The path of least resistance for the equity markets may actually be higher from here. Even with their strong performance so far this year, I view equity markets like a coiled spring, building tremendous potential energy that could be unleashed resulting in rapid valuation expansion. Interest rate hikes and geopolitical challenges remain, but those risks likely represent short-term palpitations rather than catalysts for a sustained downward move. The economy is fragile, but with numerous green shoots and silver linings underlying the equity markets, investors who are under allocated to equities and growth might want to reconsider positioning.

Key Takeaways

- Elevated pessimism, large positions in money markets, and the peaking interest rate cycle could be a powerful combination that drives markets higher.

- Conservative allocations along with under exposure to equity and growth assets could mean many investors have not fully participated in this year’s equity rally and that there is more fuel for an advance.

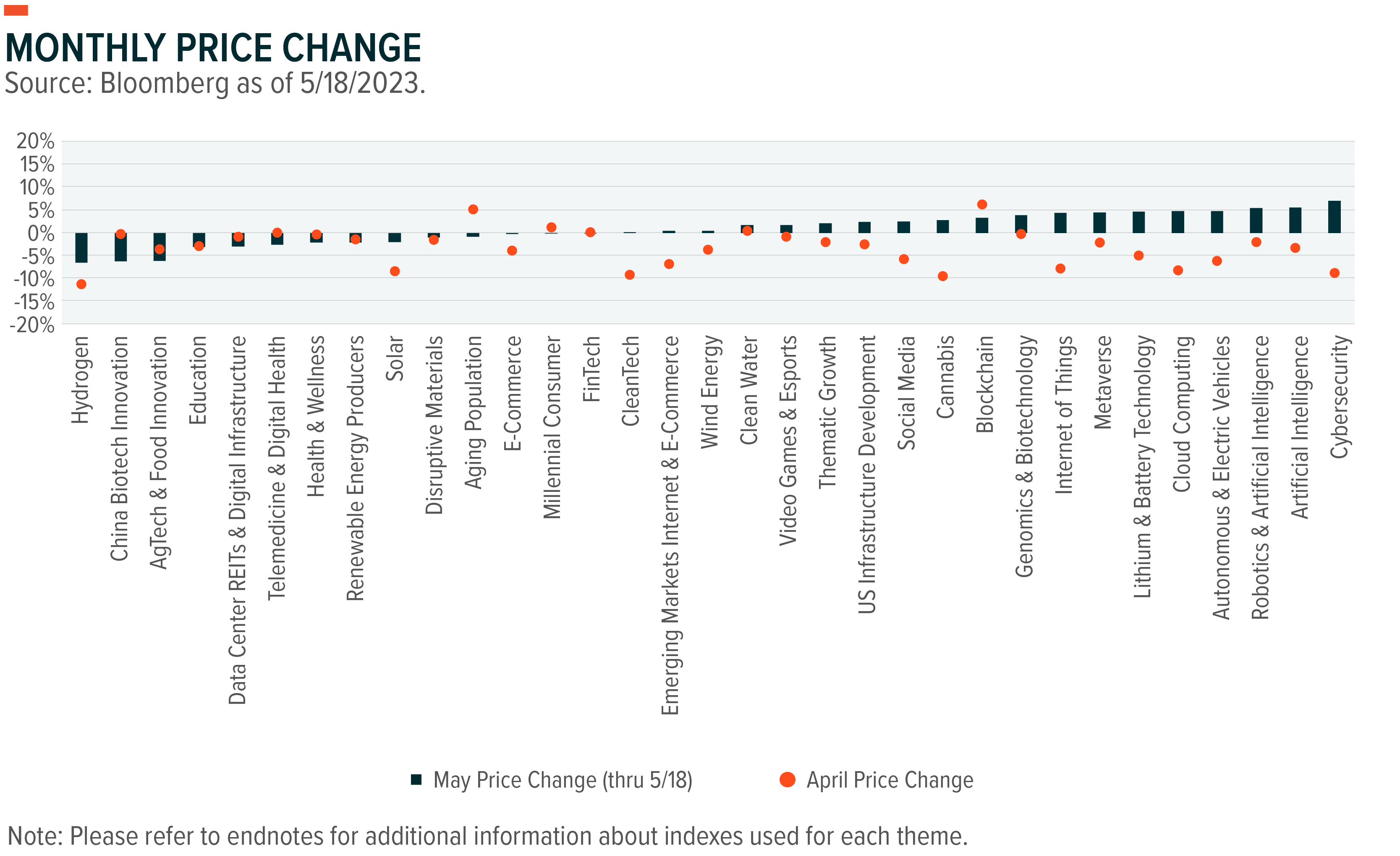

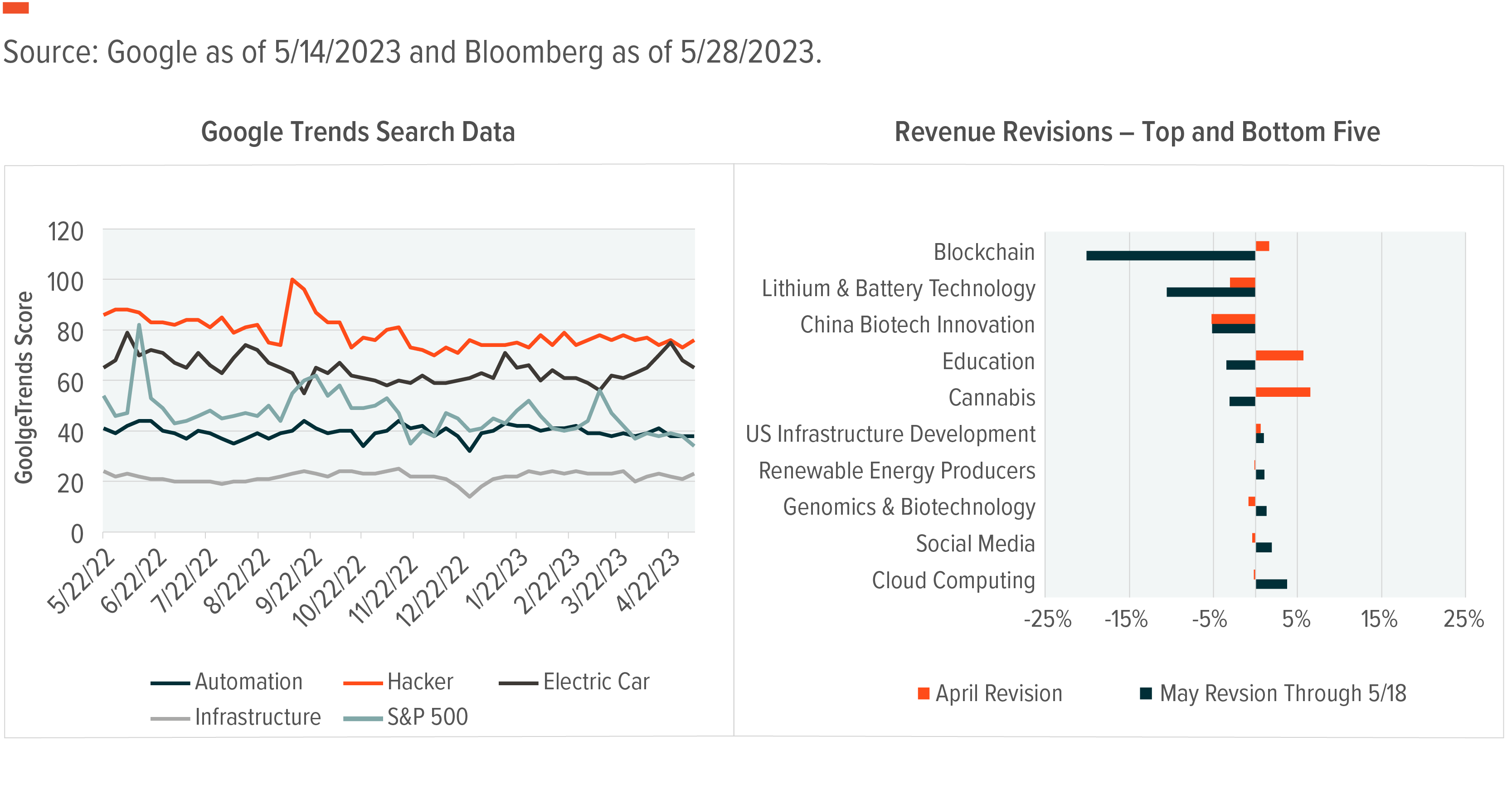

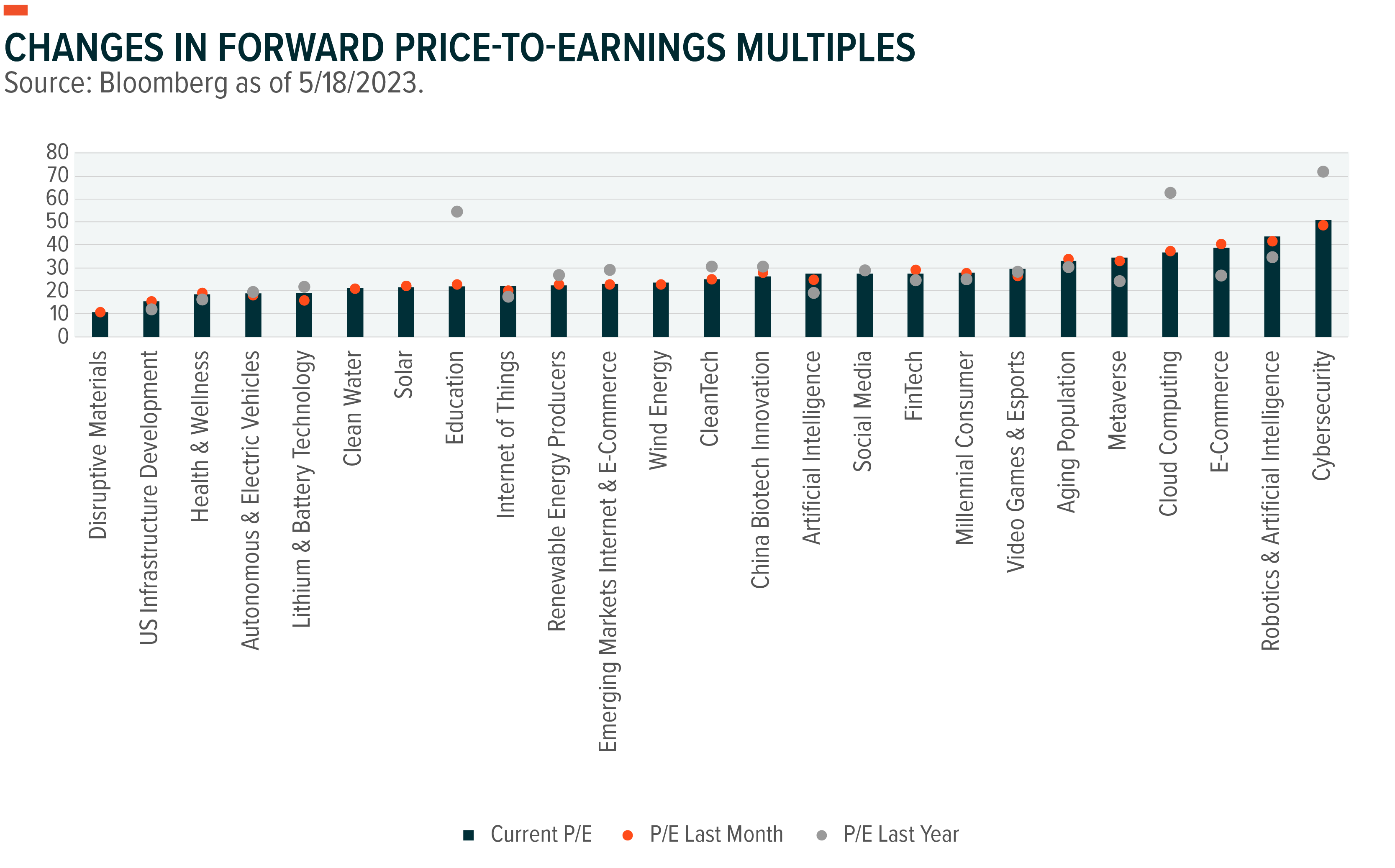

- Consider themes with momentum like Robotics & Artificial Intelligence and Cybersecurity as well as contrarian under-owned areas like Millennial Consumers, E-commerce, and CleanTech.

Pessimism, Cash, and Rates Can Push Stocks Higher

While we started the year optimistic, that was not a consensus view.1 A slew of annual outlooks delivered pessimistic views on markets and returns for 2023, and that perspective remains rather persistent.2 Even as major indexes moved higher, earnings expectations fell alongside economic growth forecasts.

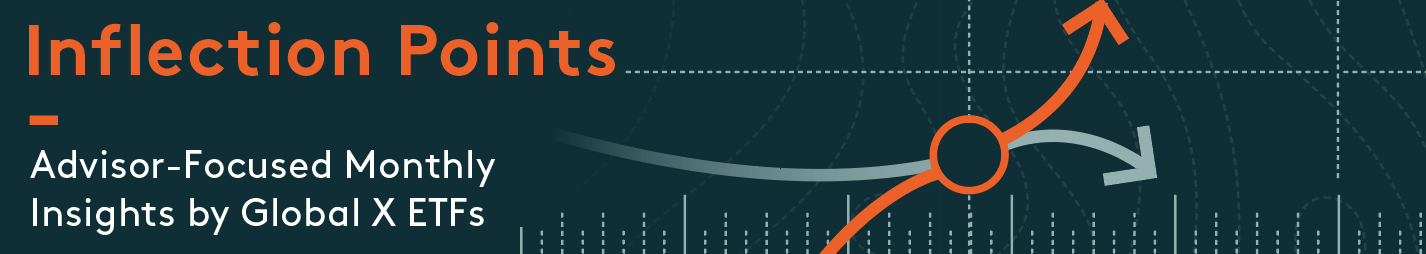

The AAII Bullish-Bearish Sentiment Indicator reflects this viewpoint and is firmly in bearish territory more than one standard deviation below the average reading (see chart).3 The indicator is not at peak bearishness, but it does highlight that many respondents remain cautious and are skeptical about the about the market’s run up. Important to note is that extreme bearish investor sentiment is usually a positive signal for equities, leading to a shift that typically brings money into stocks.4

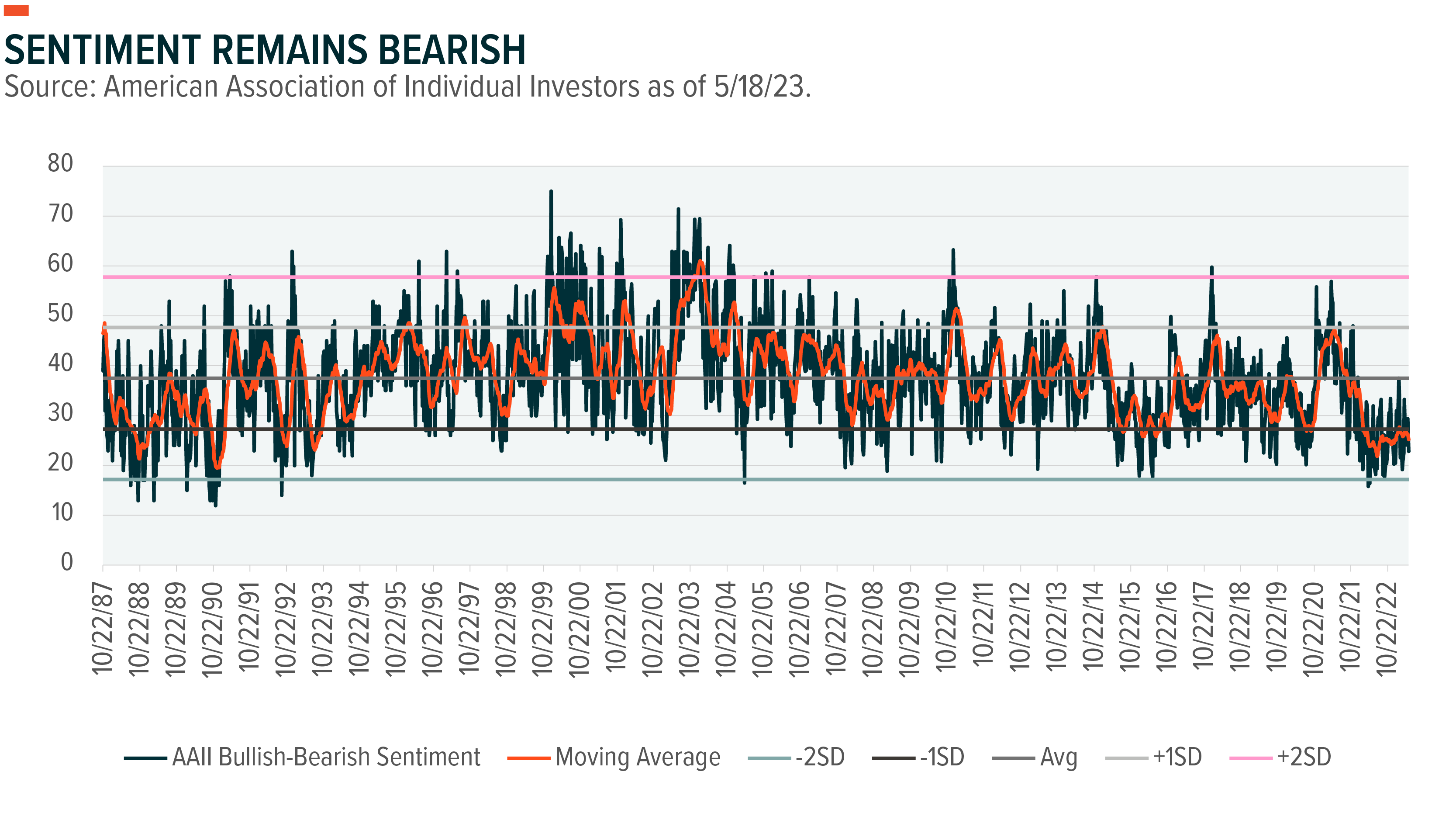

Coinciding with bearish sentiment and higher short-term rates, flows into money markets reached an all-time high in May 2023. Currently, cash in money market accounts totals over $5.3 trillion, an increase of 13% year-to-date.5 Prior to the pandemic in January 2019, cash in money markets was just $3.6 trillion. Yields that exceeded 5% for the first time in a decade combined with uncertainty about the stock market positioned money markets as a potentially attractive opportunity.

Typically, funds in money markets increase over time, but as the chart shows, pullbacks happen. Each time there was a sustained drawdown in money market funds, often after a sharp run-up, the S&P 500 moved meaningfully higher.6 Movement out of money markets does not guarantee fund flow into equities, but the historical patterns suggest that stocks are a beneficiary.

Several catalysts could push funds out of money markets and into equities, in my view. One would be a positive shift in sentiment over the economy and company prospects in general. Another catalyst could be concern over the debt ceiling in the near term. U.S. government treasuries and repos comprise a substantial part of the money market, and political tensions mounting from a lack of compromise could put those assets at risk.7 The prospect of lower rates in money markets and returns below 5% could also spur movement of capital to other asset classes.

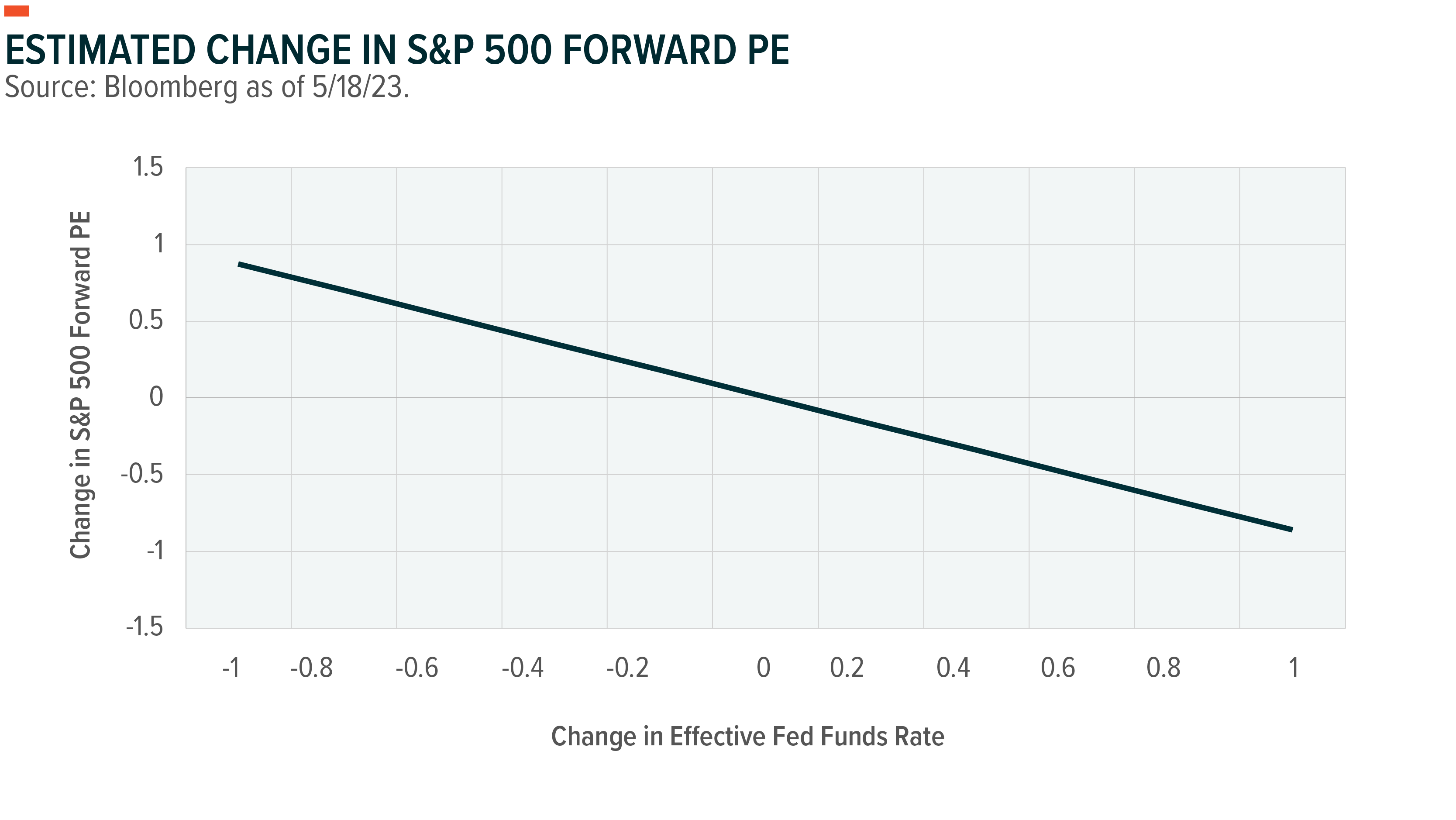

Peaking rates could also push stocks higher. The notion that financial assets struggle in higher interest rate environments is simply not true. There is no inverse correlation between interest rate levels and equity multiples.8 Forward PE multiples respond to changes in rates rather than the level. An inverse correlation exists between changes in rates and changes in multiples (see chart).

Much of the hiking cycle is probably over. Even if the Fed hikes by another 25bp or even 50bp, it will be a small move relative to the 525bp already implemented. The next logical step is a Fed pause. While the Fed may well keep rates higher for longer if inflation remains high and the economy can sustain those rates, the next sustained trend in interest rates is likely downward. This move historically triggers multiple expansion that could contribute to higher equity prices.

A 1% change in rates is correlated with a 0.9 point increase in the S&P forward PE multiple.9 Very quickly investors might be staring at valuation expansion and multiples in the 20s, pushed by this powerful trifecta of pessimism, money market allocations, and peaking rates.

Still Positioning for Risks

The path of least resistance may be higher for equities, but that does not mean the ride will be smooth. A mix of geopolitical and economic events could upset markets. The debt ceiling seems like a problem in the rearview mirror (hopefully), for the next two years, but the compromise could still slow the economy further and drawn-out debate could weigh on sentiment.10

Inflation numbers may increase modestly at the end of the summer as the most extreme readings of the past 12 months roll off.11 For markets, the hope in that scenario is that the Fed looks through that data and is content with a slow return to 3–4% CPI.

Companies have continued to surprise with relatively strong results and forecasts the past few quarters.12 The risk to corporate earnings is that sales slow and margins compress simultaneously as inflation lingers.13 For now, consumer and corporate spending continue to power along.

Geopolitical challenges are another threat, including potential nuclear brinkmanship in the Ukraine-Russia conflict or further deterioration of the already tenuous U.S.-China relationship.

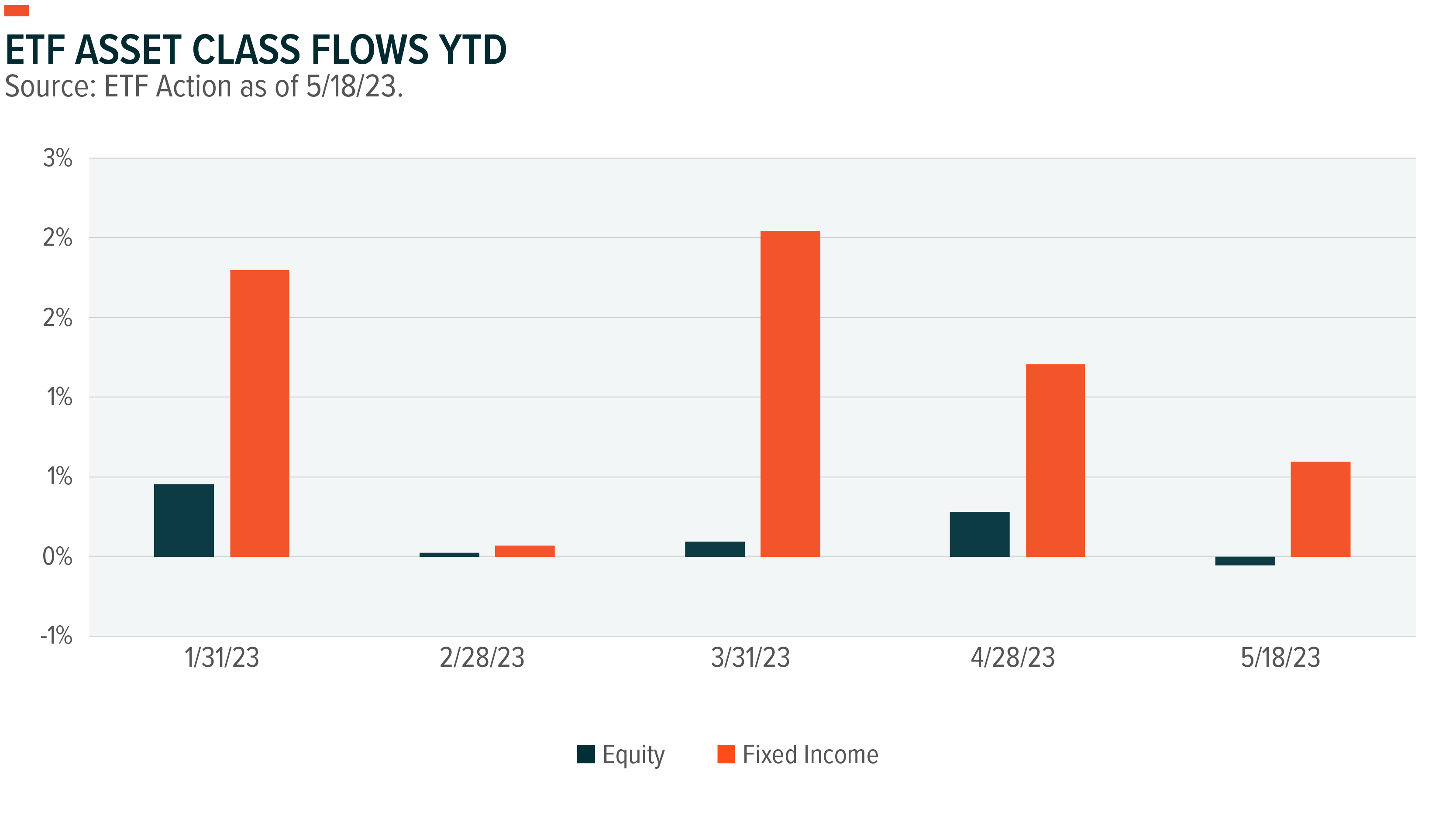

Considering these risks, investor positioning remains relatively conservative this year (see chart). Even in the equity-heavy realm of ETFs, flows have been conservative and skewed to fixed income.14 Flows into fixed income ETFs beat flows into equity ETFs by $36 billion through May 2023. On a relative basis, fixed income has added 6% to AUM this year and equity less than 1%.

Contrarian and Under-Owned Themes

Flows suggest that investors may be under allocated to stocks, which is notable because the big story so far this year is the strong performance of broad-based indexes, partially on support from mega-caps. The S&P 500 is up 9% year-to-date, but the equal weight index is up only 1%.15 The growth and tech-oriented Nasdaq has performed better, and so has the equal weight. The Nasdaq 100 is up 26%, with less mega-cap exposed equal weight still delivering 13% returns. The takeaway is that the big names are not the sole drivers of returns this year, but growth and tech more generally have outperformed.

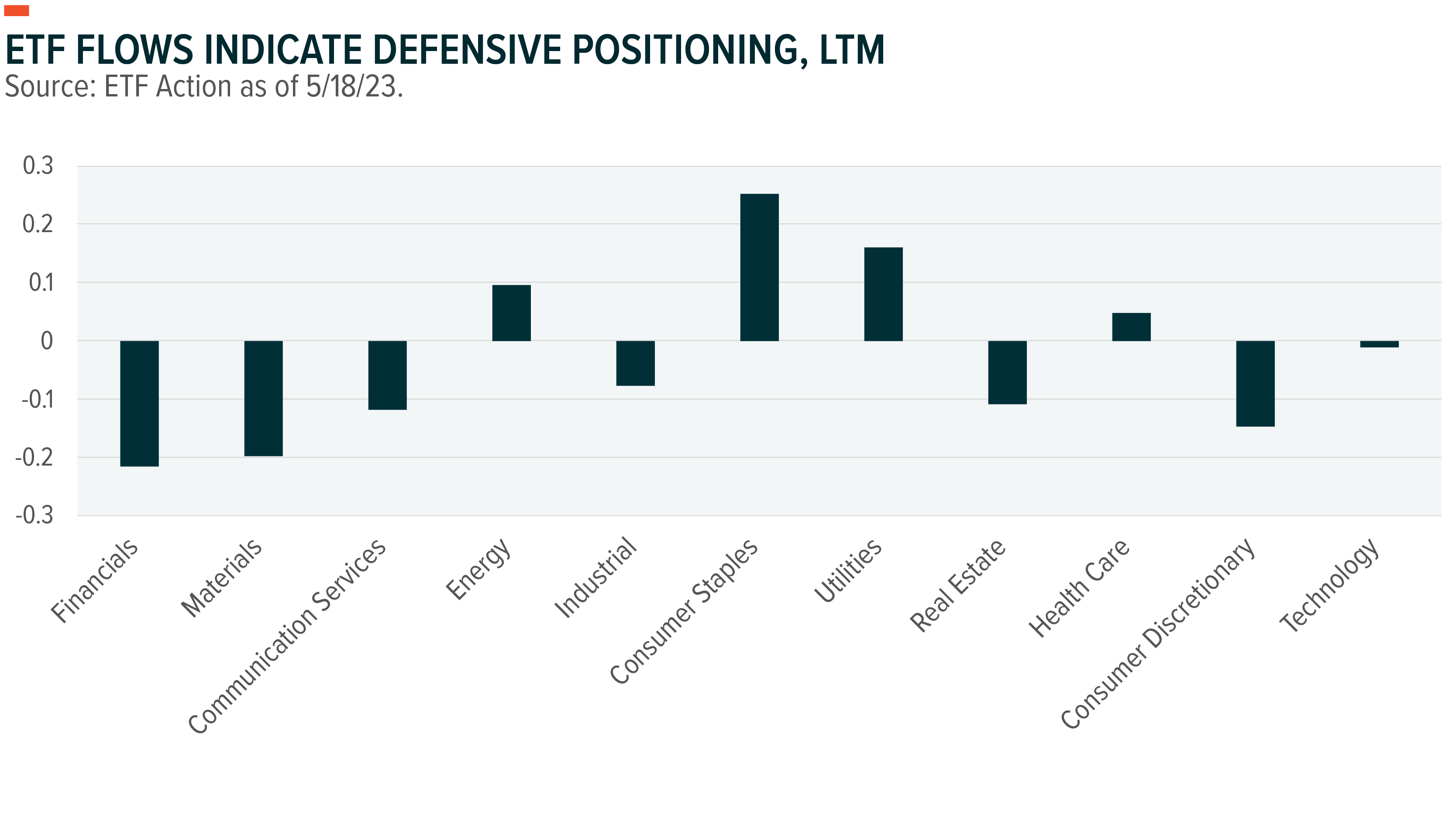

Part of this story may tie to allocation. Over the past 12 months, funds moved into defensive sectors like Consumer Staples and Utilities and out of cyclicals like Consumer Discretionary and Materials (see chart).16 These potentially under-owned segments could benefit from a reversion should markets continue their ascent with funds flowing out of defensive and back into cyclical opportunities.

Many of the themes covered in these pages recently, such as Robotics & Artificial Intelligence, Internet of Things, and Cybersecurity, have performed well thus far in 2023.17 These themes have momentum, and the combination of news catalysts and potentially attractive valuations suggests that they can continue to do well in a strong market.

That said, the recent dispersion in sector allocations suggests that contrarian investors may find interesting opportunities. For example, consumer-focused areas have started to turn around after a difficult 2022, and they could have more fuel in the tank. Themes like Millennial Consumers, E-commerce, and Video Games & Esports could offer exposure to faster-growing segments tied to Consumer Discretionary.

Themes with Energy, Materials, and Industrials exposure are another potential contrarian opportunity should pessimism begin to fade and the worst of economic predictions fail to play out. Cyclical parts of the economy could come back into focus and attract flows. Some interesting opportunities here include themes like U.S. Infrastructure, CleanTech, and Disruptive Materials.

No one can predict when pessimism recedes, cash moves out of money markets, and the Fed gets serious about a pivot. When they do, having exposure to these contrarian and under-owned themes alongside the current momentum plays may offer investors compelling return potential.

Inflection Point Theme Dashboard

Scott Helfstein

Scott Helfstein