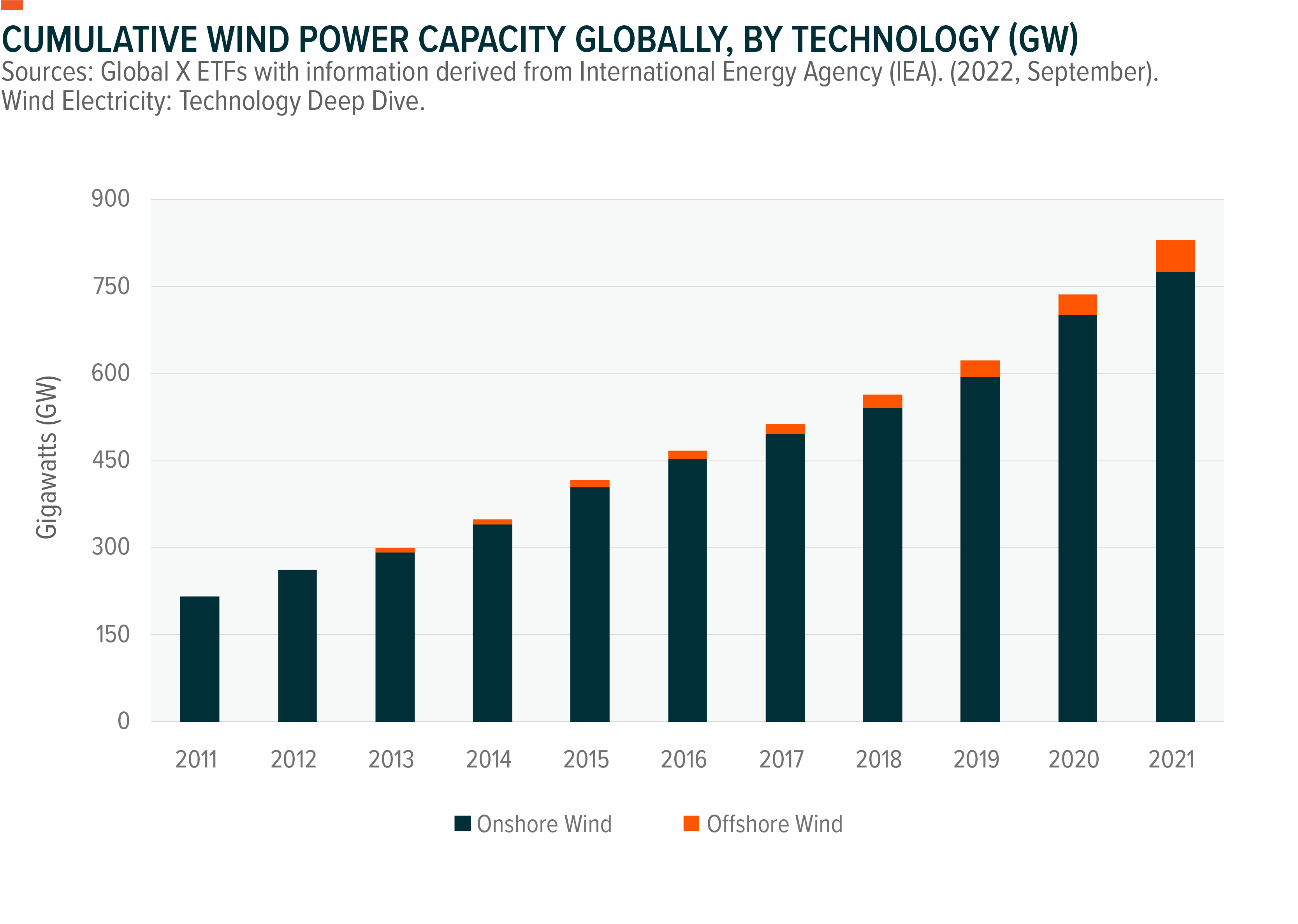

The world’s starting to turn its gaze offshore for power. Historically, onshore projects dominate the wind power sector’s project pipeline. Currently, 93% of global wind power capacity is onshore.1 However, better technology, lower costs, and more policy support for renewable energy are making offshore wind power attractive. These factors coupled with built-in advantages such as proximity to coastal demand centers can close the gap with onshore. With offshore wind capacity forecast to more than triple through 2027, we expect compelling investment opportunities to emerge across the wind power value chain, including renewables developers and wind power turbine manufacturers.2

Key Takeaways

- Offshore wind power is increasingly seen as viable in the global decarbonization effort due to its wide range of benefits and increasing cost competitiveness.

- The most mature offshore wind power markets are in Europe and Asia, where developers have a significant number of projects under construction.

- The U.S. has been a laggard in offshore wind power, but we expect comprehensive state- and federal-level investments to create significant opportunities.

Offshore Wind Industry Becoming More Competitive

Advancements in fixed and floating offshore wind technologies, lower project costs, and increased policy support are making offshore wind power projects much more attractive versus their onshore counterparts.

Offshore wind power projects also have certain built-in advantages. For example, offshore wind power projects can be more operationally predictable and efficient than onshore projects due to higher wind speeds and more consistent wind conditions.3 When combined with larger offshore wind turbines, offshore wind projects can use fewer turbines to create the same amount of energy as an equivalent onshore project.

Another advantage is that offshore projects can often be built much closer to high-demand electricity areas near major coastal cities. Looking at the geographically expansive United States, the strongest onshore wind resources are in the middle of the country, far from coastal cities with the highest electricity demand.4 Offshore wind power can reduce the need to build costly cross-regional transmission and distribution (T&D) infrastructure, which often face permitting challenges and can delay onshore wind power project timelines. In addition, offshore wind power projects can be beneficial in countries where land is scarce, such as Japan and South Korea.

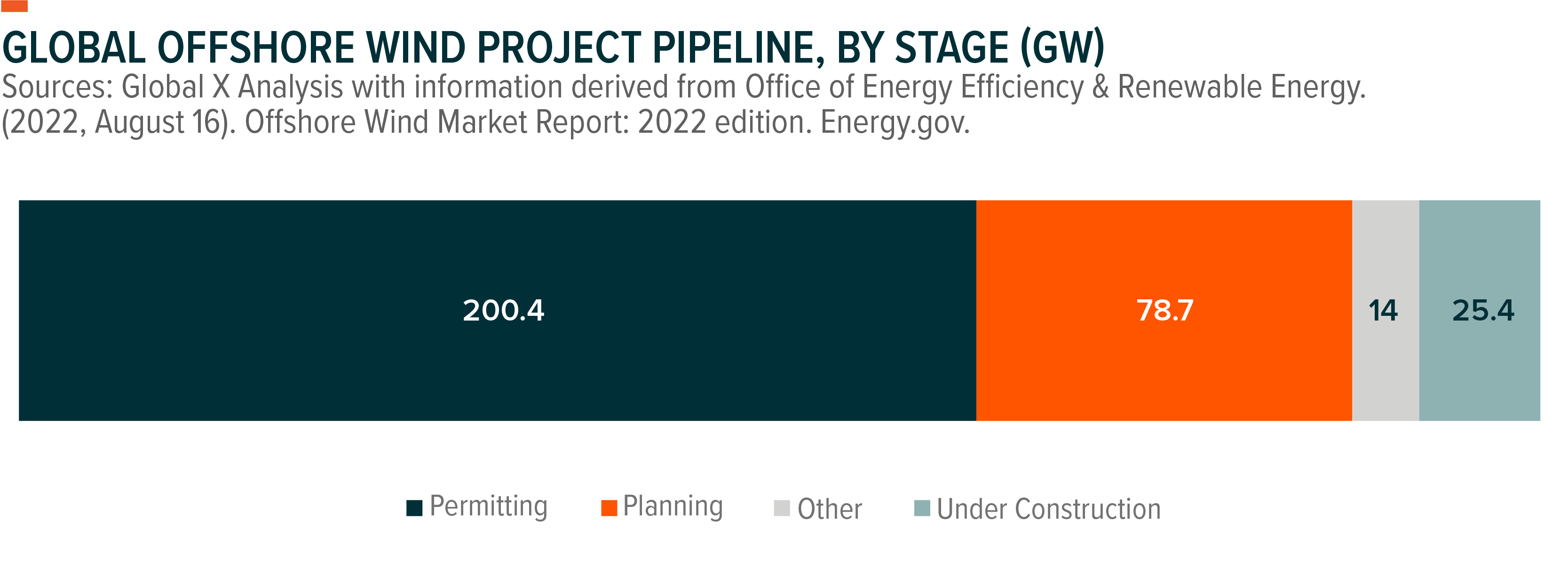

For these reasons, many national and sub-national governments around the world are ramping up policy support to develop offshore wind power projects through project tenders, wind lease area auctions, and financial incentives. The project pipeline totals nearly 320 gigawatts (GW) in potential project capacity.5 Over the medium term, global offshore wind capacity could increase by 3.5x from 50.6GW in 2021 to 177.5GW by 2027.6

Europe and Asia Lead the Way in Increasingly Global Offshore Wind Industry

Europe and Asia are the most mature markets in the offshore wind power industry, which is only about 20 countries strong, versus the 115 countries with established onshore systems.7 Many leading offshore wind equipment manufacturers and project developers are headquartered in these two regions, including Siemens Gamesa in Spain, Vestas and Ørsted in Denmark, and Nordex in Germany.

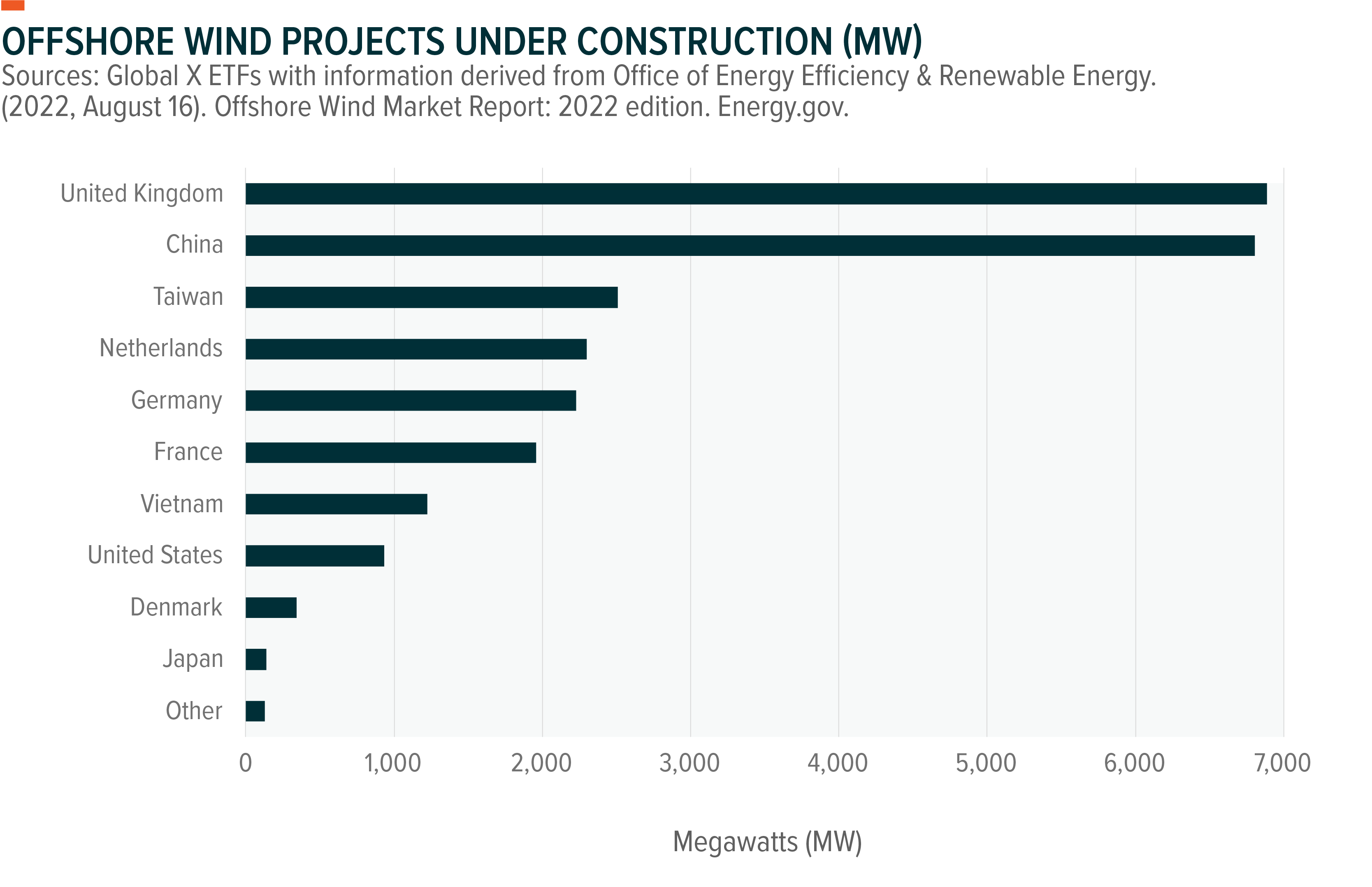

Despite their mature nature, the potential investment opportunity in the established offshore wind markets is significant. Germany, Denmark, Netherlands, and Belgium estimate that their joint offshore wind targets require at least €135 billion (~$146.5 billion) in total investments.8 In Asia, investments could reach $294 billion between 2026 and 2030 as countries race to hit 2030 capacity targets.9 The most offshore projects under construction are in China, the U.K., Taiwan, the Netherlands, Germany, and France.10

Strong policy support is a common thread in the development of the leading offshore wind markets. For example, national and sub-national governments in China have long-term capacity targets totaling more than 150GW of offshore wind, providing visibility and clear market signals even with the end of a national offshore wind power subsidy.11 For context, China’s installed offshore wind capacity totaled 25GW as of June 2022.12

In Europe, national and regional policies and billions in financial support schemes offer long-term visibility to offshore wind industry developers.13,14 As of 2022, 11 European countries have offshore wind capacity targets, totaling just under 240GW of offshore wind capacity growth by 2050 or sooner.15 Europe’s total offshore wind capacity reached just under 28GW at year-end 2021, meaning there will need to be nearly a ninefold increase to reach these targets.16 In response to Russia’s invasion of Ukraine, countries like France and Germany are considering ways to accelerate offshore wind developments to reduce dependence on Russian fossil fuel imports.

We expect the industry’s global expansion, highlighted by the United States, Brazil, and India, could usher in a new era for the wind power industry, creating substantial opportunities for established players and newcomers alike. Many of these newcomers are following similar policy playbooks to support the development of their offshore wind markets.

U.S. Offshore Wind Industry Starting to Take Off

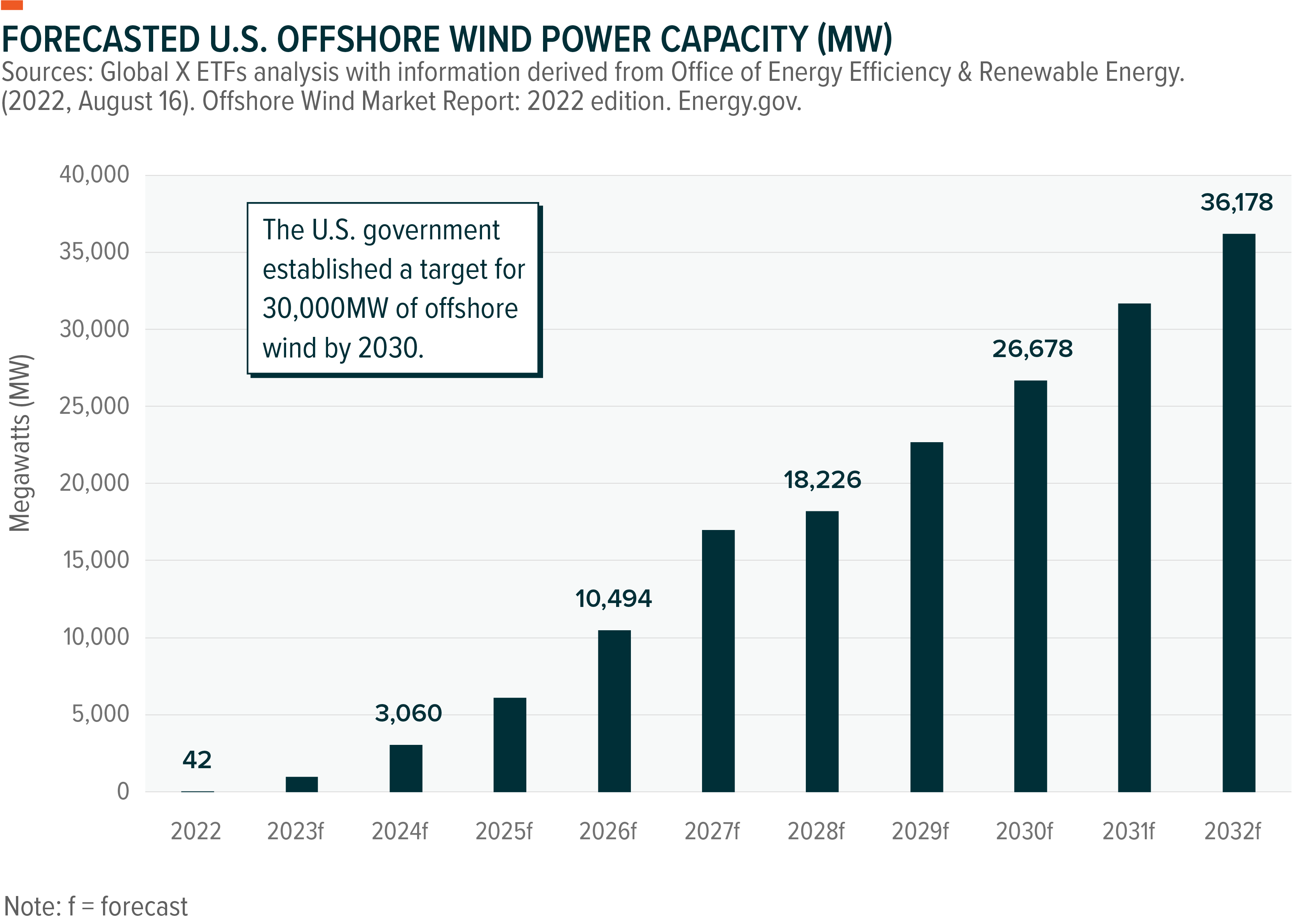

Significant state- and federal-level policy support has the United States making inroads in offshore wind power. We forecast U.S. offshore wind capacity to increase from a mere 42 megawatts (MW) at year-end 2022 to over 36GW by 2032.17 Over the next 10 years, the U.S. offshore wind industry could potentially create $109 billion for businesses throughout the offshore wind industry value chain.18

The opportunities are significant for this nascent market. For example, a full buildout of underwater T&D infrastructure will be needed to connect the planned offshore wind projects to the coastal demand centers. With meaningful U.S. investment in such projects, wind power equipment manufacturers and project developers and companies in related companies throughout the shipping, ports, and infrastructure industries can benefit.

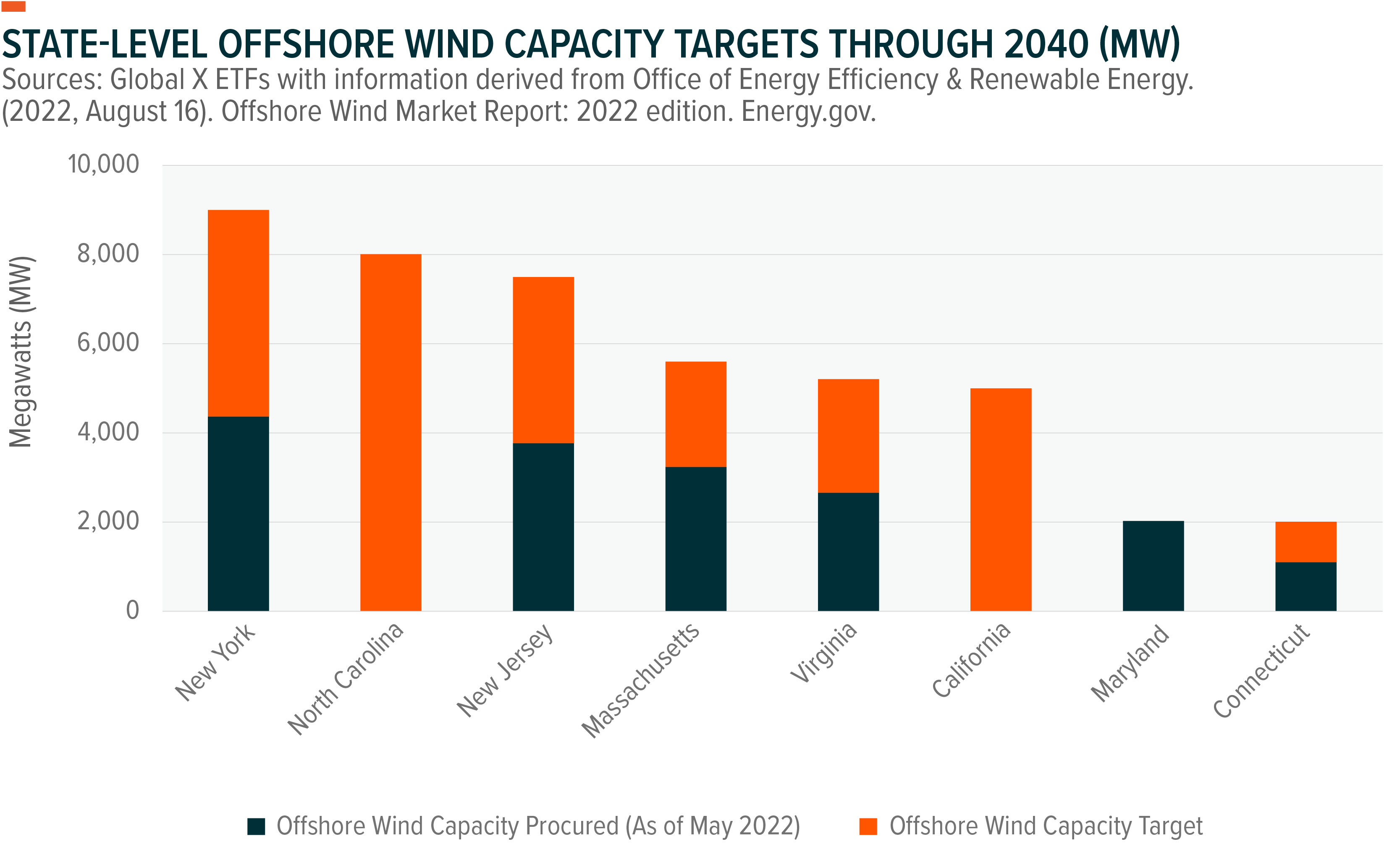

Supporting the positive growth outlook is that an increasing number of states are establishing targets and project tender auctions. Eight states have offshore wind capacity targets totaling over 44GW by 2040, and six have awarded tenders for projects.19 Ørsted, Eversource, Equinor, Avangrid, CIP, Shell, EDF, and BP are among the companies with projects expected to come online by 2030.20 While nearly all initial operational projects are planned along the East Coast, the Gulf of Mexico and Pacific Coast are rising areas of interest.

At the federal level, the Biden Administration made developing the wind power industry a priority. In 2021, the administration established a federal target of 30GW of offshore wind capacity by 2030.21 In 2022, the Bureau of Ocean Energy Management (BOEM) held successful offshore wind lease area auctions along the East Coast and the California coast, and BOEM is now finalizing plans for its first offshore wind lease area auction in the Gulf of Mexico. Additionally, BOEM’s ongoing efforts to streamline the permitting process, which has been a key obstacle for U.S. offshore wind power projects, can provide significant benefits.

Furthermore, the Inflation Reduction Act (IRA) extends tax credits for offshore wind project developers and domestic equipment manufacturers for 10 years, providing key visibility to the market.22 The IRA also includes nearly $1 billion in grants for research, planning, and construction of onshore and offshore transmission lines.23

Conclusion: Offshore Wind Power an Emerging Market

Offshore wind power is trending as more countries turn towards offshore wind power systems to generate renewable energy. In our view, the expansion of this sub-sector within wind power, driven by public sector commitments combined with better technology and increasing cost competitiveness, can create compelling investment opportunities. As capacity increases and the industry matures, offshore wind equipment manufacturers and project developers can benefit, along with companies in related industries such as steel manufacturing, shipping, ports, and infrastructure. As governments increasingly set their sights on offshore wind power, we believe investors may want to as well.

Related ETFs

WNDY – Global X Wind Energy ETF

RNRG – Global X Renewable Energy Producers ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Madeline Ruid

Madeline Ruid