignited said kindling. Since March, we’ve witnessed levels of technological disruption typical of years, not mere months. FAIR Health reports telemedicine claim lines increased about 84x from April 2019 to April 2020.1 Artificial intelligence (A.I.)-equipped health care analytics software became a valuable tool for drug and vaccine development, symptom identification, and hospital triaging.2 Connected devices like health tracking wearables and smart thermometers became commonplace, while those found in remote intensive care units allowed doctors to treat patients without risking their own health. In other words, telemedicine and digital health arrived.

In the following piece, we explore four key companies at the center of this rapidly emerging theme.

Teladoc Health: A Leader in Telemedicine

Teladoc Health is a telemedicine company that connects patients with health care providers over the phone, through video chat, and on the Teladoc platform. Teladoc’s primary services include:

- Virtual Primary Care: Connects patients with primary care providers for routine checkups and continued engagement with their regular health provider to provide proactive and personalized health plans. In a Teldadoc-conducted pilot, 30% more users got their annual exams when this feature was available.3

- General Telehealth: Connects providers and patients through on-demand appointments. These services range from general to specialized medicine. Of note, Teladoc’s platform has hosted 33 million mental health sessions, and across all telehealth sessions, 92% of patients report their health needs as being resolved.4

- Chronic Care Management: Provides round-the-clock access to health providers who can monitor patients’ health using connected devices and coaching.5

Usage of Teldadoc’s platform has surged through the pandemic as patients seek medical care without risking infection from in-person visits. In Q2 2020, during pandemic’s initial surge, Teladoc provided 2.8 million virtual health care visits, up 200% year-over-year (YoY).6 Many expected visits to decrease as COVID-19 infections subsided over the summer, but Q3 usage levels remained steady with Teladoc yet again recording another 2.8 million.7 As of the end of Q3, Teladoc had 51.5 million members, up 47% YoY. Also of note, in October, Teladoc completed its acquisition of remote health monitoring company, Livongo, for $18.5B in cash and stock. The deal integrates Livongo’s established remote monitoring technology with Teladoc’s telemedicine infrastructure, broadening and possibly solidifying Teladoc’s standing as a leader in virtual care.8

Nuance Communications: Using A.I. to Optimize Care

Nuance Communications offers a suite of products that enable digital transformation in health care, spanning the health care analytics and administrative digitization segments. These include:

- Document Capture Solutions: Enables easier electronic health records (EHR) generation for providers. Nuance’s Dragon Medical One product uses A.I.-based voice recognition to document patient narratives in a HIPAA compliant manner with high accuracy.9

- Quality Management Solutions: Uses artificial intelligence to generate recommendations on how to improve clinical, financial, and patient outcomes for providers. Nuance Performance Analytics is one of their primary offerings in this area and provides real time data analytics and decision support systems to help providers improve their operations and optimize patient care.10

- Diagnostic Solutions: Provides radiologists with data-driven insights to improve their efficiency, accuracy, quality, and performance. The PowerScribe One product uses A.I. to automate workflows and structure and digitize speech data.11

Nuance’s health care analytics and administrative digitization products continued to show strength throughout the pandemic. In Q4 of their 2020 fiscal year, Nuance reported continued growth for Dragon Medical One (DMO), with penetration in the US reaching 43% and with segment revenues growing 26% YoY. The product is growing internationally, too, reaching 14 countries and showing notable strength in the United Kingdom. DMO’s strength comes in tandem with increased adoption of Nuance’s cloud-based health care platform, with both products benefitting from shared synergies and the general trend of digitization.

iRhythym Technologies: Remote Monitoring & Wearables Collide

iRhythym Technologies develops and sells solutions for monitoring cardiac health and detecting cardiac arrhythmias. Their products include:

- Connected, Wearable Patches: Provides doctors and patients with cardiac data useful for determining and informing courses of treatment. Their Zio XT patch is embedded with biosensors that measure and record patients’ heartbeats for up to 14 days, giving physicians updates from afar.12

- The Zio Service: An end-to-end ambulatory monitoring service that integrates data from connected health care devices for analytics, presenting it via telemedicine solutions. ZioSuite is where physicians can interpret reports generated by the Zio Service and manage individual patient care.13

In Q2 2020, in the midst of the pandemic, iRhythym’s leadership noted how the current environment offers “considerable potential for structural changes to how healthcare is delivered, and that will play to the strengths of [their] digital platform.”14 Q3 validated this sentiment with a significant number of clients prescribing Zio at a higher clip than at the beginning of the year, despite the pandemic easing during the quarter. Additionally, the rise of telemedicine drove greater enrollments on the Zio platform, illustrating how the theme’s sub-segments are both enablers and beneficiaries of each other.

Invitae Corporation: Using Genomic Data to Optimize Care

Invitae Corporation provides patients and providers with germline genetic testing and offers libraries of genetic data for health care provider implementation. Invitae’s data provides insights around the risk of developing cancer and other diseases based on mutations found in cellular DNA. This can be extremely useful for patients looking to proactively understand their health risks and for providers looking to offer their patients the best care available.

Genetic data has become increasingly valuable during the pandemic as it is becoming apparent that certain genetic risks increase the lethality of COVID-19. Invitae’s Q3 2020 results reflect these developments as testing volumes grew 32% YoY and 41% compared to the previous quarter. Additionally, Invitae closed on a $1.4B deal to acquire Archer DX, increasing their offering to include somatic testing which looks at genetic changes seen in tumors. The potential market for genetic testing is vast, and companies like Invitae are making this technology and information more readily available to patients around the world.15

Conclusion

Despite impressive advancements in recording and analyzing health care data and in connected medical devices, the healthcare sector was slow to embrace the digital transformation offered by these technologies for many years. The COVID-19 pandemic finally put this disruption in motion. As illustrated by the compelling products and services mentioned above, solutions that enable remote medicine, advanced patient monitoring, A.I.-driven insights, and streamlined healthcare administration are rapidly being implemented around the world. In our view, the benefits seen by patients, providers, and payers will continue to drive the theme’s growth moving forward.

Related ETF

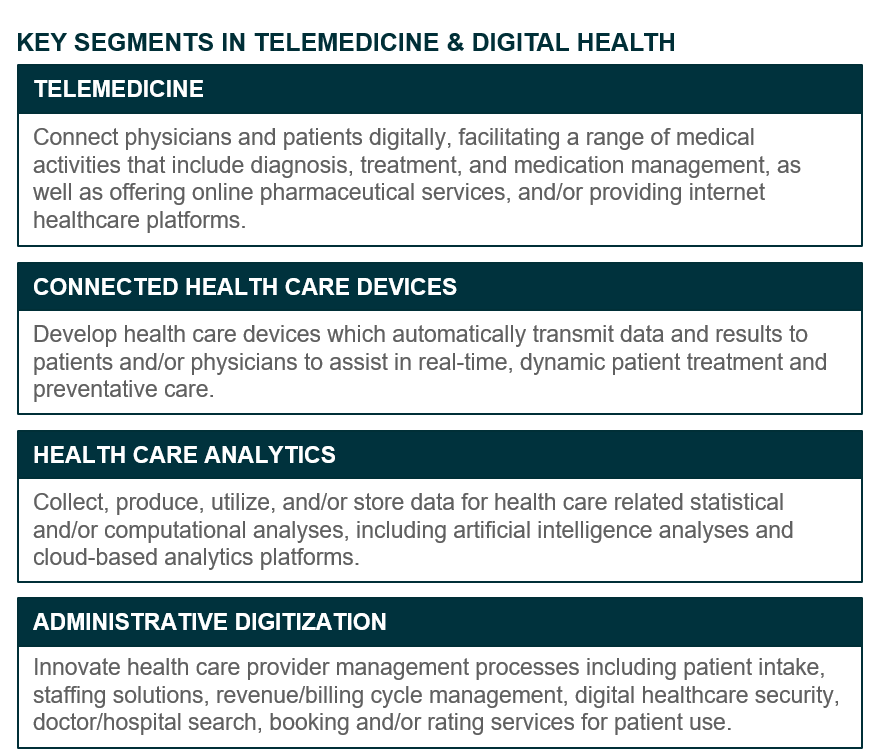

EDOC: The Global X Telemedicine & Digital Health ETF seeks to invest in companies positioned to benefit from further advances in the field of telemedicine and digital health. This includes companies involved in Telemedicine, Health Care Analytics, Connected Health Care Devices, and Administrative Digitization.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.

Global X Research Team

Global X Research Team