Long term structural trends, by definition, take time. The development and adoption of new technologies, the changes in deeply-ingrained consumer behaviors, or the materialization of demographic shifts don’t happen overnight. Yet certain events can prove to be either an accelerant or retardant to their adoption.

By and large, the COVID-19 pandemic is proving to be an accelerant for many long-term structural trends. With widespread concerns around public health and global economic growth, consumers, companies, students, and governments are all rapidly adapting their behaviors to cope these new realities. Many of these shifts involve leveraging the latest technologies to make stay-at-home orders more palatable. This includes utilizing video-conferencing for work, school, and doctor’s visits, enjoying streaming and gaming platforms for entertainment, connecting with friends and family on social media networks, and shopping for goods online rather than in-store. Outside of our homes, we’re seeing widespread changes as well. A greater emphasis on robotics & automation is helping reduce the need for human contact in places like hospitals, warehouses, and factories. Within the health care space, revolutionary genomics-based testing and treatments are gaining steam as researchers scramble to combat the virus.

COVID-19 is not just accelerating the adoption of these technologies, but also expanding their potential markets. E-commerce sites, for example, rarely considered the Silent Generation (those born between 1928 – 1945) as their target audience. Yet seniors are among the most vulnerable to the disease and amid lockdown orders are learning how to order basic food, home goods, and medicine online. Similarly, video conferencing and social media apps often target younger audiences, but are quickly realizing that older generations are increasingly using their technologies to maintain social connections.

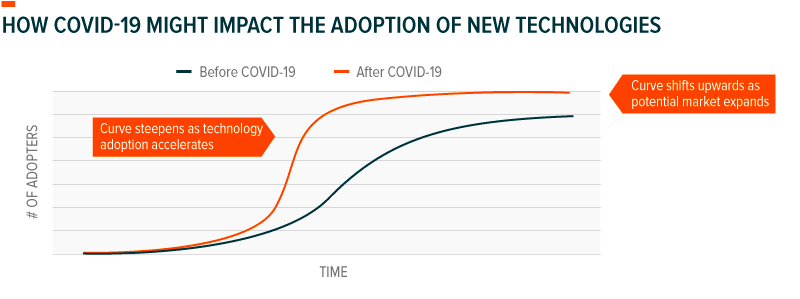

In thematic investing, we often attempt to assess a theme by plotting it along an adoption curve – an expected trajectory of adoption and the market potential for a particular theme. As demonstrated below, we show how COVID-19 is likely both steepening the curve and shifting it upwards as certain themes are both accelerating and expanding due to the viral outbreak.

How to Access Thematic Disruption

Properly investing in thematic disruption requires a two-step process. First, we believe that investors should identify, from the top down, the powerful macro level trends that they expect will disrupt large portions of the economy. Second, they should properly identify the companies that stand to benefit from the materialization of those trends. Historically, identifying themes and accessing the appropriate securities required substantial research and operational capabilities, limiting thematic investing to just sophisticated institutions. Yet now, with the increasing availability of Thematic ETFs, investors have more options than ever to efficiently access a range of powerful themes.

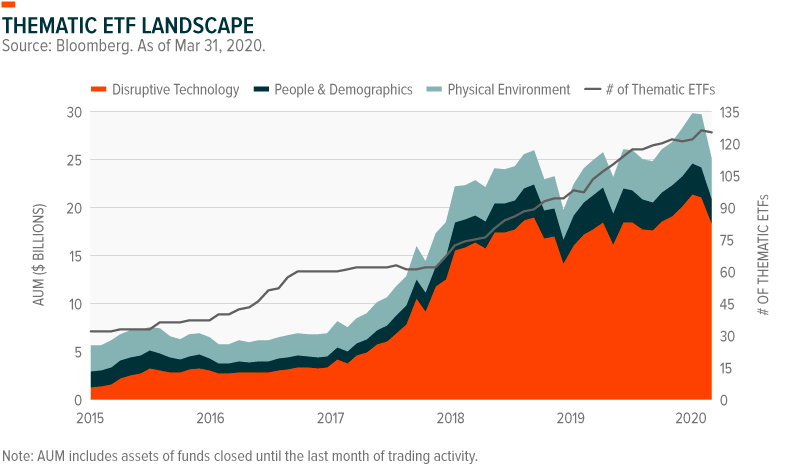

In our Q1 2020 Thematic ETF Report we identified 125 thematic ETFs tracking more than 60 different mega-themes, themes, and sub-themes, and with over $25B in cumulative assets under management. We expect thematic ETFs to continue to proliferate as investors increasingly incorporate thematic exposures in their portfolios.

Multiple Themes in One Solution

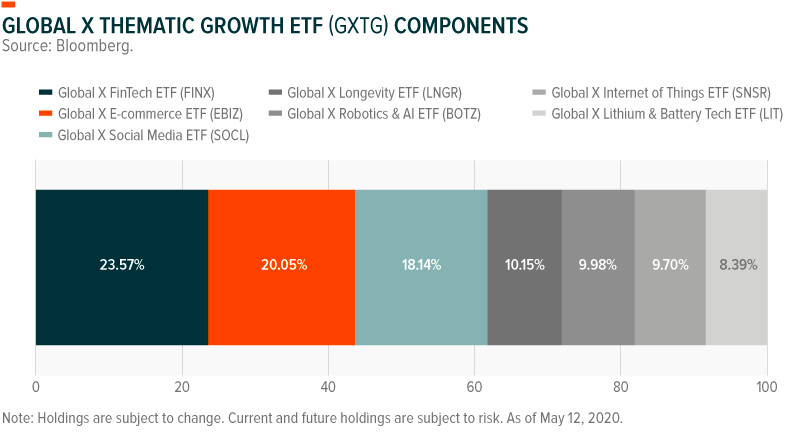

With such a wide breadth of thematic ETFs, investors can often wonder which ones to select for their portfolio and how to weight them. The Global X Thematic Growth ETF (GXTG) is a fund-of-funds designed to access a handful of potentially high-growth themes simultaneously, helping investors efficiently navigate which themes offer the most attractive growth opportunities and how to weight and diversify across those themes in a portfolio. GXTG is intended to serve as a one-trade solution that investors can use as a long-term position in a growth-oriented portfolio. Alternatively, investors can use GXTG as a core thematic position in conjunction with using ETFs targeting individual themes to tilt or complement the fund’s exposures.

The index methodology of GXTG’s underlying index is heavily based on Global X’s research and investment approach to thematic investing. One such consideration is optimizing around potential growth. By selecting themes based on their trailing sales growth and overweighting those with the highest , the methodology seeks to gain exposure to the themes that we believe , as their products and services rapidly take hold in the marketplace.

Another consideration is diversification. By grouping themes by the sectors they are disrupting, and selecting one from each group, the methodology aims to achieve balance across the major forces that are driving disruption forward.

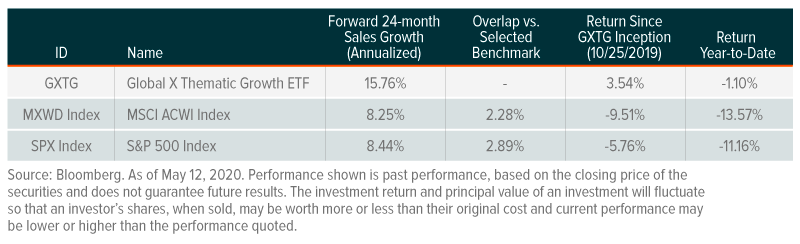

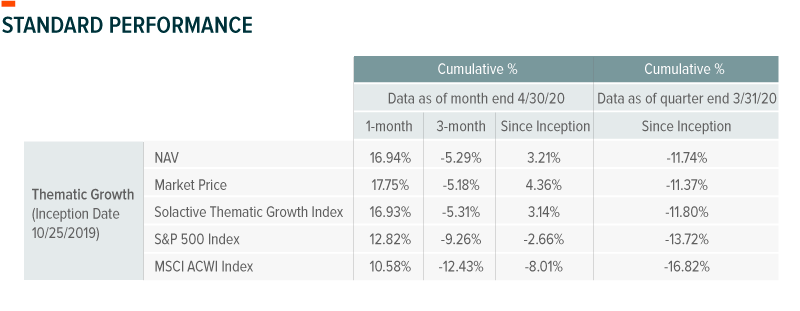

GXTG’s approach has so far proven effective at delivering higher growth than broad market benchmarks. As COVID-19 disrupts major segments of the economy and creates opportunities for certain high-growth themes, GXTG has owned positions in well-positioned themes like E-commerce, Robotics & AI, and Social Media, among others. As a result, the fund has outperformed indexes like the S&P 500 and MSCI ACWI since inception and year-to-date.

Fund’s Gross Expense Ratio is 0.50%. The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. The fund recently experienced significant positive short-term performance due to market volatility associated with the COVID-19 pandemic. For performance data current to the most recent month end, please call 1-888-493-8631, or visit www.globalxetfs.com.

Related ETFs

GXTG: The Global X Thematic Growth ETF seeks to provide broad exposure to structurally disruptive macro-trends through a portfolio of ETFs selected from the Global X Thematic Growth family.

Pedro Palandrani

Pedro Palandrani