Among the central tenets of modern portfolio theory is the concept of diversification. By allocating capital to assets with varying risk/return profiles, both across and within asset classes, investors can create efficient portfolios that attempt to maximize the level of return for a given amount of assumed risk. The practice of diversification is commonplace in the traditional investing world. In crypto investing, however, it is less widely practiced. It is not uncommon for both retail and institutional investors to hold their crypto exposure in one or two investment positions, usually bitcoin (BTC) and ether (ETH), the two largest assets as measured by market capitalization.

The tendency to take more concentrated investment positions in crypto seems to stem in part from familiarity bias. Given the fast-moving nature of crypto markets and the frequent launches of new crypto assets, investors are likely to feel more comfortable allocating to household names. This approach, however, ignores the benefits of diversification. In this blog post, we explore some of the reasons why investors in crypto markets may want to consider a diversified approach to portfolio construction.

Key Takeaways

- Faced with the challenge of investing in the fast-paced, ever-evolving crypto market, investors tend to concentrate investment positions in the assets they are familiar with. In so doing, investors disregard the benefits of diversification and risk creating inefficient portfolios that fail to maximize risk-adjusted returns.

- Crypto assets tend to exhibit low- to moderate correlations and significant variance in returns. Diversification across crypto assets may help manage portfolio volatility and provide a more representative exposure to the industry’s adoption trends and growth potential.

- The crypto industry’s nascency and persistent innovation suggests that the landscape will evolve considerably over the next decade or more, likely making it difficult to pick winners and losers without a diversified strategy.

The Crypto Market is Composed of an Array of Unique Assets

The crypto market is not a monolith. Despite its early stage of development, the global crypto market has grown into a flourishing, multi-sector ecosystem since the 2009 launch of the Bitcoin network. Continual innovations in blockchain infrastructure over the past decade have allowed the industry to progress at a breakneck pace, giving rise to new sectors and applications. Among the most prominent crypto sectors today are smart contract networks, decentralized finance (DeFi), oracles, scaling and modularity infrastructure, file sharing and storage infrastructure, Web3 communities, gaming, and decentralized social media (DeSo), among many others.

These industry classifications distinguish companies, organizations, and assets based on fundamental factors such as the types of products offered, sources of revenue, and characteristics of business operations. Like traditional industries, these sectors vary in terms of their stage of adoption and are subject to distinct competitive forces. Furthermore, these sectors are supported by dozens (and in some cases hundreds) of start-up sized projects and protocols, each of which exhibit operational idiosyncrasies, unique use cases, and varying tokenomic structures.

The fast-moving, emergent landscape of crypto markets highlights the importance of a diversified approach to investing. If history is any indication, it is very likely that the crypto market will look very different in 10 years than it does today. Rather than try to make concentrated bets on what this future will look like, spreading investable capital across crypto sectors could allow a portfolio to achieve a more wholesome, well-rounded exposure to the industry’s growth trends and disruptive potential. Moreover, allocating capital to assets within these various sectors may also help reduce the need for a portfolio manager to actively predict which specific use cases and applications will emerge as future winners. In much the same way that early-stage venture capitalists make many small investments in nascent companies to improve their chances of success, crypto investors can benefit from these same principles.

Moderate Correlations Demonstrate Diversification Benefits

Diversifying investments across low- to moderately correlated assets may also help dampen the volatility of an investment portfolio. Measured on a scale from -1 to 1, correlation represents the degree to which two variables move relative to one another. A correlation of -1 entails a perfect negative correlation, meaning if variable A appreciates by 1%, variable B will depreciate by 1%. Similarly, a correlation of 1 represents a perfect positive correlation, meaning the two variables move perfectly in line with one another. Finally, a correlation of 0 entails no relationship between two variables, implying that a change in variable A has no predictive power regarding how variable B will change.

Managing correlations is critical for proper diversification, as it helps to reduce a portfolio’s sensitivity to a single input or risk, and thereby the volatility of the portfolio. Correlations between asset classes, such as fixed income, equities, real estate, and digital assets, should be relatively low. This is because asset classes tend to perform differently depending on the market environment, which can be influenced by geopolitical events, monetary policy, the current phase of the market cycle, investor sentiment, and countless other inputs. By investing across various asset classes, a portfolio’s downside risk can be managed by relying on asset classes demonstrating relative strength to buoy the portfolio against the underperformance of other asset classes. This relationship works in the opposite direction as well, with the impact of very strong performance by a given asset class moderated at the portfolio level by the relative underperformance of a lagging asset class.

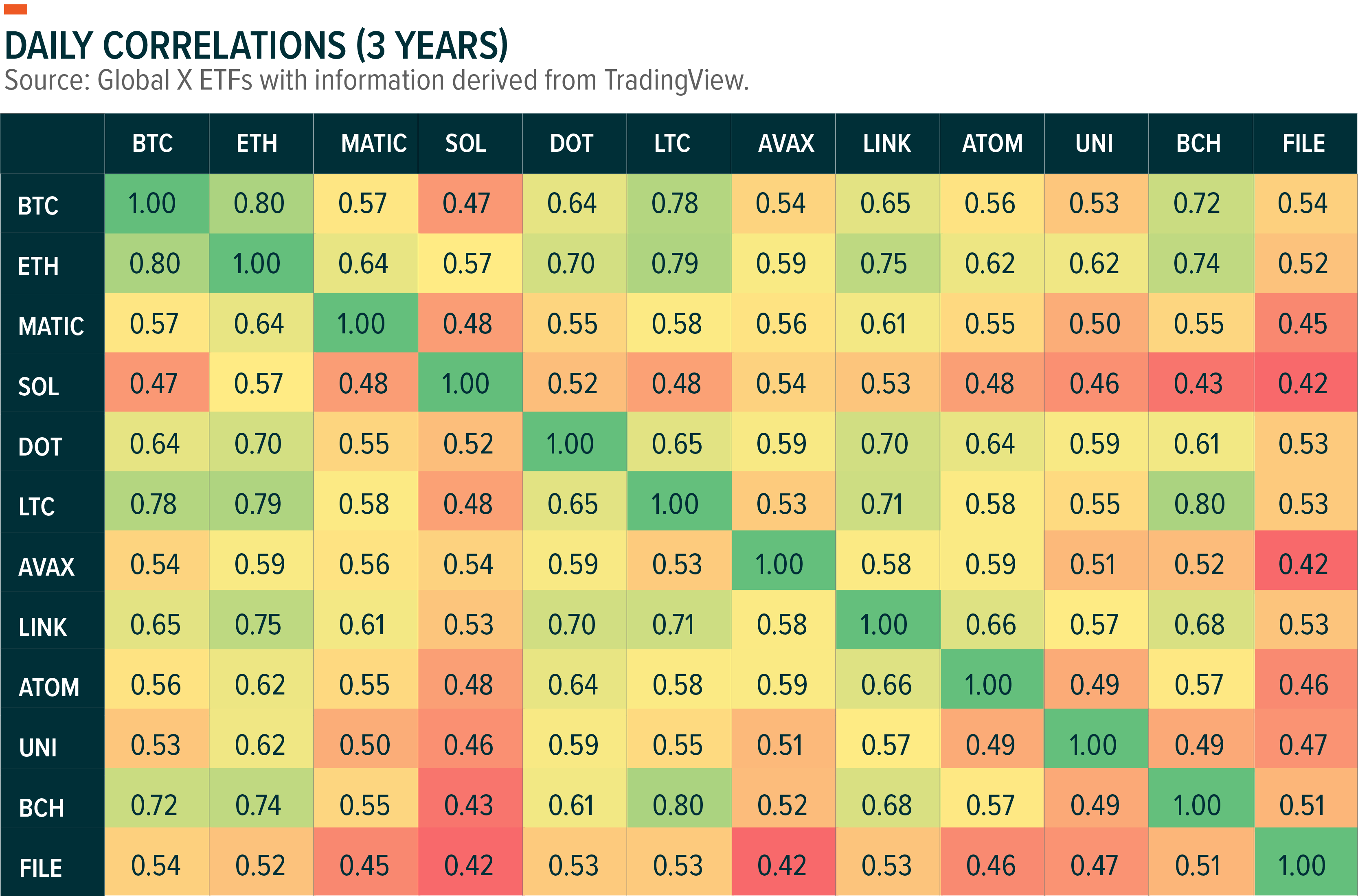

Though usually higher than the correlations exhibited across broad asset classes, diversifying investments across moderately correlated assets within a given asset class can also provide volatility-dampening benefits. The table below provides a three-year analysis of daily price correlations between twelve leading crypto assets which span several of the crypto industry’s most prominent sectors. BTC and ETH exhibit the highest correlation across the observed group and timeframe. These are the two largest crypto assets as measured by market capitalization. They also have the strongest network effects, the largest user bases, and are the most heavily traded. As such, these assets often serve as barometers for crypto market sentiment. Even so, they are not perfectly correlated with one another, implying some diversification benefits may be gleaned from holding just these two assets in a portfolio. Beyond BTC and ETH, correlations generally range from 0.4 to 0.7 and can be considered moderately correlated. In short, these assets tend to move in the same direction but do not move strictly in line with one another. In an asset class that is known for bouts of volatility and large price swings, investing in low- to moderately correlated assets may significantly improve the risk-adjusted returns expected from the portfolio.

The Crypto Market is Subject to Rotation and Changes in Leadership

The rotational nature of crypto markets is another lens through which the potential benefits of diversification in crypto can be observed. An analysis of the return profiles of this same group of industry-leading assets illustrates this rotational behavior.

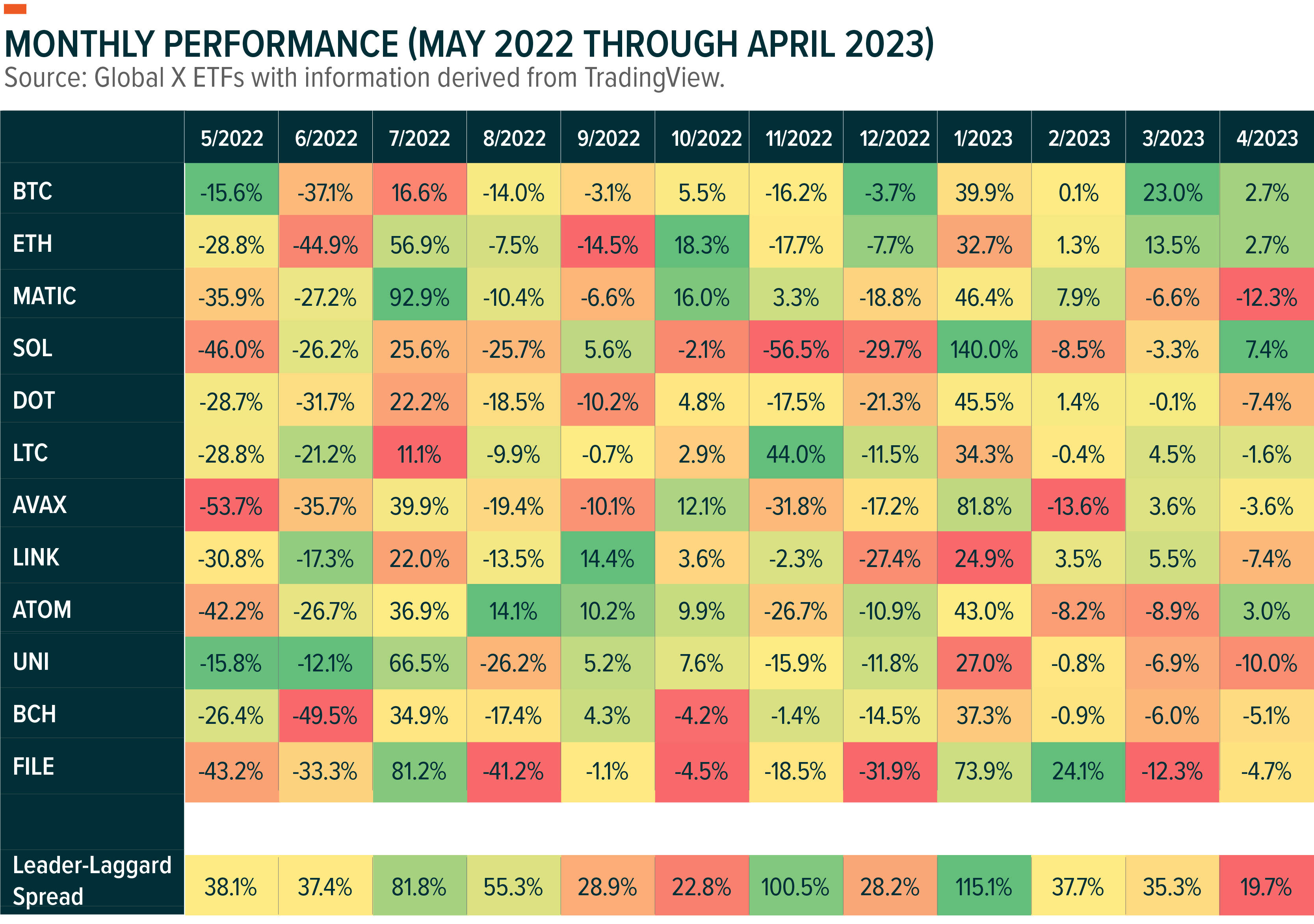

The table below exhibits monthly returns for the period of May 2022 through April 2023. This analysis highlights the variability of month-over-month (MoM) returns for each asset relative to its counterparts; in only a handful of instances does any asset demonstrate a meaningful pattern of relative strength or weakness on a consecutive-month basis. Narrowing the analysis further, there are also no instances during this period in which the strongest or weakest performer in one month continues to perform as the strongest or weakest asset in the following month.

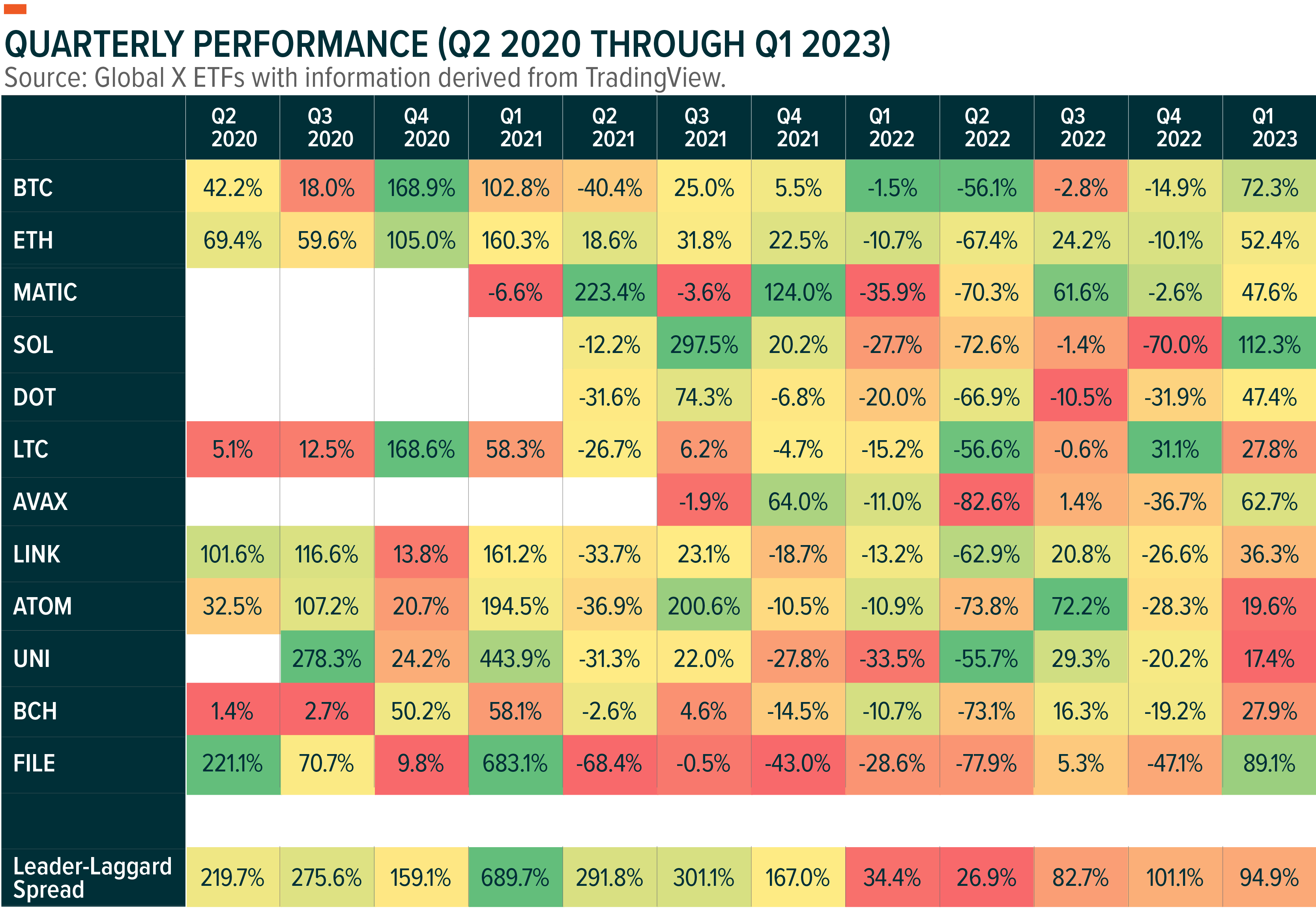

An analysis of returns over longer time periods reveals a similar trend. The table below analyzes three years of quarterly returns for the same pool of assets, with data points in italics representing performance figures comprising less than 90 days of trading activity. While still included in the analysis, it is worth highlighting these data points as tokens are often subject to greater volatility in the earliest days of price discovery.

Much like the table of monthly returns, the frequent change in colors demonstrates the tendency for individual crypto assets to experience choppy performance on a relative basis, with capital rotation leading to regular changes in market leaders and laggards. For a highly concentrated crypto portfolio to stay in front of these trends and keep pace with the market, a portfolio manager would require a high level of information asymmetry and be committed to frequent rebalancing.

This rotational behavior also contributes to significant variance of returns among crypto assets. A simple way to illustrate this variance is the spread between the price performance of the best and worst performing asset in a period, referred to here as the leader-laggard spread. Using the data from the table of monthly returns, the average leader-laggard spread is 50.1% over the past 12 months, with the spread widening to as much as 115.1% in January 2023 and to as narrow as 19.7% in April 2023. The variance in quarterly returns is even more significant. Over a three-year period, the average quarterly leader-laggard spread has been 203.7%, with a maximum spread of 689.7% in Q1 2021 and a minimum spread of 26.9% in Q2 2022. In fact, this extreme degree of variance even persists when removing the outliers from the data sets. After omitting the widest and narrowest leader-laggard spreads from the monthly and quarterly analyses, the average spread falls to 46.6% and 172.7% respectively.

With such large disparities in performance even among this select group of well-established, sector-leading assets, highly concentrated portfolios risk significantly underperforming the broader crypto market. By holding a highly concentrated portfolio, investors run the risk of over-allocating to underperforming assets, causing a significant drag on the portfolio. Investors also risk foregoing the performance of assets that outperform the market. Coupled with the mercurial nature of crypto’s market leadership, highly concentrated portfolios likely assume too much risk for a given level of expected return. Rather, spreading investable capital across a basket of crypto assets obviates the need for tactical asset allocation while providing the benefits of strong directional exposure to crypto adoption trends and market action.

Diversification Smoothens Volatility and Improves the Risk/Reward Profile of a Portfolio

While the digital assets industry is still in its infancy, it is evolving quickly with new use cases emerging at a rapid pace. As a result, picking tomorrow’s winners and losers can be difficult, making a strong case for diversification across the asset class. In our view, the potential to smooth out volatile returns and improve the risk/reward profile of a portfolio further bolsters the case for diversifying beyond the one or two largest, most established crypto assets.

Global X Research Team

Global X Research Team