The Global X Income Outlook for Q3 2021 can be viewed here. This report seeks to provide macro-level data and insights across several income-oriented asset classes and strategies.

Rising rates emerged as one of Q3’s main concerns, as bond yields rose to levels not seen since earlier in the year. Major central banks around the world triggered this bond selloff by openly considering more hawkish monetary policies after 18-months of ultra-supportive actions during the pandemic. The spike in bond yields runs counter to current economic growth trends, which are slowing amid continued spillover effects from the COVID-19 delta variant. This environment has not just impacted bond markets, but created unease in equities as well. With high valuations, slowing growth, and concerns around earnings amid supply chain disruptions, rising yields are just another reason stock investors are nervous. Income-focused investors may face the most challenges in this rising rate environment and must be prepared for the implications of hawkish policies and higher bond yields on their portfolios.

Key Takeaways:

- Continued supply chain disruptions, rising energy prices, and re-opening plans are likely to perpetuate elevated inflation levels.

- The Federal Reserve and other major central banks are beginning to signal a lifting in their easy money stance, and the bond markets have responded in tandem.

- Income investors should be prepared for higher rates and inflation to persist, making lower duration assets and real assets more attractive.

- Certain options strategies that can monetize volatility, and selective cyclical assets like Energy and Financials stocks are other ways investors can position amid this environment.

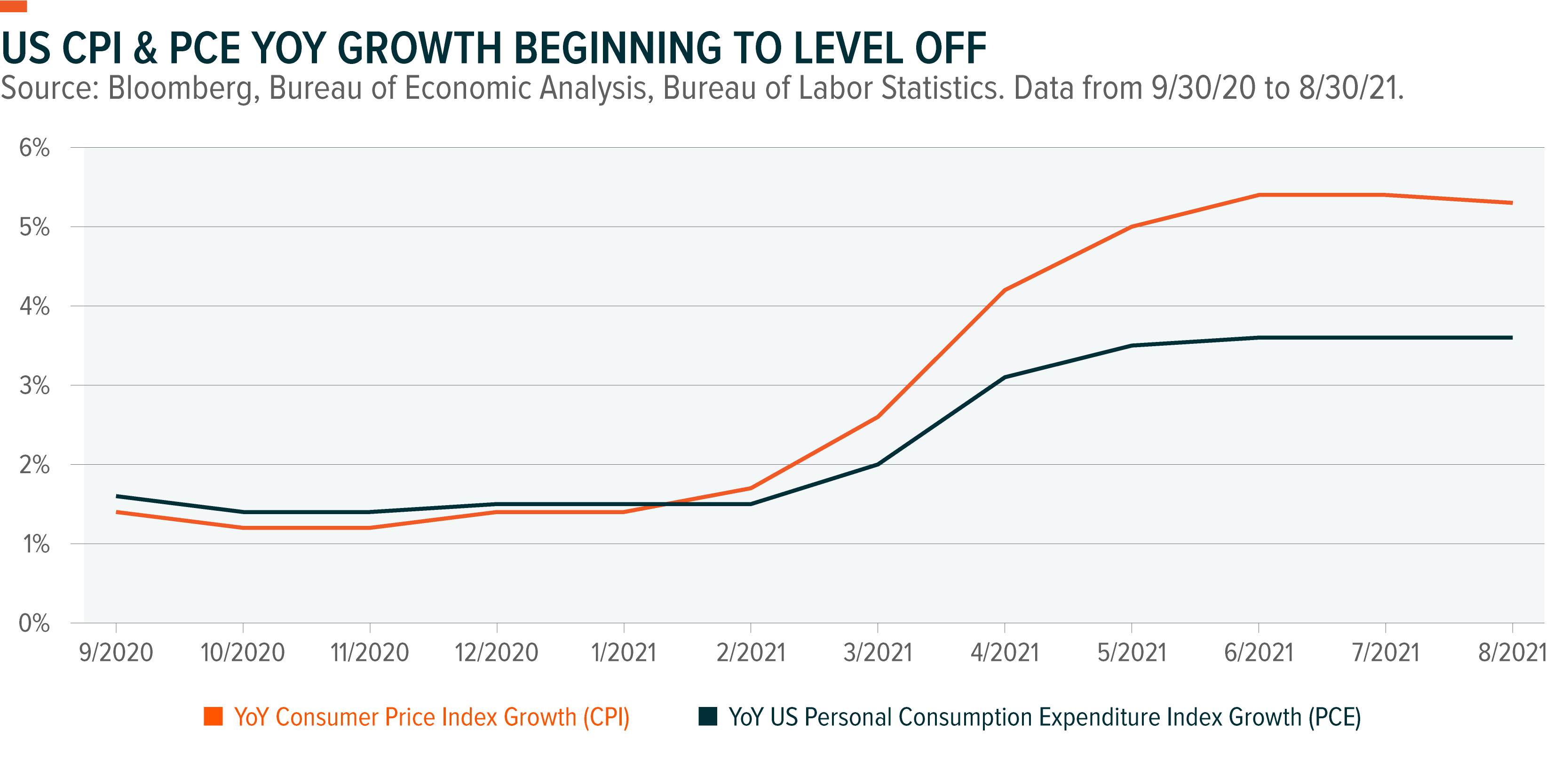

Inflation Rates Beginning to Level Off, but Remain High

Latest headline inflation data is beginning to level off after the initial dramatic rise in the first half of 2021

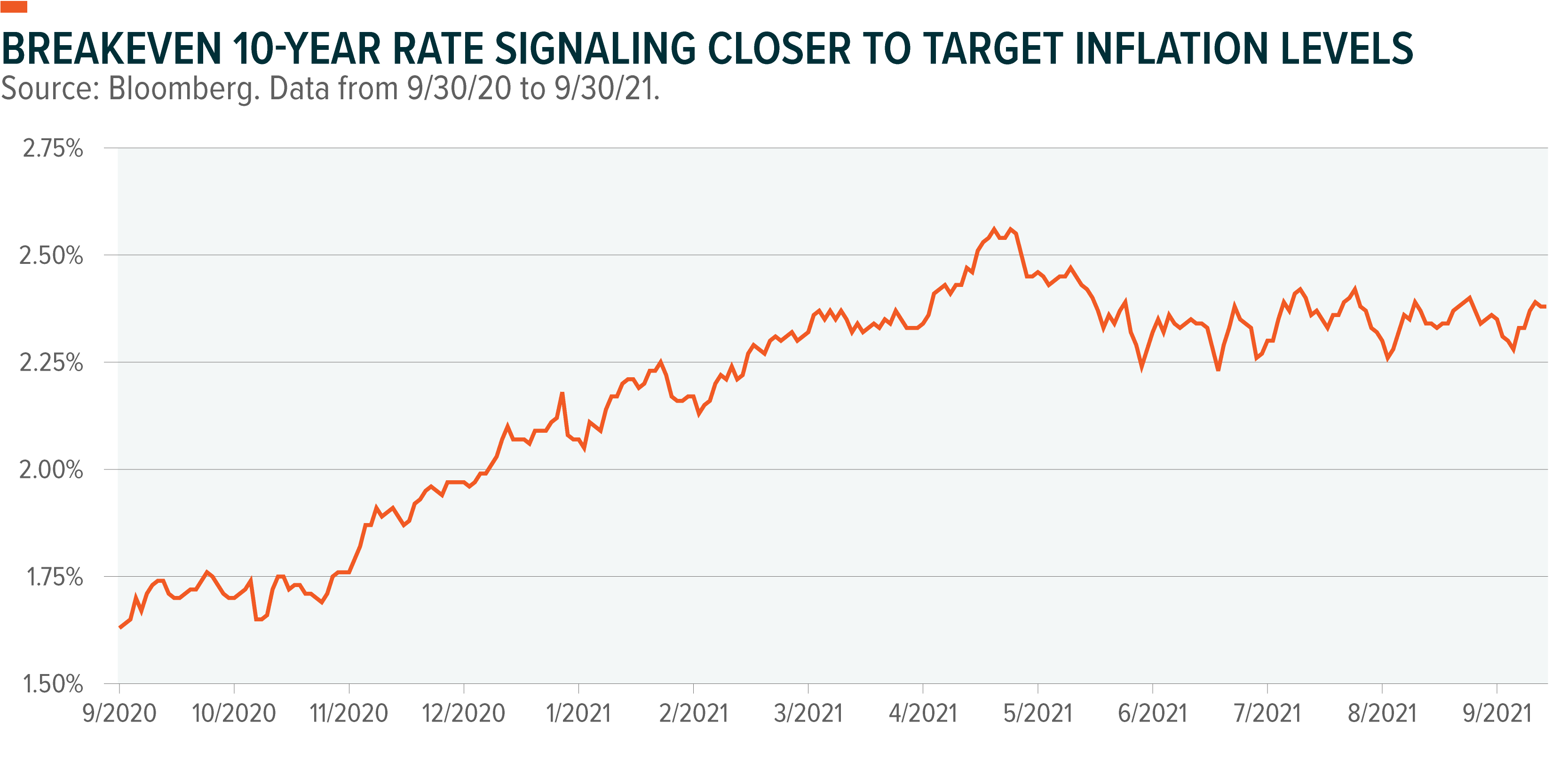

Breakeven inflation, which measures the expected inflation based on the difference between nominal yields and the inflation protected bonds of the same maturity, also stayed fairly flat the last few months, countering the steep increase earlier in the year. It could be fair to say that breakeven rates between 2.25% and 2.50% imply the market is not expecting high inflation to persist for the long term.

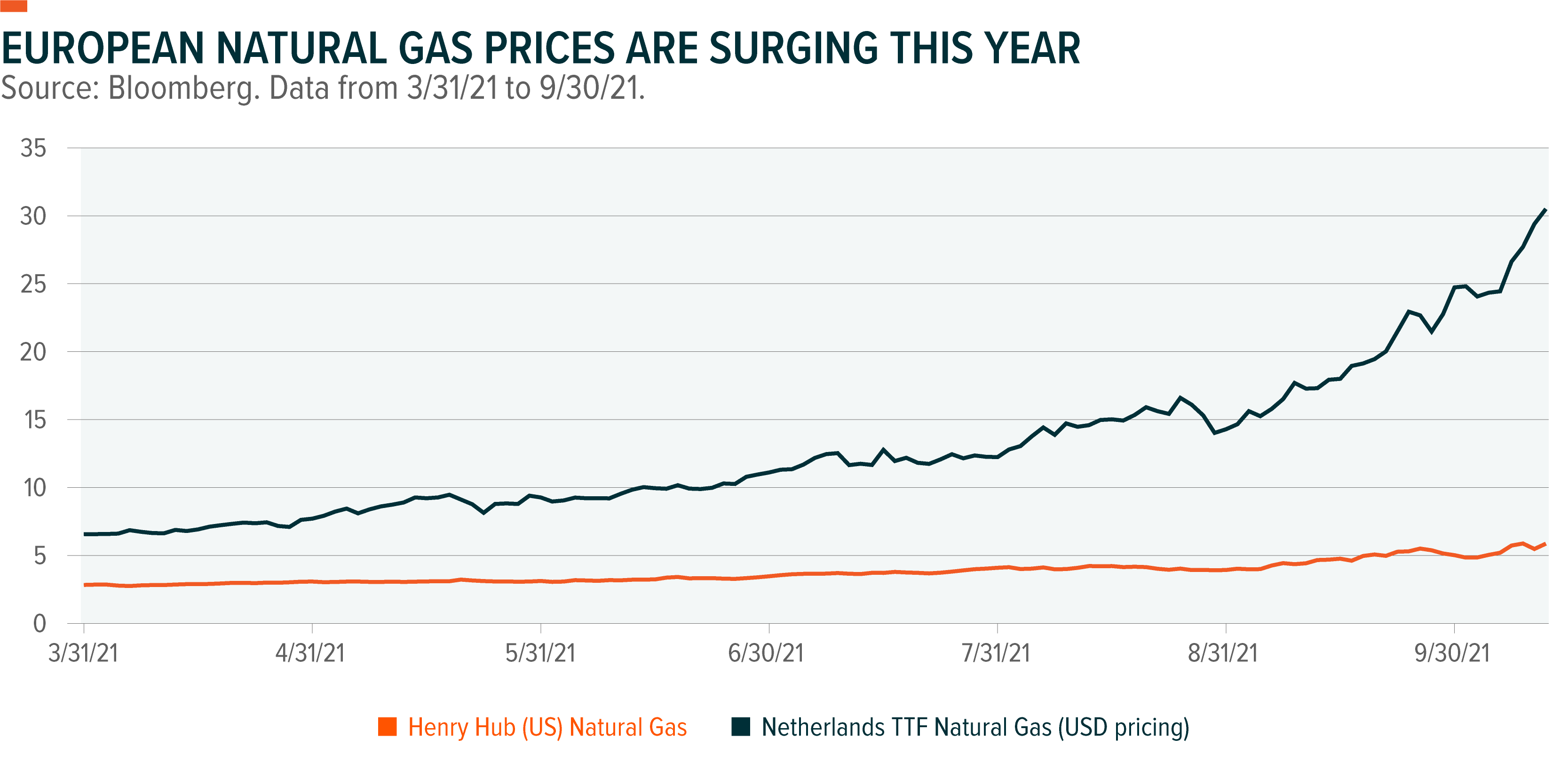

But in the near-term, inflationary pressures are likely sticking around. In addition to persistent supply chain issues and tight labor markets, the recent major spike in energy prices and rising rents are the latest contributors to inflation readings. Some of these inflation pressures are more localized, such as natural gas prices being much more pronounced in Europe compared to the US, due to less abundant domestic supplies in Europe and competition for supply stemmed around Russian gas.

Considering 23.5% of EU household expenditures amounting to 12.3% of GDP goes towards housing and utilities, the impact on the consumer is likely to be significant.1 European governments, including Spain, France, Italy and Greece already announced subsidies towards home energy cost. The problem is likely to be exacerbated heading into the winter months, forcing governments to decide how much support they are willing to provide. Germany’s inflation rate consequently hit a 29-year high of 4.1% in September and similar trends could follow across Europe for the rest of the year if energy prices remain elevated. We think investors should be conscious of inflationary risks for a more extended period.

Rising Consumer Costs Present an Opportunity for Real Assets

Inflationary issues aren’t limited to just Europe as we saw with headline US inflation. Rapidly rising rental prices are a core part of the concern, with prices rising 11.5% YoY in August.2 For income investors, real assets look much more attractive in this environment because of real inflationary pressure getting pushed into the system. Energy and real estate are two areas investors may want to consider because business models in these sectors are often able to pass through inflation.

The Energy sector’s recent renaissance is driven by higher commodity prices amid significant supply shortages. OPEC’s recent policy hold at their October meeting drove energy prices even higher after they elected to leave their production hikes stable. US producers may need to fill the void, putting midstream energy companies that move oil and gas around the country in a prime position to capitalize. For income investors, this is a welcome development given midstream’s attractive dividend yields of 6.1%.3

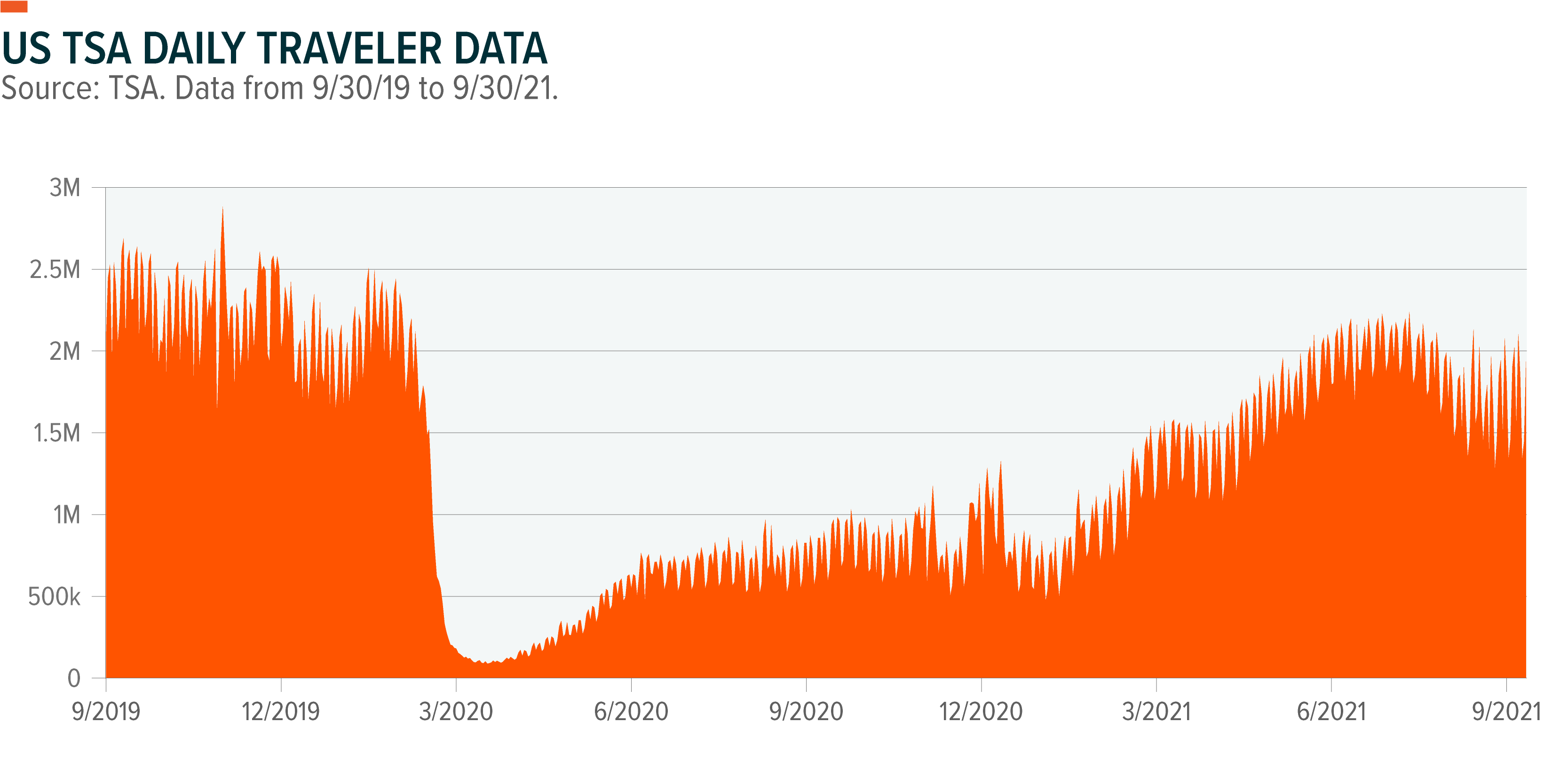

The real estate market is surging this year amid the re-opening economy, low mortgage rates, and a tight housing market. But there are some signs of weakness that may make investors want to consider more selective sector picks within real estate. The lingering delta variant has slowed economic growth and reduced consumer travel is further impacting real estate markets. Mobility figures took the biggest hit this quarter, as shown by declining traveler data reported by TSA below.

Airline and hotel prices declined in August by -12.6% and -3.3%, respectively, according to CPI data. Travel restrictions between Europe and the United States led to lackluster data, but the stop and start nature of mobility restrictions means the decline could be temporary. Europe, Australia, and the United States recently announced lifting restrictions, effective in November. Investors may want to avoid tourism-focused segments like hotels and gaming/lodging REITs. Residential REITs may be more appealing in today’s tight housing market with rising rental costs. Mortgage REITs are another area for consideration for rising long duration yields and a strong lending market. Residential REITs are currently offering 3.0% dividend yields, and Mortgage REITs, with their leveraged nature, offer a 8.2% dividend yield.

Central Bank Actions Bring Financials into the Fold

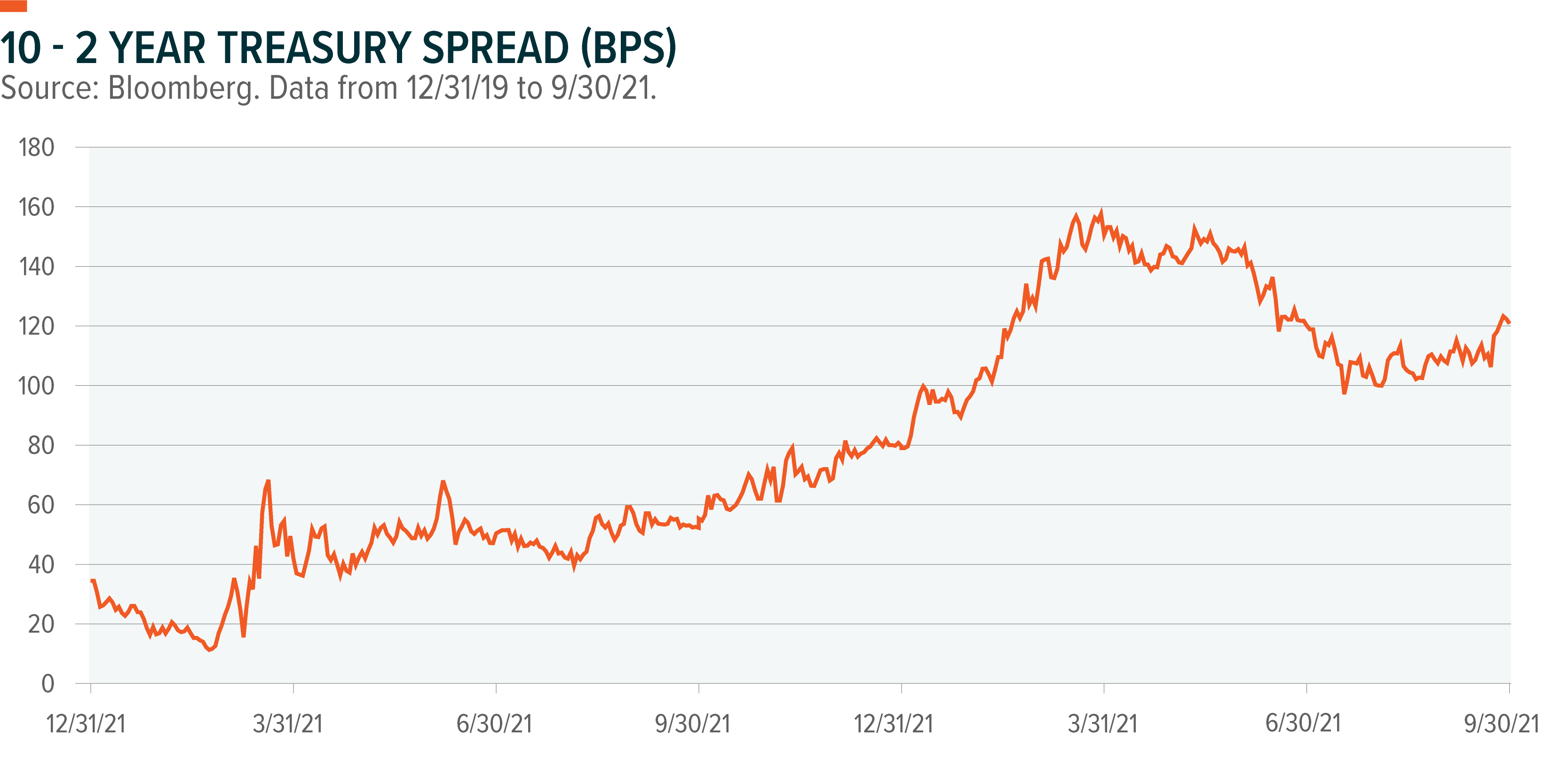

Inklings of central bank hawkishness were present earlier in the year, but officials offered more concrete comments in the last couple months. The Fed finally began acknowledging a potential taper program, and even rate hikes are looking increasingly likely within a 12-18 month time frame. The hawkish turns are due to the persistent inflationary pressures, tightening labor markets, and supply chain challenges. But hawkish stances are a global phenomenon. Other central banks like BoC, BoE, and the Brazilian central bank either raised rates or laid out plans to reduce monetary assistance. The US yield curve flattened in light of slowing growth expectations and late cycle policy stances taken by central banks. There are signs higher inflation could persist for an extended period, and the flattening yield curve indicates the market is expecting a more hawkish stance from the Fed to combat these inflationary pressures.

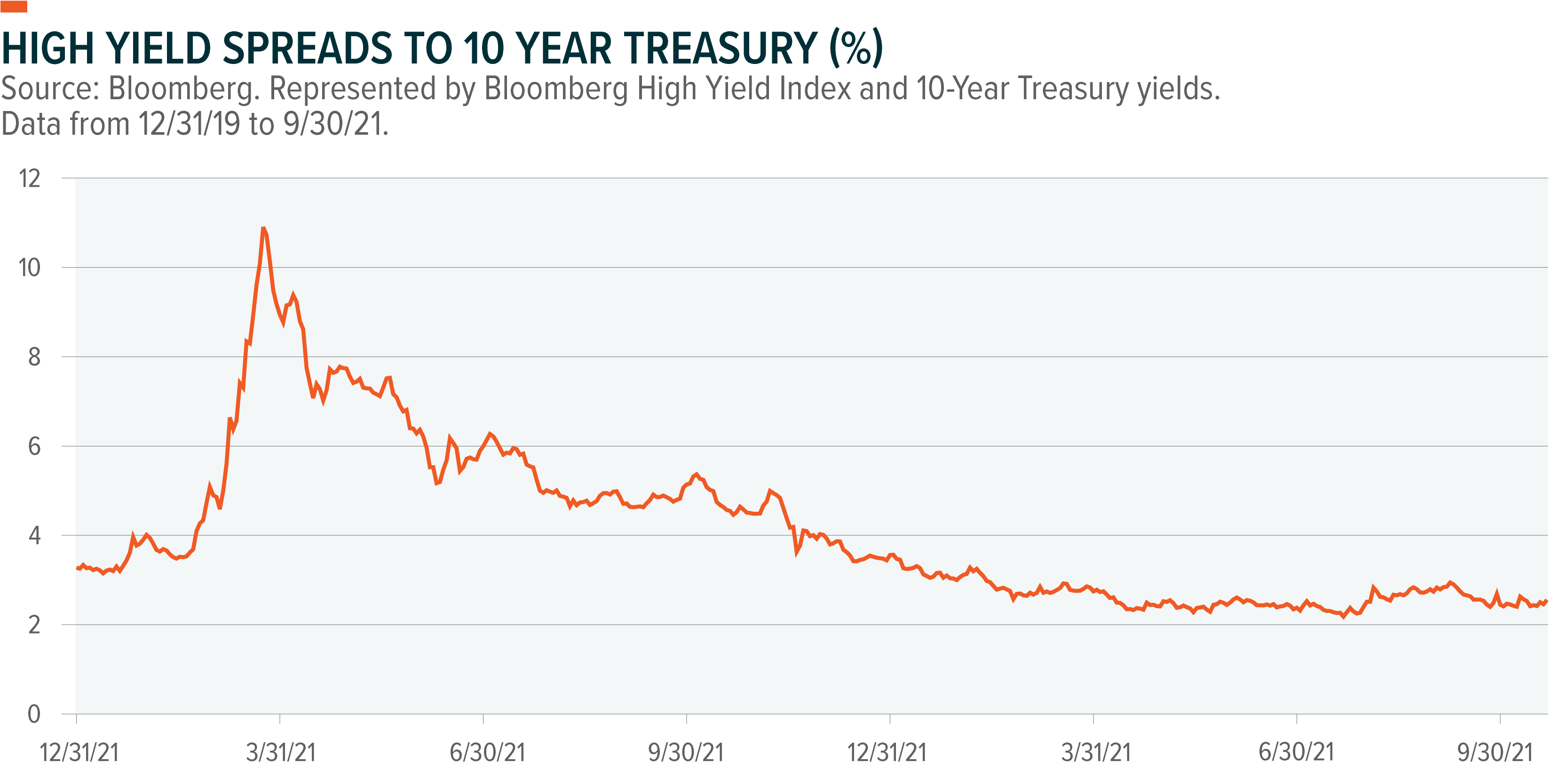

While we believe the recent flattening is reflective of the slowing nature of global growth for many of the reasons discussed above, credit spreads have not meaningfully widened despite the negative economic implications, resulting in conflicting signals.

Perhaps the most important market development happened towards the end of the quarter with Federal Reserve Chairman Jerome Powell’s comments indicating a tapering program could be put in place by year-end, indicating the end of the ultra easy monetary conditions and tight credit spreads brought on by massive monetary policy support. The exact timing of tapering aside, investors should be prepared for the reality that central bank support has likely peaked and is likely to wane heading into 2022. For income investors, this presents the ever-lasting question of how to balance the need for yield with taking on greater duration or credit risk if rising rates and weaker economic growth are underway.

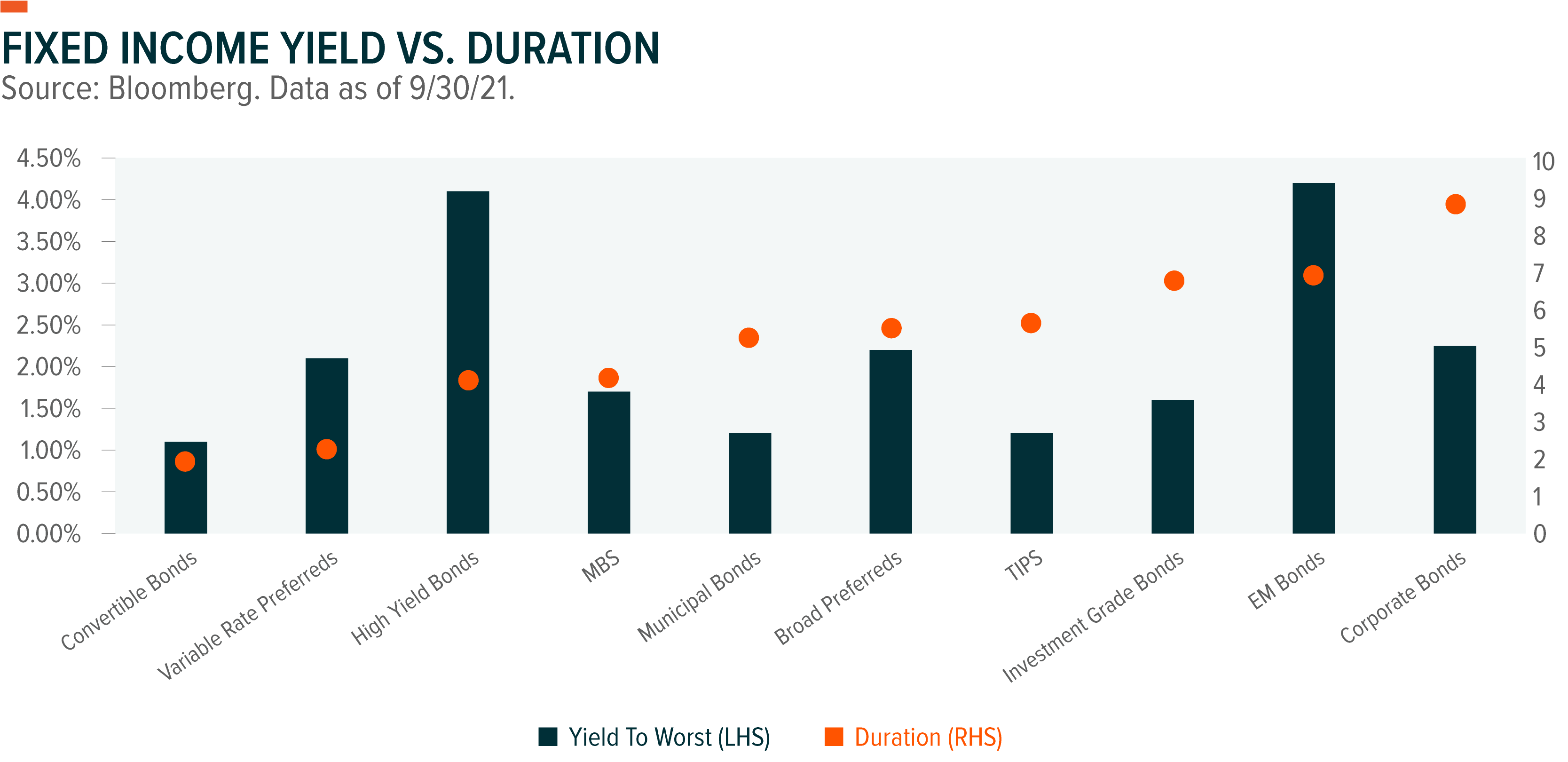

The fixed income asset class could be under significant pressure if bond yields continue to rise. From mid-2020 to the end of Q1 2021, the bond yields rose similarly as they are today and long duration assets underperformed dramatically. The Bloomberg US Agg index fell -3.70% and 20 year+ treasuries were down -20.13%.4 Reducing duration in a rising yield environment should be a consideration for fixed income investors. Amid historically tight credit markets, massive credit spread widening seems unlikely given the general re-opening momentum and current inflationary trends. But moving up in credit quality could be a prudent step. Preferred stock is one alternative for investors concerned about higher yielding bonds. Preferred stocks’ heavy exposure to the Financials sectors may be a buffer in a rising rate environment, in which Financials tend to benefit from higher lending rates. For income investors, finding meaningful yield is still a challenge especially when factoring in today’s inflation rates. This is why eschewing duration entirely is often unrealistic for fixed income investors. Preferreds offer a balance between duration and yield, a tradeoff that most traditional fixed income investors may find appropriate.

For investors willing to range outside of fixed income, the appeal of no-duration alternatives for both yield and potentially risk management is enticing. As an example, a covered call strategy combined with a protective put can generate income, while also mitigating downside risks. Such strategies based on the Nasdaq 100 can offer further diversification to a portfolio. The Tech sector is typically underweighted within income portfolios, so using income-generating options strategies based on this index can provide diversification alongside typically overweight sectors in income portfolios like Utilities, Energy, Real Estate, and Financials.

Conclusion

Elevated inflation is filtering into the economy and rising consumer prices increase the possibility this inflation may stick around. With the Fed taking notice, policy shifts mean bond yields could rise. The implications for income investors are significant, so investors may want to focus on income ideas that can be resistant to rising yields, including real assets like midstream energy and REITs, preferreds, and risk management strategies for the Technology sector.

Rohan Reddy

Rohan Reddy