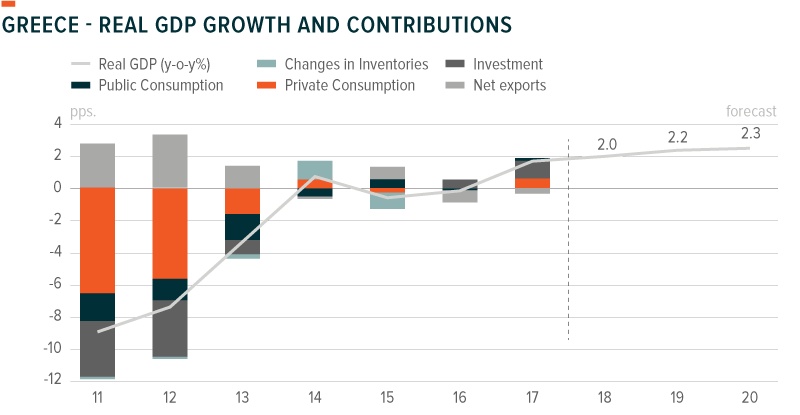

Greece’s stock market is off to a strong start in 2019, helped by the country’s broad economic growth reaching its fastest annual increase since 2007. In Q1, the markets were up 15.2% and forecasts put 2019 GDP growth at annualized 2.4%, versus Europe at just 1.3%.1 Greece’s improving growth prospects could portend the start of a virtuous cycle for Greece, making it a standout against the weak backdrop of a sluggish Europe.

Greece a top performer year to date

Greece’s strong equity market returns came amid the ongoing push to clean up bad debt from bank balance sheets. As a result, financials lead the way as the biggest positive contributor to performance during the quarter. Causes for optimism in the Financials space include increased liquidity in local financial institutions, with banks having almost fully repaid emergency European Central Bank (ECB) liquidity assistance.

Further powering returns was a recovery in consumer confidence to almost pre-crisis levels. Private consumption helped drive in strong performance during Q1 within the communication services sector and the casinos & gaming sub-industry.2 Such improvements follow labor gains with unemployment falling by 3% in 2018 and national account data reflecting improvements in labor productivity.3

Source: European Central Bank (ECB), Greece Winter Forecast, Jan 2019.

For sustained, positive performance over the longer term, the banking sector will require further improvements, like the continued reduction of non-performing loans (NPLs) and assistance to banks crippled by outstanding debts. The ongoing recovery in domestic consumption, sustainable wage growth, and the further development of key industries like tourism, will also be key.

Credit rating upgrade reflects Greece’s falling risk

In March, Moody’s raised Greece’s long-term debt rating two notches from B3 to B1 with a stable outlook. In the process, Moody’s noted that the “ongoing reform effort is slowly starting to bear fruit in the economy.”4

The credit rating agency acknowledged some missteps in Greece’s progress, but also noted that “reform momentum appears to be increasingly entrenched, with good prospects for further progress and low risk of reversal.”

Given a strengthening credit profile, the government tested investor risk appetite with a five-year bond issuance in January, the country’s first offering since exiting its international bailout programs last summer. Encouraged by the response and Moody’s upgrade, the government went back to the market with a 10-year bond offering, it’s first such issuance since 2010. The 10-year issuance was 4.7x oversubscribed, raising 2.5 billion euros at a 3.90% yield.

Risks to watch: global slowdown, elections

A global slowdown or weakening European demand could hurt Greece’s momentum, particularly given Greece’s dependence on tourism and exports. Despite risk of a potential slowdown in the EU, Greek exports are expected to remain on an increasing trajectory. Even in the event of a weakened external economic climate, Greece has potential offsets for the first time in years and expects a healthier domestic economy with improvements in employment, consumption, business conditions and renewed investor interest in the industrial and real estate sectors. In January, industrial production rose 3.4% year-over-year,5 while Foreign Direct Investment into real estate rose dramatically from 89 million euros in 2017 to 752 billion euros in 2018,6 supporting the tourism sector and leading to a modest rise in housing prices throughout Greece.

Political risk is notable, but with potential upsides as well. Legislative elections are scheduled for October; however, they could be pushed up to May 26 to coincide with local and European elections. The ruling hard-left Syriza party is likely to demand snap elections to minimize the party’s losses ahead of European elections and before a slowdown in Europe potentially curbs Greece’s progress.

Although current expectations hold that change is likely, market-friendly policies should receive greater support. The conservative ‘New Democracy’ opposition party is projected to win a majority in Parliament, regardless of the timing of elections. Foundational to the party’s platform is the promise of fast-tracked, market-friendly policies, including closer ties to the EU, lower corporate taxes for domestic and international businesses, and major investment projects worth over 10 billion euros, such as port development in Pireaus, a mining project in Skouries, a luxury resort and development at Hellinikon, dozens of smaller projects on Greek islands, and upgrades to the health care and waste management systems, which have been held up for several years by bureaucratic permits and processes.

Conclusion

Not since pre-crisis days has Greece received such positive investor attention or demonstrated such strong potential. After exiting its third IMF bailout program only months ago, Greece has demonstrated a strong resilience, unlocking growth through incremental structural change, and outperforming its regional counterparts and emerging-market peers. Despite the challenges Greece continues to face, its emergence from crisis has prompted a renewed interested in, and a solid foundation for, Greece’s long-term growth story.

Related ETFs

GREK: The Global X MSCI Greece ETF (GREK) invests in among the largest and most liquid companies in Greece.

Global X Research Team

Global X Research Team