On June 3rd, 2020, we listed the Global X Emerging Markets Bond ETF (EMBD) on NYSE Arca. EMBD is an actively managed fund sub-advised by Mirae Asset Global Investments that seeks a high level of total return consisting of both income and capital appreciation by investing in emerging market debt. EMBD primarily invests in emerging market debt securities denominated in U.S. dollars, however, the Fund may also invest in emerging market debt securities denominated in applicable local foreign currencies. Securities may include fixed-rate and floating-rate debt instruments issued by sovereign, quasi-sovereign, and corporate entities from emerging market countries.

Since the 2008 global financial crisis, global monetary policy has kept interest rates hovering near historic lows in an effort to stimulate economic growth. As a side effect of these policies, however, income-oriented investors have struggled to find investments that can produce meaningful yield. While government, municipal, and corporate bonds have traditionally made up major portions of income-oriented portfolios, they now routinely yield well below 4% - a level often targeted by portfolio managers to sustain retirement income needs. As such, investors continue to look far and wide for alternative sources of income. In this post, we analyze how emerging market (EM) bonds can potentially play an important role in generating income and providing diversification benefits to investors’ portfolios.

Topics covered in this post include:

- An overview of the EM bond asset class

- EM bonds’ role in a portfolio: seeking high yields & diversification

- Why we believe in an active approach to the EM bond space

- Our outlook and key factors impacting emerging market economies amid the current economic environment

EM Bonds Are A Major Slice of Global Debt Markets

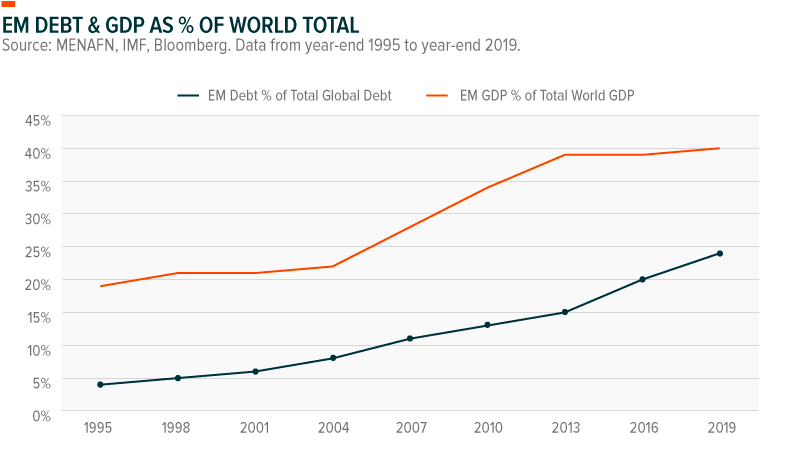

The global fixed income market totals approximately $117 trillion, with EM issuances representing 22%, or $26 trillion.1 This figure is similar in percentage terms to the equity space, where global public equities amounted to approximately $75 trillion in total market cap at the end of 2018, with EM stocks making up 24% of the total.2 Since 2009, EM debt expanded three-fold relative to the rest of the global bond market as countries like China, Brazil, and India ramped up economic activity, with debt playing a critical role in financing their boom.3

Given the increasing prominence of EM economies within the global macroeconomic landscape and their debt within the global capital markets, it is important that investors understand key segments within the EM bond markets. Two major considerations are the differences between hard vs. local currency bonds and sovereign vs. corporate bonds.

USD-denominated Bonds vs. Local Currency Bonds

EM debt can be issued in either hard currency or local currency. Hard currency debt is issued in a major currency, such as US Dollars (USD), while local currency debt is issued in the currency of the nation issuing the bonds. Today, 83% of EM debt is denominated in local currency. These numbers are heavily influenced by China, however, which makes up over 50% of EM debt, and offers more than 90% of its issuances in local Chinese Yuan.4 Excluding China, EM debt is split roughly 70/30 between local and hard currency.

For investors, the choice to invest in USD-denominated bonds versus local currency bonds comes down to risk exposures. USD bonds pay interest and principal in US dollars, and therefore transfer the currency risk from a US-based lender (the bond buyer) to the local borrower (the bond issuer). This can be particularly important for EM bonds given the volatility associated with many developing market currencies. However, should a country’s currency weaken substantially versus the USD, it can become expensive for that issuer to buy USD to service their debt, and a credit event may occur.

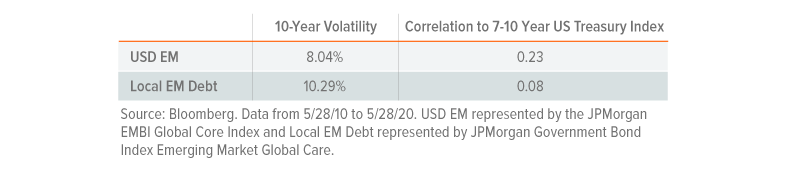

Local currency bonds, by contrast, pay their interest and principal in the local currency. This means that a US-based lender (the bond buyer) takes on that country’s currency risk: as the developing country’s currency appreciates or depreciates versus the USD, it impacts the US-based investor’s returns. This can make local currency bonds both more volatile as well as less correlated to other income-oriented positions in an investor’s portfolio.

EM currency values are driven by a variety of factors including commodity prices, political stability, economic strength, inflation, and US monetary policy. Historically, commodity prices have been one of the largest contributors, as many EMs are commodity exporters and their economies and societies depend heavily on revenues from selling raw materials. The graph below shows the relationship between EM currencies and commodity prices.5 Between the years 2009 to 2019, the EM currency index had an 0.58 correlation to commodity prices. Therefore local currency bonds may often be more correlated to commodities than USD denominated bonds.

Sovereign vs. Corporate Issuances

EM debt is split roughly evenly between sovereign and corporate issuances, at 48% versus 52%, respectively.6 Sovereign bonds are issued by government entities such as The Republic of Colombia, or quasi-government entities such as wholly state-owned enterprises. Corporate issuances are offered by private enterprises, which can include local financial institutions, energy companies, telecom providers, and more. As in developed markets, sovereign EM bonds often carry higher credit ratings than corporates from the same country, and therefore offer lower yields. EM corporate bonds can therefore help enhance yield and offer unique exposures from a variety of sectors and issuers, but may also introduce additional risks.

EM Bonds’ Role In A Portfolio: Seeking High Yield and Diversification

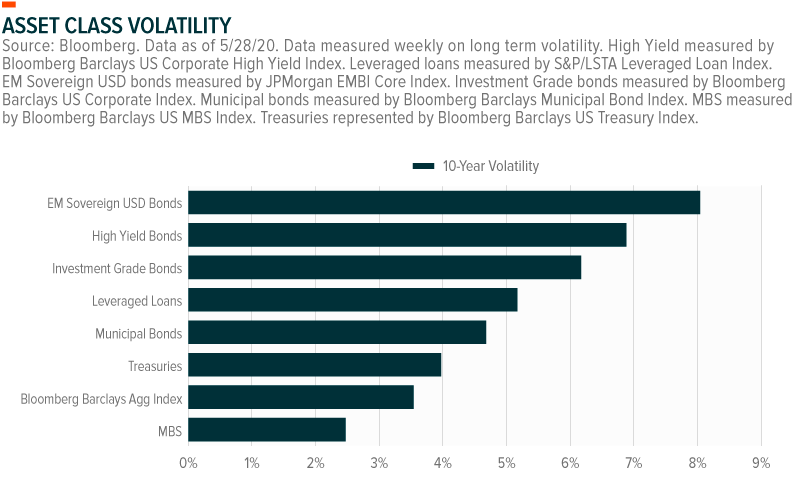

Given that emerging markets tend to carry greater risks than their developed market peers, investors are typically rewarded with higher yields for investing in these securities. In the chart below, we show that EM debt is currently one of the highest yielding debt asset classes. This can make EM bond strategies an important component of income-oriented portfolios, particularly in a low interest rate environment where developed market bonds are at historic lows.

Data quoted represents past performance. Past performance does not guarantee future results.

In addition to potentially offering high yields, EM bonds can also offer certain diversification benefits. They have historically demonstrated low correlation with US Treasuries and other high yielding asset classes. Many high yielding asset classes exhibit positive correlations with each other and are impacted heavily by US interest rates. The low correlation exhibited by EM bonds to these other income-oriented asset classes suggests that EM debt can play an important role in diversifying the sources of risk in a portfolio.

Diversification does not ensure a profit or guarantee against a loss.

Despite the potential high yield and diversification benefits, investors often underweight EM bonds in their portfolio relative to the size of the asset class. As mentioned earlier, EM bonds are a $26 trillion market, representing 22% of the global bond market, yet they will often receive a similar allocation as much smaller asset classes like high yield bonds ($1.6 trillion) and senior loans ($1.3 trillion).7

One potential explanation for the underweight towards EM bonds could that the asset class tends to be riskier than other segments in the fixed income landscape. It is true that EM bonds have historically exhibited higher volatility than many other fixed income segments, though the impact of this volatility in a portfolio may be more muted given the asset class’s low correlation to other major fixed income segments.

Why We Believe in an Active Approach to EM Bonds

The Global X Emerging Markets Bond ETF (EMBD) is Global X’s first actively managed ETF -- an evolution in our offering that we do not take lightly. Our decision to utilize an active approach stems from the unique characteristics of the EM debt asset class that offer experienced portfolio managers the opportunity to add potential value to the investment process, including:

- Navigating Liquidity: Whether issued by a government or corporate entity, many EM debt offerings trade infrequently as investors may plan to hold them until maturity. In addition, EM debt transactions are negotiated ‘over-the-counter’ rather than bought and sold on an exchange. Therefore, a portfolio manager must carefully navigate these liquidity constraints to buy and sell positions at attractive prices.

- Mitigating Downside Risks: Under normal conditions, an EM bond is expected to pay its coupons on schedule and return principle at maturation. Under adverse conditions, an EM bond can default and investors may lose a substantial portion of their investment. This skewed risk versus return dynamic places great importance on risk mitigation as a portfolio manager can seek to avoid credit events through extensive macro and micro-level analysis.

- Understanding Idiosyncrasies: Individual EM bonds can each have unique characteristics and considerations, such as whether its issued in hard versus local currency, if it’s from a sovereign, quasi-sovereign, or corporate issuer, its coupon and maturity dates, whether its recently issued (on-the-run) versus an older issuance (off-the-run), and more. Each of these characteristics can affect their risk and return profiles, which ought to be considered by a manager.

Leveraging Mirae Asset’s Extensive Experience in EM Bonds

EMBD is sub-advised by Mirae Asset Global Investments (Mirae Asset), a leading financial institution in South Korea, with deep roots in emerging markets. With over $140B in assets under management, Mirae Asset is not only known for pioneering mutual funds in South Korea, but also its strong presence across a host of fast-growing economies including India, China, Brazil, Vietnam, and Colombia.8

EMBD’s portfolio managers, Joon Hyuk Heo, CFA and Ethan Yoon, CFA, bring an average of 18 years of industry experience, and the team has run EM debt strategies since 2012.9 Combining input from their Investment, Macro Strategy, and Research support teams with regional and asset class specializations, the portfolio managers consider knowledge and analysis from over twenty investment professionals.

Seeking a high level of total return consisting of both income and capital appreciation, EMBD’s portfolio managers incorporate both top-down macro views consistent with the firm’s Investment Committee and bottom-up fundamental research to evaluate the investment attractiveness of select countries and companies that are believed to offer superior risk-adjusted returns. The portfolio managers determine country allocation primarily based on economic indicators, industry structure, terms of trade, political environment and geopolitical issues. In addition, the portfolio managers conduct relative valuation analysis on sovereign and corporate issues to tactically identify potential opportunities to enhance the Fund’s risk-adjusted returns. The portfolio managers may dynamically adjust the top-down and bottom-up strategies of the Fund to better reflect market developments.

EMBD primarily invests in emerging market debt securities denominated in U.S. dollars, however, the Fund may also invest in those denominated in applicable local foreign currencies. Securities may include fixed-rate and floating-rate debt instruments issued by sovereign, quasi-sovereign, and corporate entities from emerging market countries.

EM Bonds: Key Factors and Catalysts

The COVID-19 pandemic and its downstream impacts, such as lower commodity prices and sluggish global trade, exacerbated volatility and challenged economic outlooks across EMs. While EMs tend to be more sensitive to changes in external demand and global market swings, they are not all impacted equally, as each country has its own unique political, economic, and demographic considerations. But such heightened volatility and idiosyncratic risks further illustrates the value an actively managed approach can bring to the EM debt asset class, as risks and returns vary greatly across countries. As such, we believe the following factors could play major roles in driving EM bond risks and returns. It is important to note that the COVID-19 pandemic has introduced uncertainty into the global economy and emerging market outlook.

Long term growth potential: Over the long term, EMs remain attractive for their youthful demographics, rising middle classes, and bountiful natural resources. In addition, many EMs are shifting away from export-led economies, towards more consumer-oriented and services-driven ones. Roughly 85% of the global population lives in EMs, which are responsible for 40% of global GDP. The importance of EM exposures to investors’ portfolios cannot be understated as trends in technology, urbanization, and consumption have increasingly shifted growth opportunities from stagnating developed markets to more dynamic emerging markets. However, growth rates across EMs vary widely, as each country faces unique opportunities and challenges for sustained growth.

Monetary policy: Some EM central banks have high external debt, making them more sensitive to currency movements with fewer tools to achieve monetary and economic stability. EM central banks considering rate cuts must weigh the impacts of currency depreciation and providing stimulus to the local economy. This tradeoff leaves these central banks with little margin for error and in certain instances forces them to turn to the international institutions such as the IMF as a lender of last resort. Monetary policy in EMs can be limited, but central banks are often nimbler and lead structural and policy improvements. Several Asian economies addressed such weaknesses following the Asian Financial Crisis by reducing their overall indebtedness and building up robust foreign reserves to combat potential future crises.

It’s important to consider that developed market monetary policies can impact EMs as well. Policies that strengthen the US dollar, for example, can weaken commodity export-led EMs as well as those with high amounts of USD-denominated debt.

Evolving Political Risks: Political risk is idiosyncratic across regions, countries, and even administrations. At a macro-level, the growing polarization between the US and China could force many EMs to choose their alignments carefully, as it could impact trade, investment, and defense. At a more domestic level, rising inequality, increasing health care costs, and efforts to automate low-skilled tasks could trigger greater political uncertainty. At a minimum, maintaining proper diversification across these segments and monitoring elections and social trends can play a key role in the investment process for the EM bond asset class.

Currency Fluctuations: As rates and currencies fluctuate, local currency – and thus the value of local currency denominated debt – can demonstrate greater sensitivity and reduce potential gains for fixed income investors. By primarily utilizing US Dollar (USD)-denominated debt, which tends to be more stable during times of global market volatility than local currency-denominated debt, investors may reduce some of the risk during times of increased volatility. Likewise, rate cuts in EMs can have positive trade-related effects. While rate cuts may not erase economic woes, currency depreciation may allow certain EMs to become more competitive and improve current account imbalances. This may be especially true for smaller EMs, where currency depreciation can make exports cheaper or encourage trade deals and unions to expand cooperation on trade across regions or between smaller countries.

Conclusion

EM bonds represent a significant and growing fixed income asset class. As EMs continue to grow their economies, their debt is playing an increasingly substantial role in global capital markets. At the same time, investors may find that the higher yield and diversification characteristics offered by EM bonds can make them particularly useful to income-oriented investors.

Yet EM bonds have certain nuances that we believe requires a more hands on approach. Constrained liquidity, asymmetric risk, and material idiosyncrasies across issuances both validates the importance of thorough investment research and also creates conditions for potentially improved risk-adjusted returns using active management. We believe that experienced portfolio managers who consider global macro themes, fundamental country analysis, relative valuations between corporate and sovereign debt, bottom-up analysis of securities, and frequent portfolio reviews provides a robust approach for accessing this important asset class.

Related ETFs

EMBD: The Global X Emerging Markets Bond ETF is an actively managed fund sub-advised by Mirae Asset Global Investments that seeks a high level of total return, consisting of both income and capital appreciation, by investing in emerging market debt.