During August, higher interest rates were a major driver of market sentiment. Factors including surprisingly strong economic data, an increase in Treasury debt issuance, Fitch’s downgrade of U.S. debt, and a rise in Japanese yields all played a role in moving the 10-year Treasury yield higher over the summer months. The current strength of the U.S. economy can be attributed to the resilience of the consumer, a tight labor market, and the economy’s lower sensitivity to higher yields. While a soft landing has become the consensus view, how this cycle plays out has implications for long-term yields and market positioning. This piece will discuss positioning primarily from a U.S. sector perspective.

Key Takeaways

- The U.S. economy’s lower sensitivity to yields has factored into its resilience, but we believe it’s too early to lean fully into cyclicals.

- Monetary policy’s lower effectiveness is likely to keep policy yields elevated for an extended period.

- Increased importance of diversification and balance between interest rate and economic growth sensitive market areas. Capex and infrastructure investment remain key growth drivers for cyclical areas while Q2 earnings season confirmed an acceleration in Artificial Intelligence (AI) adoption.

U.S. Economy Reflects Reduced Interest Rate Sensitivity Than Prior Cycles

The U.S. economy is in a vastly better position than expected at the beginning of the year. Unlike prior rate hiking cycles, the U.S. economy has been far less sensitive to policy interest rates. Extremely low yields in the aftermath of the pandemic provided consumers and businesses an opportunity to refinance prior to the start of the rate rising cycle.

From a household perspective, consumer balance sheets remain solid, with excess pandemic savings likely to remain a support until the end of Q3, while consumer debt as a percentage of GDP has continued to decline since its peak in 2001.1,2 The housing market has not played its typical role in slowing down U.S. economic activity. While the tight labor market contributed to this resilience, the housing market was in a far less sensitive position relative to the last rate raising cycle. Around 42% of U.S. owner-occupied houses didn’t have mortgages at the start of the current rate raising cycle, this compares with 32% during the 2006 – 2008 cycle. Additionally, around 85% of mortgages are fixed rate, with 75% being 30-year fixed at rates below 4%.3,4

The high level of fixed rate mortgages dramatically reduced the sensitivity of U.S. households to yields as the effective mortgage rate remains below pre-Covid levels, while the marginal mortgage rate is above 7%.5,6 The lower effective mortgage rate reflects that the average consumer is less vulnerable to higher interest rates. This also implies a reduced effectiveness of monetary policy to impact consumption. As such, the “long and variable” lag in the effectiveness of monetary policy may have become longer.

A Start of a New Cycle or Consumption Brought Forward

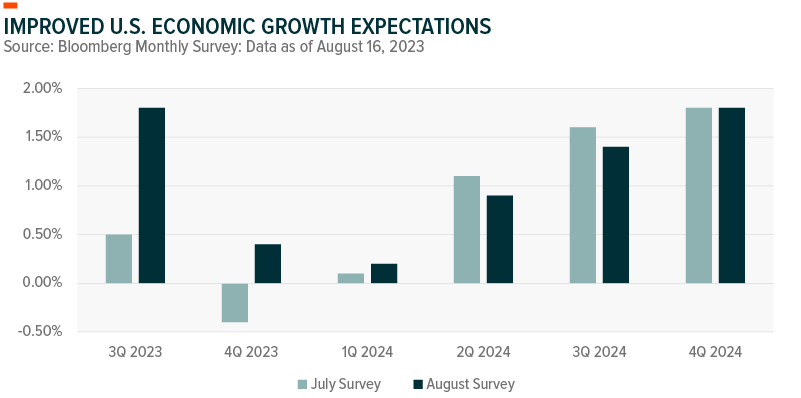

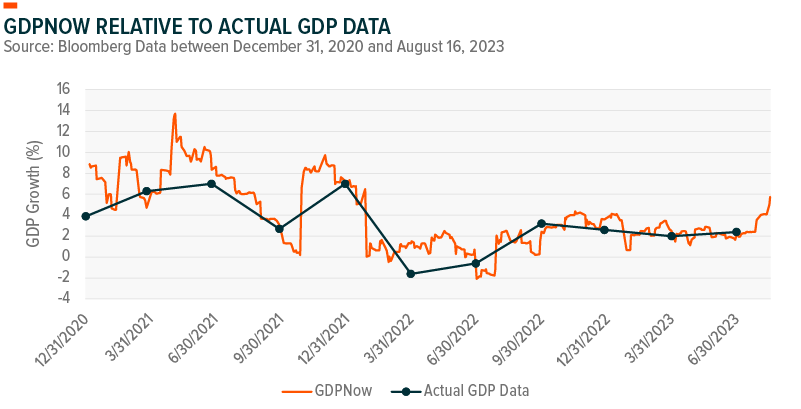

India’s Chandrayaan-3 successfully executed a soft landing at the moon’s south pole. Is it possible for the U.S. economy to replicate this achievement? This summer, market consensus expectations shifted to pricing in a soft landing. Current real GDP growth projections have been revised up for Q3 2023 – Q1 2024, removing near-term recession risks. This raises questions if the U.S. could be approaching the start of the early cycle recovery phase where cyclical market areas typically perform well. Should this be the case, we could see a broadening of market performance and a shift in market sentiment towards higher risk opportunities. Nonetheless, the most pressing question remains the sustained resilience of the consumer. In our opinion, it may be somewhat premature to claim victory for a successful soft landing.

Current economic activity remains robust, with consumer resilience supported by labor market tightness. Economic data has generally come in hotter than expectations this summer, helping support a sharp increase in Q3 GDP growth expectations. The table below illustrates key areas supporting economic activity and where there may be cracks forming in the consumer narrative.

Weighing the Balance Between Interest Rate and Economic Growth Sensitivity Market Areas

While we may be approaching the trough, we believe it’s too early to lean fully into cyclical market areas that require continued consumer resilience. Consumers and businesses have been more resilient this cycle, entering the higher rate environment well prepared. However, given the reduced effectiveness of monetary policy, the “long and variable” lag of monetary policy may have gotten even longer. As such, yields may need to remain elevated for an extended period, potentially drawing out the length of time before the economy bottoms and markets broaden out.

These factors increase the importance of diversification between both interest rate and economic growth sensitive areas of the market. On the one hand, fiscal support and strong capex remain a key driver for certain cyclical market areas while exceptionally strong demand for AI chips reflects a growing trend in AI adoption.

| Cyclical Equity Exposure – Economic Growth Sensitive | Growth Equity Exposure – Interest Rate Sensitive |

|---|---|

| Regardless of if consumer strength persists, fiscal impulse remains a key support to GDP growth. Q2 GDP grew at a 2.4% pace, which topped expectations of 2%.17 Greater nonresidential fixed investment supported economic growth. Capex increased by 9% year-over-year driven by manufacturing and reshoring.18 Infrastructure was also a bright spot as machinery and equipment companies benefitted from high demand and the ability to pass on costs to customers. Going forward, the Inflation Reduction Act and CHIPS Act could support additional infrastructure spending, focusing on domestic manufacturing of semiconductors, renewable energy, transport systems, and electric vehicle batteries. While business investment comprises 13% of nominal GDP, it has a larger impact on future economic growth potential due to fostering job creation. Please visit our blog for more information on manufacturing investment’s role in boosting Q2 GDP and how this investment can provide longer term economic benefits. Sector highlight: Industrials |

Should economic growth disappoint, markets are likely to search out companies and market areas that can grow despite the economy.AI technology has the potential to revolutionize and improve the efficiency of a wide array of commercially important activities. Similar to internet and smartphone technology, AI is a pivotal technology. However, unlike the early adopters phase of the internet, the key companies that currently stand to benefit from AI adoption are large and profitable. Q2 earnings season reflected that AI adoption remains strong. High-end AI capable semiconductor demand has accelerated. Data center demand was a key driver of stronger than expected chip demand. Growth in this area provides benefits into several related themes including Cloud Computing. Sector highlight: Information Technology (focus on profitable high growing areas) |

Our sector views table below provides more detail on positioning.

Michelle Cluver

Michelle Cluver Global X ETF Model Portfolio Team

Global X ETF Model Portfolio Team