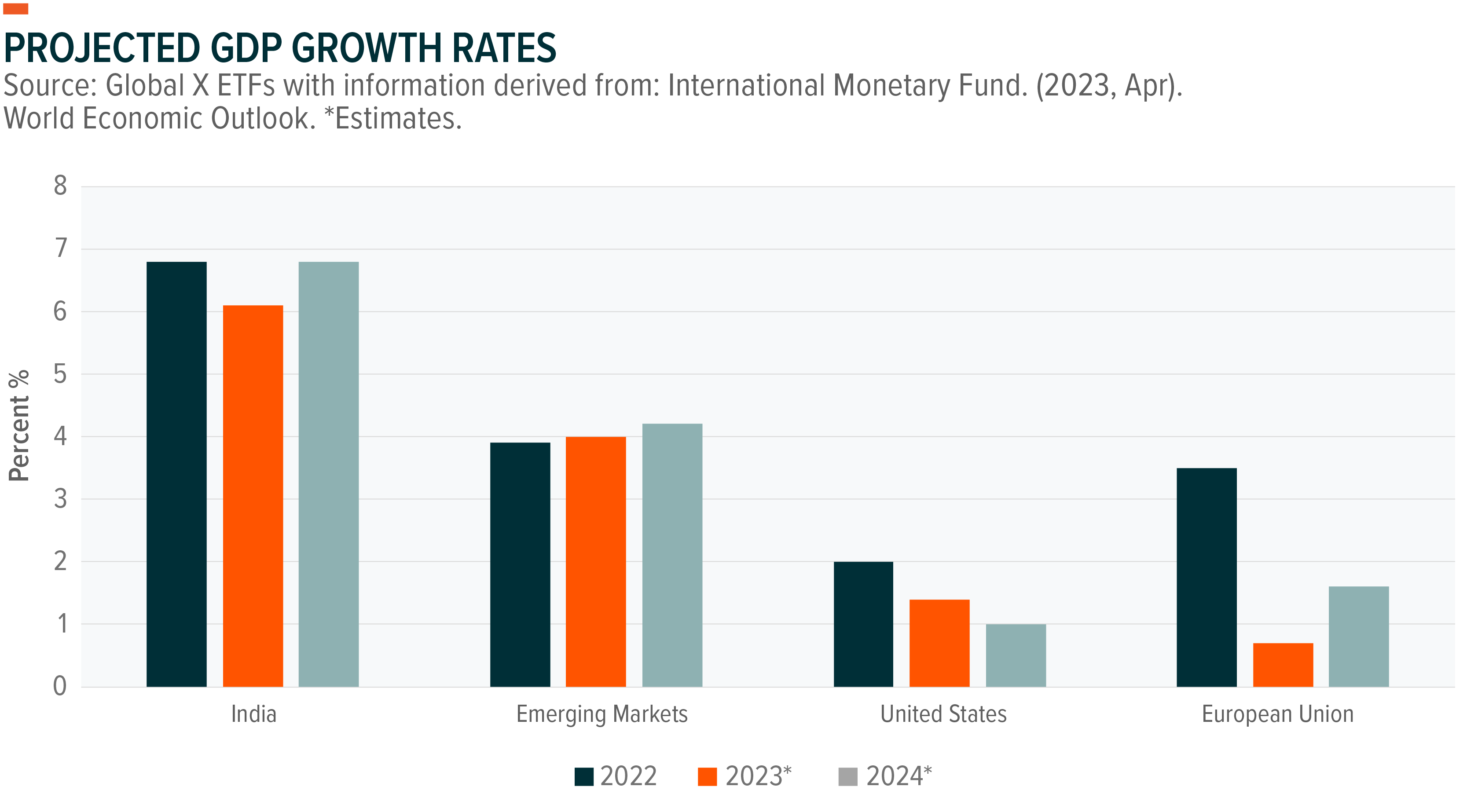

On August 18, 2023, we added two new actively managed ETFs to our international product suite. They are country-specific funds that seek long-term capital growth through exposure to Brazil and India, respectively, two of the largest (by population and gross domestic product) and most dynamic emerging market (EM) economies in the world.1,2 We see numerous potential long-term growth drivers and reasons for optimism, from favorable demographic trends and abundant natural resources to market-friendly political reforms and the nearshoring trend.

Key Takeaways

- We’re expanding our suite of international access ETFs with two new funds that can provide investors with exposure to the dynamic markets of India and Brazil, respectively.

- As the world’s most populous nation, India boasts favorable demographics, an educated workforce, attractive labor costs, government driven growth and reforms, and rising affluence that is fueling consumption.3

- Brazil, another large and populous nation, is also home to a skilled workforce, as well as sound institutional pillars, a growing consumer market, and an abundance of natural resources.

Investment Philosophy and Process

We see the Brazilian and Indian economies rapidly moving away from asset heavy, low return business models towards innovative, well-run, profitable sectors. These structural dynamics can create higher paying jobs as employees move up the value chain, which can inherently grow the middle class. These entrants often spend their newfound discretionary income on education, healthcare, technology, goods, and services – all of which fall into the latter category of business models. This has the potential to create a self-fulfilling cycle of domestic consumer-driven growth.

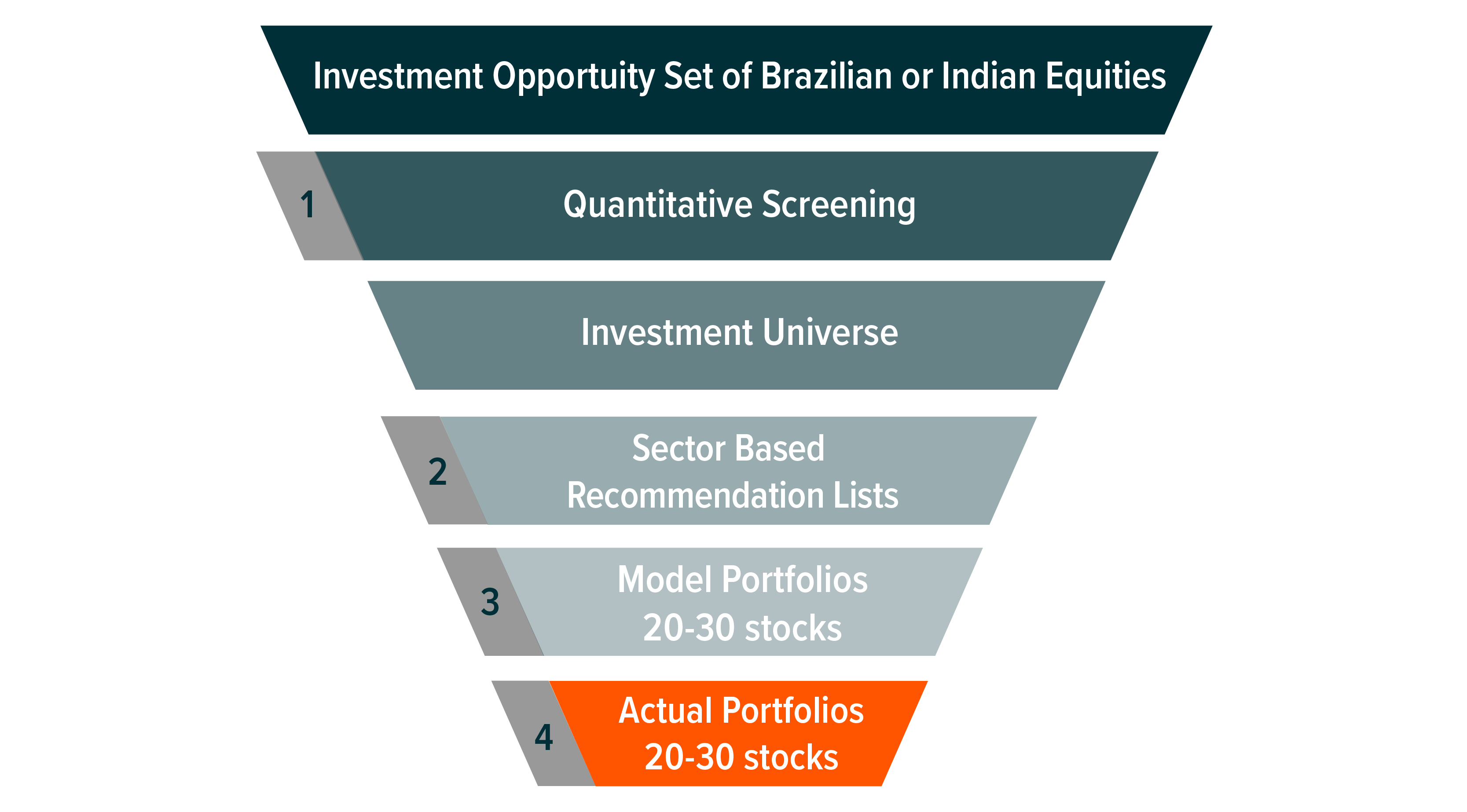

The management team’s (portfolio managers and analysts) investment process for both funds consists of the following:

Step 1: A proprietary quantitative screening of the eligible market universe is run to arrive at an investable universe (IU).

Step 2: Recommendation lists (RLs) of stocks are compiled by each sector analyst for his/her respective region through bottom-up analysis.

Step 3: A model portfolio (MP) is determined by the investment team.

Step 4: The actual portfolio (AP) construction is done by the portfolio managers.

The process requires each analyst to identify and validate his/her highest conviction ideas, based on bottom-up, fundamental company analysis, and weight them in his/her RL. The investment team utilizes the RLs to determine a model portfolio, which reflects stock weightings to indicate relative conviction levels of ideas. The portfolio manager utilizes the MP to construct an efficient, actual portfolio.

The key pillars of our investment philosophy include: identifying internal and structural tailwinds, while seeking to mitigate macroeconomic headwinds; investing in companies that can potentially benefit from sustainable competitive advantages; partnering with management teams aligned with minority shareholders; finding visible growth opportunities that could lead to potential near- and long-term positive earnings revisions; and analyzing intrinsic values based on GAARP (growth at a reasonable price) with multiples balanced by both growth and return profiles.

The Global X India and Brazil Active ETFs present opportunities to invest in concentrated strategies focused on quality business models and management teams across the country. The funds plan to invest with a four-to-five-year investment horizon and focus on domestic-driven growth. They are expected to carry investment profiles reflecting their GAARP style, with a key focus on finding companies that can reinvest and compound growth at rates above their cost of capital.

Why Invest in Brazil?

As the seventh largest country in the world (and largest in Latin America) by population and ninth by GDP, with a sophisticated capital market system and low penetration rates across various sectors and themes – Brazil stands out as a rich backdrop for investors.4 Highlights include:

- A large and diverse economy

- Abundant natural resources

- A growing consumer market

- Infrastructure development

- A skilled workforce

With a recent pivot from its central bank and a new fiscal reform package from the government, we see Brazil as one of the best cyclical opportunities on the map.5 Importantly, Brazil boasts sound institutional pillars, such as an independent central bank and judiciary system. Given a history of hyperinflation and political polarization, independent monetary policy is a key selling point for Brazil. This practice was signed into law in February 2021, and we feel it has already delivered benefits for the country.6 As the world spiraled into a post-COVID-19 inflation hangover, Brazil’s central bank proactively raised interest rates from 2% to 13.75% in order to control prices.7 As inflation came down, the central bank decoupled from the Federal Reserve (pausing ahead of the U.S. central bank) and has seen some of the highest real interest rates in the world.8 This could attract allocators looking for yield, support the currency, and reduce inflation. Dropping unemployment, positive GDP growth revisions, and low-single-digit inflation have all helped the central bank pivot into a potentially meaningful rate cutting cycle, with a 50-basis-point cut from 13.75% to 13.25% announced on August 2nd.9 We believe this could potentially act as a key forthcoming driver of growth for two reasons:

- Many Brazilian companies carry floating rate debt, meaning that when rates come down, their net interest expenses come down with them. This could translate into positive earnings revisions without any operational improvement.

- Interest rate cuts allow equity investors to use a lower cost of capital when discounting future cash flows. This translates into higher price targets and could drive a market re-rating.

In the past six rate cutting cycles, we have seen the MSCI Brazil Index rally in four of them and move down in only two.10 Importantly, those rallies have averaged roughly 96.7% upside, where the drawdowns averaged only roughly 17.3%.11 We like this set up.

We also believe that multiples of the Brazilian equity market now offer a valuation buffer that can potentially provide a margin of safety* for the inherent unknown in forecasting cash flows. The whole market, as represented by the MSCI Brazil Index, recently traded at 7.9x earnings with a 6.1% dividend yield and return on equity of 22.1% as of 8/7/2023.12 These figures are well below historical averages and trade at a steep discount to other emerging market countries.

*A margin of safety does not protect investors from the loss of principal, volatility associated with stocks, external forces, or our incorrect assumptions.

Finally, we are growing cautiously more comfortable with Brazil’s political picture. Though President Lula’s rhetoric continues to suggest government intervention in the private sector, central bank influence, and increased spending, it appears that Brazil’s institutions are offering a system of checks and balances.13,14 The government’s recent fiscal package was more balanced than we expected, and the market was happy to see congress push back on certain aspirational proposals.15 In addition, the central bank has remained autonomous and patiently waited for inflation to fall before adjusting monetary policy, despite pressure from the executive branch.

Why Invest in India?

India recently became the world’s most populous country, overtaking China.16 In our view, the country also boasts a sound structural story complemented by government driven growth and reforms. More than 50% of India’s population is below 25 years old, meaning that India offers a young and growing workforce in a world of shrinking populations.17 In addition, we believe that low per-capita income levels in India could provide a scope for catch-up rates of productivity-driven growth. Other structural highlights include:

- The youth literacy rate is high at roughly 78%.18

- India is home to the third largest group of STEM (science, technology, engineering, and math) graduates in the world.19

- Consumers and businesses have increasing access to credit, a key driver of economic growth. Credit-to-GDP (gross domestic product) levels are still only around 50%, much lower than emerging market peers like China and Vietnam, but could rise to 80% by 2030.20

- The business environment has grown more friendly in recent years. India jumped 79 positions, from 142nd in 2014 to 63rd in 2019, according to the World Bank’s Ease of Doing Business Ranking 2020, the last survey before the rankings were discontinued.21

- India’s labor cost is roughly 40% of China’s.22

- Rising affluence is driving increasing consumption in India, and the nation is expected to have the fastest growing disposable income level in the world, at nearly 10%, between 2022 and 2026.23

Importantly, India’s attractive backdrop continues to receive support from government driven reform stories. In our view, the key change in India’s structural story lies in the shift in policy focus towards lifting both capacity and productivity within the economy. Policymakers have taken up a series of reforms that have, and could continue to, support a capital spending cycle, likely leading to sustainable growth.24 These reforms include:

- Demonetization and the creation of a more expansive digital economy

- Market formalization

- Simplification of the tax system through the introduction of a goods and services tax (GST)

- Lower corporate tax rates

- Production-linked incentive schemes

- Property rights reform

Structural reforms like lower taxes, production-linked incentive schemes (most notably for the IT hardware sector), and positioning India as a potential beneficiary of supply-chain diversification could catalyze and sustain domestic investments.

We expect capital spending investments to pick up ahead of the general election in 2024, which could drive further job growth and, in turn, support domestic demand.

Why Active Management in Brazil and India?

In our view, the opportunity set in these countries is large, but nuanced, which means being in the right names and sectors can be vital to performance. From a passive perspective, our experience has been that EM benchmarks tend to lean towards large cap “national champions” and state-owned enterprises (SOEs). SOEs are generally government-owned/influenced companies operating with a broader set of interests, appealing more to their political and socioeconomic interests rather than those of minority shareholders.25 Emerging market benchmarks are also typically backward-looking in their methodology, in our opinion, significantly weighted towards historical drivers of growth, rather than smaller, innovative companies that may have the potential to capture future returns.26 While there is no guarantee an active manager will purchase specific securities or purchase them at an opportunistic time, there is more ability to do so.

Passive strategies may not always offer extensive diversification. The top five names in the MSCI India Index represent over 30% of the entire benchmark, while the top 10 names account for close to 43% of the entire index.27 In the MSCI Brazil Index, the top five names represent approximately 40% of the entire benchmark, and the top 10 names close to 60% of the entire index.28 VALE and Petrobras alone represent a combined 20.74%, and over 35% of the index is comprised of state influenced companies.29,30

Active managers have more leeway to look beyond a country’s largest players and potentially invest in a wider swath of the investable universe, which could increase diversification. Active managers may also be able to take additional precautions to balance position and sector concentration as a part of the risk management process.

Additionally, passive strategies tracking the MSCI Brazil Index and the MSCI India Index, the respective benchmarks for the funds, may not include dynamic companies that have come to market on U.S. exchanges, or those in neighboring countries that derive most of their revenues from the benchmark nation. When looking at Brazil, for example, such companies include, but are not limited to, Nubank, Mercado Libre, and Arcos Dorados. The Global X Brazil and India Active ETFs are allowed to invest in equity securities of issuers in Brazil/India, as well as those tied economically to Brazil/India. Moreover, BRAZ represents the only* active Brazil ETF publicly available to U.S. investors, and NDIA is the first active India ETF available to U.S. investors.31

*as of 6/30/2023

A Management Team with Extensive Experience in Brazil and India

Malcolm Dorson and Paul Dmitriev are based in New York and serve as co-portfolio managers for both ETFs. Malcolm is a senior portfolio manager and head of emerging markets strategy at Global X ETFs. Malcolm has been managing a Brazil fund, along with other portfolios investing in emerging markets, since 2015. Prior to joining Mirae Asset (an affiliate of Global X ETFs), Malcolm was the lead Latin America investment analyst at Ashmore Group from 2013 to 2015. From 2009 to 2011, he worked at Citigroup as an assistant vice president focusing on asset management in the Private Bank. Malcolm began his career in 2006 as an analyst on the convertible securities team at Deutsche Bank. Malcolm holds an M.B.A. from the Wharton School (concentration in finance), an M.A. in International Studies (concentration in Latin America) from the Lauder Institute, and a Bachelor of Arts degree from the University of Pennsylvania. Malcolm is a U.S. and Brazilian citizen and spent his childhood in Sao Paulo, Brazil.

In addition to Paul’s co-portfolio manager role, he serves as a senior analyst on Global X ETFs’ emerging market strategies team. Before transitioning to Global X ETFs with Malcolm, Paul worked as an investment analyst at Mirae Asset Global Investments from 2017-2023, where he covered the same global emerging markets strategies. Paul began his career at HSBC as a research analyst covering credit and equity across industrials, energy, and utilities. Paul holds a B.S. from NYU Stern School of Business, where he focused on economics, finance, and political science.

Malcolm and Paul are supported by a broader staff of analysts, including Trevor Yates in New York and a team of more than 10 people in Mumbai.

Conclusion

In our view, Brazil and India are two of the world’s most dynamic emerging market economies, with numerous potential growth drivers. Favorable demographics, encouraging structural and political reforms, abundant natural resources, and the shift to nearshoring all contribute to our long-term optimism. Against this backdrop, we see the Brazilian and Indian economies rapidly moving away from asset heavy, low return business models towards innovative, well-run, profitable sectors, which could create a cycle of domestic consumer-driven growth.

Related ETFs

BRAZ – Global X Brazil Active ETF

NDIA – Global X India Active ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.