Preview

Entry Points and Burning Buildings

Editor’s Note: Inflection Points is a monthly series intended to explore the underlying trends, dynamics and opportunities shaping the thematic investing landscape. Click here to receive future updates via email.

Waiting for an entry point is an all-too-common refrain. Many investors hear or mutter those words when market valuations seem elevated and a selloff piques their interest in buying. Easy to say but hard to do, waiting for an entry point is counterintuitive. Human instinct is to run away from burning buildings, not into them. While buying now may feel like running into a burning building, market conditions could be offering a good entry point into themes that are well below peak valuations with strong fundamentals.

Key Takeaways

- Behavioral economics identifies a number of impediments to successful investing and understanding them may help investors make better decisions.

- Based on data from the last 40 years, at some point during an economic downturn, growth stocks typically become defensive.

- Data Center REITS & Digital Infrastructure, Lithium Battery & Technology, and U.S. Infrastructure Development could offer a mix of growth and stability given valuations well off their peak, rapid sales forecasts, and strong profit margins.

Breaking Behavioral Patterns

Buying low and selling high sounds easy, but thousands of years of human evolution work against investors. Economists like Adam Smith and John Maynard Keynes understood the importance of psychology in economics, but over time, the paradigm of perfectly rational individuals became the norm.1 We humans are not perfectly rational, and for the past 40 years, behavioral economists have shown ways in which people reliably deviate from rational decision-making. Some of them are critical to investing in difficult markets.

One critical behavioral insight is loss aversion. People are more risk averse after they suffer losses and more risk acceptant when they see gains.2 This behavior is the exact opposite of buying low and selling high. Historically, buying the S&P 500 after a 25% decline is a good investment, returning 15% on average over the next year, but investors are hard-wired against acting on the entry point.3

Another insight is the tendency to think in nominal rather real terms.4 For example, many people tend to ignore inflation. A 4% yield on short-term debt may seem attractive after years of low rates, but that rate is less attractive when inflation is 8%. The real return of -4% seems a lot less appealing. The same tendency is true for income gains, which may help explain why even though higher wages still can’t keep up with inflation, consumer spending and sentiment remains healthy.

Acting in ways contrary to these behavioral patterns is difficult. Perhaps the best we can do is learn from historical market activity.

Growth Eventually Becomes Defensive

In every one of the past five recessions going back to the mid-1970s, growth indexes like the Nasdaq and the Russell 1000 Growth outperformed the broader S&P 500.5 Growth tends to be particularly hard hit early on relative to broader equity markets, but as investor focus shifts from tightening liquidity towards slowing growth, segments of the economy that can grow faster become attractive. When this shift occurs varies. In 1980, the growth-oriented Nasdaq bottomed relative to the S&P 500 61 days into the recession. In 1981, growth bottomed after 295 days.6

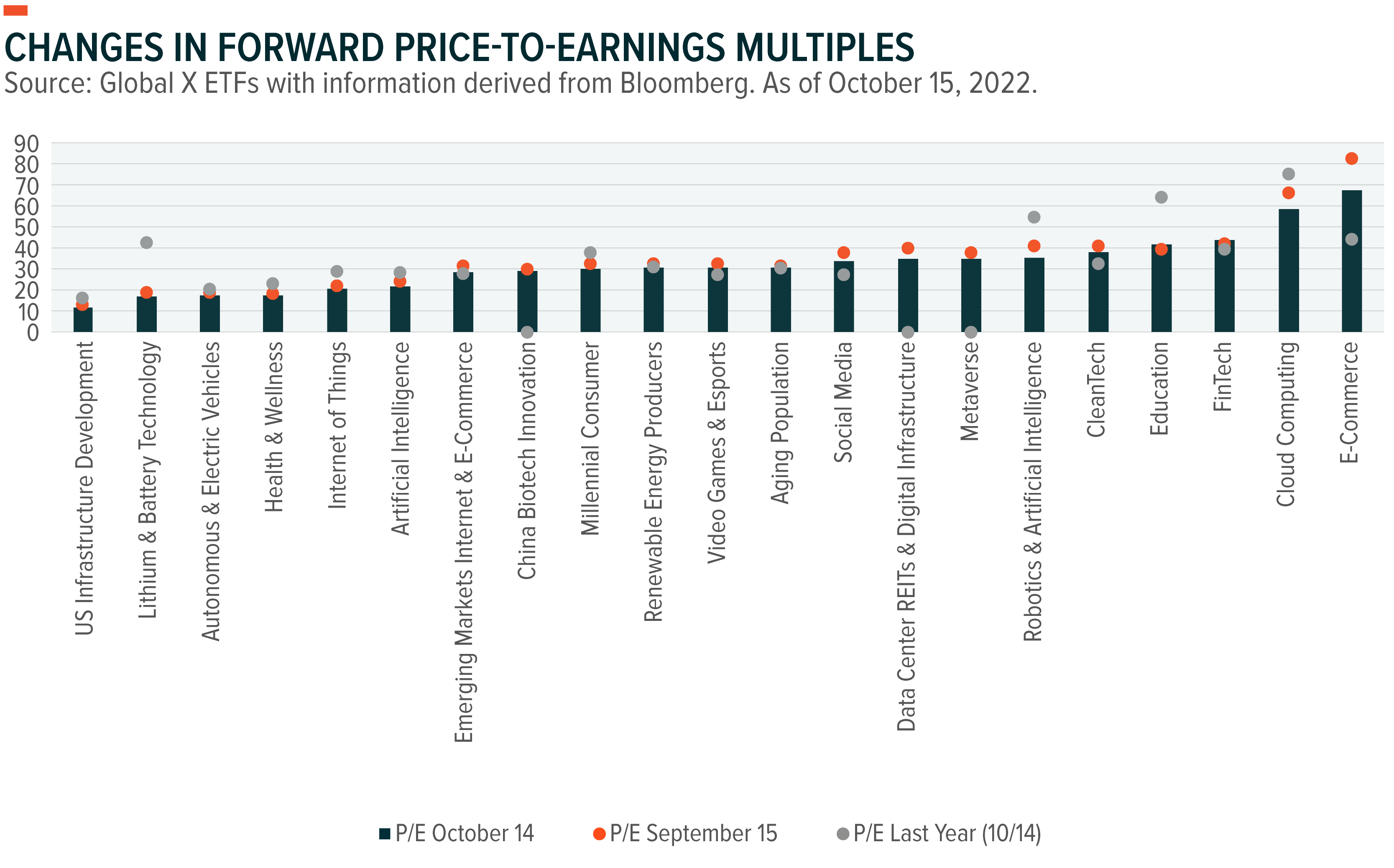

In 2022, growth’s selloff has been much more acute than the broader market’s. The Russell 1000 Growth Index has contracted off from 34x to 22x, compared to a long-term average of 22x.7 By contrast, the S&P 500 forward price-to-earnings multiple has contracted from 23x to 16x, compared to a long-term average of 18x.8

While growth themes continued to struggle overall, several performed on par with the S&P 500’s -9% return during a recent stretch.9 From September 14 to October 14, themes that improved returns from the prior month and performed in line or better than the broad market included Robotics & Automation, Internet of Things, Genomics, Aging Population, and U.S. Infrastructure. The relative success of Robotics & Automation and Internet of Things likely speaks to the continued strength of corporate investment. Genomics and Aging Population captured headlines with new alliances formed for cancer treatment. U.S. Infrastructure remained resilient and defensive.

Tactical Thematic Framework: Valuation, Growth, and Profitability

Amid uncertainty, focusing on growth alone may introduce vulnerability, but growth themes that experienced meaningful price compression in 2022 may provide an offset owning to cheaper valuations. Given that interest rates are meaningfully higher than the beginning of the year, profitability is now even more important. Companies with higher profitability will have less need to access the capital markets amid rising rates and depressed equity values with more resources to invest for growth.

Data Center REITs & Digital Infrastructure, Lithium & Battery Technology, and U.S. Infrastructure Development themes combine high growth, compressed multiples, and healthy operating margins. Combining these themes could prove a successful strategy for thematic investing in the coming months (Chart 1).

Data Center REITs & Digital Infrastructure companies’ valuation compressed meaningfully this year, but they are forecast to deliver rapid sales growth of 55% through 2023.10 Unlike the broader REITS sector, these companies are not as susceptible to a consumer or economic slump since they provide critical services to enterprises. Demand for data center capacity tripled in the first half of 2022, and firms are expected to add 20% more capacity.11 Through this theme, investors can gain exposure to a 12-month trailing operating margin of 23% following a selloff that has forward price-to-earnings down 19x.12

Lithium & Battery Technology is another theme that seems well-positioned after forward price-to-earnings for its companies declined to 15x from 39x in January.13 Battery demand is accelerating with electric vehicles (EV) sales growing 43% by 2023.14 The US EV market more broadly is forecasted to grow from 446,000 units in 2021 to almost 2.3 million by 2030, and suppliers will struggle to keep pace, likely keeping prices elevated.15 Companies delivered operating margins of 9% over the past 12 months and reduced leverage to 49% from 68% in 2019.16

The final theme highlighted here may be surprising: U.S. Infrastructure Development. The 2021 “infrastructure trade” may have passed, but the unwind has created a potential buying opportunity. U.S. infrastructure companies’ valuations have compressed from 22x to 15x in 2022, but the companies are still expected to grow their topline by 16% through 2023.17 Their market performance has been resilient year-to-date, outperforming the S&P 500 by almost 7%.18 Longer-term, the Infrastructure Bill from 2021 only accounted for $1.2 trillion of the estimated $2.6 trillion in infrastructure spending over the next 10 years, and private sector investment may be positioned to help fund the shortfall.19 While operating margins were a robust 13% in the trailing 12 months, the industry has been de-leveraging with its debt-to-equity ratio falling to 79% in 2022 from 92% in 2019.20

Inflection Point Theme Dashboard