One industry that’s thrived during stay-at-home orders is video games and esports. As consumers follow government lockdowns around the globe, there is surging interest in activities that can provide entertainment and social interactions from the comfort of one’s home. But it’s not just COVID-induced momentum – the industry’s move into the mainstream was well under way prior to the COVID-19 outbreak, and we believe will continue afterwards.

To provide more color into this fast moving theme, we highlight four companies that represent key segments of the video games & esports ecosystem targeted by the Global X Video Games & Esports ETF (HERO), including:

- Activision Blizzard: A leading video game developer and publisher that continues to develop hit titles

- Huya: A streaming platform taking the lead in China

- Sea Group: A firm at the forefront of the burgeoning esports event space

- Nintendo: What would be a discussion about video games without one of the original hardware and game developers that continues winning over new generations of gamers?

Activision Blizzard: Churning Out Hits

Activision Blizzard is one of the largest game developers and publishers in the world. The company boasts popular titles including first-person shooter Call of Duty and massively multiplayer online role-playing game World of Warcraft. Call of Duty: Modern Warfare was the top-selling video game in the U.S. at the end of April.1 Warzone, a free-to-play, battle royale, reached 60 million users in less than two months after its launch this year.2 And more games of the mobile tile-matching game Candy Crush were played in Q1 than in any other quarter since Activision Blizzard acquired the mobile game developer, King Digital Entertainment, in 2016.3

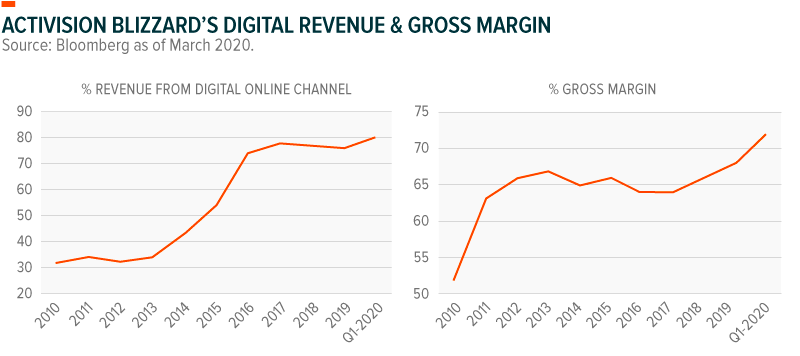

Activision Blizzard has benefitted from the secular tailwind towards the digital delivery of video games. As of Q1, approximately 80% of the company’s total revenues came from digital channels, up from merely 30% 10 years ago. Unsurprisingly, digital deliveries are more profitable than selling a physical CD in a store. With digital delivery, even a $3 in-game purchase can be highly profitable given that variable costs, like delivery, are virtually zero.4 The mobile gaming segment has continued to grow as well, now accounting for about a third of total revenue. The mobile portfolio goes beyond Candy Crush. Call of Duty Mobile became the most downloaded phone game in history after its Q4 2019 launch, scoring 100 million downloads in its first week alone.5

Looking ahead, the 2020 holiday season could provide additional momentum for the company’s sales as new consoles from Sony’s Playstation and Microsoft’s Xbox division are expected to hit the market. Anticipated titles include the latest edition of the iconic Tony Hawk Pro Skater.

Huya: A Streaming Powerhouse in China

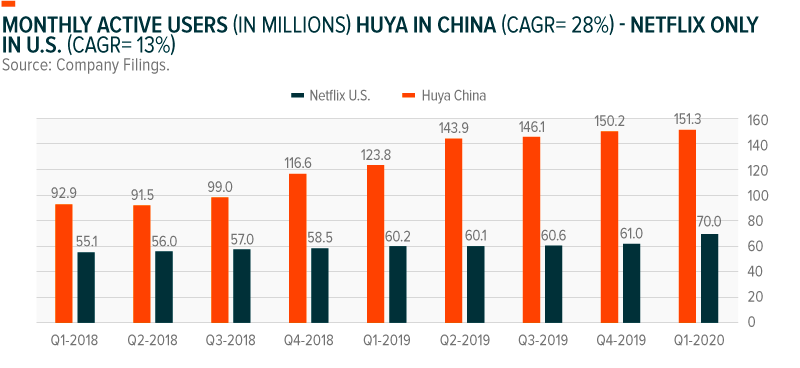

Streaming involves gamers broadcasting themselves playing a video game to an online audience. Streaming platforms provide the technology enabling this activity as well as facilitate gamers monetizing their streams. Huya is one of China’s largest live streaming platforms with over 150 million monthly active users (MAUs) and 800,000 active streamers.6 Chinese streaming platforms differ from their Western counterparts in that they predominately generate revenues from user donations to streamers. In the U.S., streaming platforms Twitch and Mixer generate most of the monetization through subscriptions and ads. However, Huya signs contracts with professional gamers and keeps 50-70% of donations, while the streamer receives the balance.7 Top video game streamers in China gross about $4 million in annual donations, each.8

Huya had a successful Q1 in its burgeoning mobile segment and in esports events. The company set a record for number of mobile viewers, reaching 75 million monthly active users (s) who represented 80% of total paying users.9 The number of active users is a helpful indicator of how video game streaming compares with other forms of entertainment. Netflix, for example, has 70 million US memberships – 5 million less than Huya’s MAUs.10 Huya also organized 18 tournaments and events in Q1, during which viewership increased 79% year-over-year to more than 113 million.11

With over 600 million gamers, China is the largest video game market in the world. And Chinese streaming platforms have a distinct advantage: U.S. streaming platforms like Twitch and YouTube are banned by the great firewall. Huya recently introduced its gaming companion app, allowing newer gamers to pay established or well-known gamers to play along with them. The new profession is booming in China, with gamers seeking to increase their skills or play alongside popular gamers. Beyond China, Huya has set its sights on future growth opportunities in India, Southeast Asia, and Brazil through its Nimo TV subsidiary.

CAGR: Compounded Annual Growth Rate

Sea Group: Developing Games, Directing the Esports Playing Field

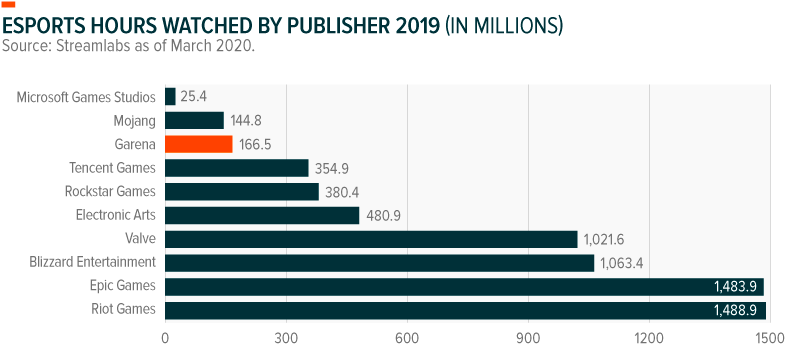

Founded in 2009, Sea Group is a leading digital entertainment player in Southeast Asia through its Garena platform, which has roughly 400 million active users. The company self-develops games, including Free Fire, which recorded a new high of 80 million peak daily users in Q1.12 Free Fire was the highest-grossing mobile game in Southeast Asia and Latin America during the same period.13 One factor in Free Fire’s success is that the game can run on less sophisticated phones that are common in these regions. Other battle royale games like Fortnite, Call of Duty and PUBG Mobile require high-performance, and high-cost smartphones.

Sea Group is also a leading organizer of esports events in Southeast Asia. In Q1 2020, the company hosted more than double the number of esports tournaments for Free Fire compared to Q1 2019. These tournaments accumulated over 90 million views in Southeast Asia.14 The company went international with Free Fire tournaments for the first time last year. November’s event drew 2 million peak, concurrent viewers.15 For context, Major League Soccer’s 2019 Final brought in 1.3 million viewers.16

Free Fire’s success has created a runway for the company to develop additional titles, and potentially grow revenues. However, Garena is also the exclusive operator of popular third-party video games in Southeast Asia, including League of Legends, FIFA Online 3, Point Blank, Blade & Soul and Arena of Valor.17 Linked to Sea Group’s growth is increasing online penetration in Southeast Asia. The region increased its internet users by 100 million over the last four years to 360 million, but that’s still well short of its 660 million population overall.18

Nintendo: A Perpetual Innovator

Nintendo is virtually synonymous with video games. From NES, to Game Boy, to Nintendo 64, and now latest Switch console, Nintendo continues to redefine video game hardware and software. And the company’s best years may be still lay ahead if the performance of its Switch console is any indication. Despite being in the market for three years now, Switch has been mostly sold out in 2020 amid shelter-in-place orders. Switch was the best-selling hardware platform in the U.S. in April, in terms of units and dollar sales.19

The company plans to increase Switch production to meet demand. Last year, the company produced and sold over 21 million consoles.20 This year, it expects demand to increase by 10%.21 At $299 per console on average, that could translate to gross revenues of over $6.6 billion.

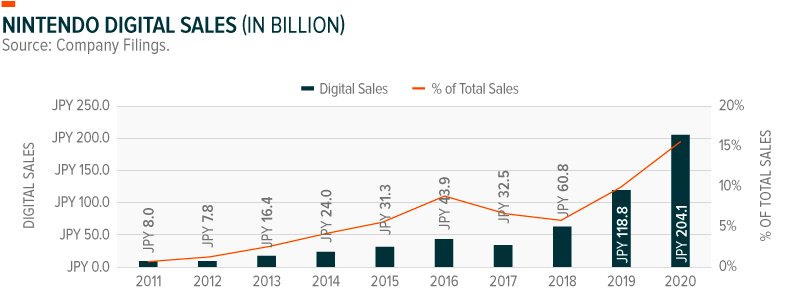

Unique to Nintendo is the integration between hardware and software; the firm develops games that can only be played on its consoles. In March, the company sold 5 million digital copies of its newest title, the hit Animal Crossing: New Horizons, the most for any console title in a single month.22 In April, digital deliveries declined to 3.6 million copies, but it’s the top Switch title in lifetime digital sales and lifetime digital revenue after just two months on the market. In addition, Animal Crossing: New Horizons includes optional in-game purchases that allow for continued revenue beyond the initial title sale. More broadly, Nintendo’s digital-based revenues continue to grow. Downloadable versions of the company’s packaged software and add-on content grew 72% year-over-year for FY 2020 (ended March 3, 2020).

Conclusion

As video games continue to expand their audience and add additional features, it is emerging as potentially the next generation of the internet; a metaverse filled with millions of users interacting in a truly life-like virtual reality. Beyond simply playing a game, the four companies we highlight here exemplify the ongoing transformation of the industry into a vast entertainment and social ecosystem. While traditional sports offer a relatively limited experience in watching games, video games and esports offer unparalleled functionality. One can play games with friends, interact with famous gamers, watch high level competitions, and connect with other fans all from the comfort of a couch. Recent events like the Formula 1 Virtual Grand Prix featuring real drivers and celebrities, and concerts like Travis Scott’s Astronomical Tour in Fortnite, each drew over 10 million viewers, and are showing that life as we know it may move to the virtual world.23, 24

Related ETF

HERO: The Global X Video Game & Esports ETF seeks to invest in companies that develop or publish video games, facilitate the streaming and distribution of video gaming or esports content, own and operate within competitive esports leagues, or produce hardware used in video games and esports, including augmented and virtual reality. Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Pedro Palandrani

Pedro Palandrani