The S&P 500 Financials sector just experienced a dose of growth. The traditional value-oriented sector has new entries from the growthier Information Technology sector, specifically in FinTech. The shakeup is the result of changes to the Global Industry Classification Standard (GICS), which is a system for categorizing public companies by sectors and industries. Changes were implemented after the close of business on Friday, March 17, 2023, with 14 S&P 500 stocks reclassified at the sector level.1 For investors, new additions to the Financials sector could result in a higher growth exposure than originally intended.

In this report, we will outline specific GICS sector changes impacting Financials and Information Technology along with insight on how to position in the current market environment.

Key Takeaways:

- GICS changes reflect FinTech’s disruption on the Financials sector.

- Financials’ growth allocation could rise, albeit with minimal impact on macro sensitivities.

- Bank stocks face headwinds as the U.S. economy transitions from late cycle to recession.

Summary of GICS Changes

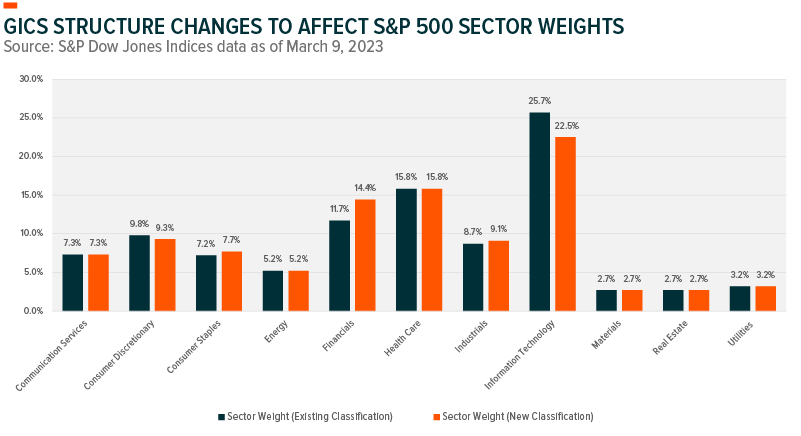

After the GICS change, Financials will account for roughly 14% of the S&P 500 Index versus its current 11% weight. Information Technology will lose 11 stocks, resulting in the largest reduction in market capitalization among the 11 GICS sectors.2

Reclassification Within FinTech and Impacts on the Financials Sector

Mobile payments and payment processing companies have been the center of a digital revolution in banking, disrupting the traditional banking industry as society has become increasingly cashless. Up until now, some of these FinTech companies have been classified as Data Processing & Outsourced Services within the Information Technology sector. As part of the GICS sector changes, this portion of the FinTech theme will be reclassified to Transaction & Payment Processing Services, a proposed new sub-industry within the Financials sector.

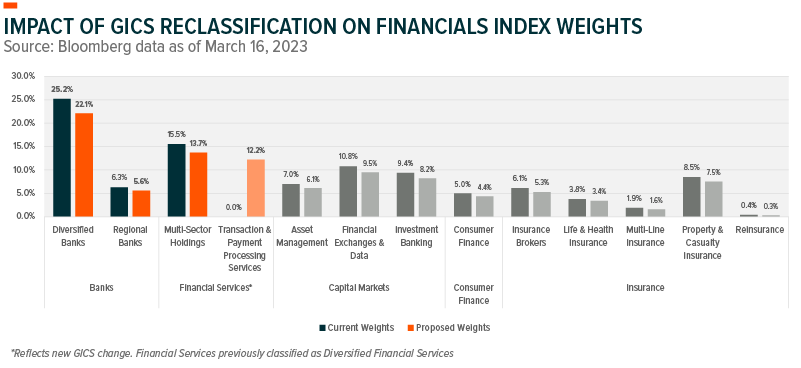

Focusing on the S&P 500 Index, the GICS sector reshuffle will involve eight companies moving from Information Technology to Financials. These firms account for roughly 10% of their present home in the Information Technology sector. Following the GICS changes, the eight payment companies will account for roughly 12% of the Financials sector, based on Bloomberg data as of March 16, 2023. The remaining three firms currently classified as Data Processing & Outsourcing Services will be moved to Industrials under a new sub-industry of Human Resources & Employment Services.

The chart below shows current industry and sub-industry group weights for the Financials sector versus proposed weights by GICS. The new sub-industry, Transaction & Payment Processing Services, is also included.

The banking industry will see the largest reduction in weight because of the GICS reclassification. This could be a positive for the Financials sector given recent liquidity concerns, particularly among regional banks. New developments have exposed the consequences of a deeply inverted yield curve. Greater economic risk and persistent inflation caused the Federal Reserve to aggressively raise interest rates, which drove short-term Treasury yields higher than long-term yields. The yield curve inversion could result in lower incomes from bank loans that are issued at longer maturities.

Short-term liabilities such as savings and checking accounts can be withdrawn at any time. This means that banks may have to compete to attract depositors with higher rates, or they will have to charge higher interest on their loans (not a competitive option) to keep margins positive. Here are some key points to consider when positioning within the banking industry.

- Banks have tightened lending standards and increased their loan loss provisions, possibly reflecting economic uncertainty.3

- We expect regional banks to remain challenged since they rely heavily on income from interest on loans, while large banks are more diversified with more sources of non-interest income.4

- Yield curve inversions typically signal recessions and could weigh on bank margins although a steepening of the yield curve can occur just before or during recessions.

Currently, the market is expecting the Fed to pause or slow the pace of rate hikes because of banking system stress. The shift in expectations triggered a steepening of the yield curve after sustained inversion, causing the largest drop in the 2-year Treasury yield since the 1980s, and falling below the Fed Funds rate.5

As existing industry weights decline, investors could see greater exposure to a portion of FinTech within Transaction & Payment Processing Services. The new sub-industry will include credit card companies, digital wallet providers, and other payment technology firms. The new GICS change could also result in a greater allocation to growth stocks. Therefore, the Financials sector could experience higher forward earnings growth, according to analysis by State Street.6 However, this is unlikely to change the sector’s overall sensitivity to the macroeconomic cycle, with payment companies remaining sensitive to consumer spending and payment volumes. Over time, a recovery in spending activity and digital payment infrastructure demand could bode well for certain stocks within the sub-industry.

Positioning in the Current Environment

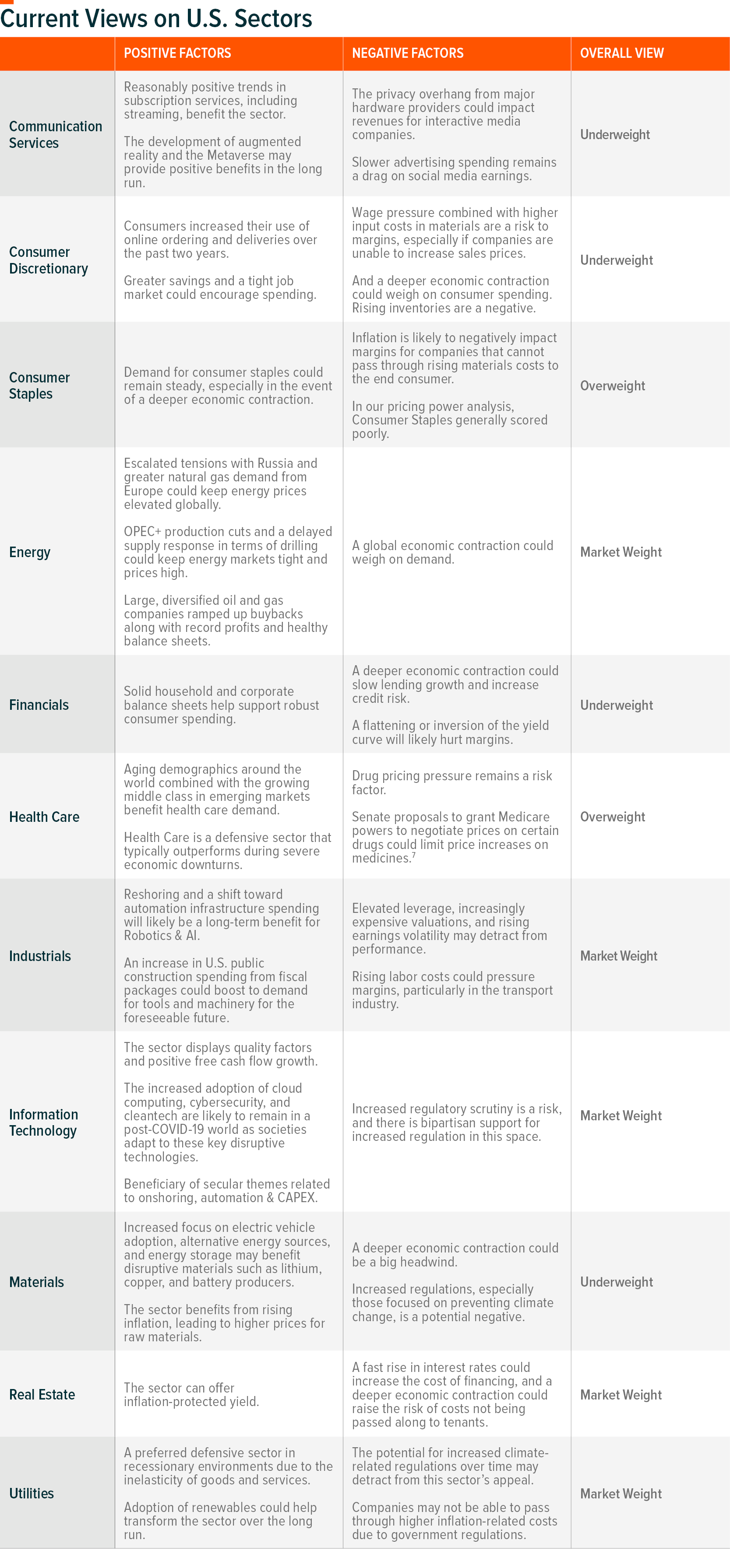

As the U.S. approaches the end of the rate hike cycle, investors could eventually find opportunities within sectors that benefit from recovery dynamics, including Financials, Consumer Discretionary, and Real Estate. But for now, defensive positioning could mitigate downside risk.

Our sector views table below provides more detail on sector positioning.

Global X ETF Model Portfolio Team

Global X ETF Model Portfolio Team