Preview

The pharmaceutical sector has historically been limited in how it can address diseases. With an increased understanding of illnesses and new therapeutic technologies, the medical community now has additional opportunities to treat, and ultimately cure, illnesses.

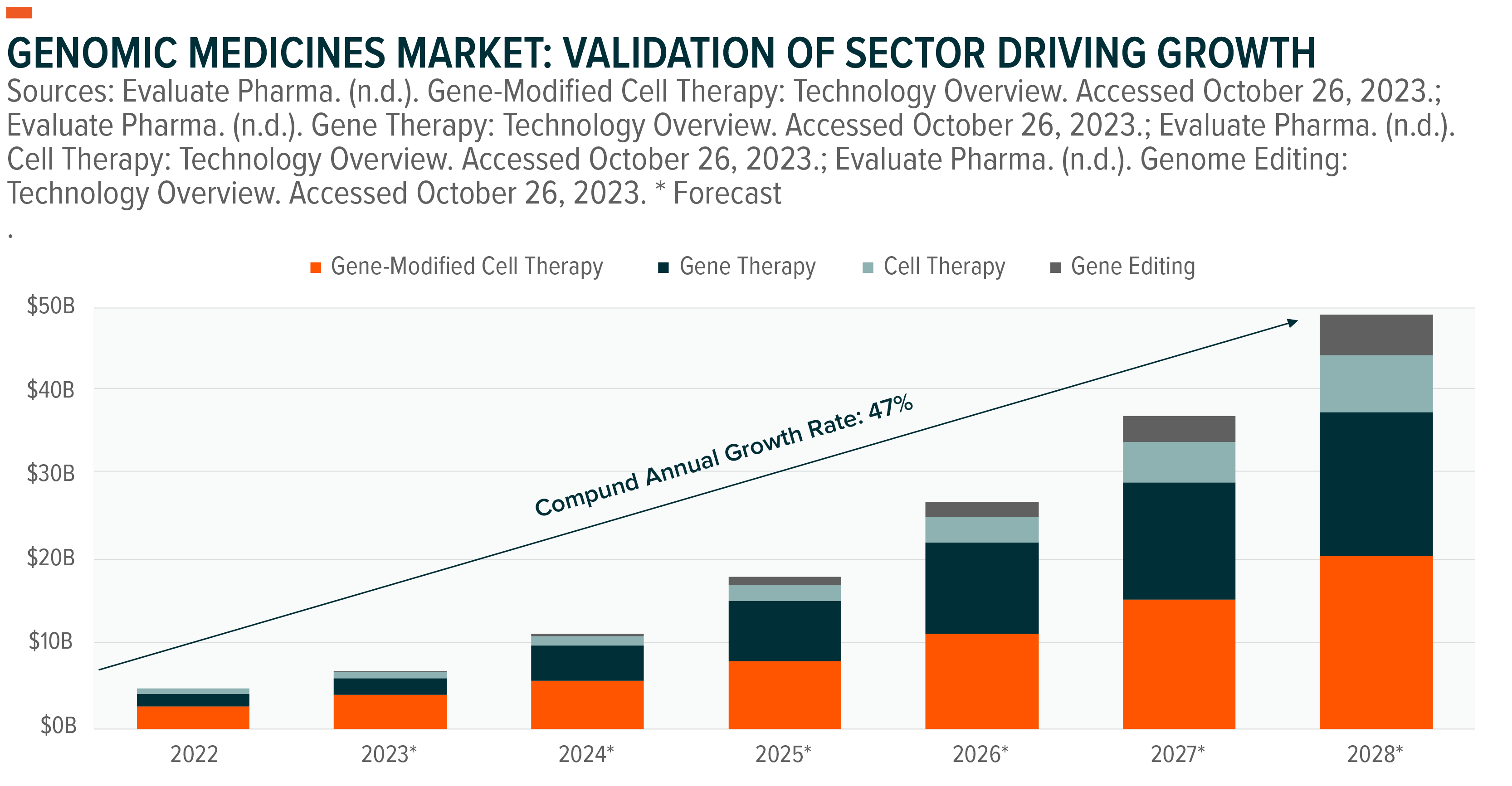

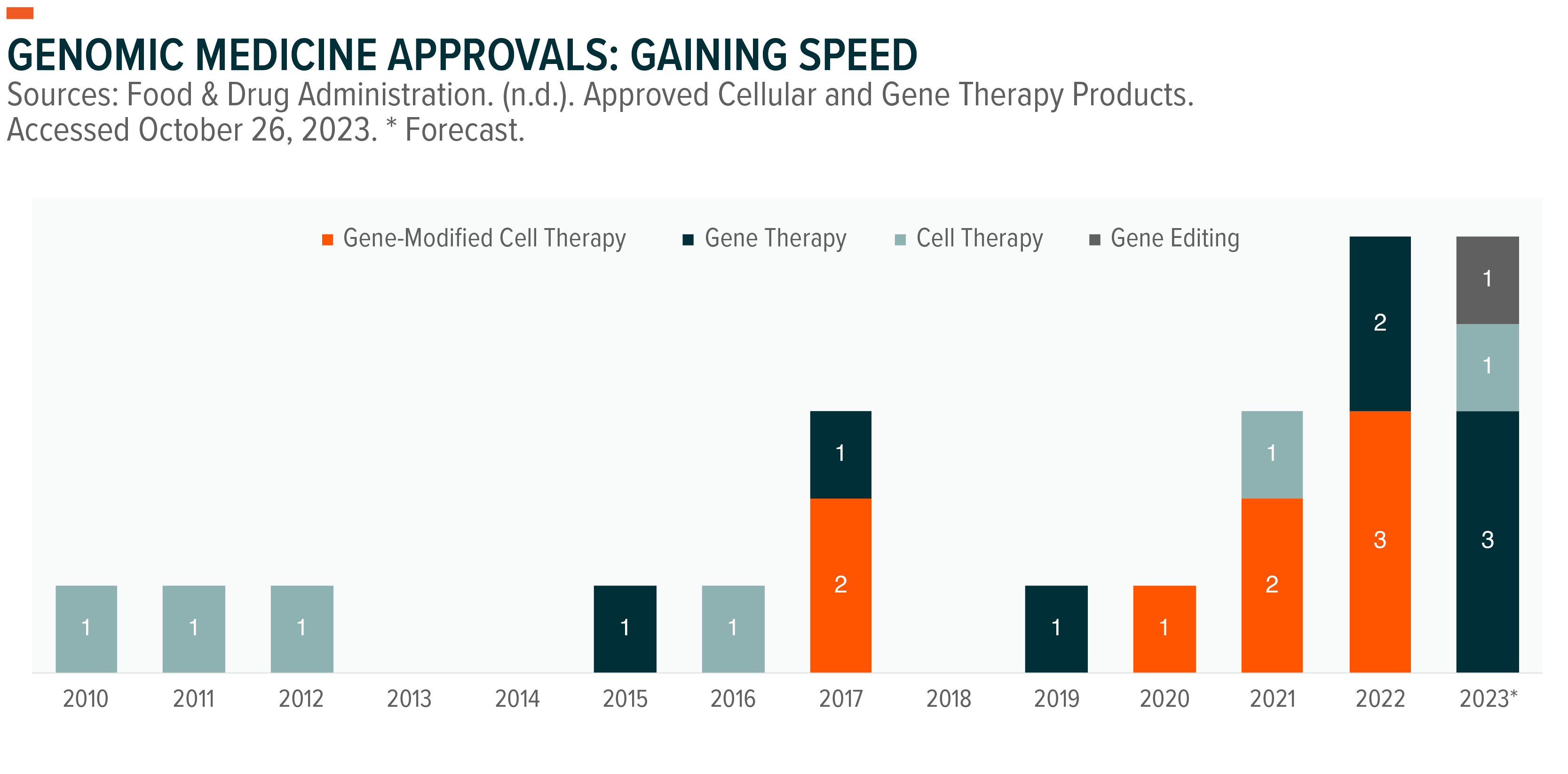

One of the newest areas of development has been genomic medicines. Since the first such approval in 2010, there are now 22 approved treatments in the United States to treat a broad range of illnesses.1 We believe 2023 will mark a breakout year in the genomic medicines space and the beginning of the gene editing market, which is expected to be worth nearly $5 billion by 2028.2

Across all technologies, we believe the genomic medicine industry will be worth $50 billion by 2028, up from just $5 billion in 2022.3,4,5,6

Key Takeaways

- Genomic medicines provide the medical community with new opportunities for treating illnesses. Combined with a favorable risk-reward profile, this area has seen increased investment that could accelerate growth and adoption.

- Despite high upfront costs, genomic medicines can be less expensive than traditional therapies over the long term, as they typically reduce the need for ongoing treatments, hospitalizations, and other healthcare expenses associated with chronic or severe illnesses.

- The genomic industry is still in its infancy, so the manufacturing process is cumbersome and inefficient. However, there are techniques being refined that could dramatically reduce up-front costs, likely leading to broader adoption.

Introduction to Genomic Medicines

Genomic medicines, such as cell and gene therapies, are a relatively new therapeutic category that leverages a person’s genetic information to tailor intervention for their specific needs. There are currently four primary technologies:

- Gene Editing: Editing parts of the genome by removing, adding, or altering sections of DNA.

- Gene Therapy: Replacing a defective or missing gene in a patient’s cells with a healthy version of that gene.

- Cell Therapy: Transplanting healthy human cells to replace or repair damaged tissue and/or cells.

- Gene-Modified Cell Therapy: Translating genetically modified cells to fight disease.

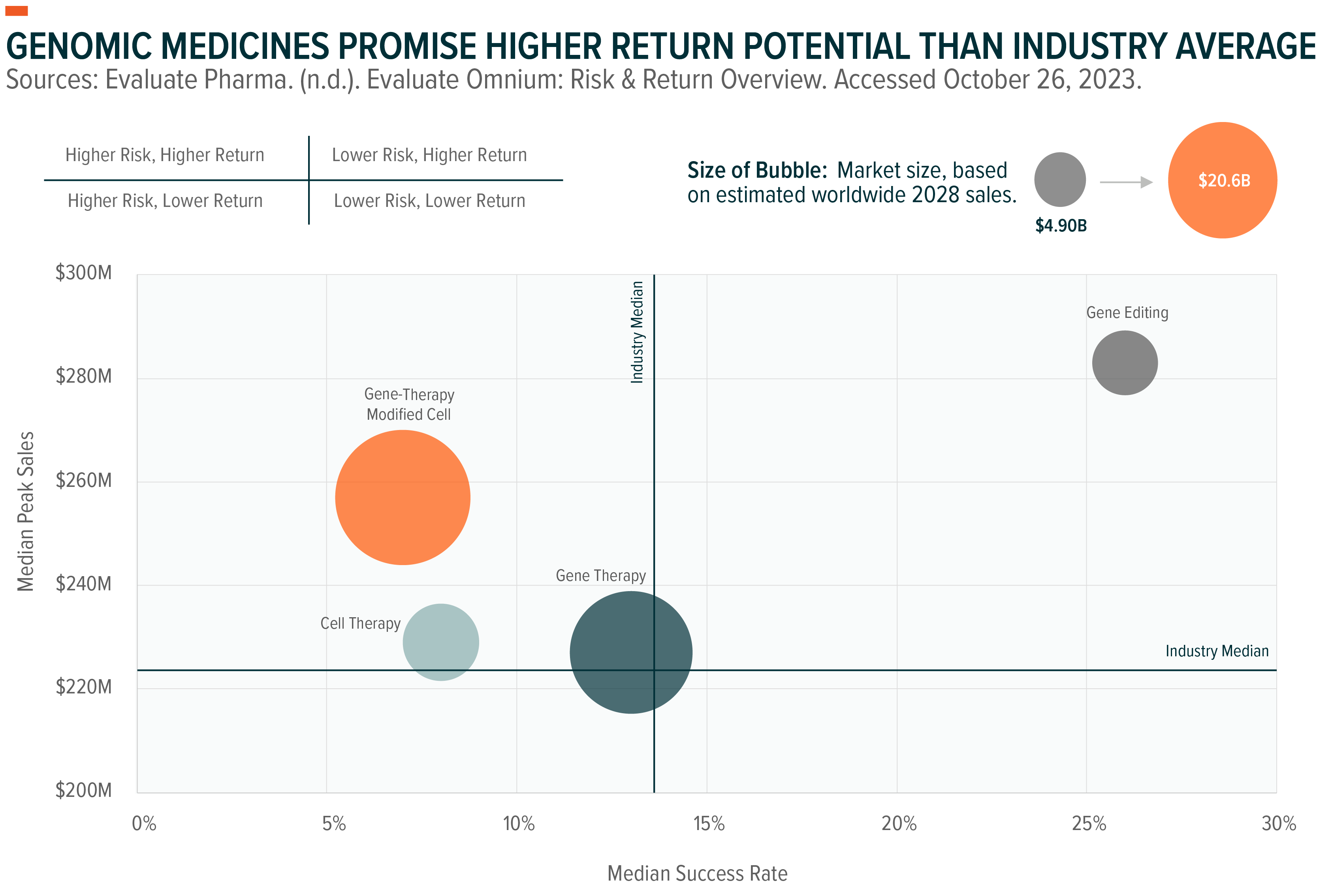

Though genomic medicines can rely on a few different technologies, all of them have a higher estimated reward profile than the pharmaceutical industry at large.

Given the favorable risk-reward profile, it’s no surprise the development of genomic medicines has been prioritized by the pharmaceutical industry. There are currently over 1,300 active clinical trials worldwide for cell and gene therapies spanning all diseases.7 This level of research and development (R&D) is expected to accelerate genomic medicine approvals, continuing the trend we’ve seen in recent years.

Though the potential for widespread adoption of genomic medicines is vast, we identify three primary catalysts for short-term adoption:

- Expanding Reach into Earlier Treatment: Genomic medicines are a relatively new drug category and they often come with higher price tags. As such, we’ve historically seen them be a treatment of last resort. Recent efforts, however, point to improved efficacy in less pretreated patients, highlighting the category’s potential and opening the door to better outcomes and rapid revenue growth. For more information on cell therapies in less pretreated cancer patients, see ASCO Annual Meeting 2023: Precision Oncology Achieving Widespread Adoption.

- Replicating Success in New Disease Categories: Thus far, we’ve seen cell and gene therapies succeed and gain approval in a concentrated set of illnesses, notably blood-based disorders like sickle cell disease or non-Hodgkin lymphoma. Recent efforts by pharmaceutical and biotechnology firms point to potential success in new categories. We have notably seen efforts for CAR-T therapies in autoimmune disorders like lupus and ulcerative colitis, and CRISPR gene editing in neurological disorders like Alzheimer’s.8,9

- Newer Modalities Close to Receiving Approval: Gene editing technology has been a pharmaceutical hopeful for years now, and 2023 might mark the year of the first such approval. CRISPR Therapeutics and Vertex Pharmaceuticals are awaiting Food and Drug Administration (FDA) approval for their investigational gene editing treatment, exa-cel. This treatment allows scientists to edit parts of the genome by removing, adding, or altering sections of a patient’s DNA sequence. If approved, exa-cel is expected to achieve sales of $2.6 billion in 2028.10 For more information on exa-cel, see Another Year of Blockbuster Drug and Treatment Approvals Possible in 2023.

Genomic Medicines: Price to Value Analysis

New therapeutic categories offer one-time treatment alternatives for cumbersome illnesses, and thus come at a higher per-dose price than most medicines. Though treatments seem more expensive at face value, new methods offer an economic benefit and improved patient experience.

Case Study: Hemophilia A

Hemophilia A is a genetic disorder caused by missing or defective Factor VIII, an important clotting protein. This disorder can result in spontaneous bleeding or disproportionate bleeding following an injury.

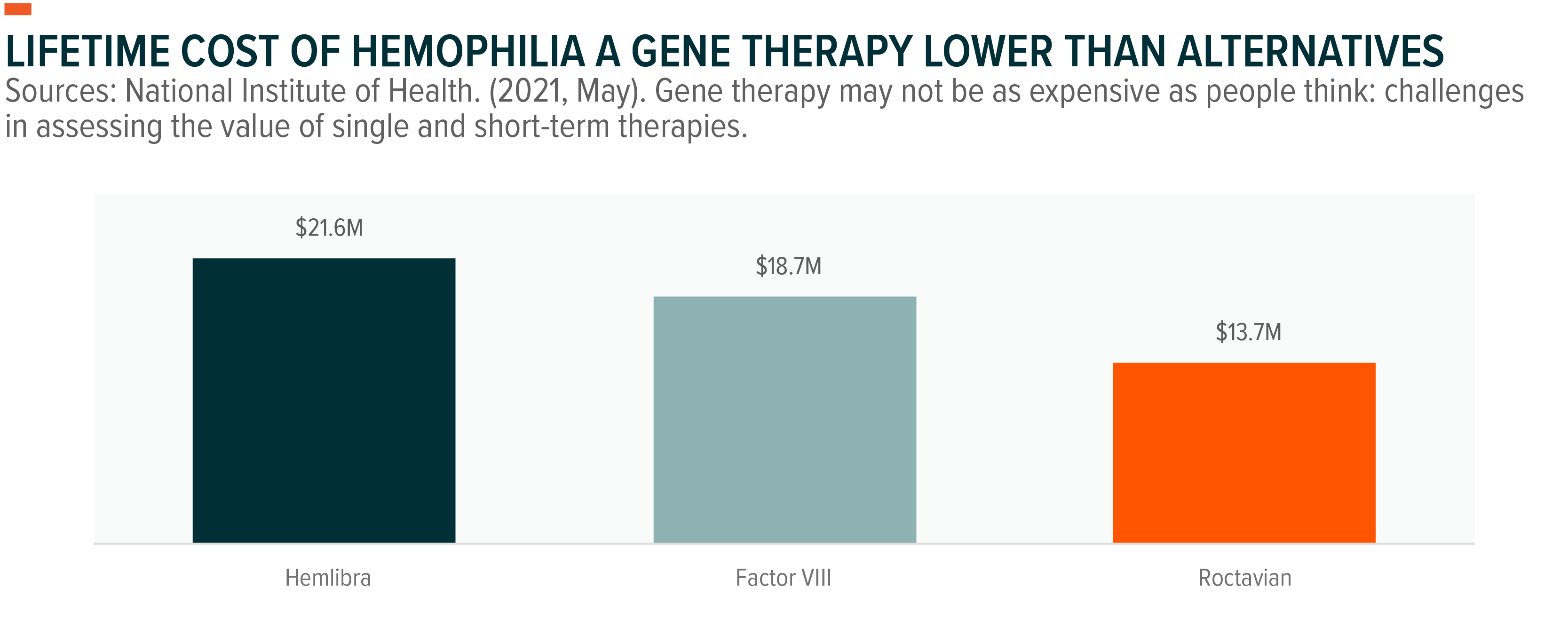

Roctavian is a one-time gene therapy that reduces bleeding rates by 85%.11 Though the dose cost is significantly higher at $2.5 million in the U.S. and €1.5 in Europe, the infrequency of administration versus alternative treatments awards Roctavian significant lifetime cost-of-care savings up to $7.9 million.12 Alternative treatments to Roctavian include:

- Hemlibra is a once-per-week injection that can result in $482,000 in annual costs.13

- Factor VIII, for its part, is administered via an infusion as frequently as every day. This results in an estimated $265,000 annual cost.14

Roctavian is expected to achieve 2028 sales of $1.4 billion, making it the third highest-grossing treatment for Hemophilia A.15

Despite the higher up-front costs, cell and gene therapies provide substantial long-term cost savings by reducing the need for ongoing treatments, hospitalizations, and other healthcare expenses associated with chronic or severe illnesses. Given the curative intent of gene therapies, a different pricing framework is needed. For example, some firms created outcome-based policies. Bluebird bio will offer up to an 80% refund of the price of its thalassemia gene therapy, Zynteglo, if the patient does not see a sustained response up to two years after administration.16

Path Forward: Bringing Manufacturing Costs Down, Expanding Reach

Though genomic medicines already offer long-term cost savings, there is potential for costs to decrease over time via improvements to manufacturing techniques.

Currently, manufacturing genomic medicines is incredibly complex. Manufacturing can take two–three weeks for cell therapies and up to three months for gene therapies, with input costs ranging from $100,000 to $300,000 per dose.17,18,19

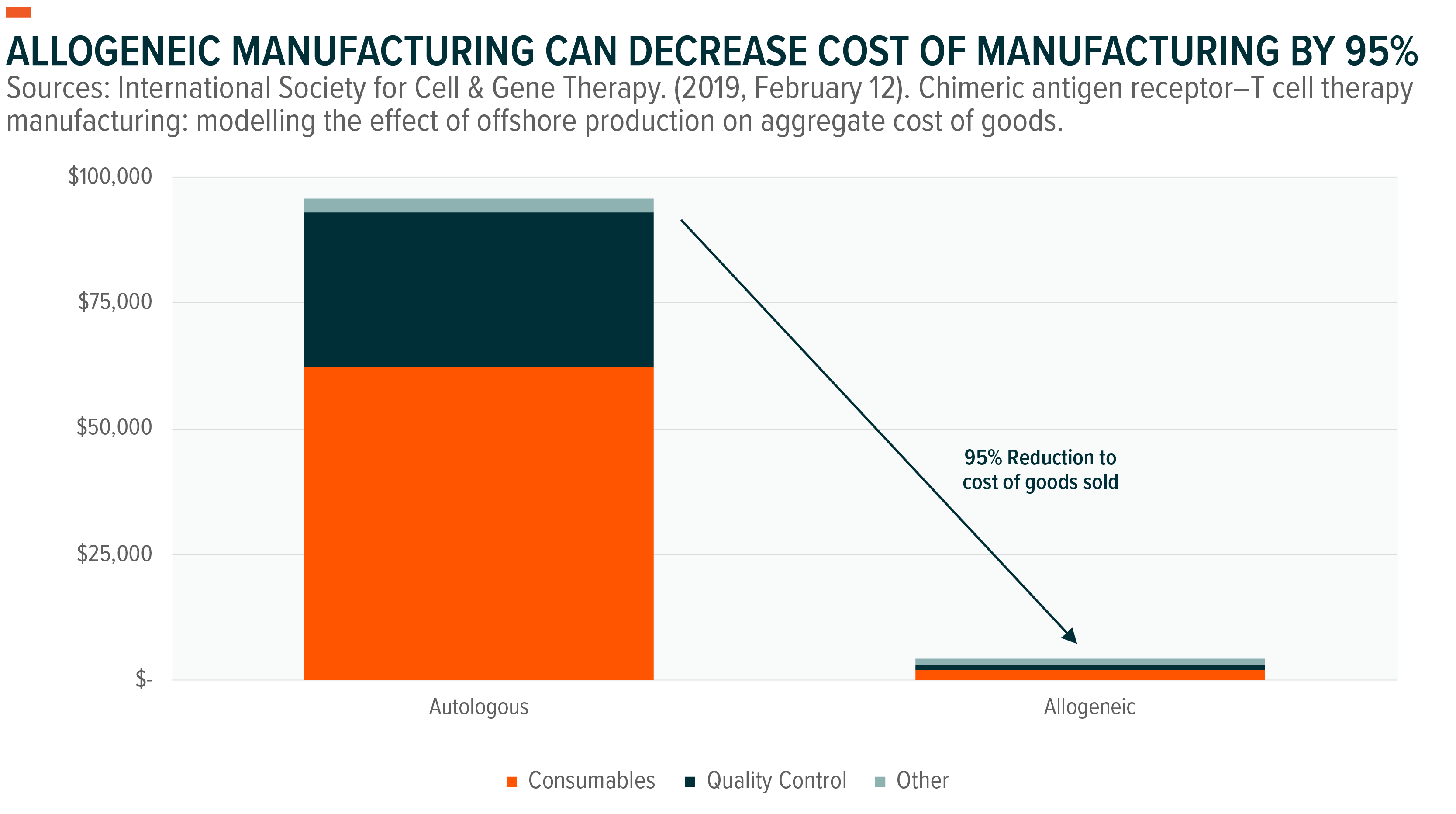

Investigational manufacturing methods – like allogeneic manufacturing – seek to improve manufacturing costs, turnaround times, and supply.

Current manufacturing relies on an autologous approach, in which T-cells are patient-derived. Conversely, an allogeneic CAR-T uses donor-derived T-cells as the basis for treatment. This approach would allow for a scalable “off-the-shelf” manufacturing process, meaning the therapies can be manufactured in large batches from donor-derived tissues instead of in single lots using the patient’s own tissues. If implemented, allogeneic manufacturing can decrease cost of manufacturing by 95%.20

Conclusion: Genomic Medicine Could be Poised for Explosive Growth

Genomic medicines have the potential to revolutionize healthcare, possibly offering patients treatment options that are more effective, cheaper, and more convenient than current therapies. Higher initial prices for genomic medicines have been an impediment to broader adoption, but long-term costs are already less expensive for some treatments relative to traditional therapies, and we envision upfront costs falling dramatically as cumbersome manufacturing processes improve over time. With such vast potential, many companies could benefit from growth in genomic medicines. Biotech firms would likely be the primary beneficiaries, but large pharmaceutical companies and those involved in medical specialties and nursing services could also benefit. An ETF such as the Global X Genomics & Biotechnology ETF offers broad exposure to this exciting theme.

Related ETFs

GNOM – Global X Genomics & Biotechnology ETF

AGNG - Global X Aging Population ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.