The Global X Research Team is pleased to release the distribution and premium numbers for our covered call ETFs for January 2024. Global X’s Covered Call suite of ETFs generally invest in the underlying securities of an index and sell call options on that index, an ETF tracking the underlying equity index, or a similar equity index. These strategies are designed to provide investors with an alternative source of income, while offering different sources of risks and returns to an income-oriented portfolio.

Click here to download the January 2024 Covered Call Report

Implied volatility metrics that forecast the price movements of some major equity indices within the United States bounced off three-year lows during the most recent roll period for the Global X Covered Call Suite. Indeed, The Cboe Volatility Index (VIX) and the Cboe Nasdaq-100 Volatility Index (VXN) established two-month highs of 15.40 and 19.41, respectively, in late January owing to the release of some economic data that fueled the higher-for-longer interest rate narrative. Sentiment was influenced by a December-period retail sales report that showed core sales, which excludes automotives, gasoline, building materials, and food services, rising 0.4% versus an estimated 0.2%.1 Better-than-expected initial jobless claims also implied maintained strength of the broader domestic economy.2 In this environment, the probability that the Federal Reserve would incorporate its first interest rate cut of the current cycle in March fell from 74% in late December to less than a coin flip.3

For the roll period ending January 19, 2024, rising levels of volatility positively impacted the premiums received across the scope of the Global X Covered Call Suite. Discounting those funds that maintain holdings in indexes featuring environmental, social, and governance tilts, as well as those that write covered calls on the Dow 30, all premium values exhibited positive sequential trends.

Past performance is not a guarantee of future results. For performance data current to the most recent month- or quarter-end or a copy of the Fund prospectus, please visit QYLD, QYLE, XYLD, XYLE, DJIA, RYLD, EMCC, QYLG, XYLG, RYLG, DYLG, TYLG, HYLG, FYLG.

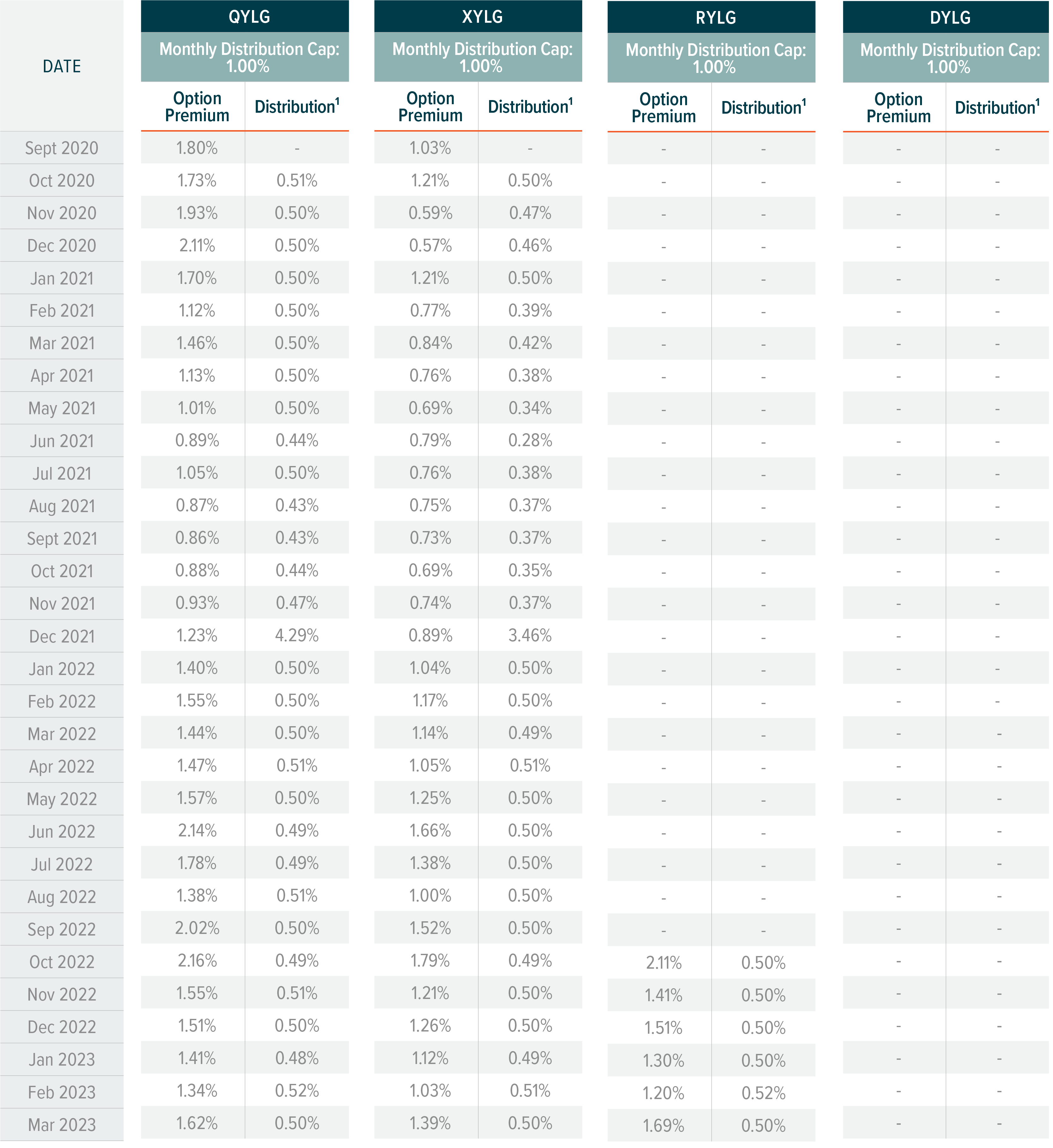

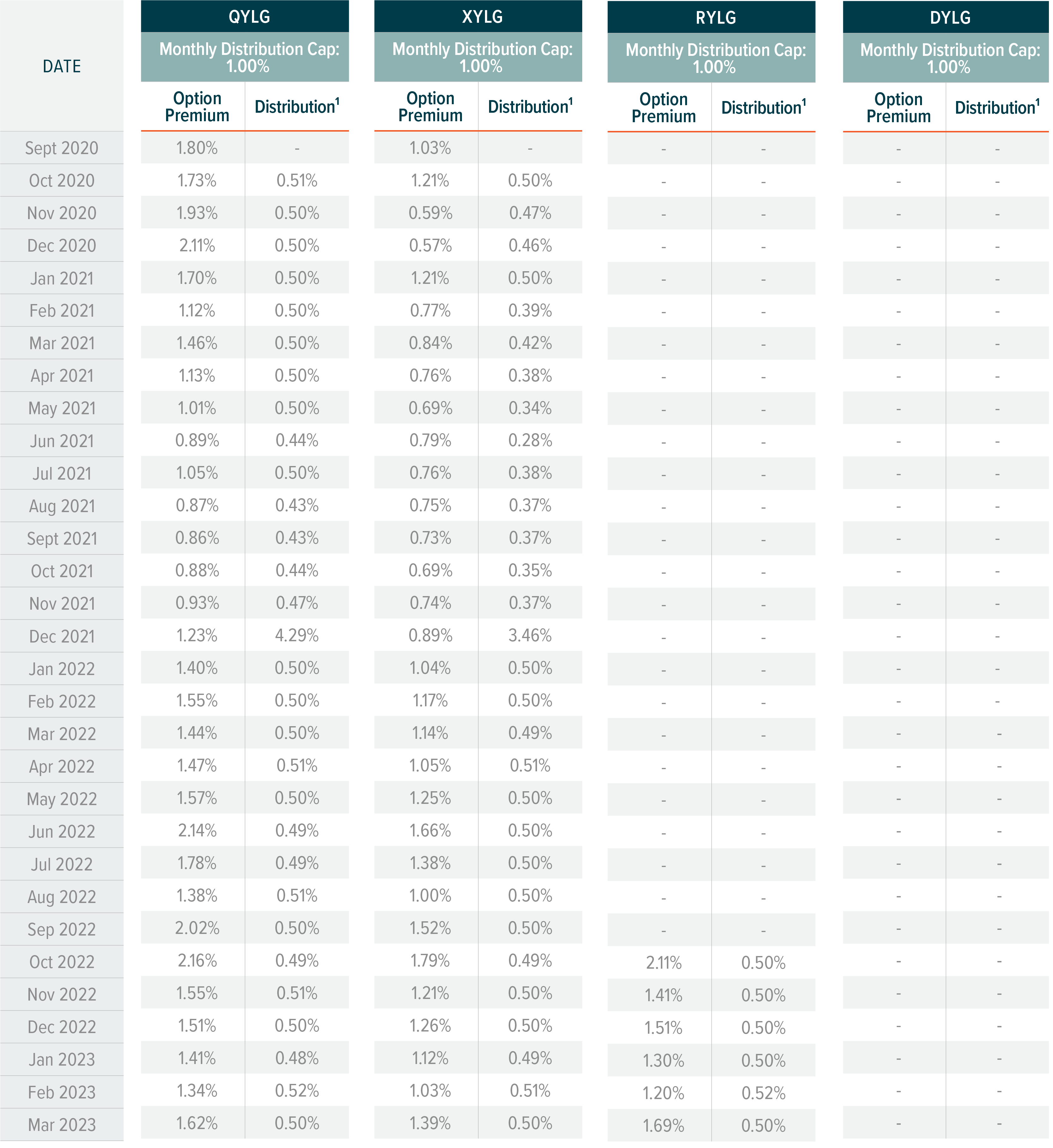

1As a general guideline, the monthly distribution for the funds is approximately capped at the lower of: a) half of premiums received, or b) 1% of net asset value (NAV). The excess amount of option premiums received, if applicable, is reinvested into the fund. Year-end distributions can exceed the general guideline due to capital gains that are paid out at the end of the year.

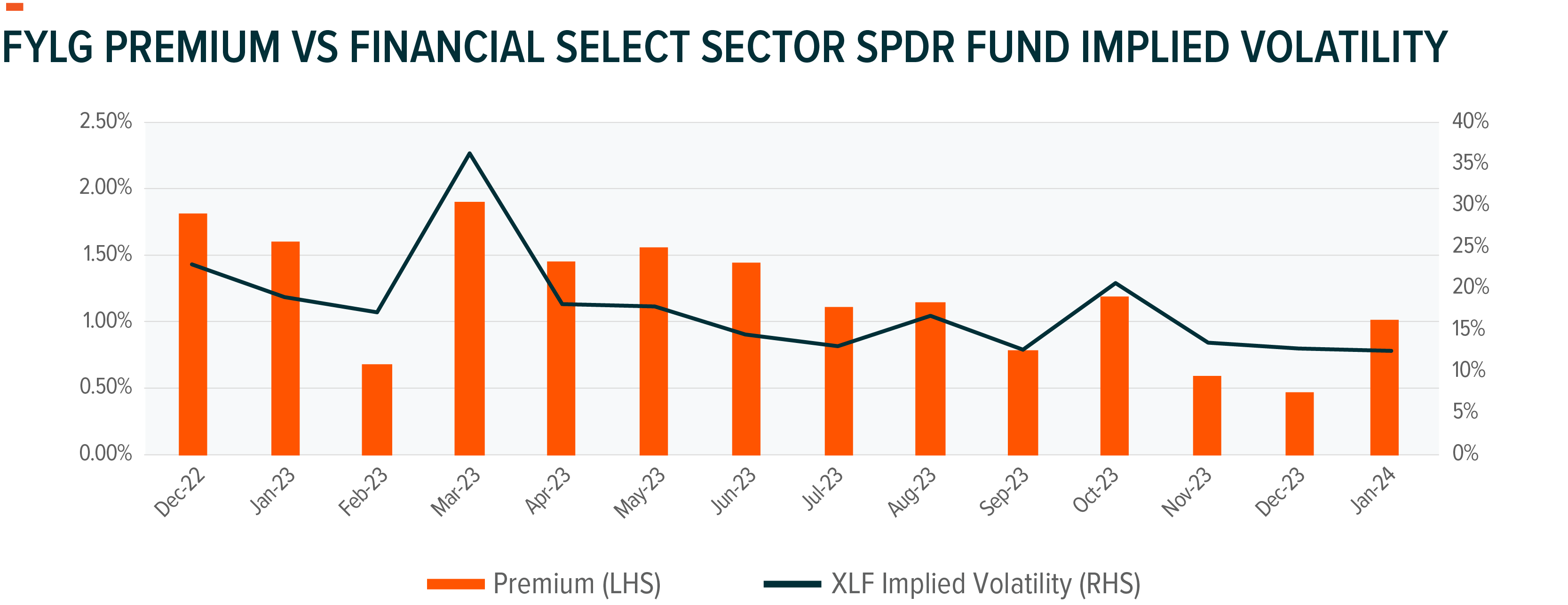

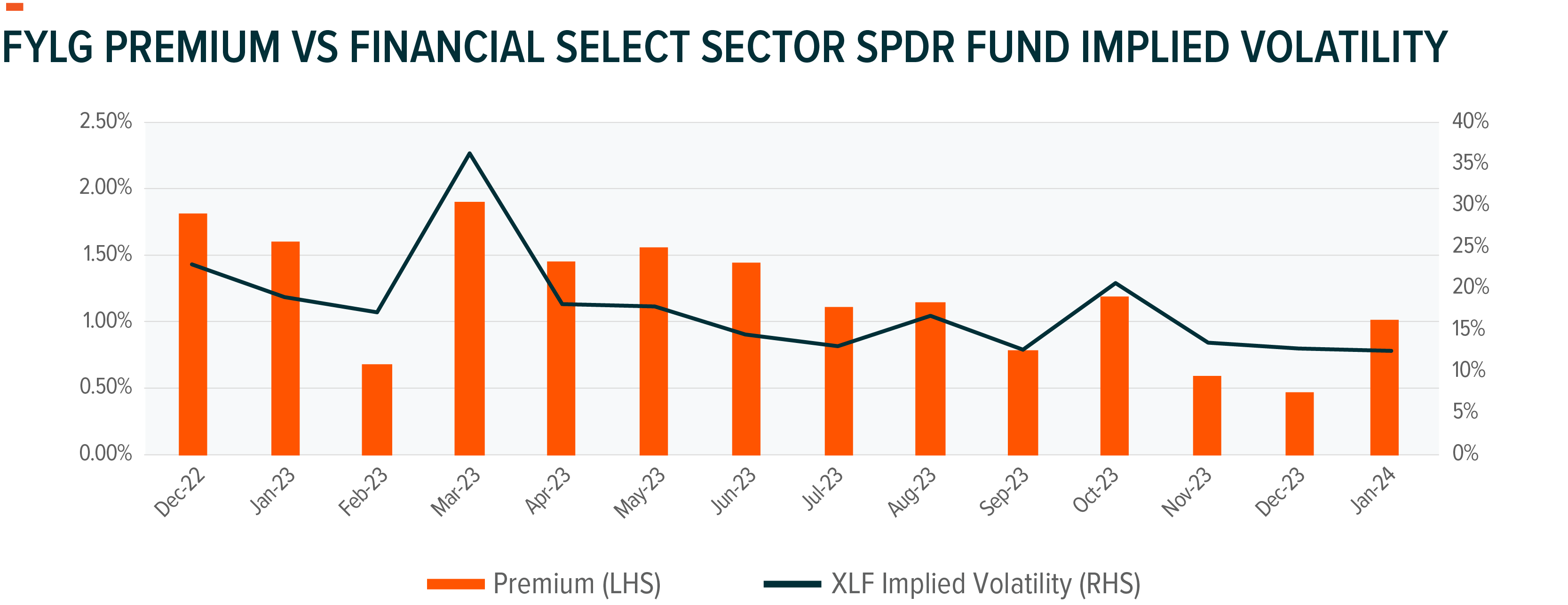

Implied volatility of Financial, Health Care, and Technology Select Sector SPDR Funds are calculated using Bloomberg 30 Day IVOL at 100% Moneyness LIVE (Listed Implied Volatility Engine), which is a hypothetical implied volatility measure devised using historical option pricing data on the respective funds on contracts with 30 days until expiration and strike prices that are at the money.

Options Premiums vs. Implied Volatility graphs include implied volatility for the Nasdaq 100, S&P 500, Russell 2000, and Dow Jones Industrial Average Indexes. QYLE, QYLG, XYLG, DYLG, and RYLG write covered calls on these same, aforementioned equity indices, thus, their premiums are not displayed here. DYLG, XYLE and EMCC have only rolled their options portfolios six, eleven, and three times, respectively. Therefore Options Premiums vs. Implied Volatility graphs are currently not displayed for these ETFs and are expected to be added once more option premium data is received.

To learn more about our covered call options, read the latest research from Global X, including:

Related ETFs

QYLD – Global X Nasdaq 100 Covered Call ETF

XYLD – Global X S&P 500 Covered Call ETF

RYLD- Global X Russell 2000 Covered Call ETF

DJIA – Global X Dow 30 Covered Call ETF

EMCC – MSCI Emerging Markets Covered Call ETF

QYLG – Global X Nasdaq 100 Covered Call & Growth ETF

XYLG – Global X S&P 500 Covered Call & Growth ETF

RYLG – Global X Russell 2000 Covered Call & Growth ETF

DYLG – Global X Dow 30 Covered Call & Growth ETF

TYLG – Global X Information Technology Covered Call & Growth ETF

HYLG – Global X Health Care Covered Call & Growth ETF

FYLG – Global X Financials Covered Call & Growth ETF

QYLE – Global X Nasdaq 100 ESG Covered Call ETF

XYLE – Global X S&P 500 ESG Covered Call ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Click here to download the January 2024 Covered Call Report

Implied volatility metrics that forecast the price movements of some major equity indices within the United States bounced off three-year lows during the most recent roll period for the Global X Covered Call Suite. Indeed, The Cboe Volatility Index (VIX) and the Cboe Nasdaq-100 Volatility Index (VXN) established two-month highs of 15.40 and 19.41, respectively, in late January owing to the release of some economic data that fueled the higher-for-longer interest rate narrative. Sentiment was influenced by a December-period retail sales report that showed core sales, which excludes automotives, gasoline, building materials, and food services, rising 0.4% versus an estimated 0.2%.1 Better-than-expected initial jobless claims also implied maintained strength of the broader domestic economy.2 In this environment, the probability that the Federal Reserve would incorporate its first interest rate cut of the current cycle in March fell from 74% in late December to less than a coin flip.3

For the roll period ending January 19, 2024, rising levels of volatility positively impacted the premiums received across the scope of the Global X Covered Call Suite. Discounting those funds that maintain holdings in indexes featuring environmental, social, and governance tilts, as well as those that write covered calls on the Dow 30, all premium values exhibited positive sequential trends.

Past performance is not a guarantee of future results. For performance data current to the most recent month- or quarter-end or a copy of the Fund prospectus, please visit QYLD, QYLE, XYLD, XYLE, DJIA, RYLD, EMCC, QYLG, XYLG, RYLG, DYLG, TYLG, HYLG, FYLG.

1As a general guideline, the monthly distribution for the funds is approximately capped at the lower of: a) half of premiums received, or b) 1% of net asset value (NAV). The excess amount of option premiums received, if applicable, is reinvested into the fund. Year-end distributions can exceed the general guideline due to capital gains that are paid out at the end of the year.

Fund Premiums and Implied Index Volatility

Implied volatility of Financial, Health Care, and Technology Select Sector SPDR Funds are calculated using Bloomberg 30 Day IVOL at 100% Moneyness LIVE (Listed Implied Volatility Engine), which is a hypothetical implied volatility measure devised using historical option pricing data on the respective funds on contracts with 30 days until expiration and strike prices that are at the money.

Options Premiums vs. Implied Volatility graphs include implied volatility for the Nasdaq 100, S&P 500, Russell 2000, and Dow Jones Industrial Average Indexes. QYLE, QYLG, XYLG, DYLG, and RYLG write covered calls on these same, aforementioned equity indices, thus, their premiums are not displayed here. DYLG, XYLE and EMCC have only rolled their options portfolios six, eleven, and three times, respectively. Therefore Options Premiums vs. Implied Volatility graphs are currently not displayed for these ETFs and are expected to be added once more option premium data is received.

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about our covered call options, read the latest research from Global X, including:

- Enhancing Retirement Portfolios with Global X’s Options Strategies

- Covered Call Strategies, Explained

- QYLD – Exploring the Case for a Nasdaq 100 Covered Call Strategy

Related ETFs

QYLD – Global X Nasdaq 100 Covered Call ETF

XYLD – Global X S&P 500 Covered Call ETF

RYLD- Global X Russell 2000 Covered Call ETF

DJIA – Global X Dow 30 Covered Call ETF

EMCC – MSCI Emerging Markets Covered Call ETF

QYLG – Global X Nasdaq 100 Covered Call & Growth ETF

XYLG – Global X S&P 500 Covered Call & Growth ETF

RYLG – Global X Russell 2000 Covered Call & Growth ETF

DYLG – Global X Dow 30 Covered Call & Growth ETF

TYLG – Global X Information Technology Covered Call & Growth ETF

HYLG – Global X Health Care Covered Call & Growth ETF

FYLG – Global X Financials Covered Call & Growth ETF

QYLE – Global X Nasdaq 100 ESG Covered Call ETF

XYLE – Global X S&P 500 ESG Covered Call ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Category:Income