Real Estate Investment Trusts, or REITs, invest in physical real estate or mortgages with the primary goal of generating income for shareholders.1 REITs are able to bypass federal taxation by paying out 90% of their income to shareholders.2 The dividends paid, however, are often taxed at one’s ordinary income rate, not the long-term capital gains rate typical for qualified dividends.1

Given the extended low interest rate environment, REITs have become popular investments for investors looking for alternative sources of income. In this piece, we dive deeper into the REIT space, discussing topics relevant to the current investing landscape, including:

- Equity REITs

- Mortgage REITs

- How REITs fit into a portfolio

- The implications of the real estate sector reclassification

What types of Equity REITs exist and how do they differ?

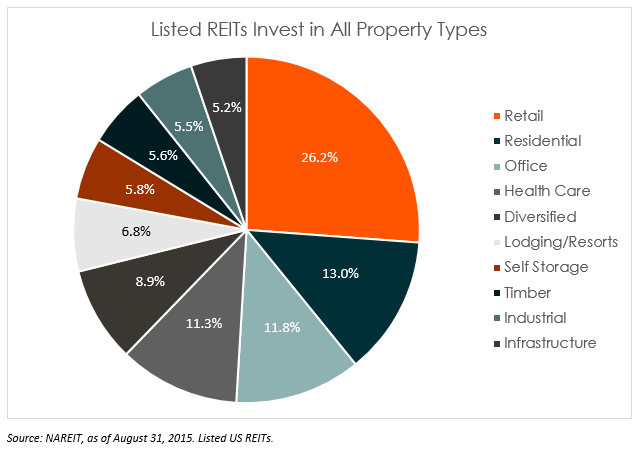

REITs backed by physical real estate are generally referred to as Equity REITs, which can invest in a broad range of real estate properties including, but is not limited to, retail space, offices, residential properties, malls, storage facilities, resorts, and health care facilities.i REITs often own multiple properties in a given real estate sector, giving investors exposure to a variety of buildings and diversity of geographic locations. REITs that invest in multiple property types are known as Diversified REITs.

What are Mortgage REITs?

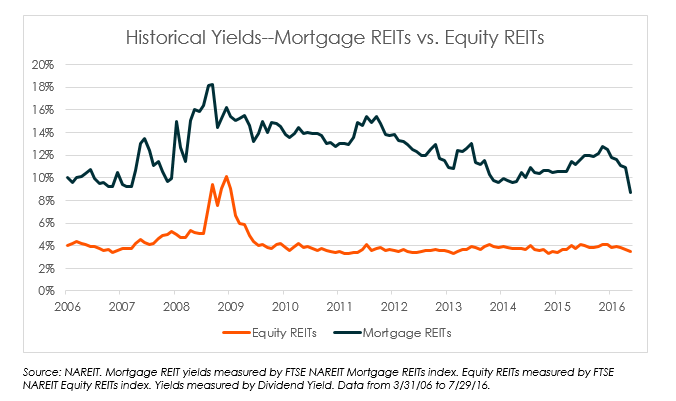

Rather than owning physical real estate, mortgage REITs purchase mortgages or mortgage backed securities (MBS). This sub-sector makes up nearly 6% of the US REIT market, but often receives outsized attention due to their yields being, on average, 5.5% higher than Equity REITs.3 Mortgage REITs often achieve this yield through the use of leverage, exhibited by their current 4.6x debt to equity ratio vs. 1.2x for Equity REITs.4 Mortgage REITs have higher leverage ratios because they borrow short term debt and use the proceeds to invest in longer-dated mortgages.5 They profit by making the difference between the income received from the mortgage payments and the interest expense on their debt. The payoff tends to be greater when the yield curve is steeper, which means that the difference on the yield of long term mortgages versus short term debt is greater. The opposite can occur, however, if the yield curve flattens or becomes inverted. In addition, a volatile interest rate environment can encourage mortgage prepayments, which reduces the value of the underlying mortgages.

Where do REITs Fit in a Portfolio?

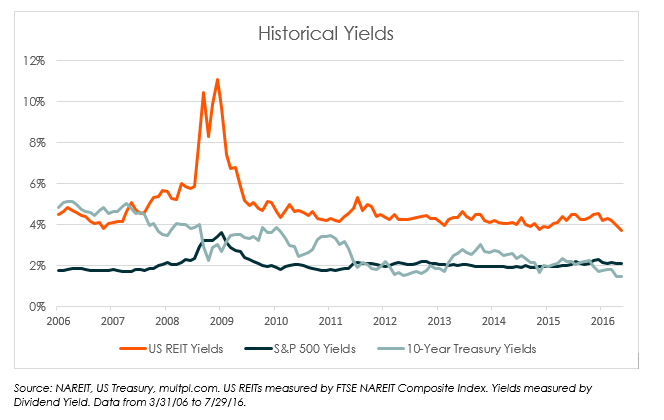

REITs can provide returns from two sources: dividends and growth of principal. From an income perspective, REITs are unique compared to traditional fixed income instruments or dividend paying stocks since they are primarily backed by physical assets that generate cash-flow. Since March 2006, US REITs have had an average monthly yield spread to 10-year US Treasuries of over 180 basis points and 274 basis points to the S&P 500’s dividend yield.6 With a 0.65 historical correlation to global equities, REITs are also typically used to help diversify portfolios in addition to potentially increasing income.7

Historical REIT Performance

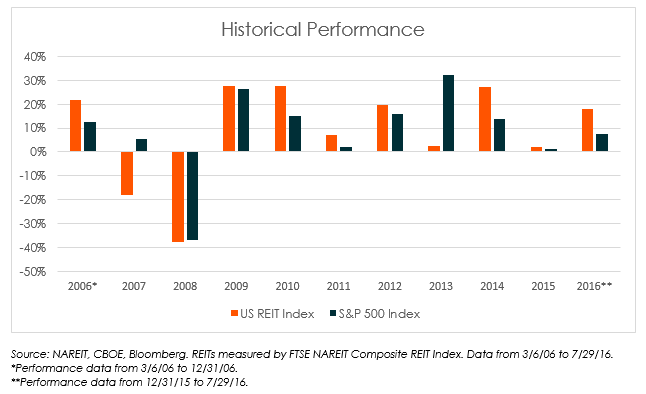

REITs can appreciate or depreciate depending on the value of their properties, projected growth rates, interest rates, and other factors. Larger REITs tend to hold a more diversified portfolio of properties, enabling those REITs to mitigate the idiosyncratic risks inherent in investing in only a handful of buildings. Smaller REITs, on the other hand, can provide more targeted exposure to a particular geography or property type.

While REITs have been on a torrid streak in 2016, this performance is not unprecedented. Since the US Composite REIT’s launch in 2006, the US REIT market has outperformed the S&P 500 in 8 of the past 11 years.8

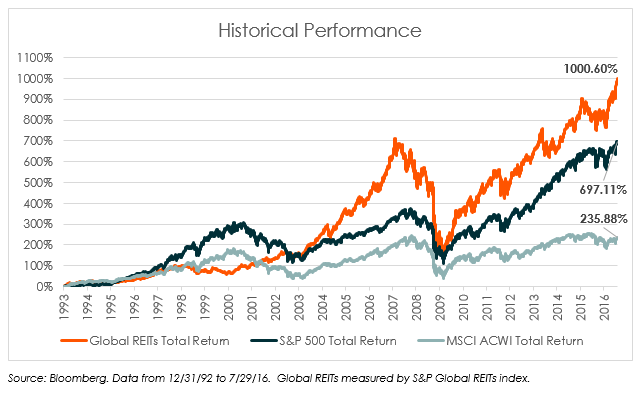

This strong performance has not been limited to just US REITs. Global REITs have outperformed the S&P 500 by 303% since 1993 and the MSCI All Country World Index by a stunning 764%, or an annualized 1.77% and 5.70%, respectively.9

Implications of the REIT reclassification for the industry

In March 2015, MSCI and S&P jointly announced that the Global Industry Classification Standards (GICS) would reclassify Real Estate as its own sector beginning in August 2016.10 Previously, REITs had been included in the Financials sector. MSCI stated that “the creation of the Real Estate Sector is important, as it will elevate its position from under the Financial Sector, recognizing Real Estate as a distinct asset class and a foundational building block of a modern portfolio.”10

The near term implications of this change may involve short-term volatility, with asset managers possibly buying or selling REITs to match benchmark allocations after the reclassification. Over the long term, however, this change is not expected to have a major impact on the asset class except promoting greater awareness and attention to the real estate sector.

Investors looking to maximize their yield potential from REITs should consider the Global X SuperDividend REIT ETF (SRET), which invests in 30 of the highest yielding REITs around the world.

Global X Research Team

Global X Research Team