Preview

Contents

- Emerging Markets Overview

- Key Opportunities: Cyclical, Structural, Contrarian, and Value

- Keys to Potential EM Outperformance: Growth and the U.S. Dollar

- China

- India

- South Korea

- Taiwan

- The Association of Southeast Asian Nations (ASEAN)

- Brazil

- Mexico

- Andean Region

- Emerging Europe

- Middle East and North Africa (MENA)

- South Africa

- Frontier Markets Watch List

Emerging Markets Overview

In general, investors are underweight in their emerging market (EM) allocations, and we feel this is an excellent time for a reassessment of that positioning, as the asset class looks poised for potential outperformance in 2024. EM countries represent over 75% of global land, almost 90% of the population, and 80% of global gross domestic product (GDP) growth, but only 11.7% of global market cap.1,2,3,4 Looking into 2024, we’re encouraged by a combination of:

- A margin of safety from a valuation perspective (EM equities were recently at their lowest level versus the U.S. since 1971!).5

- The prospect of a weaker U.S. dollar, driven by the likely peak of the U.S. monetary policy cycle.

Though we’re cautious of the impact of slowing Western demand on hardware producers in North Asia and materials producers in Latin America, we see an abundance of structural stock picking opportunities in India, Brazil, Southeast Asia, Greece, and Mexico. EM equities have only outperformed the S&P two times over the past ten years.6 Following a decade of U.S. exceptionalism, emerging markets now offer outsized growth potential at discounted valuations. The market is over 700bps underweight the asset class, and valuations are more than one standard deviation below their historical average.7 We are eager to take advantage of this potentially unique window of opportunity.

Key Opportunities: Cyclical, Structural, Contrarian, and Value

- A Cyclical Opportunity: We believe Brazil represents 2024’s best cyclical opportunity. After raising interest rates by 1,175bps (!), the Central Bank pivoted its stance in 2022 and began an impactful rate cutting cycle, slashing the benchmark SELIC rate by 50bps in each of four consecutive meetings. We believe there is significant room to go. In the past six rate cutting cycles, we’ve seen the MSCI Brazil Index (USD based) rally in four of them and move down in only two.8 Importantly, those rallies have averaged roughly 96.7% upside, where the drawdowns averaged only roughly 17.3%.9 We like this set up. Last, Brazilian equities also boast a strong (roughly 5%) inverse relationship with the U.S. dollar.10

- A Structural Opportunity: We continue to see India as the best structural growth opportunity in emerging markets, if not the world. India boasts both the world’s largest general and youth populations, with 65% of people below 35 years old.11 This young population is broadly educated, with the youth literacy rate standing at roughly 90%.12 The country should deliver the most university graduates in the world this year and boasts the third largest group of scientists and technicians in the world.13 Importantly, this demographic setup is supported by a market friendly and democratically elected government. India is young, educated, and ready to deliver across services, manufacturing, and consumption.

- A Contrarian Opportunity: China appears to have reached a state of “peak pessimism” just at the time when the effects of stimulus have begun hitting the real economy and political leaders have taken meaningful steps towards easing geopolitical tensions. Though obstacles remain for the broad market, we believe that China consumer names look especially attractive from a valuation and earnings perspective.

- A Value Opportunity: Greece recently received an upgrade to Investment Grade status and has bonds trading with yields lower than U.S. Treasuries. However, its equity market still trades at 5.1x earnings and 0.9x book value with a 13.75% return on equity (ROE) profile and a 5% dividend yield.14 With political and economic momentum on its side, we believe Greece is priced to perform well in 2024.

Keys to Potential EM Outperformance: Growth and the U.S. Dollar

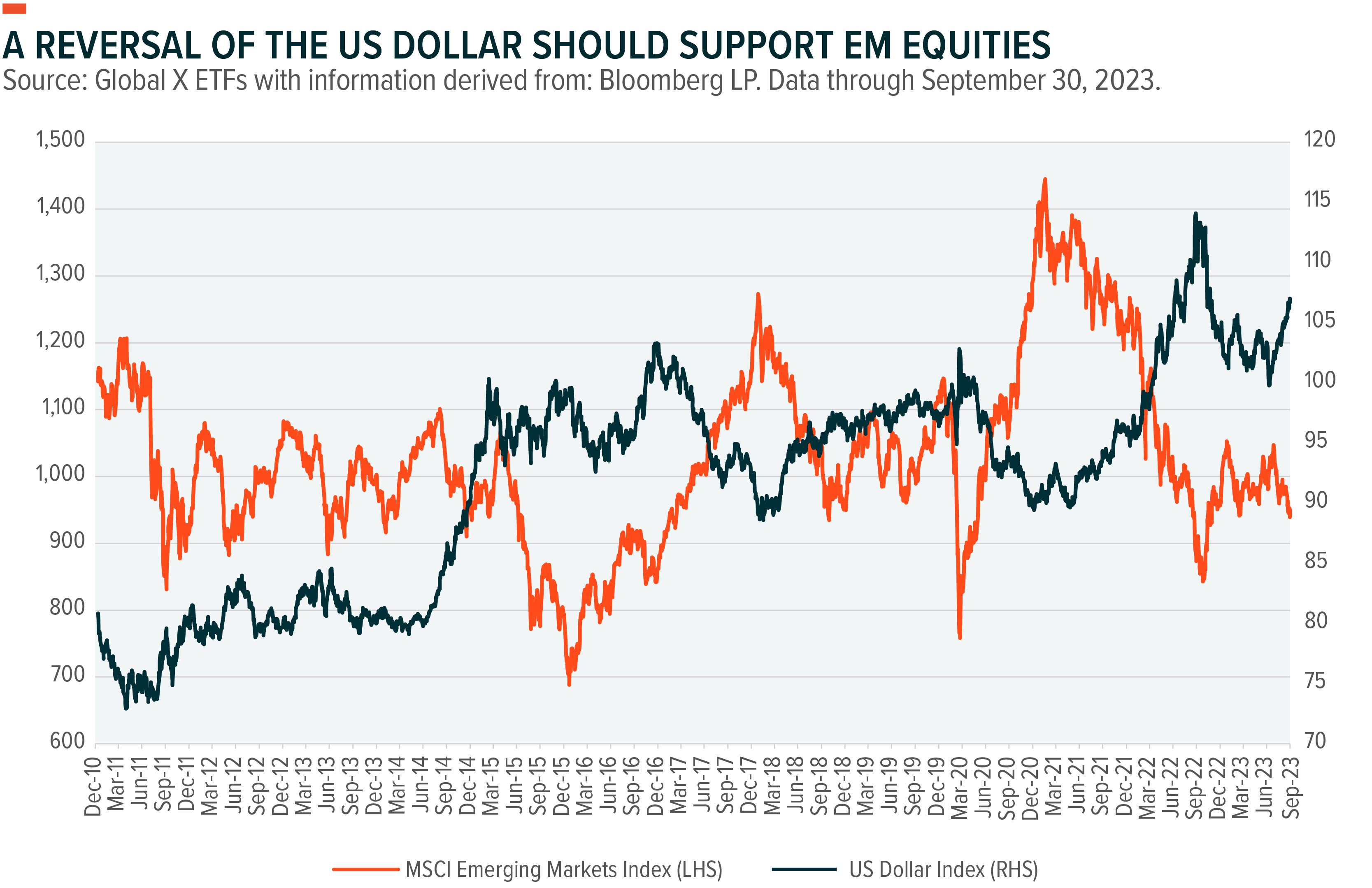

U.S. Dollar Weakness: We see the U.S. dollar as the most impactful driver to broad emerging market equity performance. Historically, EM equities have displayed an inverse relationship with the dollar (gaining roughly 4% for every 1% downwards move of the USD).15 This correlation is due to both:

- The inverse relationship between the USD and commodity prices, and

- EM countries and the companies within them having historically funded their growth prospects with USD debt.

Though we refrain from making an outright call on the U.S. dollar, it is important to consider potential drivers of the currency:

- The Fed has signaled the potential end to its monetary policy hiking cycle. Lower rates, inherently, attract less capital, which means less demand for U.S. dollars and, hence, potential weakness.

- An uncertain and polarizing election cycle in which both leading candidates have displayed a propensity to spend and increase the U.S. fiscal deficit.

- Diminishing confidence in key institutions, as “looming” government shutdowns have become common practice.

Growth: Consensus numbers show EBITDA (earnings before interest, taxes, depreciation, and amortization) growth levels for the S&P 500 Index coming down from 10% in 2023 to 9.1% in 2024.16 At the same time, expectations for revenues appear stagnant in the mid to low single digits.17 This makes sense as one considers the effects of the steepest and quickest rate hiking cycle in U.S. history. Additionally, as U.S. consumers and companies digest higher rates, they are also feeling the effects of tapering stimulus. Expectations for EM EBITDA growth, on the other hand, have companies moving from zero growth this year to 17.5% in 2024, while also doubling top-line growth numbers.18 This rebound should be led by China’s delayed reopening, India’s structural momentum, and monetary easing across Latin America. In a world where interest rates might be tapering off, we could see investors searching for growth again, and EM just might be the source. Prospects of a weaker USD could signal healthier balance sheets, lower interest expenses, and higher earnings revisions – all positives for EM equities and similar to what we have seen in past cycles. EM has historically been the best performing asset class one year following the last hike of a cycle.

China

Given the pessimism in the market, 2024 may present an opportunity for stock pickers in China, as valuations grow disconnected from fundamentals. Though China may face uncertainties in terms of a U.S. election cycle and hawkish rhetoric from all parties, valuations are discounted and fundamentals appear to be improving. We believe it’s vital to look at these key points:

- Stimulus: Albeit slower than market desires, we have seen steady and proactive government support since the middle of 2023. Thus, we believe that signs of stabilization and growth should continue to emerge through 2024. In terms of consumption, we believe policymakers will likely focus on enhancing effective income while eschewing large-scale consumption vouchers, indicating a preference for more active fiscal policy with targeted distribution adjustments.

- Geopolitics: We have been encouraged by the various meetings between senior level officials from China and the U.S. through 2023, culminating in a summit between President Xi Jinping and President Biden in November. We expect U.S. politicians to show more “bark than bite” through the 2024 election cycle, as tariffs have proven a challenge for U.S. inflation.

- Manufacturing & Trade: Though not in our base case, any signs of improving external demand for Chinese goods would likely translate into a significant tailwind for China’s economy.

- Property Sector: President Xi’s 2017 statement prioritizing housing for living, not speculation, signaled a shift in policy that many developers and investors didn’t fully acknowledge. There is still significant supply for the market to digest, but we are encouraged by the proactive government measures to avoid spillover into other sectors. Broadly speaking, we’re also encouraged by the trend of Chinese households moving their savings out of real estate and into capital markets.

- Reopening: Though overlooked, we continue to see improving consumer confidence coming out of the delayed reopening from China’s severe lockdown period.

- Valuations: China trades at an 8.8x price-to-earnings (P/E) ratio and 1x book value, which is more than one standard deviation below five-year historical averages.19

It’s important to also examine the message from the December Central Economic Work Conference (CEWC), which noted that economic activity had already hit its lowest point. However, policy makers indicated that challenges persist and that their work is not yet done. The CEWC outlined nine tasks, five of which we see as potentially important to market dynamics:

- Drive innovation and industry advancement, emphasizing digital economy, AI technology, bio-manufacturing, aerospace, quantum, and life science.

- Stimulate domestic demand, creating a mutually reinforcing cycle between consumption and investment. Enhance social welfare and safety nets, particularly emphasizing employment for key groups.

- Uphold and implement the "two unswerving" principles: fortifying the public sector while supporting non-public economy development.

- Improve market access across telecommunications, medical, and other service sectors.

- Mitigate risks in critical areas like real estate, local government debt, and small- to medium-sized financial institutions.

Despite the government’s 2023 efforts to stabilize the economy, it will likely take time for these policies to translate into growth. We expect monthly data to fluctuate, but fears concerning systemic risks have diminished, possibly resulting in the emergence of bottom-up opportunities. Thus, we are cautious on China from a broad perspective, but see many fundamental opportunities amidst the widespread pessimism.

India

We are positive on the outlook for Indian equities in 2024, driven by the high visibility of multi-year growth. As India gears up for its general elections in April-May 2024, the current government is likely to roll out new initiatives aimed at bolstering the less affluent segments of the population. Additional spending designed to elevate public sentiment and stimulate consumption could also be on the horizon. Regardless, 2024 elections will likely be a key macro event for markets in that the outcome is expected to have an important bearing on policy direction. The stakes are high for the ruling Bharatiya Janata Party (BJP), which has recently secured victories in three out of four crucial state elections. This success bodes well for the BJP and further boosts hopes of political continuity in 2024.

In addition, given the combination of 1. Market friendly government policies and spending; 2. Strong flows from foreign investment; and 3. Demographic dividends translating into an emerging consumer class – corporate earnings strength appears durable. We are also encouraged by a prudent central bank, which seems to have stabilized inflation. Last, the including of India into EM fixed income benchmarks could act as another tailwind for Indian capital markets and funding. Overall, India looks like the best structural opportunity in the world, with the opportunity to reinvest outsized growth into profitable projects.

South Korea

South Korea’s equity market has seen unusually large earnings swings in recent years, largely due to COVID disruptions and weakness in the memory chip and battery materials sectors. However, with memory makers expected to swing from losses to strong profits in 2024, a major earnings turnaround appears to be underway. Korea is also projected to see improving macroeconomic conditions in 2024 as GDP growth is anticipated to rebound alongside moderating inflation. Against this backdrop, sectors such as memory and autos could be well-positioned to outperform as earnings momentum recovers. Nonetheless, uncertainties around a potential U.S. recession or ongoing memory inventory overhang pose downside risks to the outlook. The April 2024 general election could also impact the legislative policy environment in the second half of the year.

Taiwan

Taiwanese equities surged in 2023, partly driven by the anticipation of an earnings recovery and burgeoning optimism in AI technology. However, as several key sectors like technology are highly exposed to swings in the global macro outlook, the risks of consolidation remain if investor sentiment turns on the prospects for a soft-landing in the U.S. Although valuations in the technology sector have already re-rated, the earnings upgrade is expected to continue on the back of the AI investment trend and recovery of memory chips and the smartphone cycle. If a U.S. recession materializes, it could significantly undermine Taiwan’s growth and stock performance given its export dependence. However, some sectors, like semiconductor packaging and Android smartphone components, may offer relatively brighter outlooks. Meanwhile, Taiwan's economy is projected to see GDP growth stabilize in 2024, likely supporting the market recovery. Lastly, geopolitical risks remain a wildcard, with upcoming elections in Taiwan and the U.S. potentially reshaping the investment landscape.

The Association of Southeast Asian Nations (ASEAN)

Indonesia: The Indonesian market is set to experience dynamic growth in 2024, particularly within sectors such as electric vehicles and consumer spending, which are thriving due to the country's evolving macroeconomic landscape. While the forthcoming presidential election in early 2024 could introduce short-term volatility, anticipations of a favorable political climate post-election suggest that domestically oriented sectors, such as financials and consumer goods, could outperform. In particular, we are optimistic on Indonesian banks, as the sector’s ability to defend earnings, maintain profitability, and grow balance sheets could be key in generating alpha amidst an uncertain global macro environment.

Malaysia: Malaysia is expected to face some challenges in 2024, with rising headwinds such as tight liquidity conditions, flat net interest margins, and subdued loan growth potentially impacting the financial sector. Moreover, a global economic slowdown could place pressure on the commodity sector and deteriorate the quality of bank assets. Despite these risks, the country's stable political environment and ongoing positive government reforms, particularly in construction and infrastructure development, should provide a buffer.

Philippines: The outlook for Philippine equities appears subdued as the market grapples with persistent inflation, a tough monetary policy stance, and macroeconomic uncertainties. However, the real estate sector, known for its resilience to inflation and defensive earnings, is anticipated to be a bright spot amongst the broader market challenges, especially leading mall operators.

Brazil

We believe Brazil remains one of the most attractive cyclical opportunities in EM, if not the world. Brazilian equities rallied 23.67% this year in U.S. dollar terms (as of 12/11/23), and we believe this is just the beginning.20 Over 8% of that rally came from a stronger currency, and we are just beginning to see the signs of earnings improvements. From a valuation perspective, Brazil trades at an undemanding 7.5x P/E ratio (the S&P trades at 19x!) and 1.3x book value.21 We believe this setup provides a strong margin of safety. Perhaps more exciting is that even if prices remain stagnant, the market also pays a 7% dividend yield.22 Optically, this makes sense, but the additional enthusiasm for Brazil comes from its prospects for positive earnings revisions.

Brazil’s key interest rate peaked at 13.75% in 2022, while inflation came down to roughly 3% in June, 2023.23,24 That translated into the highest real rates in the world. The combination of this carry trade, continuously lower unemployment (now in mid-single digits), and consensus upgrades to GDP forecasts allowed the central bank to make four consecutive 50bp rate cuts between August and December with signals that there is more room to go. This is important for four reasons:

- Brazilian companies levered in floating rate debt benefit from lower interest rates, as they shrink their balance sheets and lower net interest expenses. This translates into positive earnings revisions without any operational improvement.

- Brazilian local investors were recently able to benefit from earning 14% on government bonds. As interest rates come down and earnings yields (now 13.5%) show higher returns than fixed income, we could see a shift in local capital allocations away from bonds and into equities.

- Lower interest rates reduce the burden for borrowers and inherently reduce asset quality pressure on banks. According to our research, nonperforming loan formation for the banking system came down for the first time in two years in Q3, which we take as a positive sign looking forward.

- Lower rates should stimulate borrowing and spending across the entire Brazilian economy.

Mexico

Mexico appears poised to carryover its strong momentum from 2023 into 2024. While Presidential and Senatorial elections could create some disruption, we believe the risk of extreme reforms has diminished. On the domestic side, demand remains buoyed by a combination of strong real wage income growth (which includes another 20% minimum wage increase in 2024), increasing government spending ahead of elections, growing remittances from abroad, and a strong FX with a positive real interest rate environment. Furthermore, nearshoring should provide strong continued external tailwinds and has helped drive a 28.6% YoY increase in fixed capital investment through June to reach its highest level on record.25 We expect gross fixed capital formation to continue growing, and note that the pick-up in imported machinery and equipment since 2020 has been the main driver behind the strong growth since the COVID-19 pandemic, reflecting Mexico’s preference as a nearshoring destination. In fact, imported machinery and equipment has grown at more than double the overall pace of gross fixed capital formation.26 Furthermore, even with a 20% increase in minimum wages in 2024, average Mexican factory wages should remain well below their Chinese peers, as seen in the chart below. A key risk for 2024 is the deteriorating fiscal account, given an expected increase in government spend in an election year. However, inflation has declined from its 2022 peak of near 9% to 4.32% in November 2023, while rates have remained elevated at 11.25% throughout most of the year, as seen in chart nearby, and we expect Banxico to begin cutting rates in 2024.27,28 The combination of lower rates, a strong consumer, continued nearshoring related investments and a stable FX could provide a powerful backdrop for equities, but we are mindful of potential exogenous risks, including a possible U.S. slowdown and elections.

Andean Region

Chile: Following a difficult period that saw the consumer price index (CPI) peak above +14% and three consecutive negative quarters of year-over-year GDP growth, Chile’s economy seems to have reached an inflection point. We expect the sharp decline in consumer prices and rate cuts from the central bank to spur consumption over the coming quarters. Furthermore, a political shift back to the center and the improving medium-term copper and lithium price outlooks should not only boost growth but also help backstop the currency.

Colombia: In our view, Colombia remains a valuation story heading into 2024, as cheap multiples of near 6x P/E for the MSCI COLCAP Index versus a historical average of nearly 9x is offset by weak domestic demand, fiscal uncertainty, and upside risks to inflation during an El Niño year.29 Higher inflation could keep rate cuts at bay and result in a slower pace of easing versus other LatAm peers, while consumers remain largely tapped-out, limiting potential growth in 2024 – even coming from a low base in 2023. Furthermore, ongoing uncertainty over reforms, especially after the government’s recent setback in regional elections, continues to act as a headwind to domestic capex and investment, which will likely negatively impact future growth potential. On the other hand, higher energy prices could provide tailwinds for the market and help improve the country’s fiscal account more than the market expects.

Peru: In Peru, political uncertainty remains at the forefront, as Dina Boluarte’s Administration remains fragile, and support grows for early elections. At the same time, Congress is reluctant to approve impeachment proceedings that could risk early Congressional elections, especially given low approval ratings for Congress. Although consensus GDP growth of 2.4% for 2024e looks strong, it is coming from an extremely low base of 0.5% in 2023e, given disruptions to economic activity due to social protests and harsh weather conditions in the beginning of the year. Although these effects will not carry over into 2024, there are downside risks due to the El Niño phenomenon. On the positive side, potential cuts from the U.S. Fed should support gold prices, and we could also see a pick-up in demand for copper. Finally, Peru started its monetary easing cycle in September, and we expect additional rate cuts through 2024 as economic activity remains weak and inflation continues to decline.

Emerging Europe

Poland: With elections in the rear-view mirror, the hard work begins for Poland in 2024. First steps from the new government should draw parallels to those from the previous administration and continue to support the broad consumer. Though positive for consumption growth, this will likely pressure the fiscal account. After surprising pre-election cuts in 2023, we do not expect the central bank to cut again in the first half of the new year. Over the medium term, we expect goodwill from both Poland and the E.U. to allow for the approval of E.U. funding as relations normalize. Poland would probably also benefit from a potential rebound in E.U. growth, along with any de-escalation of tension between Russia and Ukraine. Of course, both also represent risks.

Turkey: Turkey’s story appears uncertain into 2024. President Erdogan, a leader known for controversial economic policies, surprised the world with a reelection victory in the first half of 2023. To the benefit of markets, he named two well respected private market veterans to lead fiscal and monetary policy. This has been a positive for Turkey’s market, but the President is known for high turnover in his cabinet and, looking into 2024, we are uncertain if Erdogan will keep this new market-friendly leadership in place beyond regional elections. In addition, we note that high interest rates, high energy prices, and regional tensions can all put pressure on Turkey’s economy. The market expects Turkish inflation to remain above 50% through 2024, which creates headwinds for a U.S. dollar investor.

Greece: Trading at deeply discounted valuations, we see Greece as one of the best value opportunities in the world. Importantly, we also see clear potential catalysts in the form of more rating agency upgrades to Investment Grade, the reintroduction of dividends to the banking sector, and a reopening of the IPO market leading to conversations about a potential re-classification to “developed market” status.

Czech Republic and Hungary: Both Hungary and the Czech Republic are experiencing similar macro trends, with disinflation paving the way for a consumer and economic recovery in the coming year, while both economies stand to benefit from a potential rebound in E.U. growth. Deteriorating growth in Western Europe, however, does represent a risk. Hungary’s Central Bank has been more aggressive than most, beginning its easing cycle in October. In the Czech Republic, we see room for the CNB to begin cutting soon, while GDP growth is expected to continue to accelerate sequentially in 2024. We also highlight that both these markets stand to be outsized beneficiaries of a resolution in the Russia-Ukraine conflict, should one emerge.

Middle East and North Africa (MENA)

Saudi Arabia: We maintain a positive outlook on Saudi Arabia heading into 2024, underpinned by its long-term strategy to diversify away from its reliance on oil for GDP growth, positive demographic dividend, low investor positioning, USD peg coupled with a low weighted average cost of capital (WACC), and macro stability. In fact, the International Monetary Fund forecasts non-oil GDP CAGR (compound annual growth rate) of >4% towards the end of the decade in Saudi Arabia. Although self-imposed production cuts at energy giant Aramco limited GDP growth in 2023, growth is expected to re-accelerate in 2024e towards 3.5%, as production cuts ween off throughout the year and domestic consumption and accelerated project implementation from structural reforms underpin growth. Furthermore, additional potential sell-downs from the kingdom’s Public Investment Fund could help drive additional flows to the market and help make Saudi/GCC a larger part of the MSCI Emerging Markets Index than Brazil/LatAm.

United Arab Emirates: The United Arab Emirates experienced substantial growth since the pandemic, with favorable regulatory changes driving population growth and attracting both tourists and corporates. Looking ahead, the higher medium-term oil price outlook represents an expected tailwind for Abu Dhabi’s energy-heavy index, while Dubai’s consumer facing economy stands to benefit from the associated second-hand effects. The UAE’s IPO pipeline remains robust, likely leading to deeper capital markets, attracting flows, and increasing the country’s regional and global importance. We remain optimistic on the long-term outlook for the UAE, as the government remains committed to its ambitious growth targets, while also managing to remain neutral amid growing global geopolitical tensions. On the negative side, we do acknowledge the impact the Israel/Hammas war may have on tourism.

Kuwait and Qatar: Like Saudi Arabia, Kuwait and Qatar benefit from incremental non-oil GDP Growth, a dollar related peg, macro stability, underweight positioning, and a moderately strong outlook for energy prices as OPEC+ keeps supply restrained. On the other hand, geopolitical risks remain a concern. In Kuwait, growth could recover in 2024, given the lower base in 2023. On the positive side, the country’s fiscal and current accounts are in excellent shape, and the country could start enacting much needed reforms around labor, business, and taxes. Qatar also benefits from its strong current and fiscal accounts and has been able to sustain its growth since hosting the 2022 World Cup. Consensus expects GDP to grow 2.5% in 2024, underpinned by progresses with the country’s North Field expansion plan. Although geopolitics could remain a headwind, Qatar could also benefit from a better-than-expected 3rd National Development Strategy that will be released soon.

South Africa

South Africa’s outlook for 2024 remains bleak, with continued power outages, limited upside from a China property sector recovery, and the August Presidential election set to weigh on growth. We see the result of the upcoming Presidential election as more uncertain than in previous votes, with early polls predicting President Ramaphosa to fall short of a majority. This increases the risk that the African National Congress will be forced to work with smaller parties to govern effectively, potentially limiting progress on necessary reforms. South Africa’s equity index has a lot of exposure to the materials sector, so it could be well positioned to benefit from a potential commodity price rally associated with any rebound in the Chinese property sector. Although we recognize increased stimulus could help the property sector as well as spark some infrastructure growth, we don’t expect to see the industry returning to its previous levels of growth. We also don’t anticipate loadshedding to be solved in 2024, and the lack of consistent power will probably continue to cap domestic growth. However, we do see room for the situation to improve as private sector power generation capacity increases. On the positive side, the consumer may benefit from decreasing inflation, potentially leading to interest rate cuts and subsequent acceleration in credit growth. We think tourism still has room to catch up, with international arrivals by air still at ~80% of 2019 levels.30 Overall, we remain cautious on the South African market in 2024.

Frontier Markets Watch List

Argentina: Argentines voted decisively for change in the most recent Presidential election, rejecting Peronism and electing Javier Milei by a near 12% margin.31 Despite being seen as a more radical figure, the Milei victory was the clear positive outcome for markets, and we believe gridlock in congress and aligned economic policies will likely pave the way for continued moderation from Milei. The newly elected President has already begun making orthodox market-friendly appointments to key positions, such as Finance Minister. He will be tasked with implementing tough fiscal adjustments and economic policy reforms over the coming years and, if successful, could pave the way for a brighter future. We continue to recognize the long-term economic potential for Argentina, highlighting the vast and green-positioned natural resource base, its educated population, and low credit penetration. Overall, the Milei Presidency represents a major shift for the country’s economic outlook, which could drive foreign investment into the country and unlock Argentina’s true economic potential.

Vietnam: Vietnam’s outlook continues to improve as we head into 2024. The Central Bank moved aggressively in late 2022 to tighten interest rates, weighing on both domestic credit growth and the real estate sector. However, the group began its easing cycle in April 2023, which we see as increasingly supportive for the consumer. Vietnam was not immune to the global consumption slowdown seen in 2023, with exports declining YoY for nine of 10 months through August. However, data has shown sequential acceleration for three straight months since then, with easier comparisons setting a stage for a more favorable outlook heading into 2024.32 The recent visit from President Biden rang positive, with Vietnam subsequently upgrading its relationship with the U.S. by two-notches to “Comprehensive Strategic Partnership,” the country’s highest level of relations and on par with those of China and South Korea. We see this development as critical to bolster Vietnam’s case as a “friend shoring” destination. This theme is key to attracting foreign direct investment into the country, evidenced by the recent deal between semiconductor company Nvidia and local tech company FPT.33 We have also seen signs of the government being more active about gaining an emerging market designation, which would be a major catalyst for driving flows to the market. We remain positive on Vietnam heading into 2024, with the region set to be an outsized beneficiary of a possible U.S. and E.U. consumer rebound, while strong domestic tailwinds remain.

Pakistan: Pakistan showed one of the best second half rallies in the world this year. Despite returning only 3.19% YTD (as of 11/28), Pakistani stocks rallied 33.76% (in USD) since the end of June.34 In classic EM fashion, this move came on the back of a new USD $1.2bln International Monetary Fund (IMF) agreement. The deal aims to support stabilization of the economy and guard against shocks while creating the space for social and development spending to help the people of Pakistan. Big picture, the program demands fiscal discipline and a market determined currency, all seen as market friendly. Though Pakistan has seen a strong recent run, the broad benchmark still trades at 0.5x book value and 2.7x earnings with a 14.7% dividend yield.35 Though Pakistan could continue to face challenges in the form of uncertain elections, another IMF negotiation, and an unbalanced economy, recent momentum is pointing in the right direction and valuations are some of the most attractive in the world.